XRP Burn Rate Explained: A Security Feature, Not a Supply Cut Strategy

Design Rationale

The XRP Ledger (XRPL) burn mechanism is designed to prevent spam and maintain network efficiency. Every transaction incurs a nominal fee, currently set at 0.00001 XRP (10 drops), which is burned, with no portion paid to validators or miners. This feature serves as XRPL’s primary safeguard against transaction spam and network abuse.

Daily Burn Volume

By mid-2025, XRPL’s daily XRP burn averages between 2,700 and 4,000 XRP, which fluctuates based on network activity and demand. Since XRPL’s launch, only about 14 million XRP have been burned, which is only 0.014% of the total supply.

Market Perception vs. Design Intent

Some investors see the burn rate as signaling reduced supply and increasing scarcity, which they believe may contribute to price appreciation. However, from an engineering perspective, at the current burn rate, it would take an extremely long time to eliminate even 1% of XRP’s total supply.

System Sustainability and Deflationary Architecture

XRP’s burn rate is intended to balance efficiency and sustainability, rather than to significantly reduce the circulating supply. As XRP’s value rises, validators may further lower transaction fees (to as little as 5 drops, for example) to maintain affordable transfers, which slows the burn rate and helps maintain the long-term supply. This architecture maintains network efficiency while preserving XRP’s long-term utility by avoiding excessive deflationary pressure. Ultimately, XRP’s design prioritizes its transactional utility over scarcity-driven investment strategies.

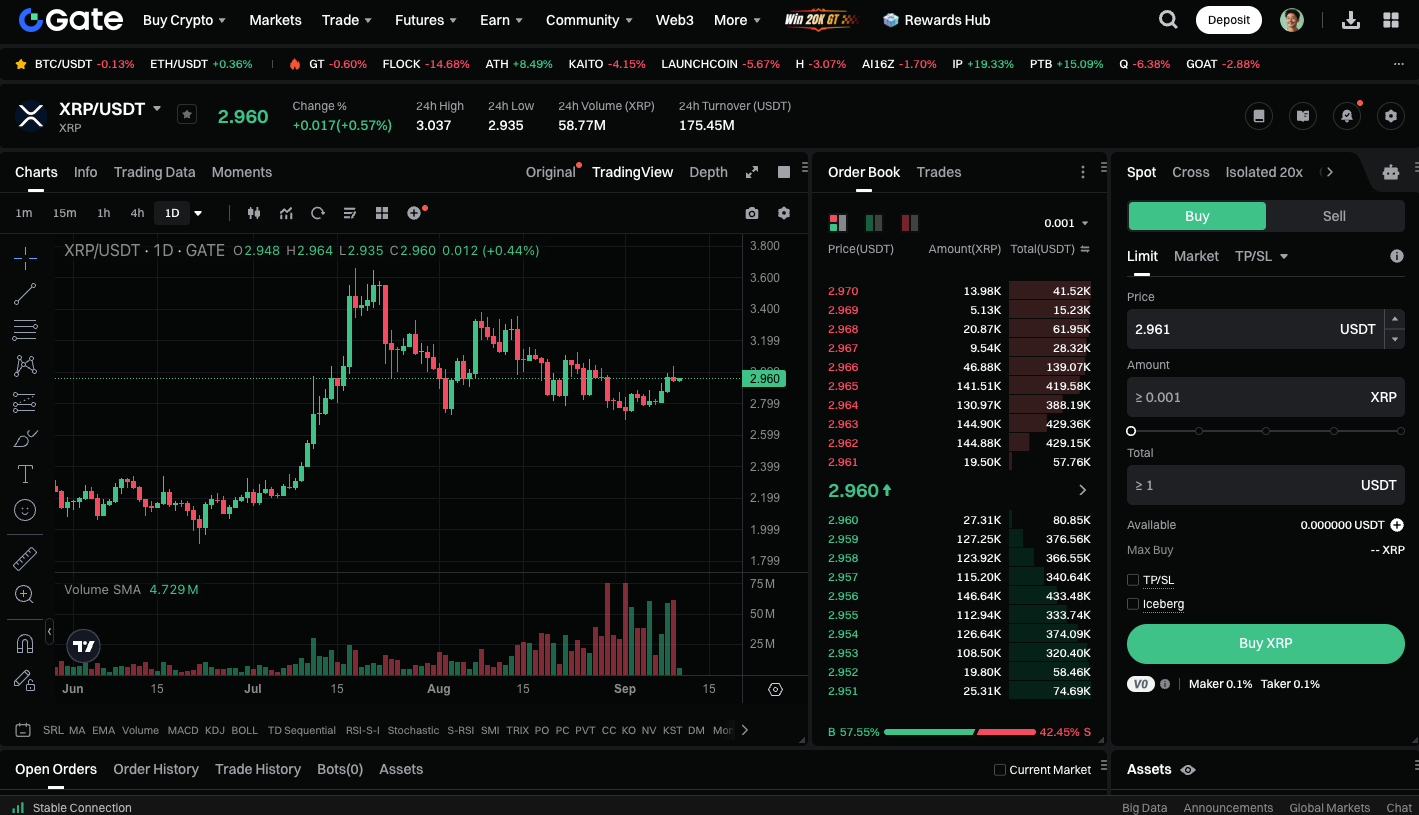

Trade XRP spot instantly on Gate: https://www.gate.com/trade/XRP_USDT

Summary

XRP’s burn rate is not fundamentally a deflationary strategy; it is a security measure that prevents spam and denial-of-service attacks.

Investors should focus on XRP’s genuine value drivers, such as real-world utility, cross-border payment demand, Ripple’s enterprise collaborations, and regulatory endorsements, rather than on burn statistics, which have limited impact on XRP’s long-term value.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution