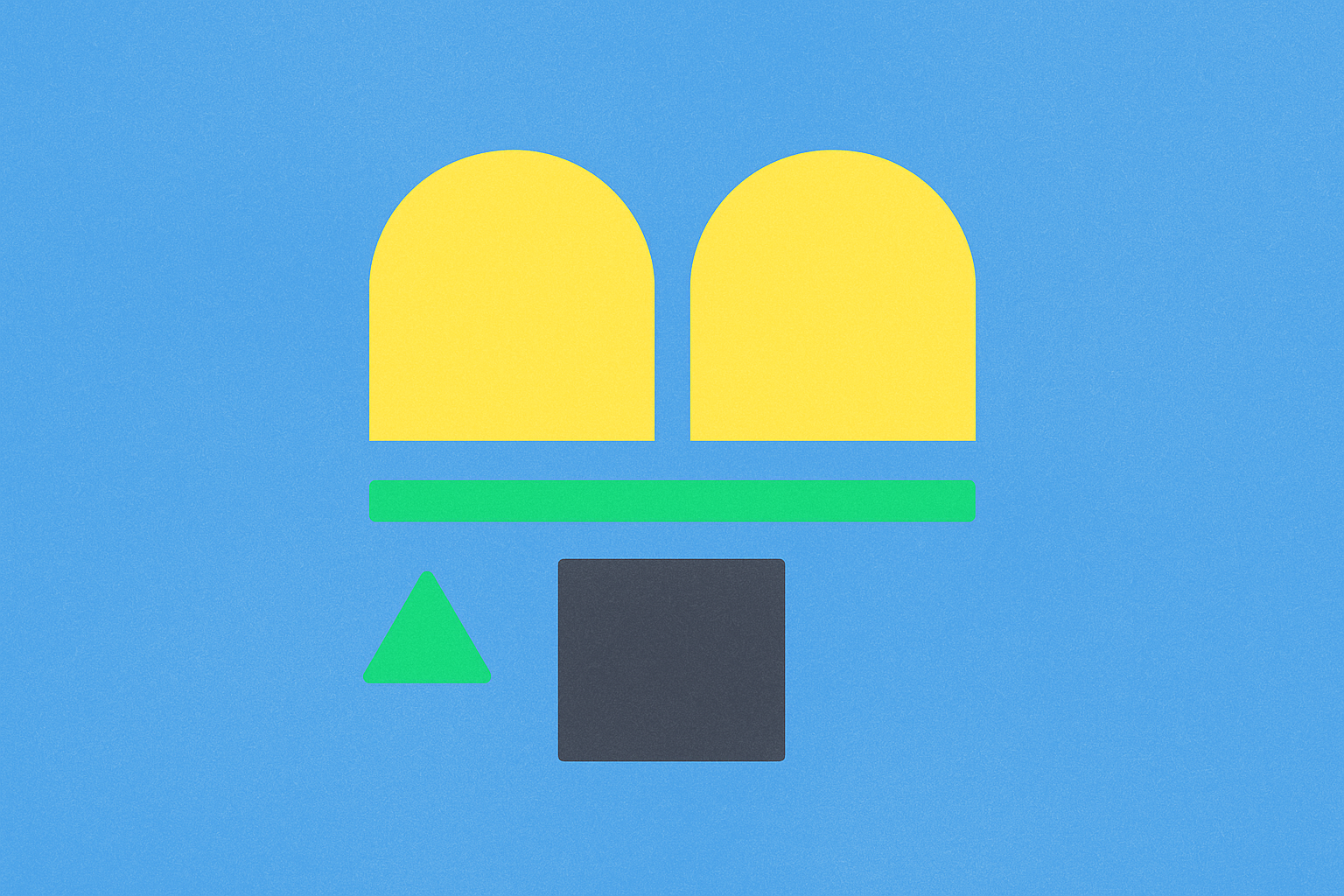

doubletop

What Is a Double Top Pattern?

A double top pattern is a potential reversal formation that appears after a sustained upward price movement. It is characterized by two peaks at similar price levels, separated by a trough that forms the neckline. A decisive breakdown below the neckline is widely regarded as a technical signal indicating weakening momentum.

On a chart, you will notice that the price rallies to a resistance area (where further upward movement is constrained), pulls back, then attempts another rally but fails again at approximately the same level—creating two “peaks.” The trough between the two peaks serves as the neckline, which can be either horizontal or slightly sloped. Confirmation of the pattern typically requires a closing price below the neckline, often accompanied by an increase in trading volume.

Why Does the Double Top Pattern Occur?

The double top pattern reflects shifts in supply, demand, and market sentiment. The first peak signals strong bullish momentum, but it encounters significant selling pressure. After a pullback, bulls attempt another rally; if they cannot attract enough buying interest, resistance forms again at roughly the same level.

Failure to break above the previous high on the second attempt often signals declining buying strength or insufficient marginal capital. The trough that forms the neckline marks the last “defensive line” for buyers. If this support is broken convincingly, it suggests buyers are capitulating and that prices may move lower to find a new equilibrium.

How to Identify a Double Top Pattern? Key Elements

To identify a double top pattern, focus on three main chart features: a clearly defined prior uptrend, two peaks at similar heights (not necessarily identical), and a distinct trough between them for drawing the neckline.

Step 1: Confirm the Prerequisite. Ensure there is a significant preceding uptrend—without this context, the double top’s reliability diminishes.

Step 2: Observe the Two Peaks. The highs should be within a close price range, but perfect symmetry isn’t required. On shorter timeframes, the tolerance for variance is smaller.

Step 3: Draw the Neckline. Connect the trough between the two peaks with a horizontal or slightly sloped line—clarity is key. Subsequent confirmation depends on whether the closing price breaks this neckline.

Step 4: Monitor Trading Volume. If volume contracts at the second peak or expands on the neckline breakdown, these are often seen as supporting signals for pattern validity.

How to Trade the Double Top Pattern? Entry, Stop-Loss, and Take-Profit

There are two common trading strategies: entering on a confirmed breakdown below the neckline or waiting for a failed retest of the neckline after breakdown. In both cases, stop-loss and profit targets should be clearly defined.

Step 1: Entry Methods.

- Direct Entry: Enter after a confirmed close below the neckline for greater certainty—though some downside potential may be missed.

- Retest Entry: Wait for the price to break below, then return to test resistance near the neckline. Enter when renewed weakness appears for better positioning.

Step 2: Setting Stop-Loss.

- Place stop-loss conservatively above the second peak; if this is too wide, use a smaller position size to manage risk.

- If entering on a retest, stops can be set just above the neckline—exit immediately if invalidated.

Step 3: Take-Profit and Targets.

- Use “measured move” technique: project the distance from either peak to the neckline downward as your initial target.

- Consider partial take-profit: close part of your position at the first target and trail stops on remaining size.

Step 4: Position Sizing and Risk.

- Limit risk per trade to a fixed percentage of your account equity (e.g., 1%-2%) to withstand periods of consecutive losses.

- Avoid trading during major announcements or high-volatility periods to reduce fake breakout risks.

These are standard technical approaches and do not constitute investment advice. Always combine with personal risk management and backtesting before execution.

Is the Double Top Pattern Reliable in Crypto Markets? Limitations

Double top patterns can be valuable in crypto markets, but their reliability is affected by timeframe, volatility, and liquidity conditions. Shorter timeframes carry more noise and false breakouts; low-liquidity tokens are more susceptible to manipulation by single trades.

To improve reliability:

- Choose stable trading pairs during high-liquidity sessions.

- Confirm patterns with closing prices and volume changes—do not rely solely on candlestick wicks.

- Consider macro and on-chain event windows; significant news may distort technical signals.

- Combine double tops with trendlines, key moving averages, or structural highs/lows for additional confirmation.

Double Top vs. Double Bottom vs. Head and Shoulders

Double tops and double bottoms are mirror images: double tops signal potential tops after uptrends, while double bottoms indicate potential bottoms after downtrends. Both patterns require a decisive break of the neckline for confirmation—the only difference is direction.

Compared to head and shoulders patterns, double tops are more symmetrical and straightforward: head and shoulders involve three swings (left shoulder, head, right shoulder) with often more slanted necklines and require right shoulder development. Double tops feature only two peaks—making them easier to spot but also more prone to being confused with range-bound consolidation.

How to Implement Double Top Strategies on Gate? Available Tools

Gate’s charting and order execution tools make it practical to act on double top patterns. As of 2026, features include drawing tools, price alerts, conditional orders, and stop-loss/take-profit mechanisms.

Step 1: On spot or futures pages (e.g., BTC/USDT), select your preferred timeframe (daily or 4-hour), mark two similar peaks and the intermediate trough, then draw your neckline.

Step 2: Set Alerts and Orders. Place price alerts near the neckline or pre-set conditional orders to trigger entry once a close below neckline occurs. Set stop-loss (e.g., above second peak) and initial target (using measured move) in advance.

Step 3: Execution and Review. After execution, monitor slippage and position sizing; take profits in tranches and trail stops as planned. After each trade, screenshot and document your pattern, entry/exit points for performance tracking.

Risk warning: When trading futures, monitor liquidation prices and funding fees; rapid market moves may cause slippage or gaps—always use stop-loss and limit order tools for risk control.

Common Pitfalls and Risks of Double Tops—How to Avoid Them

Common mistakes include:

- Premature anticipation: Entering before a second peak forms or before confirmation increases risk of false signals.

- Overemphasis on perfect symmetry: Highs do not need to match exactly—insisting on perfection may cause missed opportunities.

- Ignoring market context: In strong trending markets, double top signals have lower reliability—use stricter confirmation and smaller position sizes.

- Rigid targets/stops: Failing to adjust stops or targets for volatility can lead to stops being too tight or targets overly ambitious.

How to avoid these:

- Confirm with closing price, volume support, and retest behavior.

- Apply consistent risk management (fixed per-trade risk percentage, mandatory stops, partial exits).

- Reduce or pause trading around major events.

How Do All Key Points of Double Tops Fit Together?

First, confirm a valid prior uptrend. Then look for two rally attempts forming clear peaks with an identifiable neckline. Use closing price breakdown below neckline as your main trigger, supported by volume analysis and retests. Define entry, stop-loss, and take-profit plans before placing any trade; maintain small and consistent risk per trade across attempts. On Gate, leverage drawing tools, alerts, and conditional orders to formalize your plan into actionable steps. Treat patterns as “warning lights,” not “guarantees”—continuous documentation and review are essential for mastering double top strategies.

FAQ

Does a Double Top Breakdown Always Lead to Decline?

A breakdown from a double top typically results in downward movement but is not guaranteed. The validity of the move depends on volume confirmation—a high-volume breakdown is more reliable than one with low volume (which may be a fakeout). Always combine pattern analysis with other technical indicators like moving averages or support levels; never rely solely on chart patterns.

How Can You Distinguish Between Real and Fake Double Top Breakdowns?

A genuine breakdown is usually accompanied by a noticeable surge in trading volume and sustained price action below the neckline. A fakeout is characterized by only brief moves below the neckline followed by quick rebounds with low volume. On Gate’s candlestick charts, compare volume bars at breakdowns against average levels—this is key for assessing breakout validity.

What Are Common Mistakes Beginners Make When Identifying Double Tops?

Typical beginner errors include mistaking ordinary sideways movement for double tops (real patterns require two clearly defined peaks separated by a distinct interval), underestimating the importance of the neckline (which must be a clear support area), and jumping into shorts prematurely (always wait for decisive confirmation). Practice on historical charts first; develop discipline around “confirm breakout → wait for pullback → enter” routines.

What If the Neckline Placement Is Unclear?

If you cannot identify a clear neckline, pattern reliability is compromised—exercise caution. Try finding an obvious support level between peaks as an alternative neckline or wait for more clarity before trading. Gate’s trendline tools can help mark potential necklines with greater accuracy.

What Is the Relationship Between Double Tops and Market Sentiment?

Double tops typically emerge during transitions from optimism to caution. The first peak represents buyers’ final push; the second peak shows waning strength as sellers regain control and trigger breakdowns. Understanding these sentiment shifts helps time trades and assess pattern reliability more effectively.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?