Digital Trading Engineering: Elite Strategies in Crypto Markets

In a 24/7 market driven by algorithms and (Market Makers), traditional technical analysis alone is no longer sufficient. Professionalism in cryptocurrencies requires a deep understanding of liquidity flows, whale psychology, and balancing yields with the sovereign risks of platforms.

1. Liquidity Flow Analysis (Order Flow & Order Book)

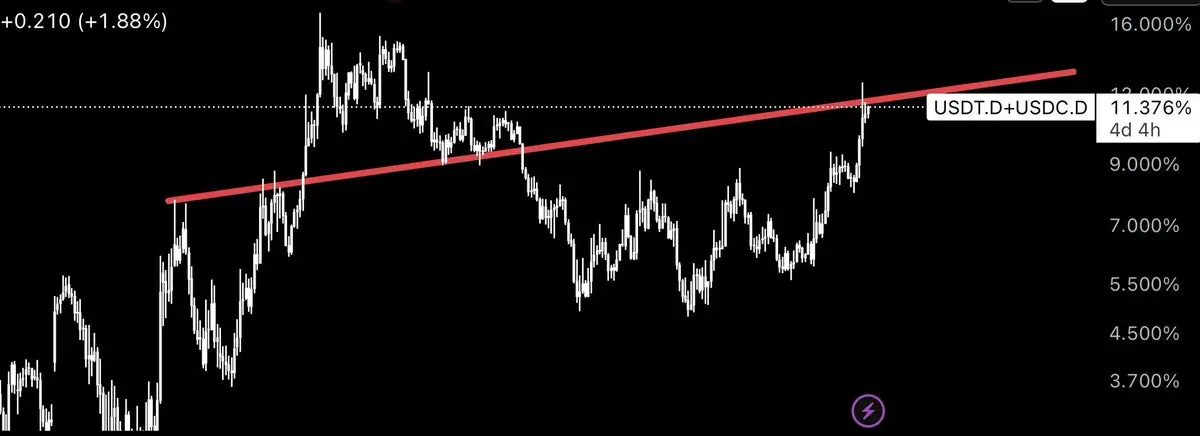

Professionals don’t just look at "candles," but monitor market depth (Market Depth):

Liquidity zones: identifying stop-loss clusters (Stop Losses) targeted by whales to generate price momentum.

On-Chain Data: tracking large wallet movements to and from exchanges. Massive Bitcoin withdrawals to cold wallets are a cumulative indicator (Accumulation) stronger than any technical indicator.

2. Advanced Hedging Strategies (Hedging)

Professional traders don’t just bet on upward movement but protect their portfolios through:

Futures (Futures): opening short (Short) positions parallel to spot (Spot) positions during uncertain times to safeguard capital.

Crypto Options (Options): using "Put Options" contracts as a form of insurance against sudden crashes (Black Swan Events).

3. Capital Management: "The Survival Rule"

The key difference between amateurs and professionals is position sizing (Position Sizing):

Calculated risk: risking no more than 1-2% of the total portfolio on a single trade.

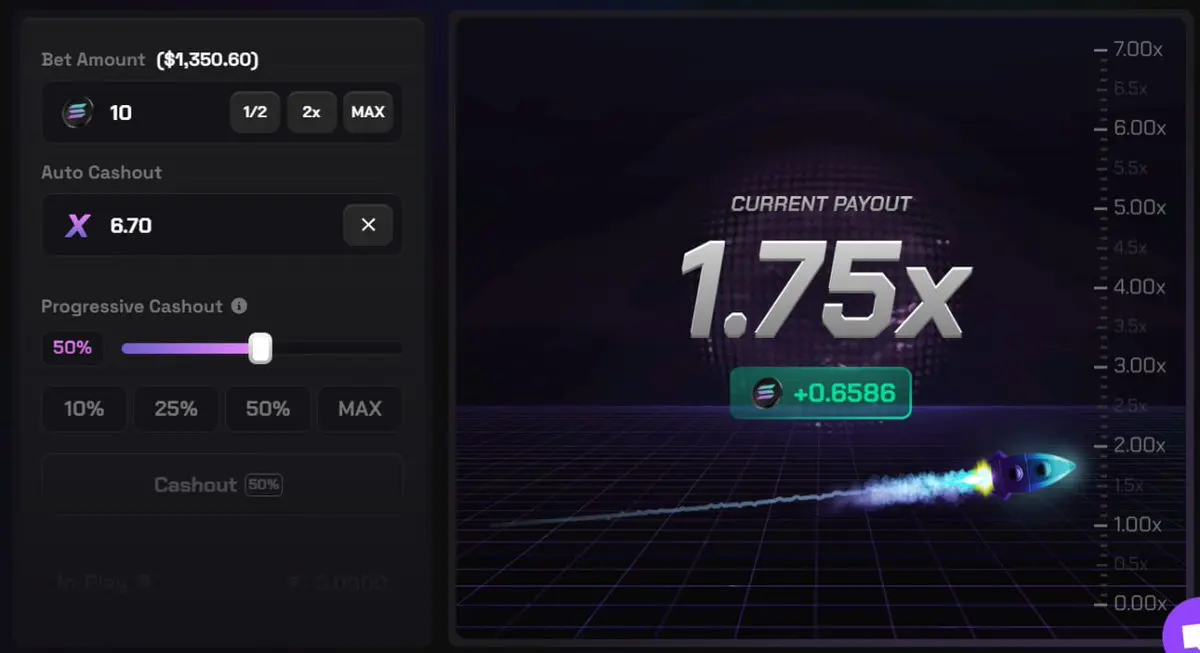

Profit-taking: once certain goals are achieved, withdraw "working capital" and start trading with "house money" (House Money), increasing emotional stability in decision-making.

4. Market Psychology Traps (The Wyckoff Theory)

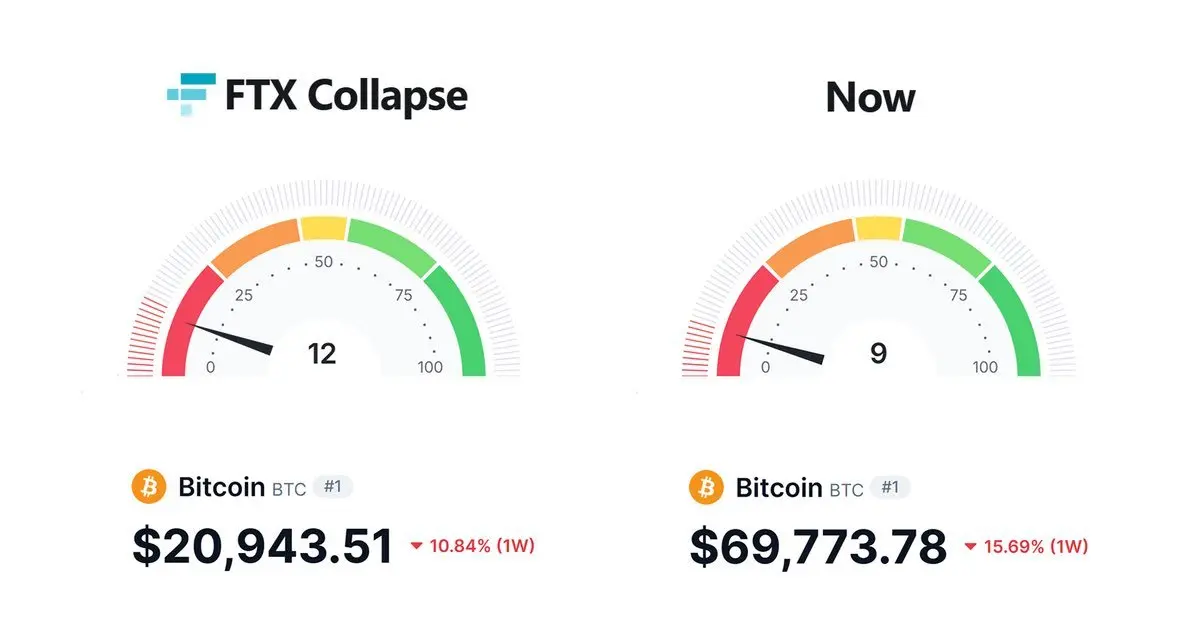

Understanding the four market cycles: accumulation, markup, distribution, and markdown. The professional buys at the "desperation" top and sells at the "euphoria" peak (FOMO), considering that successive positive news often fuels major distribution phases.

5. Automation and Artificial Intelligence

Relying on trading bots (Trading Bots) to execute "Arbitrage" (exploiting price differences between platforms) or "Grid Trading" strategies ensures presence in the market 24/7 without being affected by human factors.#GateSquare$50KRedPacketGiveaway

In a 24/7 market driven by algorithms and (Market Makers), traditional technical analysis alone is no longer sufficient. Professionalism in cryptocurrencies requires a deep understanding of liquidity flows, whale psychology, and balancing yields with the sovereign risks of platforms.

1. Liquidity Flow Analysis (Order Flow & Order Book)

Professionals don’t just look at "candles," but monitor market depth (Market Depth):

Liquidity zones: identifying stop-loss clusters (Stop Losses) targeted by whales to generate price momentum.

On-Chain Data: tracking large wallet movements to and from exchanges. Massive Bitcoin withdrawals to cold wallets are a cumulative indicator (Accumulation) stronger than any technical indicator.

2. Advanced Hedging Strategies (Hedging)

Professional traders don’t just bet on upward movement but protect their portfolios through:

Futures (Futures): opening short (Short) positions parallel to spot (Spot) positions during uncertain times to safeguard capital.

Crypto Options (Options): using "Put Options" contracts as a form of insurance against sudden crashes (Black Swan Events).

3. Capital Management: "The Survival Rule"

The key difference between amateurs and professionals is position sizing (Position Sizing):

Calculated risk: risking no more than 1-2% of the total portfolio on a single trade.

Profit-taking: once certain goals are achieved, withdraw "working capital" and start trading with "house money" (House Money), increasing emotional stability in decision-making.

4. Market Psychology Traps (The Wyckoff Theory)

Understanding the four market cycles: accumulation, markup, distribution, and markdown. The professional buys at the "desperation" top and sells at the "euphoria" peak (FOMO), considering that successive positive news often fuels major distribution phases.

5. Automation and Artificial Intelligence

Relying on trading bots (Trading Bots) to execute "Arbitrage" (exploiting price differences between platforms) or "Grid Trading" strategies ensures presence in the market 24/7 without being affected by human factors.#GateSquare$50KRedPacketGiveaway