2025 ANKR Price Prediction: Will the Ankr Protocol Token Reach New Highs in the Upcoming Year?

Introduction: ANKR's Market Position and Investment Value

Ankr Network (ANKR) is a distributed computing platform that leverages idle computing power from data centers, personal computers, and edge devices to unlock a cloud-based sharing economy. Since its inception in 2020, ANKR has established itself as a utility token powering decentralized computing infrastructure. As of December 2025, ANKR has a market capitalization of $63.53 million with a circulating supply of 10 billion tokens, currently trading at $0.006353 per token. This asset, recognized for its practical utility in computing cost payments and value transfer within the platform ecosystem, continues to play an increasingly important role in decentralized cloud computing infrastructure.

This article provides a comprehensive analysis of ANKR's price movements and market dynamics, incorporating historical price patterns, market supply and demand factors, ecosystem development, and macroeconomic conditions. Our analysis will deliver professional price forecasts and practical investment strategies for investors seeking to understand ANKR's potential trajectory through 2030.

I. ANKR Price History Review and Current Market Status

ANKR Historical Price Trajectory

ANKR reached its all-time high of $0.213513 on April 17, 2021, during the peak of the crypto market cycle. The token subsequently experienced significant depreciation, declining to its all-time low of $0.00070728 on March 13, 2020. Over the past year, ANKR has suffered a substantial downturn, with a 85.06% decrease in value, reflecting broader market headwinds affecting distributed computing and blockchain infrastructure projects.

ANKR Current Market Status

As of December 18, 2025, ANKR is trading at $0.006353, representing a 24-hour decline of 7.57%. The token exhibits weakness across multiple timeframes: over 7 days it has declined 16.28%, and over 30 days it has fallen 25.69%. The hourly performance shows a marginal gain of 0.13%, suggesting limited upward momentum.

ANKR maintains a market capitalization of $63.53 million with a fully diluted valuation equal to its market cap, indicating that all 10 billion tokens are already in circulation. The 24-hour trading volume stands at approximately $75,841.85, reflecting relatively modest liquidity. The token ranks 437th by market capitalization, with a market dominance of 0.0020%.

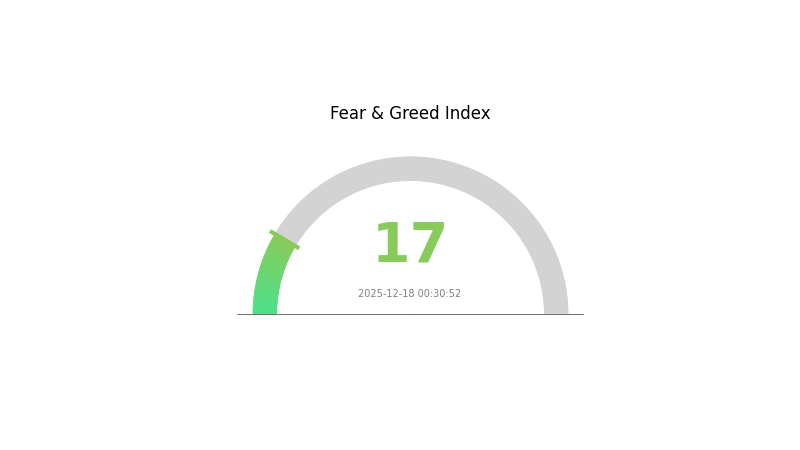

The project currently boasts 62,490 token holders distributed across 46 exchanges, demonstrating reasonable adoption at the infrastructure level. The market sentiment indicator registers as 0, with the broader cryptocurrency market experiencing extreme fear conditions (VIX reading of 17).

Within the past 24 hours, ANKR has fluctuated between a high of $0.006902 and a low of $0.006311, illustrating the consolidation pattern characteristic of assets experiencing sustained selling pressure.

Click to view current ANKR market price

ANKR Market Sentiment Indicator

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index plummeting to 17. This indicates severe bearish sentiment among investors, driven by market volatility and negative market conditions. During such periods of extreme fear, prices often reach oversold levels, potentially creating opportunities for contrarian investors. However, caution is advised, as further downside risks remain. Traders should closely monitor market developments and manage risk accordingly. Consider using Gate.com's market analysis tools to make informed trading decisions during this volatile period.

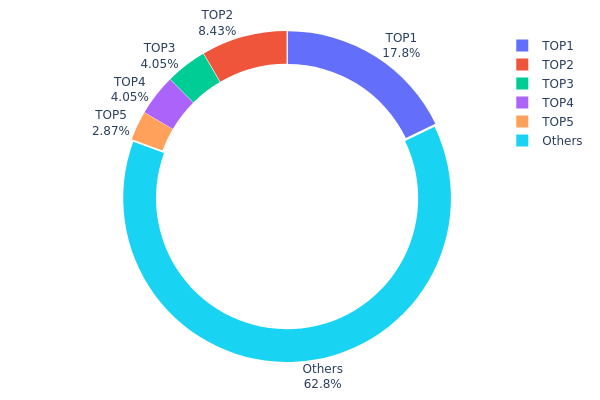

ANKR Holdings Distribution

The address holdings distribution represents a snapshot of token concentration across the blockchain, tracking the top wallet addresses and their respective ANKR holdings as a percentage of total supply. This metric serves as a critical indicator for assessing decentralization levels, potential market manipulation risks, and the overall health of the token's on-chain ecosystem structure.

Current analysis of ANKR's holdings distribution reveals a moderately concentrated token structure. The top five addresses collectively hold approximately 37.19% of the circulating supply, with the largest holder commanding 17.82% of total tokens. While this concentration level is not extreme by industry standards, it merits close attention given the implications for market dynamics. The second-largest holder at 8.42% demonstrates a significant concentration gap between the dominant address and subsequent holders, suggesting that decision-making power is not evenly distributed across major stakeholders.

The remaining 62.81% of tokens dispersed across other addresses indicates a relatively healthy degree of decentralization at the secondary level. However, the top-heavy distribution pattern—where the leading address holds nearly double the combined holdings of the fourth and fifth largest holders—creates inherent risks for price stability and governance resilience. Such concentration patterns typically correlate with higher volatility potential and increased susceptibility to large-scale liquidation events or coordinated selling pressure. The current distribution reflects a token ecosystem in transition, balancing between early-stage concentration from initial distribution phases and progressive decentralization through ongoing market participation and organic token distribution.

View current ANKR holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6401...793464 | 1782976.76K | 17.82% |

| 2 | 0xf977...41acec | 842677.33K | 8.42% |

| 3 | 0xa93f...818d4f | 405409.89K | 4.05% |

| 4 | 0x76ec...78fbd3 | 404578.60K | 4.04% |

| 5 | 0xd86f...0d3bca | 286950.95K | 2.86% |

| - | Others | 6277406.48K | 62.81% |

II. Core Factors Affecting ANKR's Future Price

Macroeconomic Environment

-

Market Sentiment and Economic Conditions: Global economic conditions and market sentiment fluctuations directly impact ANKR's price performance. The cryptocurrency market remains sensitive to broader financial market movements and macroeconomic headwinds, which have historically contributed to downward pressure on ANKR's valuation.

-

Current Market Conditions: ANKR is currently classified as a high-risk asset with significant price uncertainty. The token has traded near $0.0385 USD as of 2025, with price declines attributable to general market weakness and financial market fatigue affecting the entire cryptocurrency sector.

Technology Development and Ecosystem Building

-

Blockchain Infrastructure Innovation: Ankr Network focuses on providing decentralized blockchain infrastructure services, addressing the high costs and centralization issues of traditional cloud computing. The project's core objective is to revolutionize Web3 infrastructure through decentralized solutions, which positions it within a growing sector of blockchain development.

-

Ecosystem Projects: Bounce.Finance emerged as a derivative project from Ankr, representing a decentralized auction platform built initially on Ethereum, demonstrating the ecosystem's capacity for spawning complementary applications.

III. 2025-2030 ANKR Price Forecast

2025 Outlook

- Conservative Forecast: $0.00336 - $0.00634

- Neutral Forecast: $0.00634

- Bullish Forecast: $0.00856 (requires sustained network growth and increased enterprise adoption)

2026-2028 Medium-Term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with improving market sentiment and token utility expansion

- Price Range Predictions:

- 2026: $0.00604 - $0.00827

- 2027: $0.00645 - $0.00826

- 2028: $0.00604 - $0.00983

- Key Catalysts: Infrastructure layer adoption acceleration, expansion of node validator ecosystem, strategic partnerships with major cloud and blockchain platforms, and improving overall market conditions

2029-2030 Long-Term Outlook

- Base Case Scenario: $0.00555 - $0.01297 (assuming steady ecosystem development and moderate market recovery)

- Optimistic Scenario: $0.01297 (assuming significant institutional interest and widespread enterprise adoption of Ankr's Web3 infrastructure solutions)

- Transformational Scenario: $0.01348 (extreme favorable conditions including breakthrough protocol innovations, major mainstream adoption, and significant expansion of decentralized cloud computing market)

- December 18, 2030: ANKR reaching $0.01348 represents a 72% cumulative appreciation potential from current baseline, reflecting substantial long-term value recognition

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00856 | 0.00634 | 0.00336 | 0 |

| 2026 | 0.00827 | 0.00745 | 0.00604 | 17 |

| 2027 | 0.00826 | 0.00786 | 0.00645 | 23 |

| 2028 | 0.00983 | 0.00806 | 0.00604 | 26 |

| 2029 | 0.01297 | 0.00895 | 0.00555 | 40 |

| 2030 | 0.01348 | 0.01096 | 0.00942 | 72 |

ANKR Investment Strategy and Risk Management Report

IV. ANKR Professional Investment Strategy and Risk Management

ANKR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a 2+ year investment horizon seeking exposure to distributed computing infrastructure

- Operational recommendations:

- Accumulate ANKR during market downturns when volatility increases opportunity costs

- Hold through market cycles to benefit from potential recovery as cloud computing adoption expands

- Reinvest any platform rewards to compound returns over time

(2) Active Trading Strategy

- Technical analysis tools:

- Support and Resistance Levels: Monitor key price points at $0.006311 (24H low) and $0.006902 (24H high) for entry and exit signals

- Volume Analysis: Track the 24-hour trading volume of $75,841.85 to identify breakout opportunities and confirm trend reversals

- Wave trading key points:

- Capitalize on short-term volatility while maintaining strict stop-loss discipline

- Use momentum indicators to confirm directional bias before entering positions

ANKR Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of portfolio

- Active investors: 3-5% of portfolio

- Professional investors: 5-10% of portfolio

(2) Risk Hedging Solutions

- Position Sizing: Limit single position sizes to prevent catastrophic losses during extreme volatility

- Dollar-Cost Averaging: Spread purchases over multiple time periods to reduce timing risk and average entry prices

(3) Secure Storage Solutions

- Cold Storage Recommendation: Store ANKR on secure hardware solutions with multi-signature authentication for long-term holdings

- Exchange Storage: Use Gate.com for active trading positions due to platform security infrastructure and liquidity depth

- Security Considerations: Enable two-factor authentication, maintain offline backup of private keys, and never share seed phrases with third parties

V. ANKR Potential Risks and Challenges

ANKR Market Risks

- Severe price depreciation: ANKR has declined 85.06% over the past year, indicating substantial loss of investor confidence and potential fundamental challenges

- Liquidity constraints: The 24-hour trading volume of only $75,841.85 relative to market cap suggests thin liquidity that may result in significant slippage on large orders

- Market sentiment deterioration: Current market emotion indicators reflect negative sentiment, which may continue to pressure prices downward

ANKR Regulatory Risks

- Distributed computing classification uncertainty: Regulators may reclassify computing resource platforms, imposing compliance requirements that increase operational costs

- Token utility challenges: Regulatory scrutiny on token utility mechanisms could limit ANKR's functional role within the platform ecosystem

- International compliance complexity: Operating across multiple jurisdictions creates regulatory arbitrage risks and potential enforcement actions

ANKR Technology Risks

- Platform adoption lag: Competing cloud infrastructure solutions with established market presence may limit Ankr's ability to capture market share

- Integration complexity: Integrating blockchain technology with existing cloud infrastructure requires solving scalability and performance challenges

- Security vulnerabilities: Distributed computing networks face heightened cybersecurity risks from coordinated attacks and node compromises

VI. Conclusion and Action Recommendations

ANKR Investment Value Assessment

ANKR represents a distributed computing platform with long-term technological relevance in decentralized infrastructure. However, the project faces significant headwinds reflected in its 85.06% annual decline and thin market liquidity. The token's utility is tied to platform adoption, which remains uncertain given competitive pressures and regulatory complexities. Investors should carefully evaluate their risk tolerance before participating, as the project remains in a challenging market position with unproven commercial viability at scale.

ANKR Investment Recommendations

✅ Beginners: Start with minimal allocations (0.5-1% of portfolio) only after thorough research into distributed computing infrastructure trends and competitive dynamics

✅ Experienced investors: Consider ANKR as a speculative position with strict risk controls, deploying only capital you can afford to lose completely

✅ Institutional investors: Conduct deep technical due diligence on platform adoption metrics, user growth, and token demand before consideration

ANKR Trading Participation Methods

- Spot Trading: Trade ANKR against major stablecoins on Gate.com with attention to bid-ask spreads due to limited liquidity

- Strategic Accumulation: Use limit orders during extreme market dislocations to build positions at significant discounts to historical averages

- Platform Participation: Engage directly with the Ankr computing network to earn token rewards through resource contribution if infrastructure investment is feasible

Cryptocurrency investments carry extreme risk and are highly volatile. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. It is strongly recommended to consult with a qualified financial advisor before investing. Never invest more capital than you can afford to lose completely.

FAQ

Can ankr reach $1?

Yes, ANKR could potentially reach $1 if market conditions improve significantly and the project achieves major adoption milestones. However, this would require substantial growth from current levels and strong bullish market momentum.

Is ankr a good stock to buy?

ANKR shows strong potential in Web3 infrastructure. With growing adoption of decentralized computing, ANKR could reach $0.70-$1.00 by 2030. Current valuation offers attractive entry points for long-term investors.

Why is ankr falling?

Ankr is falling due to negative market trends and reduced investor interest. The price chart shows no support, indicating further declines. This reflects broader market sentiment.

What are the risks of investing in ankr?

ANKR investment carries volatility risk where prices fluctuate significantly. Liquidity risk may affect trading volume and exit opportunities. Market uncertainty and regulatory changes could impact token performance and adoption rates.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

2024's Most Anticipated NFT Innovations

Secure and User-Friendly Digital Wallet for Tezos Blockchain

Creating Your Own Digital Currency: Step-by-Step Development Guide

Comprehensive Guide to the DRC 20 Token Standard

What is DRV: Understanding Dividend Reinvestment Plans and Their Investment Benefits