#USCoreCPIHitsFourYearLow — What Jan 2026 Inflation Really Means for Crypto 🧵

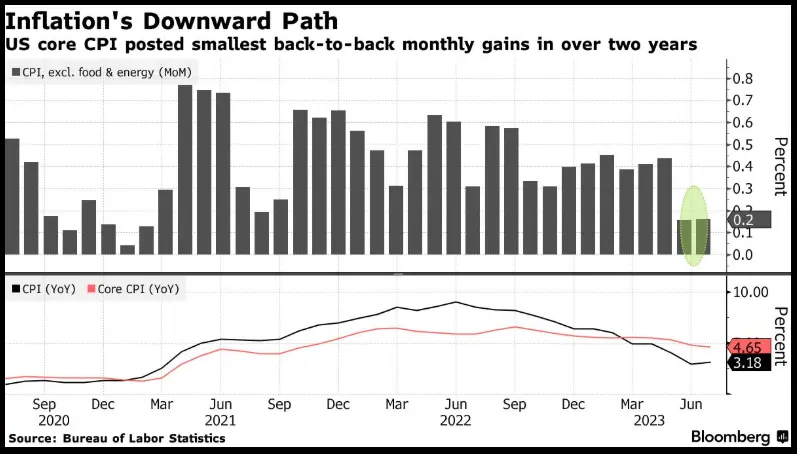

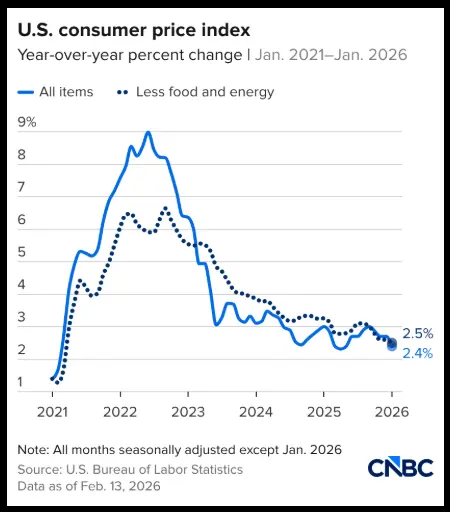

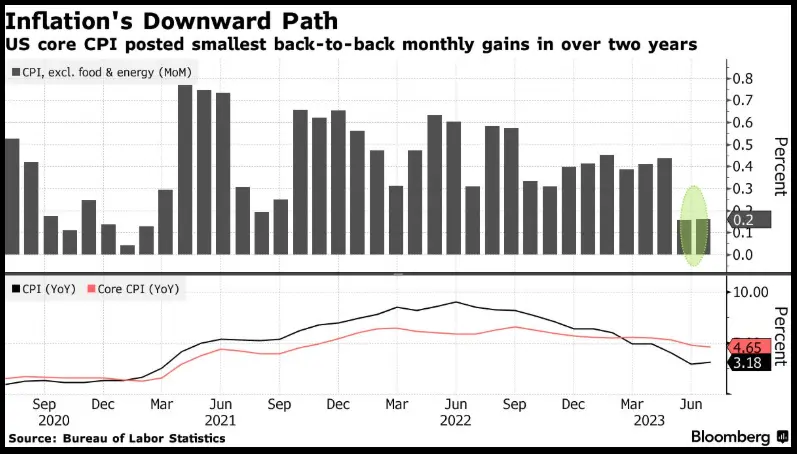

1/ Fresh January data from the Bureau of Labor Statistics shows inflation cooling faster than expected. Headline CPI came in at +0.2% MoM and +2.4% YoY — the softest yearly pace in months. Core CPI (excluding food and energy) slowed to +2.5% YoY, hovering near a 4-year low. Energy prices pulled back, food stayed stable, and shelter inflation is finally easing.

2/ The bigger story is trend direction. Disinflation is clearly back in motion. Goods prices are soft (used cars and consumer goods still deflating), while services remain sticky but no longer accelerating. This is exactly the kind of gradual cooldown the Federal Reserve wants to see on the path toward its 2% target.

3/ Policy outlook: this is a “Goldilocks” print — cooling inflation without visible economic damage. It reduces pressure for immediate rate cuts but increases the probability of easing later in 2026 if the trend continues. Markets are now leaning toward mid-year cuts, assuming upcoming PCE data confirms the slowdown.

4/ Market reaction was immediate. Bitcoin ripped higher as traders priced in softer monetary conditions. Lower inflation expectations weaken the dollar and compress bond yields, which historically boosts risk assets. Liquidity expectations — not just current rates — are driving crypto sentiment.

5/ Crypto angle: sustained disinflation is a tailwind for the entire digital asset market. If inflation keeps cooling, global liquidity conditions improve and capital rotates back into high-beta assets. That creates room for BTC and ETH to test higher resistance zones. A surprise hot print in future data, however, could quickly tighten conditions and trigger volatility.

6/ Bottom line: inflation is cooling, core pressures are easing, and macro conditions are slowly tilting risk-on. For crypto, this environment favors accumulation over panic. Next key catalyst is the upcoming PCE report — that will either validate this trend or challenge it.

What’s your read on the macro setup? Bullish continuation or short-term pullback? 👇

#Crypto #Inflation #Fed #Bitcoin $BTC $ETH

1/ Fresh January data from the Bureau of Labor Statistics shows inflation cooling faster than expected. Headline CPI came in at +0.2% MoM and +2.4% YoY — the softest yearly pace in months. Core CPI (excluding food and energy) slowed to +2.5% YoY, hovering near a 4-year low. Energy prices pulled back, food stayed stable, and shelter inflation is finally easing.

2/ The bigger story is trend direction. Disinflation is clearly back in motion. Goods prices are soft (used cars and consumer goods still deflating), while services remain sticky but no longer accelerating. This is exactly the kind of gradual cooldown the Federal Reserve wants to see on the path toward its 2% target.

3/ Policy outlook: this is a “Goldilocks” print — cooling inflation without visible economic damage. It reduces pressure for immediate rate cuts but increases the probability of easing later in 2026 if the trend continues. Markets are now leaning toward mid-year cuts, assuming upcoming PCE data confirms the slowdown.

4/ Market reaction was immediate. Bitcoin ripped higher as traders priced in softer monetary conditions. Lower inflation expectations weaken the dollar and compress bond yields, which historically boosts risk assets. Liquidity expectations — not just current rates — are driving crypto sentiment.

5/ Crypto angle: sustained disinflation is a tailwind for the entire digital asset market. If inflation keeps cooling, global liquidity conditions improve and capital rotates back into high-beta assets. That creates room for BTC and ETH to test higher resistance zones. A surprise hot print in future data, however, could quickly tighten conditions and trigger volatility.

6/ Bottom line: inflation is cooling, core pressures are easing, and macro conditions are slowly tilting risk-on. For crypto, this environment favors accumulation over panic. Next key catalyst is the upcoming PCE report — that will either validate this trend or challenge it.

What’s your read on the macro setup? Bullish continuation or short-term pullback? 👇

#Crypto #Inflation #Fed #Bitcoin $BTC $ETH