Institutional Whales Flood In! Evernorth Holds $1B in XRP — Can It Break the $2.60 Resistance?

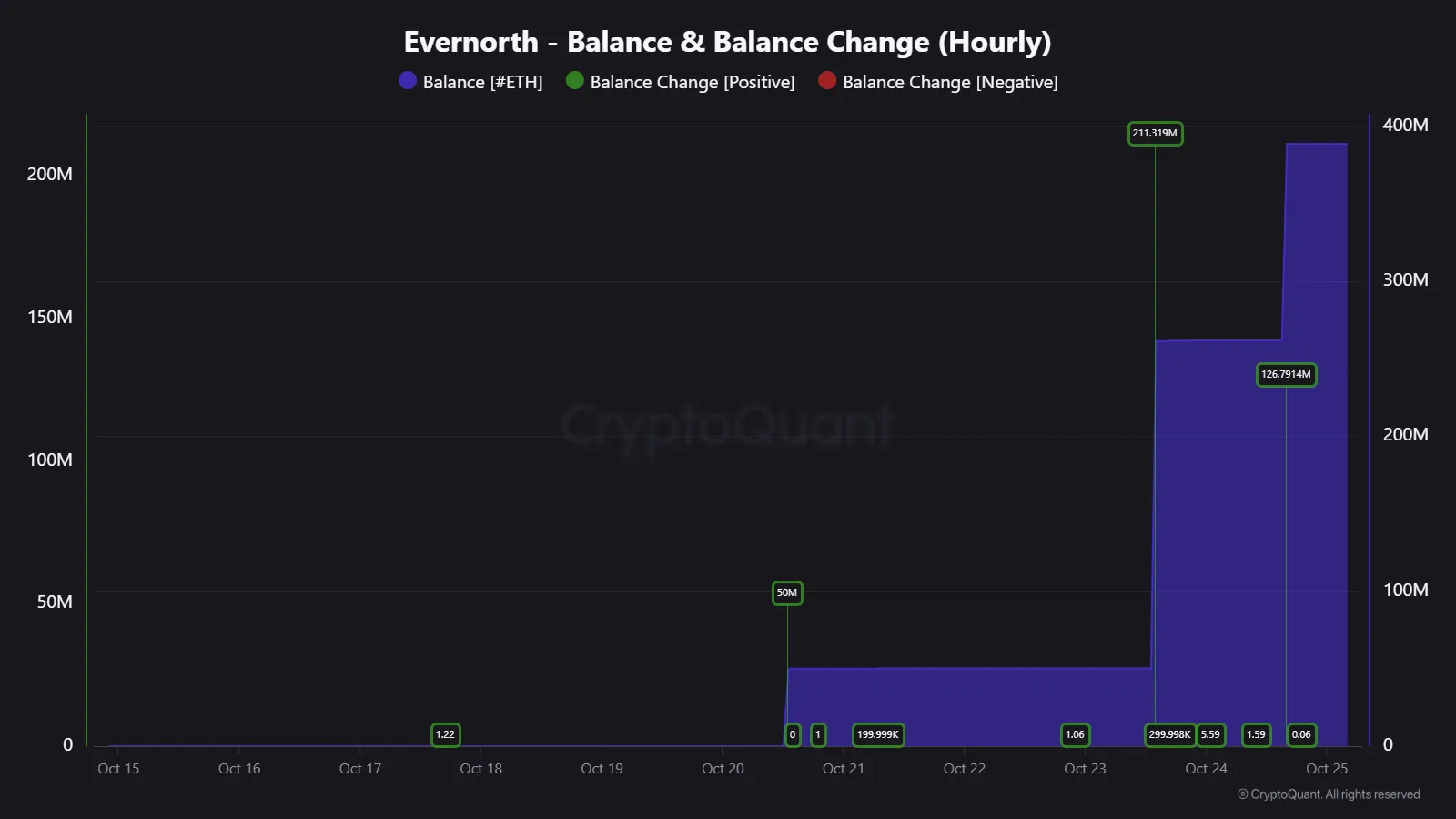

As the cryptocurrency market matures, institutional capital is becoming increasingly active. The large-scale entry of Evernorth Holdings (hereafter “Evernorth”) stands out. According to the latest disclosures, Evernorth now controls approximately 388.7 million XRP, with a market value exceeding $1 billion—about 95% of its stated target.

Institutional Whales Move In: Evernorth’s $1 Billion XRP Positioning Strategy

Evernorth is an institution specializing in XRP assets, with strategic backing from Ripple Labs, Japan’s SBI Holdings, and others. Its objective goes beyond passive holding; Evernorth actively acquires XRP on the open market, builds an “open-traded” XRP asset vehicle, and plans to list on the NASDAQ stock exchange via a SPAC.

Figure: https://www.gate.com/trade/XRP_USDT

Data indicates Evernorth’s average purchase price is approximately $2.44 per XRP. As of October 29, 2025, XRP trades around $2.65. Evernorth’s massive holdings significantly reduce the amount of XRP available for market circulation.

Historically, such institutional moves often signal structural shifts in the market.

Current XRP Price Dynamics

XRP is currently priced near $2.62, consolidating at elevated levels. The prior $2.40 range is no longer the primary trading zone; instead, XRP is digesting in a higher band. The $2.60–$2.65 range is widely regarded as a support zone, while $3.00–$3.10 represents the main resistance overhead. If trading volume increases and breaks through resistance, prices could move higher; if support fails, prices may retreat to lower levels. For newcomers, this stage is best suited for observing market structure and forming clear plans, rather than chasing price rallies. When entering, set stop-loss levels in advance (for example, a certain margin below support) and take-profit targets (such as gradually exiting near resistance) to ensure risk control before the trend is fully confirmed.

Potential Impact of Evernorth’s XRP Holdings on Supply and Price

Why does large-scale institutional accumulation raise market expectations? The main reasons include:

- Reduced circulation: When major institutions lock up substantial amounts of XRP for the long term, the amount of XRP available to the public or on exchanges decreases. If demand remains steady or increases, prices are likely to rise. Evernorth’s accumulation is seen as a potential “supply shock.”

- Institutional signaling: Institutional participation is often viewed as a vote of confidence in the market, serving as a key reference point for newcomers still building their understanding.

- Equity and token linkage: Evernorth plans to go public via SPAC, enabling investors to gain indirect exposure to XRP assets through equity. This could introduce a new dimension where traditional finance intersects with crypto assets.

Nonetheless, risks remain: If institutions are accumulating for short-term speculation or if regulatory uncertainties arise, this could trigger selling pressure.

Beginner Investors: Key Risks and Opportunities

Opportunities:

- The current price zone (around $2.62) is viewed as a potential “bottom/accumulation area.” If the price sustains above $2.60, a follow-up rally could emerge.

- Strong institutional backing and improved market structure are positive signals to monitor.

Risks:

- Despite institutional buying, the market’s size, supply-demand dynamics, and macro environment remain complex—price appreciation is not guaranteed.

- The crypto market is highly volatile. Beginners without stop-losses or risk controls may be exposed to significant losses.

- If the price drops below support (e.g., under $2.30), panic selling could be triggered.

Trading tips:

- Keep position sizes within a loss-tolerant range.

- Set clear stop-losses (e.g., exit if the price falls below $2.25) and take-profit levels.

- Closely monitor institutional activity, changes in trading volume, and regulatory developments.

- Avoid chasing price spikes; wait for confirmed breakouts or bottoming signals before entering for a more prudent approach.

Summary: Why XRP and Evernorth Are Worth Watching Now

In summary, Evernorth’s $1 billion XRP position, current consolidation near $2.60, potential supply shocks, and technical accumulation signals combine to make this a “window of opportunity” for new investors. Of course, “worth watching” does not mean “guaranteed profit”—the market remains highly uncertain. It is advisable to approach with a “learning phase plus small-scale trial” strategy.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution