Trade

Trading Type

Spot

Trade crypto freely

Alpha

Points

Get promising tokens in streamlined on-chain trading

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-Stop Lending Hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

BTC Staking

HOT

Stake BTC and earn 10% APR

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

- Trending TopicsView More

253.74K Popularity

46.1K Popularity

4.61K Popularity

6.87K Popularity

6.58K Popularity

- Hot Gate FunView More

- MC:$3.67KHolders:20.04%

- MC:$3.7KHolders:20.09%

- MC:$3.64KHolders:10.00%

- MC:$3.64KHolders:10.00%

- MC:$3.7KHolders:20.18%

- Pin

ReFi model enters structural upgrade period: ORA's transparency path sparks industry follow.

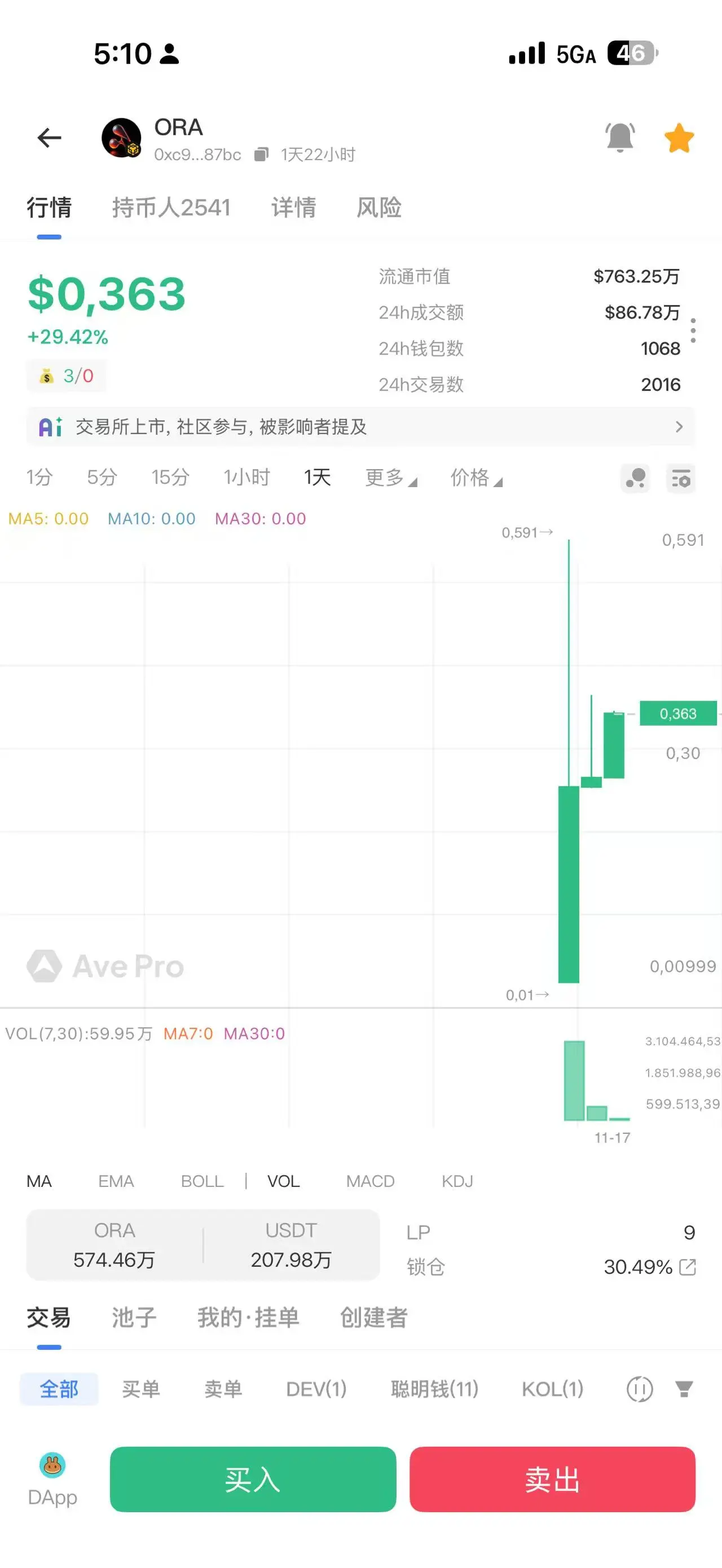

ReFi experienced rapid expansion from 2024 to 2025, becoming one of the most densely funded zones in on-chain finance. However, as the scale rises, structural issues of traditional ReFi models began to emerge: insufficient transparency, excessive incentive pressure, and unclear cash flow sources. The recently launched ORA, with its combination of “transparency + cash flow solidification + deflationary model,” is considered a landmark project marking the structural upgrade period for the ReFi track.

The limitations of the first-generation ReFi model are gradually becoming apparent.

The first generation of ReFi, represented by the Lafi Protocol, achieved rapid growth through incentive-driven mechanisms. However, as the user base expands, the unverifiability of the mechanisms brings a certain level of uncertainty. Industry articles generally point out that to attract a broader range of users, ReFi must shift from “story-driven” to “structure-driven.”

ORA takes transparency as its core breakthrough.

The emergence of ORA is regarded as a structural upgrade to the first-generation model. Its transparent dashboard covers all on-chain data, including: tax fee paths, main coin destruction, sub-coin burning, LP injection sources, reserve proofs, and more. Transparency not only facilitates user supervision but also helps institutions assess risk and return models.

Industry analysis points out: “The transparency of ORA is not partial disclosure, but mechanism-level transparency,” which gives it stronger auditability.

Cash flow solidification into protocols brings stability.

The cash flow of ORA is composed of transaction tax and profit tax, both of which are automatically executed and solidified in the contract. Compared to the old model that relies on incentive diffusion, verifiable cash flow has become one of the key advantages of ORA. Analysts believe that the transparency of the structure reduces the evaluation costs for participants, establishing a foundation for the long-term operation of the protocol.

Deflationary ORAC provides a new supply logic

The model features of the sub-token ORAC include:

Daily Fixed Burn

Cannot buy in the secondary market

Sell and burn

No possibility of issuance increase

This structure creates strong constraints on the supply side, making ORAC inherently scarce. Research institutions indicate that this type of structure is suitable for integration into real usage scenarios, rather than relying solely on incentives to maintain traffic.

Industry Trends: From Incentive Competition to Structural Competition

Multiple research articles point out that ReFi is about to enter the “structured competition” phase. Factors related to system robustness, including transparency, deflationary structure, cash flow pathways, ecological expansion capabilities, and contract autonomy, will become the new evaluation criteria for the industry.

The design of ORA is considered to align with this trend, thus gaining higher attention.