Post content & earn content mining yield

placeholder

CryptoHaoGe

After oscillating around the 89500 level in the morning, Bitcoin briefly retraced to the 88800 level, but the bearish momentum failed to continue. The price found clear support at that level and stabilized with a rebound. Currently, the market has regained the 89000 integer level, indicating that the bulls still hold the initiative during the pullback.

From a technical perspective, the price stopped falling and rebounded around 88800, suggesting strong buying support in that area, which may be a key support level tested multiple times recently. As the price moves back above 89000, the short-te

From a technical perspective, the price stopped falling and rebounded around 88800, suggesting strong buying support in that area, which may be a key support level tested multiple times recently. As the price moves back above 89000, the short-te

BTC1,01%

- Reward

- like

- Comment

- Repost

- Share

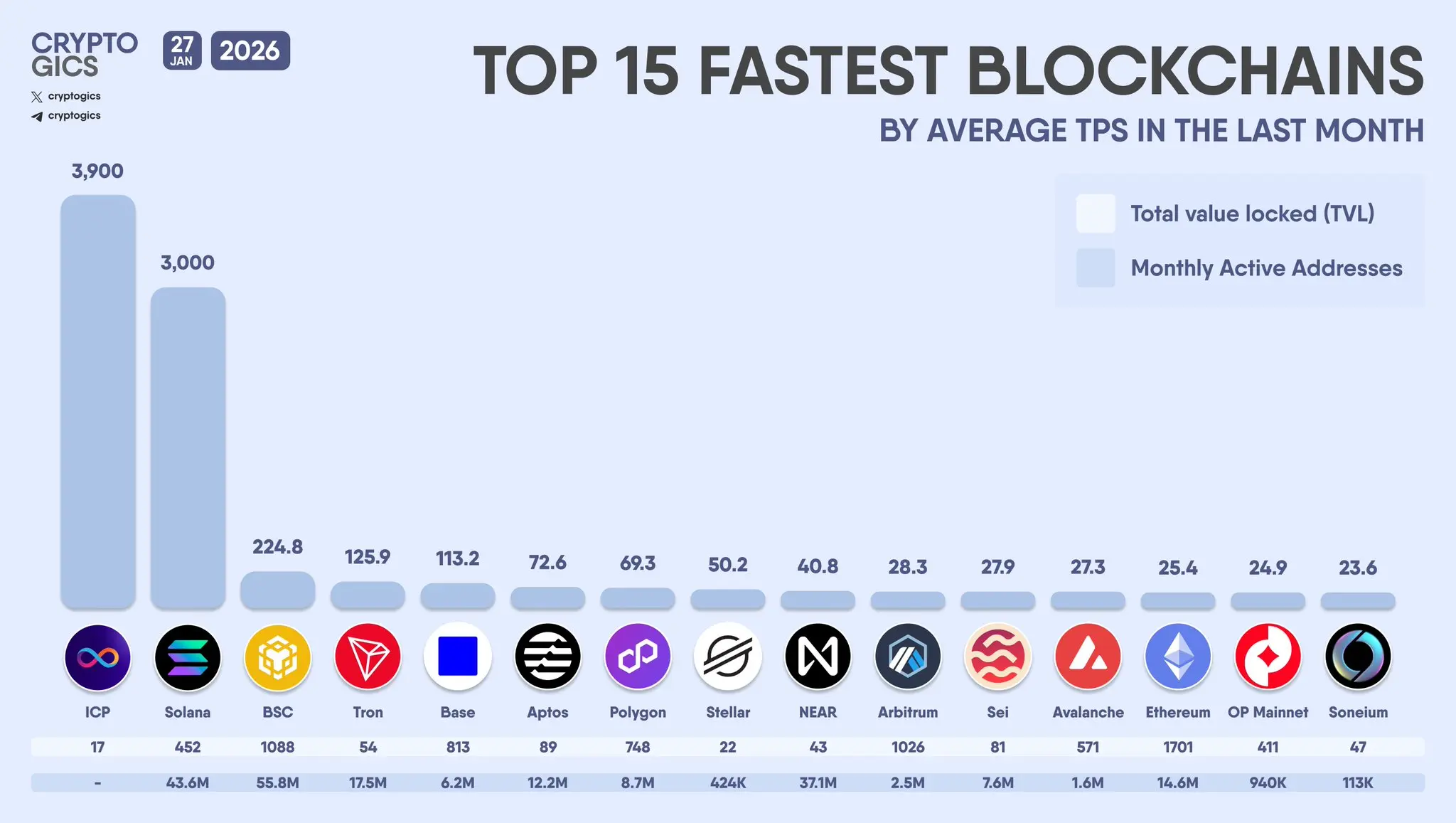

TOP 15 FASTEST BLOCKCHAINS BY AVERAGE $XRP $10,000

Here’s the truth most people miss:

$XRP doesn’t need to be cheap.

It needs to be efficient.

The global system doesn’t scale on

millions of tiny units.

It scales on a few, high-value units.

That’s the shift:

• Retail thinks $10,000 $XRP is crazy

• Institutions think it’s necessary

• Infrastructure requires it

Same value.

Completely different market impact.

So which system is easier to run?

One $XRP at $10,000

—or—

One million $0.01 XRP?

Once you see it, you can’t unsee it.#TPS

$ICP $SOL #Solana #Soneium

Here’s the truth most people miss:

$XRP doesn’t need to be cheap.

It needs to be efficient.

The global system doesn’t scale on

millions of tiny units.

It scales on a few, high-value units.

That’s the shift:

• Retail thinks $10,000 $XRP is crazy

• Institutions think it’s necessary

• Infrastructure requires it

Same value.

Completely different market impact.

So which system is easier to run?

One $XRP at $10,000

—or—

One million $0.01 XRP?

Once you see it, you can’t unsee it.#TPS

$ICP $SOL #Solana #Soneium

- Reward

- like

- Comment

- Repost

- Share

#CryptoRegulationNewProgress

The world of digital assets is seeing a pivotal shift today as highlights major updates in regulatory frameworks across key markets. On January 28, 2026, governments, financial authorities, and international organizations are moving closer to formalized, globally coordinated crypto regulations that aim to balance innovation with investor protection. After years of fragmented policies and regulatory uncertainty, this sequence of developments signals a new era where crypto markets could operate with greater clarity, legitimacy, and stability.

Sequence of Key Events

The world of digital assets is seeing a pivotal shift today as highlights major updates in regulatory frameworks across key markets. On January 28, 2026, governments, financial authorities, and international organizations are moving closer to formalized, globally coordinated crypto regulations that aim to balance innovation with investor protection. After years of fragmented policies and regulatory uncertainty, this sequence of developments signals a new era where crypto markets could operate with greater clarity, legitimacy, and stability.

Sequence of Key Events

- Reward

- 3

- 4

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎View More

孔子

孔子

Created By@PiggyFromTheOcean

Listing Progress

100.00%

MC:

$42.56K

Create My Token

1.28 Wednesday Intraday Mistress Analysis

From the daily chart perspective, although there is an intraday rebound, the overall structure remains weak. The rebound is more of a technical correction during the downward retracement. The upward rebound space is limited, and previous attempts to break higher failed to establish a solid footing. Selling pressure above remains heavy. Although the MACD green histogram has contracted, it is still below the zero line. The downward trend has not reversed. The current rebound lacks sustained volume increase, making an effective reversal unlikely. From the

From the daily chart perspective, although there is an intraday rebound, the overall structure remains weak. The rebound is more of a technical correction during the downward retracement. The upward rebound space is limited, and previous attempts to break higher failed to establish a solid footing. Selling pressure above remains heavy. Although the MACD green histogram has contracted, it is still below the zero line. The downward trend has not reversed. The current rebound lacks sustained volume increase, making an effective reversal unlikely. From the

ETH2,55%

- Reward

- like

- Comment

- Repost

- Share

Make today the day you choose better.

- Reward

- like

- Comment

- Repost

- Share

#MiddleEastTensionsEscalate 🌍

Geopolitical risk is back in focus, and markets are repricing uncertainty in real time. Energy markets are heating up, volatility is spreading, and capital is shifting toward protection rather than speculation.

What we’re seeing: • Oil reacting to supply risk and regional instability

• Equities turning cautious as risk premiums rise

• Gold attracting defensive flows

• Crypto facing short-term pressure as liquidity tightens

This phase isn’t about predicting headlines. It’s about reading capital behavior.

During geopolitical stress, markets reward: • Reduced levera

Geopolitical risk is back in focus, and markets are repricing uncertainty in real time. Energy markets are heating up, volatility is spreading, and capital is shifting toward protection rather than speculation.

What we’re seeing: • Oil reacting to supply risk and regional instability

• Equities turning cautious as risk premiums rise

• Gold attracting defensive flows

• Crypto facing short-term pressure as liquidity tightens

This phase isn’t about predicting headlines. It’s about reading capital behavior.

During geopolitical stress, markets reward: • Reduced levera

- Reward

- 1

- 1

- Repost

- Share

PakMaliki :

:

Happy New Year! 🤑ETH from the daily and 4-hour charts shows moving averages in a bullish alignment, with the price staying above the MA20. The pullback has not broken below key support, and the medium-term upward trend remains intact.

Key formations indicate a rounded bottom pattern on the weekly chart, and a double bottom along with a flag consolidation structure on the 4-hour chart, signaling a bullish reversal or continuation.

In terms of strategy, consider going long on a pullback to the 2970-2950 zone, with targets around 3050-3100.

View OriginalKey formations indicate a rounded bottom pattern on the weekly chart, and a double bottom along with a flag consolidation structure on the 4-hour chart, signaling a bullish reversal or continuation.

In terms of strategy, consider going long on a pullback to the 2970-2950 zone, with targets around 3050-3100.

- Reward

- like

- Comment

- Repost

- Share

Everyone is just good at farming. This thing doesn't make money.

View Original

MC:$3.59KHolders:3

0.66%

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Which #crypto will moon in Q4? 🚀🚀

- Reward

- 1

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

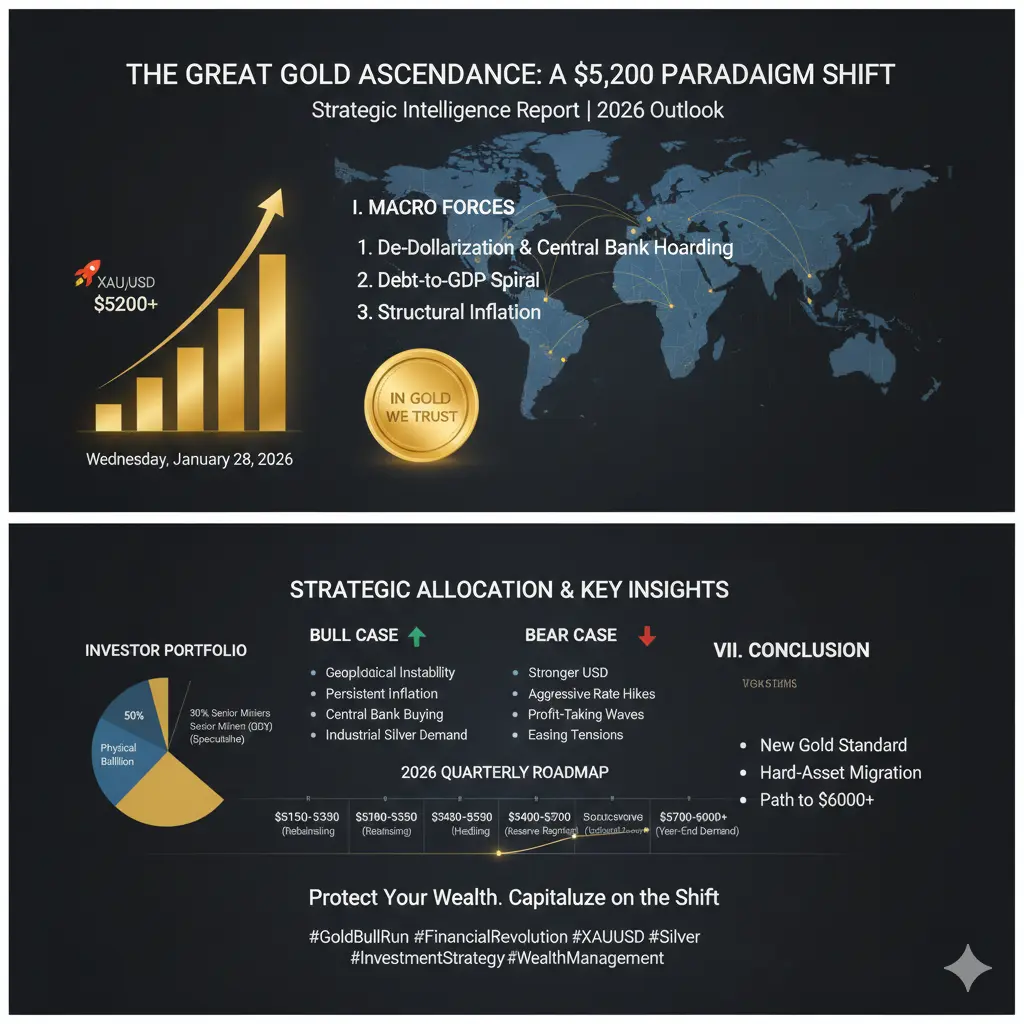

#GoldBreaksAbove$5,200:

Gold Breaks Above $5,200: What Investors Need to Know

Gold, the world’s most trusted safe-haven asset, has recently achieved a significant milestone by breaking above the $5,200 mark.

This surge has attracted attention from investors, traders, and market analysts worldwide. Gold’s performance is more than just a number—it reflects broader economic trends, investor sentiment, and global uncertainties. Understanding what this breakthrough means for the market and investment strategies is crucial for anyone involved in financial planning or trading.

The Significance of $5

Gold Breaks Above $5,200: What Investors Need to Know

Gold, the world’s most trusted safe-haven asset, has recently achieved a significant milestone by breaking above the $5,200 mark.

This surge has attracted attention from investors, traders, and market analysts worldwide. Gold’s performance is more than just a number—it reflects broader economic trends, investor sentiment, and global uncertainties. Understanding what this breakthrough means for the market and investment strategies is crucial for anyone involved in financial planning or trading.

The Significance of $5

- Reward

- 1

- Comment

- Repost

- Share

LYP

李亚鹏

Created By@FangBingwu

Listing Progress

0.00%

MC:

$0.1

Create My Token

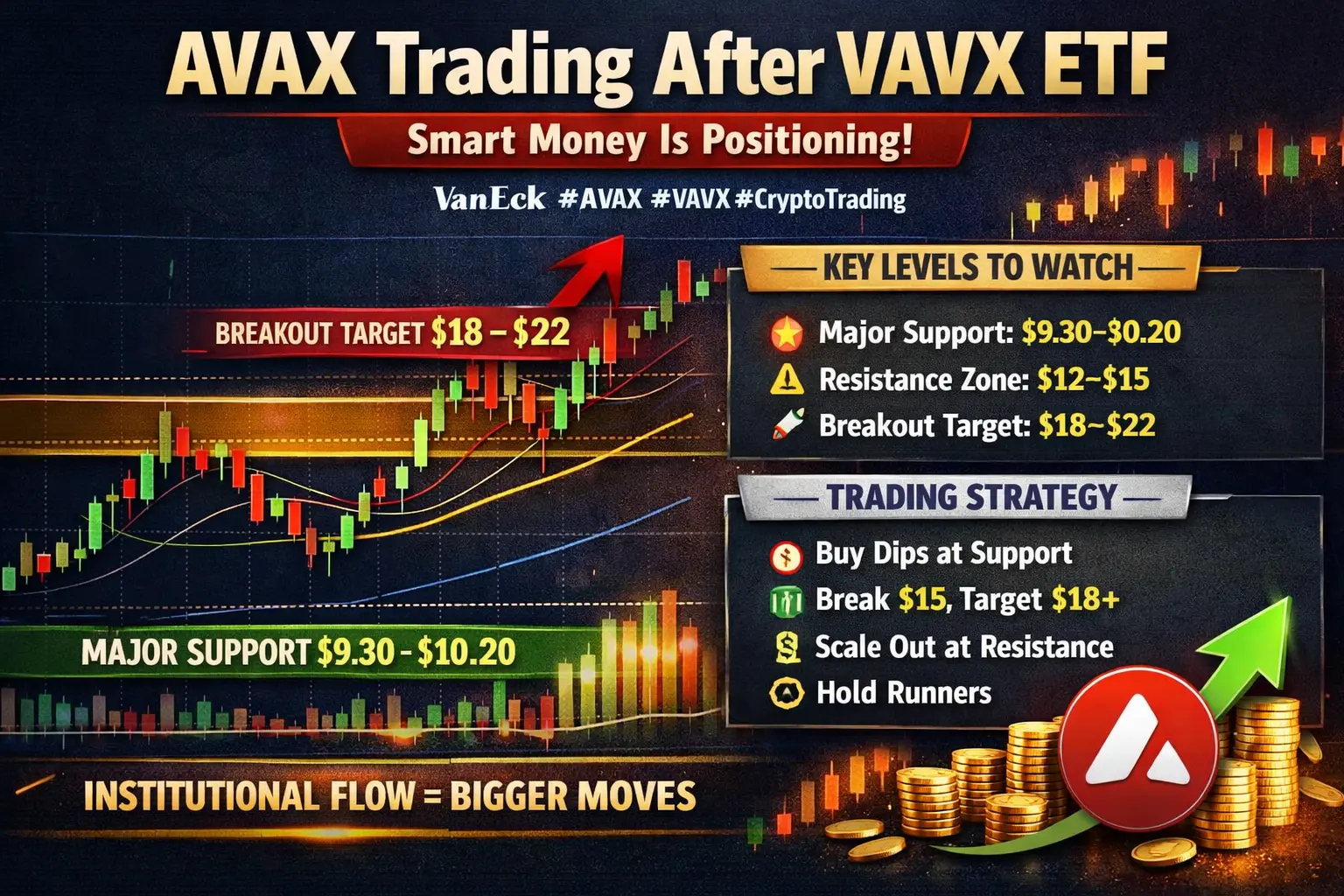

#VanEckLaunchesAVAXSpotETF AVAX Trading Outlook After VAVX ETF — Smart Money Is Positioning

#AVAX #VAVX #VanEck #MarketSetup

The launch of VanEck’s AVAX Spot ETF (VAVX) has officially pushed Avalanche into the institutional trading arena and for serious traders, this changes everything.

This is no longer a retail-only playground.

We’re now entering a phase where:

ETF inflows drive price action

Institutions build long-term positions

Volatility creates high-probability setups

Fundamentals support technical breakouts

Welcome to the next AVAX trading cycle.

Current Market Structure

Right now AVA

#AVAX #VAVX #VanEck #MarketSetup

The launch of VanEck’s AVAX Spot ETF (VAVX) has officially pushed Avalanche into the institutional trading arena and for serious traders, this changes everything.

This is no longer a retail-only playground.

We’re now entering a phase where:

ETF inflows drive price action

Institutions build long-term positions

Volatility creates high-probability setups

Fundamentals support technical breakouts

Welcome to the next AVAX trading cycle.

Current Market Structure

Right now AVA

AVAX2,62%

- Reward

- 1

- Comment

- Repost

- Share

Market structure:Higher timeframe trend remains intact above key levels

- Reward

- like

- Comment

- Repost

- Share

patiently waiting on $buttcoin while the rest of ct gets thrashed rotations from trash bag coins to trash base coins.

- Reward

- like

- Comment

- Repost

- Share

【$PTB Signal】Long Breakout and Pullback Confirmation

$PTB After a surge of 31% with high volume, the price is consolidating strongly at a high level. This is not a top distribution but a healthy reset. The order book shows good absorption of buy orders, with no panic selling pressure.

🎯Direction: Long

🎯Entry: 0.00265 - 0.00270

🛑Stop Loss: 0.00245 (Rigid Stop Loss)

🚀Target 1: 0.00300

🚀Target 2: 0.00330

After a massive breakout, the price rejected a deep correction and formed a support platform above the previous high area. This structure indicates that main funds are still in the market, a

$PTB After a surge of 31% with high volume, the price is consolidating strongly at a high level. This is not a top distribution but a healthy reset. The order book shows good absorption of buy orders, with no panic selling pressure.

🎯Direction: Long

🎯Entry: 0.00265 - 0.00270

🛑Stop Loss: 0.00245 (Rigid Stop Loss)

🚀Target 1: 0.00300

🚀Target 2: 0.00330

After a massive breakout, the price rejected a deep correction and formed a support platform above the previous high area. This structure indicates that main funds are still in the market, a

PTB19,26%

- Reward

- 2

- Comment

- Repost

- Share

【$HYPE Signal】Long | Healthy Reset After Breakout with Volume

$HYPE After a 22% volume-driven surge, the price is consolidating in a narrow range at high levels. The price action indicates healthy cooling rather than distribution at the top, with strong buy-side absorption and no signs of panic selling.

🎯 Direction: Long

🎯 Entry: 32.80 - 33.20

🛑 Stop Loss: 31.50 ( Rigid stop loss, invalidates the structure if broken )

🚀 Target 1: 35.80

🚀 Target 2: 38.50

$HYPE The massive increase accompanied by rising open interest is a typical sign of main capital entering, not a short squeeze. Curren

$HYPE After a 22% volume-driven surge, the price is consolidating in a narrow range at high levels. The price action indicates healthy cooling rather than distribution at the top, with strong buy-side absorption and no signs of panic selling.

🎯 Direction: Long

🎯 Entry: 32.80 - 33.20

🛑 Stop Loss: 31.50 ( Rigid stop loss, invalidates the structure if broken )

🚀 Target 1: 35.80

🚀 Target 2: 38.50

$HYPE The massive increase accompanied by rising open interest is a typical sign of main capital entering, not a short squeeze. Curren

HYPE24,02%

- Reward

- like

- Comment

- Repost

- Share

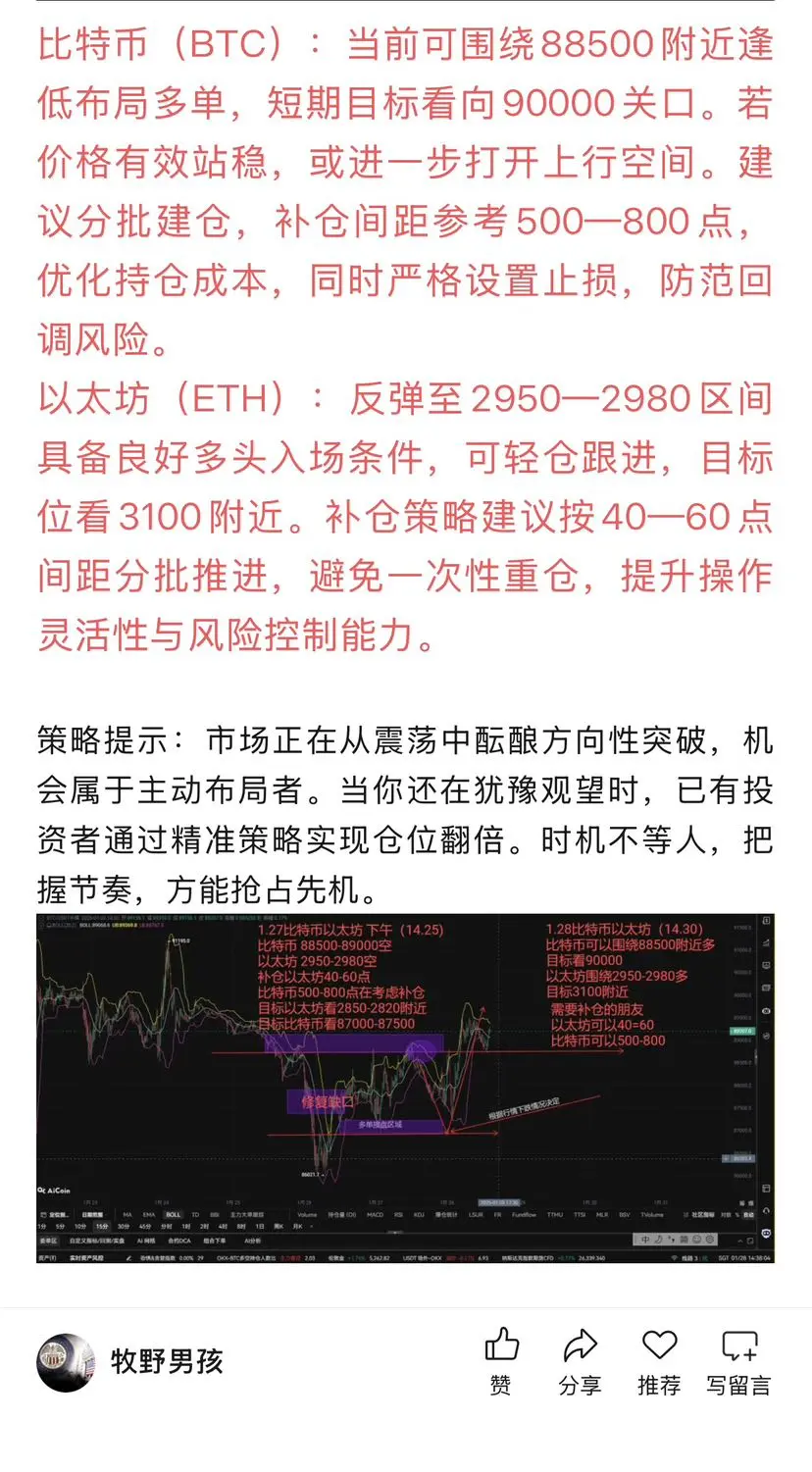

January 28th Bitcoin and Ethereum Afternoon Strategy (Updated at 14:30)

Review and Outlook:

Yesterday's Bitcoin and Ethereum market movements fulfilled expectations, with precise capture of both bullish and bearish opportunities, and strategies fully implemented. As early as last weekend, we clearly indicated the possibility of a trend reversal this week, and now the market trend confirms our prediction. Next, we outline today's core operational ideas to seize the new wave of trading opportunities.

Bitcoin (BTC):

Currently, consider buying on dips around 88,500, with a short-term target of 90,

View OriginalReview and Outlook:

Yesterday's Bitcoin and Ethereum market movements fulfilled expectations, with precise capture of both bullish and bearish opportunities, and strategies fully implemented. As early as last weekend, we clearly indicated the possibility of a trend reversal this week, and now the market trend confirms our prediction. Next, we outline today's core operational ideas to seize the new wave of trading opportunities.

Bitcoin (BTC):

Currently, consider buying on dips around 88,500, with a short-term target of 90,

- Reward

- like

- Comment

- Repost

- Share

#BitcoinFallsBehindGold 📉🟡

Bitcoin is losing ground against gold. The BTC/Gold ratio is down ~55% from its peak

and has now fallen below the 200-week

moving average — a level many long-term investors watch closely.

Historically, moments like this have sparked

debate:

·

🟢 Value zone? Long-term buyers see weakness vs gold as an

accumulation signal.

·

🔴 More downside? Others warn the trend still favors safe

havens in the near term.

With macro uncertainty high and gold leading,

the question is whether Bitcoin is setting up for a rebound — or needs more

time to base.

#Bitcoin

Bitcoin is losing ground against gold. The BTC/Gold ratio is down ~55% from its peak

and has now fallen below the 200-week

moving average — a level many long-term investors watch closely.

Historically, moments like this have sparked

debate:

·

🟢 Value zone? Long-term buyers see weakness vs gold as an

accumulation signal.

·

🔴 More downside? Others warn the trend still favors safe

havens in the near term.

With macro uncertainty high and gold leading,

the question is whether Bitcoin is setting up for a rebound — or needs more

time to base.

#Bitcoin

BTC1,01%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More3.57K Popularity

67.02K Popularity

24.86K Popularity

8.8K Popularity

8.07K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$3.44KHolders:10.00%

- MC:$3.44KHolders:10.00%

- MC:$3.44KHolders:10.00%

- MC:$3.44KHolders:10.00%

News

View MoreVitalik Buterin personally tests multi-signature wallet experience: Why open source and verifiability are reshaping the Ethereum user experience

1 m

A newly created wallet has deposited another $36.15 million into HyperLiquid to increase its HYPE holdings.

1 m

PYTH Price Forecast: Holding steady at the key level of $0.05, technical indicators point to a 65% upside potential

4 m

BlockSec releases analysis of major vulnerabilities in closed-source contracts: SwapNet and Aperture Finance suffer attacks due to insufficient input validation, resulting in a loss of $17 million

5 m

Bitcoin rebound stalls at 4%, rate cut expectations suppress ETF sentiment

10 m

Pin