2025 CFX Price Prediction: Analyzing Growth Potential and Market Factors for Conflux Network Token

Introduction: CFX's Market Position and Investment Value

Conflux (CFX), as a scalable decentralized blockchain network, has achieved significant milestones since its inception in 2019. As of 2025, Conflux's market capitalization has reached $907,622,956, with a circulating supply of approximately 5,135,937,959 tokens, and a price hovering around $0.17672. This asset, dubbed the "high-throughput blockchain," is playing an increasingly crucial role in decentralized applications and ecosystem development.

This article will comprehensively analyze Conflux's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. CFX Price History Review and Current Market Status

CFX Historical Price Evolution

- 2020: CFX launched, initial price around $0.12

- 2021: Bull market, CFX reached all-time high of $1.70 on March 27

- 2022: Bear market, price dropped to all-time low of $0.022 on December 30

CFX Current Market Situation

As of September 16, 2025, CFX is trading at $0.17672, ranking 115th by market capitalization. The 24-hour trading volume stands at $8,450,225.89. CFX has experienced a slight decline of 1.59% in the past 24 hours, with a price range between $0.17219 and $0.18393. The current price represents a 31.48% increase over the past year, despite a 1.48% decrease in the last 30 days. The market capitalization is $907,622,956.27, with a circulating supply of 5,135,937,959.86 CFX. The fully diluted market cap is $1,008,875,589.13.

Click to view the current CFX market price

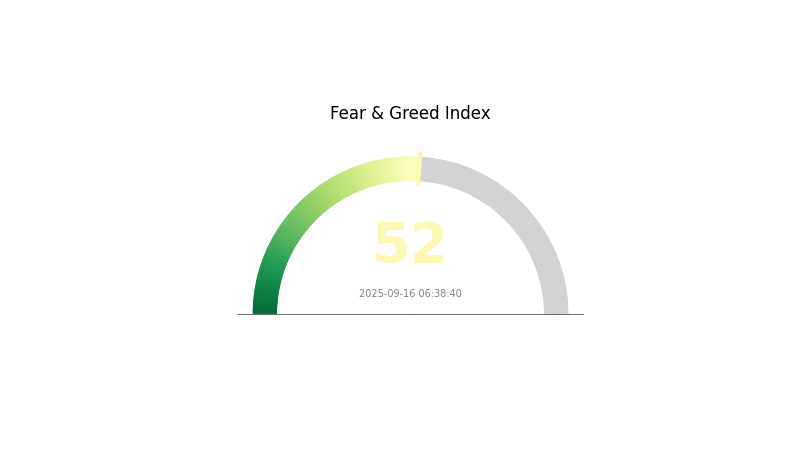

CFX Market Sentiment Indicator

2025-09-16 Fear and Greed Index: 52 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index at 52, indicating a neutral outlook. This suggests that investors are neither overly pessimistic nor excessively optimistic about the current market conditions. While caution is still advised, the neutral sentiment may present opportunities for both buyers and sellers. As always, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions in the volatile crypto market.

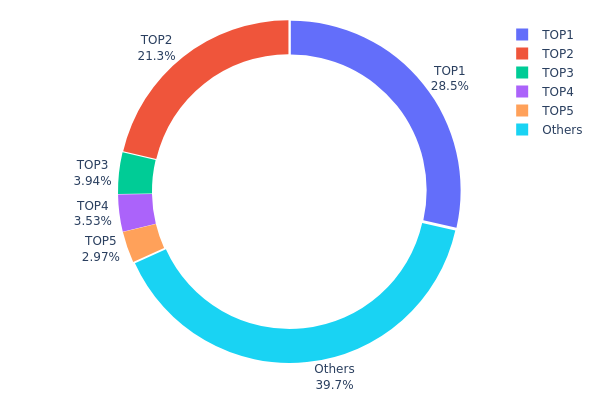

CFX Holdings Distribution

The address holdings distribution data for CFX reveals a significant concentration of tokens among a few top addresses. The top address holds 28.52% of the total supply, while the second largest holder accounts for 21.31%. Collectively, the top five addresses control approximately 60.26% of the total CFX supply, indicating a high level of centralization.

This concentration of holdings raises concerns about the potential for market manipulation and price volatility. With such a large portion of tokens held by a small number of addresses, any significant movement or sale by these major holders could have a substantial impact on CFX's market price and liquidity. Furthermore, this level of centralization may undermine the project's claims of decentralization and could potentially affect governance decisions if these are based on token holdings.

However, it's worth noting that 39.74% of the supply is distributed among other addresses, which suggests some level of broader market participation. While this distribution is not ideal for a fully decentralized ecosystem, it does provide a counterbalance to the top holders and may help mitigate some of the risks associated with extreme concentration.

Click to view the current CFX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 307343.85K | 28.52% |

| 2 | 0x5a52...70efcb | 229617.08K | 21.31% |

| 3 | 0xc9c2...3cea06 | 42500.00K | 3.94% |

| 4 | 0xa371...fa3879 | 38087.11K | 3.53% |

| 5 | 0xc882...84f071 | 31990.89K | 2.96% |

| - | Others | 427900.99K | 39.74% |

2. Key Factors Influencing CFX's Future Price

Supply Mechanism

- Mining and Distribution: CFX tokens are mined through a Proof-of-Work mechanism, with a decreasing issuance rate over time.

- Historical Patterns: Previous supply changes have shown correlation with price movements, particularly around halving events.

- Current Impact: The current supply dynamics are expected to maintain a balanced inflationary pressure on CFX price.

Institutional and Whale Activity

- Institutional Holdings: Several major blockchain investment firms have shown interest in CFX, potentially indicating growing institutional adoption.

- Corporate Adoption: Conflux Network has partnered with China Telecom for blockchain SIM card development, showcasing real-world application.

- National Policies: China's stance on blockchain technology, particularly its support for Conflux as a compliant public chain, significantly impacts CFX's potential.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, especially those of major economies, continue to influence crypto market sentiment and CFX price.

- Inflation Hedging Properties: CFX has shown some potential as an inflation hedge, though not as strongly as more established cryptocurrencies.

- Geopolitical Factors: International relations and regulatory developments in key markets like China and the US affect CFX's global adoption and value.

Technical Development and Ecosystem Growth

- Tree-Graph Consensus: Conflux's unique consensus mechanism enables high throughput and scalability, potentially driving increased adoption and value.

- EVM Compatibility: The network's compatibility with Ethereum Virtual Machine attracts developers and projects, expanding the ecosystem.

- DApp Ecosystem: The growing number of decentralized applications on Conflux Network contributes to CFX's utility and demand.

III. CFX Price Prediction for 2025-2030

2025 Outlook

- Conservative estimate: $0.14583 - $0.17570

- Neutral estimate: $0.17570 - $0.19854

- Optimistic estimate: $0.19854 - $0.22138 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.1888 - $0.33347

- 2028: $0.21989 - $0.30091

- Key catalysts: Increased adoption, technological advancements, market sentiment

2029-2030 Long-term Outlook

- Base scenario: $0.29512 - $0.34529 (assuming steady market growth)

- Optimistic scenario: $0.34529 - $0.50758 (assuming strong market performance)

- Transformative scenario: $0.50758 - $0.60000 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: CFX $0.34529 (95% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.22138 | 0.1757 | 0.14583 | 0 |

| 2026 | 0.29186 | 0.19854 | 0.10721 | 12 |

| 2027 | 0.33347 | 0.2452 | 0.1888 | 38 |

| 2028 | 0.30091 | 0.28933 | 0.21989 | 63 |

| 2029 | 0.39546 | 0.29512 | 0.17412 | 66 |

| 2030 | 0.50758 | 0.34529 | 0.27278 | 95 |

IV. Professional CFX Investment Strategies and Risk Management

CFX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate CFX during market dips

- Set price targets for partial profit-taking

- Store in secure hardware wallets or reputable custodial services

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and potential reversal points

- RSI (Relative Strength Index): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor CFX's correlation with major cryptocurrencies

- Pay attention to network upgrades and partnerships

CFX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different blockchain projects

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for CFX

CFX Market Risks

- High volatility: CFX price can experience significant fluctuations

- Competition: Other scalable blockchain projects may gain market share

- Market sentiment: Negative news can impact CFX's value

CFX Regulatory Risks

- Regulatory uncertainty: Changing cryptocurrency regulations may affect CFX

- Compliance challenges: Potential difficulties in meeting new regulatory requirements

- Cross-border restrictions: Varying international regulations may limit CFX's adoption

CFX Technical Risks

- Network security: Potential vulnerabilities in the Conflux network

- Scalability challenges: Unforeseen issues in maintaining high throughput

- Smart contract risks: Bugs or exploits in dApps built on Conflux

VI. Conclusion and Action Recommendations

CFX Investment Value Assessment

Conflux (CFX) presents a promising long-term value proposition with its high-throughput blockchain technology. However, short-term risks include market volatility and regulatory uncertainties.

CFX Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about Conflux technology ✅ Experienced investors: Consider a balanced approach with both long-term holdings and active trading ✅ Institutional investors: Conduct thorough due diligence and consider CFX as part of a diversified crypto portfolio

CFX Trading Participation Methods

- Spot trading: Buy and sell CFX on Gate.com's spot market

- Staking: Participate in CFX staking programs for passive income

- DeFi: Explore decentralized finance applications built on Conflux network

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of CFX?

CFX is projected to reach $0.1820 by 2025, with an average price of $0.1518. Further price increases are anticipated in 2026, suggesting continued growth potential.

What is the price prediction for CFX coin in 2050?

Based on current projections, the price of CFX coin in 2050 is estimated to reach $0.606855.

What is the all time high of CFX?

The all-time high of CFX is $1.70, reached before September 2025.

Why CFX coin pump?

CFX coin's surge is driven by favorable regulations, advanced technology, and strong political support, attracting significant investor interest and market confidence.

2025 GRT Price Prediction: Analyzing Graph Protocol's Future Value Trajectory and Market Potential

2025 XLM Price Prediction: Stellar's Potential Surge in the Evolving Crypto Landscape

2025 SLC Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 SYSPrice Prediction: Analyzing Market Trends, Technical Factors, and Institutional Adoption Potential

2025 TLOS Price Prediction: Market Analysis and Growth Potential for Telos Blockchain

2025 REI Price Prediction: Market Analysis and Growth Forecast for the Real Estate Token Economy

What is cryptocurrency compliance and regulatory risk: SEC oversight and KYC/AML requirements explained

Understanding the Yield Curve: A Guide for Crypto Enthusiasts

Khám Phá Pre Sale: Hướng Dẫn Cơ Bản Cho Người Mới trong Thế Giới Crypto

What are the compliance and regulatory risks facing crypto projects like BEAT in 2025?

Investing in Popcat: 2024 Insights, Opportunities & Community Events