2025 API3 Price Prediction: Expert Analysis and Market Forecast for the Decentralized Oracle Network Token

Introduction: API3's Market Position and Investment Value

API3 (API3) serves as a decentralized data oracle solution that enables APIs to provide data directly to blockchain applications without intermediaries. Since its launch in 2020, the project has established itself as a key infrastructure component in the Web3 ecosystem. As of December 2025, API3's market capitalization has reached approximately $56.76 million, with a circulating supply of approximately 138.97 million tokens, and the price is currently trading around $0.4084. This innovative oracle solution, recognized for bridging traditional Web APIs with decentralized applications, is playing an increasingly critical role in expanding blockchain functionality while maintaining decentralization principles.

This article will provide a comprehensive analysis of API3's price trajectory through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

API3 Price History Review and Market Status

I. API3 Price History Review and Current Market Situation

API3 Historical Price Evolution Trajectory

-

April 7, 2021: API3 reached its all-time high (ATH) of $10.3, marking the peak of its market valuation during the early phases of its market development.

-

December 18, 2025: API3 reached its all-time low (ATL) of $0.407089, reflecting significant price depreciation over the project's lifetime.

API3 Current Market Status

As of December 18, 2025, API3 is trading at $0.4084, representing a substantial decline from its historical peaks. The token's market performance shows:

Price Performance Metrics:

- 24-hour change: -7.53%

- 7-day change: -15.65%

- 30-day change: -26.84%

- 1-year change: -79.4%

- 1-hour change: -0.32%

Market Capitalization Data:

- Market Cap (Circulating): $56,755,067.03

- Fully Diluted Valuation: $64,054,673.35

- Circulating Supply: 138,969,312.03 API3

- Total Supply: 156,842,980.78 API3

- Market Cap to FDV Ratio: 89.33%

Trading Activity:

- 24-hour Volume: $149,736.45

- Market Ranking: #463

- Number of Holders: 23,954

- Number of Listed Exchanges: 38

- Market Dominance: 0.0020%

Daily Price Range:

- 24-hour High: $0.4471

- 24-hour Low: $0.4057

Click to view current API3 market price

API3 Market Sentiment Indicator

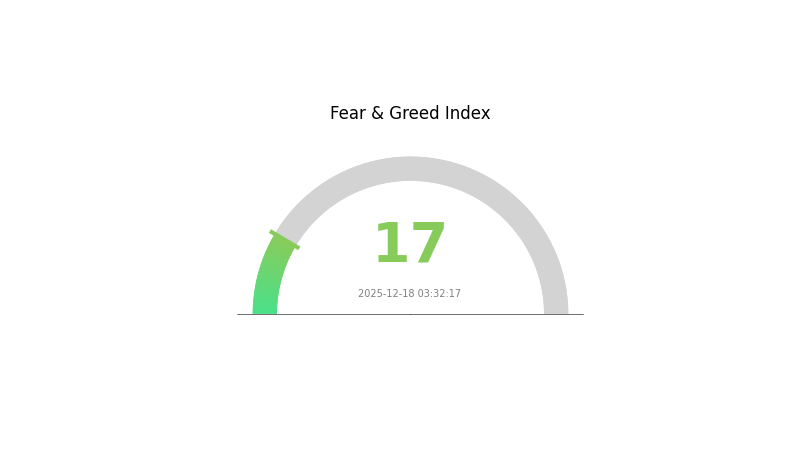

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The API3 market is currently experiencing extreme fear, with the Fear and Greed Index standing at 17. This indicates significant bearish sentiment among investors, reflecting heightened market uncertainty and risk aversion. Such extreme fear levels historically present contrarian opportunities, as markets often recover from pessimistic extremes. Investors should exercise caution while considering that panic-driven sell-offs may create entry points for long-term positions. Monitor market fundamentals closely and manage risk appropriately during this volatile period on Gate.com.

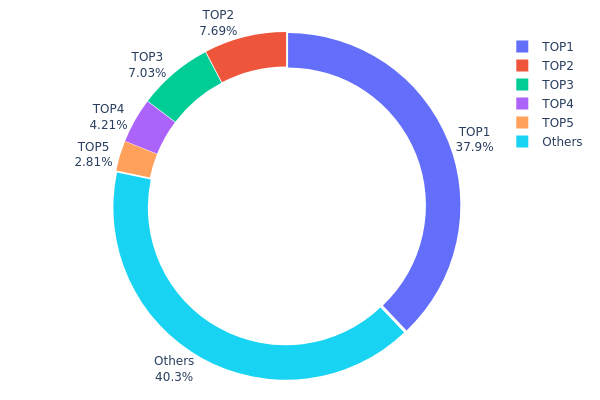

API3 Holdings Distribution

Click to view current API3 holdings distribution

The address holdings distribution map reveals the concentration of API3 tokens across different wallet addresses on the blockchain. This metric is crucial for assessing token decentralization, understanding potential liquidity dynamics, and evaluating governance concentration risks. By examining how tokens are distributed among top holders versus smaller addresses, investors can gauge the level of market concentration and predict potential price volatility patterns.

API3 exhibits moderate concentration characteristics, with notable centralization in the top addresses. The leading address (0x6dd6...c76d76) commands 37.92% of total holdings, representing a substantial concentration point that warrants attention. The second and third addresses hold 7.69% and 7.02% respectively, while the fourth and fifth addresses account for 4.20% and 2.80%. Collectively, the top five addresses control approximately 59.63% of all API3 tokens, indicating a significant concentration risk. However, the remaining 40.37% distributed among other addresses demonstrates that nearly half of the token supply maintains reasonable dispersal, preventing extreme centralization.

This distribution pattern suggests moderate market structure vulnerability. While the dominant position of the top holder raises concerns about potential price manipulation or sudden liquidation risks, the substantial retail and distributed holdings provide a countervailing force. The mixed concentration-dispersion dynamic indicates that API3 maintains a relatively balanced on-chain ecosystem, though ecosystem participants should monitor top holder movements closely. For long-term network health and decentralization objectives, continued token distribution efforts would strengthen governance robustness and reduce systemic risks associated with large holder actions.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6dd6...c76d76 | 59319.98K | 37.92% |

| 2 | 0xf977...41acec | 12030.81K | 7.69% |

| 3 | 0xa15b...a397b4 | 10987.83K | 7.02% |

| 4 | 0xd9f8...6704ae | 6583.87K | 4.20% |

| 5 | 0xb0bf...cd898e | 4391.31K | 2.80% |

| - | Others | 63090.27K | 40.37% |

II. Core Factors Affecting API3's Future Price

Supply Mechanism

- Token Emission and Unlock Schedules: Token supply dynamics play a crucial role in future price movements. Key factors include issuance plans, unlock timelines, staking rewards, and token burn mechanisms that impact circulating supply.

- Historical Patterns: Supply adjustments and protocol updates have historically influenced API3's price trajectory through changes in token availability and market circulation.

- Current Impact: Ongoing monitoring of token economics and supply schedule announcements will be essential in determining near-term price movements.

Institutional and Whale Dynamics

- Enterprise Adoption: Growing adoption across DeFi and IoT sectors is driving increased demand for decentralized data services through the API3 ecosystem.

- Real-world Events: Regulatory developments, government and enterprise adoption initiatives, and security incidents in the cryptocurrency market can significantly impact API3's price.

Macroeconomic Environment

- Market Sentiment and Trends: API3's price is influenced by broader cryptocurrency market trends, market sentiment, news events, and general supply-demand dynamics affecting the entire sector.

- Regulatory Impact: Regulatory developments and compliance changes represent critical external factors that can substantially affect API3's price trajectory and market adoption rates.

Technology Development and Ecosystem Building

- Protocol Upgrades: Hard forks and protocol updates directly impact API3's price movement and technical capabilities of the dAPI system.

- Ecosystem Applications: The decentralized API (dAPI) system enables integration across DeFi and IoT platforms, representing the core innovation driving ecosystem expansion and market demand.

III. API3 Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.3137 - $0.4074

- Base Case Forecast: $0.4074

- Optimistic Forecast: $0.60295 (requires sustained adoption of decentralized oracle solutions)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Gradual expansion phase with increasing institutional recognition and ecosystem development maturation

- Price Range Forecasts:

- 2026: $0.3284 - $0.6264 (23% upside potential)

- 2027: $0.4753 - $0.7582 (38% upside potential)

- 2028: $0.6223 - $0.7811 (62% upside potential)

- Key Catalysts: Enhanced oracle infrastructure adoption, expanded API3 Alliance partnerships, integration with emerging blockchain ecosystems, and growing demand for reliable off-chain data solutions

2029-2030 Long-term Outlook

- Base Case Scenario: $0.5195 - $0.9236 (76% growth by 2029), advancing toward $0.5182 - $0.9048 by 2030 (assumes steady market adoption and competitive positioning)

- Optimistic Scenario: $0.7216 - $0.9236 by 2029, potentially reaching $0.8226 by 2030 (assumes accelerated enterprise adoption and broader Web3 infrastructure maturation)

- Transformative Scenario: $0.9048+ by 2030 (assumes API3 becomes the dominant oracle solution across multiple blockchain networks and captures significant market share in decentralized data provisioning)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.60295 | 0.4074 | 0.3137 | 0 |

| 2026 | 0.62642 | 0.50518 | 0.32836 | 23 |

| 2027 | 0.75817 | 0.5658 | 0.47527 | 38 |

| 2028 | 0.78114 | 0.66198 | 0.62226 | 62 |

| 2029 | 0.9236 | 0.72156 | 0.51952 | 76 |

| 2030 | 0.90484 | 0.82258 | 0.51823 | 101 |

API3 Professional Investment Strategy and Risk Management Report

IV. API3 Professional Investment Strategy and Risk Management

API3 Investment Methodology

(1) Long-term Hold Strategy

- Suitable for: Investors with a 2-5 year investment horizon who believe in decentralized oracle infrastructure development

- Operational Recommendations:

- Accumulate API3 during market downturns when sentiment is negative, as the token has declined 79.4% over the past year, potentially presenting value opportunities for long-term believers in the project

- Set a long-term accumulation target based on your risk tolerance and dollar-cost average through regular purchases to reduce timing risk

- Participate in API3 staking to earn staking rewards through the insurance collateral pool mechanism, which provides passive income while supporting the network

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour trading range ($0.4057-$0.4471) as key price boundaries, with previous all-time low at $0.407089 as critical support

- Moving Averages: Track 7-day and 30-day price trends (-15.65% and -26.84% respectively) to identify momentum shifts and potential reversal points

- Wave Trading Key Points:

- Execute entries near identified support levels during oversold conditions, with stop-losses positioned below recent lows

- Take profit targets at previous resistance levels or during positive market sentiment shifts toward the oracle and Web3 infrastructure sectors

API3 Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation maximum

- Active Investors: 3-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Sector Diversification: Balance API3 holdings with other blockchain infrastructure tokens to reduce single-project concentration risk

- Staking Strategy: Utilize API3 staking in insurance collateral pools to generate returns that offset potential price depreciation

(3) Secure Storage Solutions

- Hot Wallet Strategy: Gate Web3 Wallet for frequent trading and staking participation, offering convenient access to API3 governance and rewards

- Self-Custody Approach: For long-term holdings, transfer API3 to self-managed wallets where you control private keys to eliminate counterparty risk

- Security Considerations: Enable multi-signature authentication, regularly back up wallet recovery phrases in offline secure locations, and never share private keys or seed phrases with any third parties

V. API3 Potential Risks and Challenges

API3 Market Risks

- Severe Price Depreciation: API3 has lost 79.4% of its value over the past year and 26.84% over the past month, indicating significant price volatility and potential continued downward pressure if adoption fails to accelerate

- Low Trading Volume: 24-hour trading volume of approximately $149,736 is relatively modest for a token with $56.7 million market capitalization, which may limit liquidity for large traders

- Market Competition: Multiple oracle solutions and data feed providers exist in the blockchain ecosystem, creating competitive pressure on API3's market share and value proposition

API3 Regulatory Risks

- Unclear Regulatory Framework: As oracle and data infrastructure providers operate in a nascent regulatory environment, future regulatory actions regarding data provision and smart contract integration could impact API3's operations

- Governance Structure Scrutiny: The API3 DAO governance model may face regulatory examination regarding token holder voting rights and decentralized decision-making authority

- Jurisdictional Compliance: Different blockchain applications and data providers operating across multiple jurisdictions could create compliance complexities for API3 network participants

API3 Technical Risks

- Oracle Dependency Risk: As a data oracle provider, API3 faces technical risks if Airnode middleware or Beacon data feeds experience failures, outages, or inaccuracies that could harm dependent applications

- Smart Contract Vulnerabilities: The underlying smart contracts and infrastructure components may contain undiscovered vulnerabilities that could be exploited to compromise network security or user funds

- Adoption Acceleration Challenges: Widespread adoption of API3's DAPI infrastructure depends on competing oracle solutions not capturing market share, and on successful scaling of blockchain applications requiring decentralized data feeds

VI. Conclusions and Action Recommendations

API3 Investment Value Assessment

API3 operates in the critical oracle and data infrastructure segment of blockchain technology, addressing the essential need for trustless data provision to smart contracts. The project's governance structure through API3 DAO and its insurance collateral pool mechanism represent innovative approaches to oracle security. However, the token has experienced severe depreciation (-79.4% annually), suggesting either significant market skepticism regarding competitive positioning or broader market cycles affecting infrastructure tokens. The relatively low market capitalization ($56.7 million) and modest trading volume present both liquidity challenges and potential upside opportunity if project adoption accelerates. Investment in API3 requires conviction in long-term blockchain oracle market growth and API3's ability to compete against alternative solutions.

API3 Investment Recommendations

✅ Beginners: Start with small position sizes (1-2% of crypto allocation) through dollar-cost averaging on Gate.com to reduce timing risk, and consider staking rewards as a mechanism to potentially offset price volatility

✅ Experienced Investors: Evaluate API3 as part of a diversified blockchain infrastructure portfolio, using technical analysis to identify entry points near support levels, and participate selectively in governance discussions through the API3 DAO

✅ Institutional Investors: Conduct thorough due diligence on API3's competitive positioning within the oracle market, assess staking economics and yield sustainability, and consider the project's development roadmap and ecosystem partnerships

API3 Trading Participation Methods

- Gate.com Spot Trading: Purchase and hold API3 tokens directly through Gate.com's spot trading markets for flexible entry and exit flexibility

- Staking Programs: Participate in API3 staking through the insurance collateral pool to earn rewards while supporting network security and contributing to oracle coverage

- Governance Participation: Hold API3 tokens to participate in DAO governance proposals and voting on protocol developments, fee structures, and resource allocation decisions

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situations. It is strongly recommended to consult with professional financial advisors before investing. Never invest more than you can afford to lose.

FAQ

Does API3 have a future?

Yes, API3 has a promising future. As an innovative oracle project, analysts predict it could trade between $8–$15 by 2030. With growing adoption and strong market recognition, API3 shows solid long-term potential.

Is API3 a buy or sell?

API3 is currently a strong sell based on technical indicators and recent market trends. The moving averages suggest caution. However, always conduct your own analysis before making trading decisions.

Why is API3 pumping?

API3 is pumping due to increased demand for its decentralized APIs connecting smart contracts with real-world data. Positive ecosystem developments and market optimism are driving the price surge.

Will hamster coin prices increase?

Yes, Hamster Kombat prices are expected to rise by 30-50% by end of July 2025, potentially reaching $0.0015-$0.0019, assuming key support levels hold.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Top Altcoins Primed for Massive Growth You Shouldn't Miss!

Understanding the Distinctions Between Futures and Forward Contracts

Introduction to MetaMask: A Beginner's Guide to Crypto Wallets

Become a Web3 Developer: Key Skills and Career Path Essentials in Blockchain

Moonshot Potential: Insights into Cryptocurrency's Rapid Expansion