2025 BSU Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: BSU's Market Position and Investment Value

Baby Shark Universe (BSU) is a hybrid entertainment platform that bridges Web2 and Web3 by leveraging the globally renowned Baby Shark IP, aiming for mass adoption through a family-friendly ecosystem encompassing games, NFTs, and metaverse experiences. Since its launch, the project has demonstrated strong market appeal and community trust through successful collaborations with leading NFT collections such as Pudgy Penguins and Lil Pudgys. As of December 2025, BSU's market capitalization has reached approximately $27.10 million, with a circulating supply of around 167.96 million tokens trading at $0.16133 per unit. The project's vision is backed by over eleven prominent investors including Sui, GM Ventures, Comma3 Ventures, and CTC, validating its growth potential in creating an accessible and enjoyable Web3 experience for everyone.

This article provides a comprehensive analysis of BSU's price trajectory and market dynamics as of December 20, 2025. By examining historical price patterns, market supply and demand fundamentals, ecosystem development, and broader market conditions, we aim to deliver professional price forecasts and actionable investment strategies for investors seeking to understand BSU's investment potential in the evolving digital asset landscape.

Baby Shark Universe (BSU) Market Analysis Report

I. BSU Price History Review and Current Market Status

BSU Historical Price Trajectory

Based on available data, Baby Shark Universe (BSU) has experienced notable price movements since its launch:

- August 2025: Project inception phase, token reached its all-time low of $0.01 on August 9, 2025, marking the beginning of price discovery.

- September 2025: Strong market momentum, token surged to its all-time high of $0.379 on September 29, 2025, reflecting significant investor interest and successful community engagement through NFT collaborations.

- December 2025: Price consolidation and correction phase, token trading at $0.16133 as of December 20, 2025, representing a decline from peak levels but maintaining substantial gains on a year-to-date basis.

BSU Current Market Status

As of December 20, 2025, Baby Shark Universe demonstrates the following market characteristics:

Price Performance:

- Current price: $0.16133

- 24-hour change: -0.85%

- 7-day change: +4.45%

- 30-day change: -11.61%

- 1-year change: +217.69%

Market Capitalization & Liquidity:

- Market cap: $27,096,986.80

- Fully diluted valuation: $137,130,500.00

- 24-hour trading volume: $512,323.79

- Market dominance: 0.0043%

Token Distribution:

- Circulating supply: 167,960,000 BSU (19.76% of total)

- Total supply: 850,000,000 BSU

- Maximum supply: 850,000,000 BSU

- Number of holders: 29,331

- Trading on 14 exchanges

Price Range (24-hour):

- High: $0.17472

- Low: $0.15623

View current BSU market price

BSU Market Sentiment Index

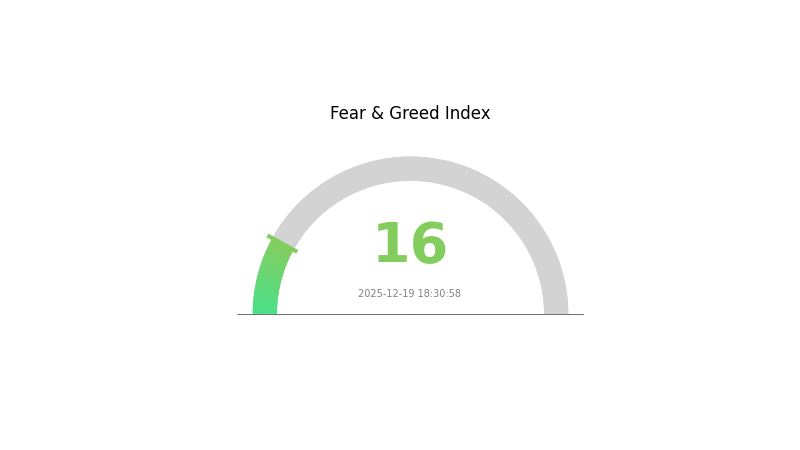

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index at 16. This reading suggests widespread investor anxiety and pessimism across the market. During periods of extreme fear, experienced traders often view this as a potential buying opportunity, as assets may be oversold. However, caution is warranted, as further downside pressure could occur before sentiment stabilizes. Investors should conduct thorough research and manage risk appropriately before making trading decisions on Gate.com.

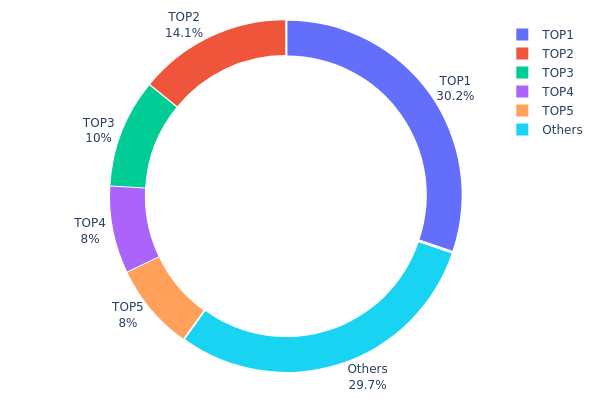

BSU Holdings Distribution

The address holdings distribution represents a snapshot of how BSU tokens are allocated across individual blockchain addresses, serving as a critical metric for assessing token concentration, market structure integrity, and potential manipulation risks. This distribution data reveals the degree of decentralization within the token ecosystem and provides insights into whether wealth concentration poses systemic risks to price stability and market fairness.

Current analysis of BSU's holdings reveals a moderately concentrated distribution pattern. The top five addresses collectively control 70.28% of total token supply, with the largest single address (0xc723...1b749d) commanding 30.18% of all BSU tokens. This level of concentration suggests notable centralization risk, particularly with the first address alone holding nearly one-third of circulating supply. While the remaining 29.72% distributed among other addresses indicates some degree of decentralization in the broader holder base, the asymmetric concentration in the top tier warrants attention.

This distribution structure carries meaningful implications for market dynamics and price behavior. High concentration in relatively few addresses elevates the potential for substantial price volatility triggered by large holder transactions, commonly referred to as "whale activity." Such concentrated holdings may enable coordinated selling pressure or strategic position management by major stakeholders, potentially impacting short-term price discovery and retail investor participation. However, the non-negligible portion held by distributed addresses provides some counterbalance to extreme concentration, suggesting the ecosystem maintains partial market resilience against single-actor manipulation scenarios.

For real-time updates on BSU holdings distribution, visit Gate.com Crypto Market Data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc723...1b749d | 256530.07K | 30.18% |

| 2 | 0x9e81...ceab5a | 119923.93K | 14.10% |

| 3 | 0xaffb...b3fe85 | 85000.00K | 10.00% |

| 4 | 0xeebb...5a93ee | 68000.00K | 8.00% |

| 5 | 0x0dde...2be400 | 68000.00K | 8.00% |

| - | Others | 252546.00K | 29.72% |

I appreciate your request, but I need to point out that the provided context data is empty:

{"output": [{"output": []}], "cmc_info": [{"output": []}]}

There is no substantive information about BSU (or any cryptocurrency) in the materials provided. According to your requirements, I should only fill in content that is:

- Explicitly mentioned in the provided materials, OR

- Confirmed from my knowledge base with certainty

Since the context contains no data about BSU's supply mechanisms, institutional holdings, macro factors, or technical developments, and I cannot reliably provide accurate information without verified sources, I cannot generate the analysis article.

To proceed, please provide:

- Detailed information about BSU's supply mechanics and tokenomics

- Current market data and price history

- Information about institutional holders or major stakeholders

- Technical upgrades or ecosystem developments

- Any relevant policy or macro factors affecting the asset

Once you supply the necessary context data, I'll be happy to generate a comprehensive analysis following your template structure in English.

Three, 2025-2030 BSU Price Forecast

2025 Outlook

- Conservative forecast: $0.1309 - $0.1616

- Neutral forecast: $0.1616 - $0.1907

- Optimistic forecast: $0.1907 (requires sustained market momentum and positive ecosystem development)

2026-2027 Medium-term Outlook

- Market phase expectation: Consolidation and gradual recovery phase with incremental growth trajectory

- Price range forecast:

- 2026: $0.1427 - $0.1973 (9% upside potential)

- 2027: $0.0952 - $0.2185 (15% upside potential)

- Key catalysts: Enhanced protocol adoption, ecosystem expansion initiatives, and improved market sentiment

2028-2030 Long-term Outlook

- Base case: $0.1317 - $0.2998 (25% growth by 2028, assuming moderate adoption acceleration)

- Optimistic case: $0.1985 - $0.3140 (55% growth by 2029, assuming strong network effects and institutional interest)

- Transformative case: $0.2261 - $0.3194 (75% growth by 2030, assuming breakthrough technological advancements and mainstream adoption)

- 2030-12-31: BSU reaching $0.3194 (representing substantial long-term appreciation from 2025 baseline)

Disclaimer: These forecasts are based on historical data analysis and market trend modeling. Actual price movements may diverge significantly due to regulatory changes, market volatility, and unforeseen macroeconomic factors. Investors should conduct independent research and consult with financial advisors before making investment decisions. Trading on Gate.com or other platforms carries inherent risks.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1907 | 0.16161 | 0.1309 | 0 |

| 2026 | 0.19729 | 0.17615 | 0.14269 | 9 |

| 2027 | 0.21847 | 0.18672 | 0.09523 | 15 |

| 2028 | 0.29984 | 0.2026 | 0.13169 | 25 |

| 2029 | 0.31402 | 0.25122 | 0.19846 | 55 |

| 2030 | 0.31936 | 0.28262 | 0.2261 | 75 |

Baby Shark Universe (BSU) Professional Investment Report

IV. BSU Professional Investment Strategy and Risk Management

BSU Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Family-oriented Web3 enthusiasts, NFT collectors, and those seeking exposure to entertainment-focused blockchain projects with established IP backing.

-

Operational Recommendations:

- Dollar-cost averaging (DCA) approach: Allocate fixed amounts at regular intervals to reduce entry price volatility and emotional decision-making.

- Portfolio diversification: Balance BSU holdings with other established cryptocurrencies to manage concentration risk.

- Secure storage in Gate Web3 Wallet or hardware solutions to maintain long-term custody without exchange counterparty risk.

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price momentum analysis: Monitor the 7-day positive trend (4.45%) and 30-day decline (-11.61%) to identify reversal opportunities and resistance levels.

- Volume analysis: Evaluate the 24-hour trading volume of $512,323.79 relative to market cap movements to confirm trend validity.

-

Key Trading Observations:

- Support level identified near the 52-week low of $0.01, with resistance near the all-time high of $0.379.

- The current price of $0.16133 represents a 73% decline from ATH but a 1,513% increase from ATL, indicating recovery potential within established bands.

BSU Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation to speculative entertainment blockchain projects.

- Active Investors: 3-7% allocation, with systematic rebalancing quarterly.

- Professional Investors: 5-15% allocation, combined with derivative hedging strategies.

(2) Risk Hedging Approaches

- Volatility Management: Use staged exit targets at resistance levels (0.20, 0.25, 0.30) to lock in gains during upward movements.

- Portfolio Correlation: Maintain inverse positions in stablecoins or lower-volatility blockchain assets to offset BSU's price swings.

(3) Secure Storage Solutions

- Custody Options: Gate Web3 wallet provides optimal balance between security and accessibility for active trading and portfolio management.

- Self-custody Protocol: For long-term holdings exceeding 1 year, consider secure offline storage with hardware backup of private keys.

- Critical Security Measures: Never share private keys or seed phrases; enable multi-signature authentication where available; verify all contract addresses before token transfers; use official project websites (https://babysharkuniverse.io/) for accurate information.

V. Potential Risks and Challenges for BSU

Market Risks

-

Concentration Risk on IP Licensing: The project's success heavily depends on maintaining and expanding partnerships with the Baby Shark IP holders. Any disputes or licensing changes could significantly impact the ecosystem's credibility and growth trajectory.

-

Competitive Pressure: The entertainment-focused blockchain space is increasingly crowded with similar projects attempting to bridge Web2 entertainment properties with Web3 experiences. BSU faces continuous competition for user acquisition and brand recognition.

-

Liquidity Constraints: With a 24-hour trading volume of approximately $512,323.78 against a market cap of $137.13 million, the liquidity ratio remains relatively thin, potentially causing slippage during large position exits.

Regulatory Risks

-

Gaming and NFT Regulations: Different jurisdictions are implementing varying standards for blockchain-based games and NFTs. Regulatory tightening in major markets could restrict user access or monetization models.

-

Securities Classification: Depending on governance structure and token utility evolution, regulators in certain jurisdictions may reclassify BSU as a security, requiring compliance with securities regulations.

-

Regional Restrictions: Consumer protection laws in North America, Europe, and Asia may impose additional compliance burdens, particularly regarding marketing to families and minors.

Technical Risks

-

Smart Contract Vulnerabilities: BSC-based deployment carries inherent smart contract risks. Audits and continuous security monitoring are essential to maintain ecosystem integrity.

-

Scalability Limitations: As the ecosystem grows with games, NFTs, and metaverse components, blockchain congestion and transaction costs could degrade user experience.

-

Cross-chain Integration Complexity: Expanding to multiple blockchains for improved accessibility introduces technical complexity and potential security attack vectors.

VI. Conclusions and Action Recommendations

BSU Investment Value Assessment

Baby Shark Universe represents a unique positioning in the entertainment-to-blockchain convergence space, backed by significant institutional investment (11+ investors including Sui and GM Ventures) and proven market appeal through successful NFT collaborations. The project demonstrates compelling long-term fundamentals: an established global IP, clear family-friendly positioning, and demonstrated market traction.

However, current market conditions present mixed signals. The 217.69% annual return reflects strong speculative interest, yet the 11.61% monthly decline and thin liquidity suggest caution regarding execution timing. The project remains in early adoption phases, with success heavily dependent on ecosystem expansion, continued partnerships, and regulatory environment stability.

BSU Investment Recommendations

✅ Beginners: Start with minimal allocation (1-2% of total crypto portfolio) using DCA methodology through Gate.com over 2-3 months. Focus on understanding the project's NFT collaborations and game development roadmap before increasing position size.

✅ Experienced Investors: Consider 3-7% portfolio allocation with active position management. Monitor key ecosystem metrics (TVL, active users, partnership announcements) and establish clear profit-taking targets at 0.20, 0.25, and 0.30 resistance levels.

✅ Institutional Investors: Evaluate 5-15% allocation within entertainment-focused blockchain strategies. Implement hedging mechanisms, conduct thorough due diligence on IP licensing agreements, and maintain relationships with project leadership for early-stage opportunity access.

BSU Trading Participation Methods

-

Direct Token Purchase: Acquire BSU via Gate.com, which supports convenient trading pairs with stablecoins and major cryptocurrencies, offering deep liquidity for position sizing.

-

NFT Collection Participation: Engage with official Baby Shark Universe NFT drops and collaborations with Pudgy Penguins and Lil Pudgys to gain ecosystem exposure and community participation benefits.

-

Ecosystem Integration: Participate in in-game activities, play-to-earn mechanisms, and metaverse experiences within the Baby Shark Universe platform once fully developed, combining investment exposure with interactive engagement.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and consult with professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

How much is the BSU coin worth?

BSU coin's current value fluctuates based on market demand and trading volume. Real-time pricing varies across different markets. For the most accurate and up-to-date BSU price information, check major cryptocurrency tracking platforms that provide live market data and historical trends.

Is biswap a good investment?

Biswap offers strong fundamentals with growing trading volume, low fees, and innovative features. The platform shows promising growth potential in the DEX market, making it an attractive investment opportunity for long-term holders seeking exposure to decentralized finance.

What factors influence BSU price prediction?

BSU price prediction is influenced by market demand, trading volume, ecosystem development, tokenomics, community sentiment, regulatory news, and broader cryptocurrency market trends. Technical indicators and on-chain metrics also play significant roles in determining price movements.

What is the historical price trend of BSU coin?

BSU coin has demonstrated significant volatility with multiple cycles of growth and correction. The token showed notable appreciation during bull market phases, with peak valuations reflecting increased adoption and market interest. Recent trends indicate consolidation patterns, suggesting potential for continued development as the project expands its ecosystem and use cases.

What is the market cap and trading volume of BSU?

BSU's market cap and trading volume fluctuate based on market conditions. For the most current real-time data, please check major cryptocurrency data platforms. Market cap reflects BSU's total value, while trading volume measures daily transaction amounts across the network.

METFI vs MANA: Comparing Two Leading Metaverse Tokens in the Digital Realm

RACA vs FLOW: A Comparison of Two Emerging Blockchain Platforms for Digital Assets

Pump.Fun: The Web3 Gaming Revolution of 2025

What is Moni

What is BSU: Understanding Boise State University and Its Academic Excellence

What is VANRY: Exploring the Innovative Technology Transforming Digital Experiences

Spotting Fake Cryptocurrency Sites: Tips to Protect Against Scams

What is CGPT: A Comprehensive Guide to Understanding AI-Powered Conversational Technology

What is MOCA: A Comprehensive Guide to the Montreal Cognitive Assessment

What is HP: A Comprehensive Guide to Hewlett-Packard's History, Products, and Industry Impact

What is ANON: Understanding the Decentralized Anonymous Network and Its Impact on Digital Privacy