ETH/BTC

What Is Bitcoin?

Bitcoin is a digital currency built on blockchain technology, designed to serve as a global medium for transferring and storing value without reliance on any single institution. A blockchain is a publicly verifiable ledger of transactions, linked in chronological order. Decentralization means the network is maintained by numerous nodes, with no company or authority having control. The security mechanism known as Proof of Work (PoW) relies on computational competition for recording transactions, with participants referred to as miners.

Bitcoin has a fixed supply cap of 21 million coins, giving it a unique scarcity property. Transactions are broadcast and confirmed via a peer-to-peer (P2P) network, with users signing transactions using private keys. A private key is a secret string that grants control over assets—loss or exposure of this key can result in irretrievable loss or theft of funds.

Bitcoin (BTC) Price, Market Cap, and Circulating Supply

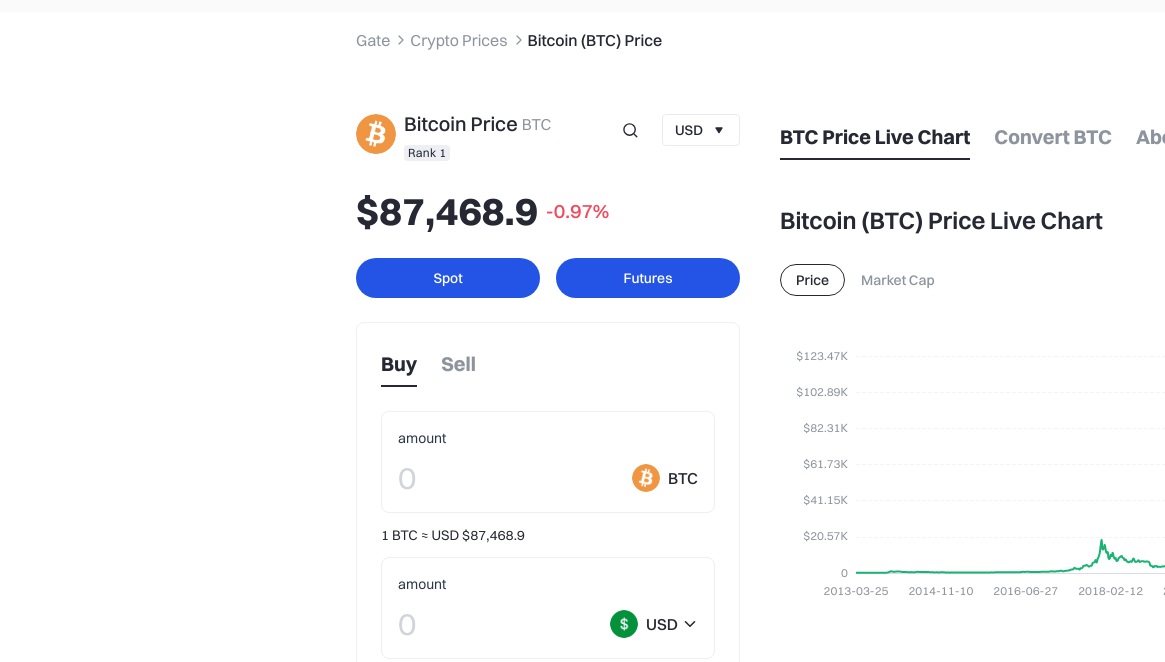

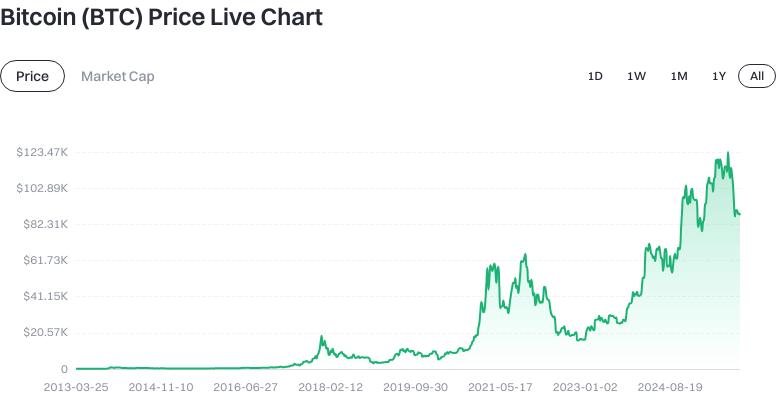

As of 2025-12-24 (source: input market data), the price of Bitcoin is $87,606.30; circulating supply stands at 19,966,153.00 BTC; total supply is 19,966,221.00 BTC; maximum supply remains 21,000,000.00 BTC.

Click to view BTC USDT price

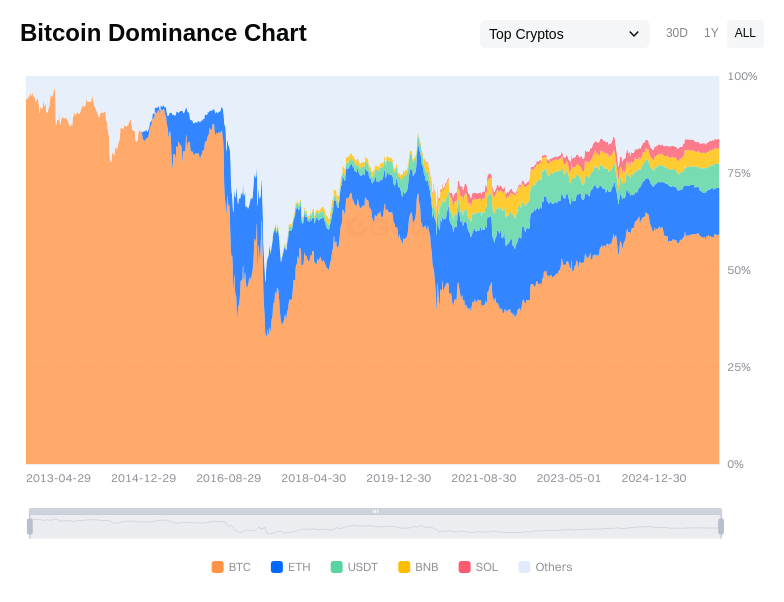

The circulating market capitalization is $1,749,166,746,792.30; fully diluted market cap matches at $1,749,166,746,792.30; market dominance is 55.14%.

Click to view Top crypto market cap share

Market capitalization is calculated as price times circulating supply and measures asset scale; fully diluted market cap assumes all possible coins are in circulation. The 24-hour trading volume is $973,559,422.34, reflecting short-term trading activity.

Short-term performance: 1-hour change is +0.06%, 24-hour change is -1.09%, 7-day change is +0.03%, and 30-day change is +0.94%.

Click to view BTC latest price chart

Short-term volatility is normal—investors should match their risk tolerance and holding period when considering positions.

Who Created Bitcoin (BTC) and When?

Bitcoin's concept was publicly introduced by the pseudonymous “Satoshi Nakamoto” in 2008 through a whitepaper outlining its technical and economic design. In 2009, the genesis block was mined and the network launched, initially attracting participants from tech and cryptography communities.

Satoshi Nakamoto was active in the project's early days but gradually stepped away. This anonymity reinforces Bitcoin’s decentralized and community-driven nature—subsequent development has been advanced by a global collective of developers, miners, node operators, and users.

How Does Bitcoin (BTC) Work?

Bitcoin operates using the Proof of Work (PoW) consensus mechanism. Miners compete by computing hashes—a type of irreversible cryptographic function—to win the right to package transactions into new blocks. The first miner to find a hash meeting the difficulty requirement creates the next block and earns both a block reward and transaction fees.

Mining difficulty adjusts periodically based on total network hash rate to maintain an average block interval of about 10 minutes. The block reward halves approximately every four years—a process called "halving"—which controls new supply and drives scarcity. Transaction confirmation involves adding blocks to the chain—the higher the number of confirmations, the lower the risk of rollback.

Nodes validate every transaction and block for correctness. Network consensus relies on the longest chain rule and economic incentives; attackers would need majority hash power to rewrite history—a “51% attack” that is prohibitively expensive on the mainnet.

What Can Bitcoin (BTC) Be Used For?

Common use cases for Bitcoin include store of value (“digital gold”), cross-border payments and remittances, portfolio diversification, and serving as a base asset in trading pairs (such as BTC/USDT or ETH/BTC for swapping between cryptocurrencies).

For payments, Bitcoin enables global value transfers without banking intermediaries. For micro and high-frequency transactions, the community is exploring Layer 2 (L2) solutions like the Lightning Network. These second-layer protocols are built atop the main chain to increase speed and reduce fees.

What Wallets and Expansion Solutions Exist in the Bitcoin (BTC) Ecosystem?

Wallets fall into cold wallets and hot wallets categories. Cold wallets store private keys offline for enhanced security, suitable for long-term holding; hot wallets are connected to the internet for daily transactions but require stricter security practices. Custodial wallets are managed by platforms for convenience; non-custodial wallets let users self-manage their private keys for greater control but require diligent backup and protection.

Expansion solutions include the Lightning Network for small, instant payments; multisignature wallets (multi-sig) that require multiple signers to boost asset security; and block explorers that allow users to query transaction status and block information for increased transparency and auditability.

What Are the Main Risks and Regulatory Considerations with Bitcoin (BTC)?

Price Volatility: Crypto assets are affected by macroeconomic factors, liquidity, and market sentiment—expect significant short-term price swings. Manage risk through position sizing and stop-loss planning.

Compliance & Taxation: Regulatory and tax rules vary by jurisdiction, impacting buying/selling, reporting, and custody practices. Operate within your local legal framework and maintain thorough transaction records.

Private Key & Custody: Loss or exposure of your private key results in permanent asset loss. Custodial arrangements require attention to platform security; non-custodial options demand robust backup and phishing defense.

Network & Fees: During periods of high blockchain congestion, transaction fees may spike and confirmation times may lengthen. Always select the correct network and reasonable fees when transferring funds.

Technical & Security Risks: While theoretically vulnerable to 51% attacks or software bugs, social engineering, phishing websites, texts, or emails are common threats. Enable two-factor authentication (2FA) and verify site URLs before entering sensitive information.

How Can I Buy and Safely Store Bitcoin (BTC) on Gate?

Step 1: Registration & Security Setup. Visit Gate’s official website to create an account, set a strong password, and enable two-factor authentication (2FA). 2FA adds a one-time verification code at login to significantly reduce account theft risks.

Step 2: Complete Identity Verification (KYC). Submit identity information as prompted—KYC stands for "Know Your Customer," essential for compliance and anti-money laundering, helping upgrade account privileges and withdrawal limits.

Step 3: Fund Your Account. Deposit fiat-supported assets or stablecoins, transfer funds to your spot account to ensure sufficient available balance.

Step 4: Spot Buy BTC. On Gate’s spot trading section, choose your preferred trading pair (such as BTC/USDT or ETH/BTC), place either limit or market orders to execute trades. Limit orders set your desired price; market orders fill immediately at current rates.

Step 5: Withdraw BTC to a Secure Wallet. For self-custody, request withdrawal of BTC to your personal non-custodial wallet. Ensure you select the Bitcoin mainnet—test with a small amount first before transferring large sums; back up your recovery phrase securely offline. A recovery phrase is a set of words used to restore your private key.

Step 6: Long-Term Storage & Risk Management. Use cold wallets for large or long-term holdings; hot wallets are best for daily spending but keep balances low. Regularly check backup recoverability, stay alert for phishing/malicious links, record times/methods when changing critical settings.

How Does Bitcoin (BTC) Differ from Ethereum?

Purpose: Bitcoin focuses on store of value and decentralized settlement with an emphasis on scarcity and stability; Ethereum is positioned as a general-purpose smart contract platform enabling decentralized applications (DApps). Smart contracts are self-executing code on-chain.

Consensus Mechanism: Bitcoin uses PoW; Ethereum adopted Proof of Stake (PoS) after “The Merge” in 2022. PoS relies on staked holdings for consensus—reducing energy use and boosting throughput—but differs from PoW in decentralization and security assumptions.

Supply & Inflation: Bitcoin has a fixed cap of 21 million coins; Ethereum has no fixed limit—its supply changes due to burning mechanisms and issuance parameters so it can be deflationary or slightly inflationary.

Functionality & Ecosystem: Bitcoin’s main chain does not natively support complex contracts—expansion happens via layers or sidechains; Ethereum supports contracts natively along with a rich DeFi/NFT/app ecosystem.

Performance & Fees: Ethereum’s Layer 2 solutions offer higher throughput and lower fees; Bitcoin uses Lightning Network for improved small payment experiences. Both balance trade-offs between security, performance, and decentralization differently.

Summary of Bitcoin (BTC)

With its decentralized architecture, PoW security model, and hard cap of 21 million coins, Bitcoin offers a transparent and scarce value network suitable for long-term holding and global settlement. For practical investing, combine market data with personal goals—prioritize compliance, account/private key security, transaction fees/network conditions, and make informed choices between custodial or non-custodial solutions. Beginners should start with proper purchase procedures and security habits while gradually learning about halving cycles, scaling solutions, and risk management strategies. In the long term, network effects, institutional adoption, and technological evolution will shape its performance—patience and discipline are key components of effective allocation.

FAQ

What Does ETH/BTC Mean?

ETH/BTC is a trading pair representing the price ratio of Ethereum (ETH) relative to Bitcoin (BTC). It shows how many BTC are needed to buy one ETH—an important indicator for comparing the relative value of these two leading cryptocurrencies. Fluctuations in this ratio can influence investors’ asset allocation decisions.

How Do I Trade ETH/BTC on Gate?

Trading ETH/BTC on Gate is straightforward: log into your account, enter the spot trading section, search for the ETH/BTC pair, then choose buy or sell. You can set limit orders at specific prices or use market orders for instant execution. Beginners are advised to start with small amounts until familiar with the interface before increasing trade size.

What Does a High or Low ETH/BTC Ratio Indicate?

A high ETH/BTC ratio means Ethereum is stronger relative to Bitcoin—it takes more BTC to buy one ETH. A low ratio indicates Ethereum is weaker compared to Bitcoin. Investors use this ratio to gauge market trends: rising ratios suggest Ethereum outperforms; declining ratios may signal greater favor toward Bitcoin.

Why Monitor ETH/BTC Price Movements?

ETH/BTC reflects the relative strength of the two largest cryptocurrencies—helping you spot where market attention lies. If you allocate assets between them, tracking this ratio helps you optimize timing for portfolio shifts. It’s also a crucial indicator used by professional traders to assess market cycles.

Is ETH/BTC Better for Long-Term Holding or Short-Term Trading?

ETH/BTC can be used for both long-term portfolio balancing and short-term trading strategies. Long-term investors use it to adjust their ETH/BTC holdings; short-term traders seek profits from ratio volatility. Which approach suits you depends on your goals and risk tolerance—newcomers should understand fundamentals before setting their strategy.

Bitcoin (BTC) Key Terms Overview

- Proof of Work (PoW): A consensus mechanism where miners compete using computational power to validate transactions and secure the network.

- Block: A data bundle containing transaction details, timestamps, and previous block hashes—forming a linked chain.

- Mining: The process where miners solve complex mathematical puzzles to validate transactions, create new blocks, and earn BTC rewards.

- Private Key: A unique secret key used by users to sign transactions and prove asset ownership—must be carefully secured.

- Hash Function: A cryptographic algorithm converting data of any length into a fixed-length hash value—ensures data integrity.

- Difficulty Adjustment: Automatic recalibration of mining difficulty based on total network hash rate—to maintain ~10 minute average block time.

Recommended Reading & References on Bitcoin (BTC)

-

Official Website / Whitepaper:

-

Developer Documentation:

-

Trusted Media / Research:

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

BTC and Projects in The BRC-20 Ecosystem