2025 EUL Price Prediction: Expert Analysis and Market Forecast for Euler Token

Introduction: Market Position and Investment Value of EUL

Euler (EUL), an unmanaged, non-custodial lending protocol on Ethereum, has emerged as a significant player in decentralized finance since its inception in 2022. As of December 2025, EUL has achieved a market capitalization of approximately $56.56 million, with a circulating supply of about 18.69 million tokens, currently trading around $3.03 per token. This governance token, which powers the Euler protocol, is playing an increasingly important role in enabling users to earn interest on cryptocurrency assets and hedge against market volatility without relying on trusted intermediaries.

This article will provide a comprehensive analysis of EUL's price trajectory through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and broader macroeconomic factors to deliver professional price forecasting and actionable investment strategies for investors.

Euler (EUL) Market Analysis Report

I. EUL Price History Review and Current Market Status

EUL Historical Price Evolution

- June 2022: Project launch at initial price of $1.00, marking the beginning of Euler protocol's governance token journey on Ethereum.

- July 2025: All-time high reached at $15.81 on July 11, 2025, representing significant appreciation from launch price as the protocol gained market traction.

- June 2023: All-time low recorded at $1.44 on June 16, 2023, reflecting market volatility and early protocol challenges.

EUL Current Market Status

As of December 18, 2025, EUL is trading at $3.027, reflecting a -5.25% decline over the past 24 hours. The token is experiencing broader market pressure, with a -13.30% weekly decline and a -31.89% monthly decline, indicating sustained downward momentum across multiple timeframes. Over the one-year period, EUL has depreciated by -14.12% from its previous levels.

The 24-hour price range shows EUL trading between $3.002 (low) and $3.235 (high), with a 1-hour movement of +0.70%, suggesting some minor intraday recovery attempts. The token commands a market capitalization of approximately $56.56 million against a fully diluted valuation of $82.28 million, with a circulating supply of 18.69 million EUL tokens out of a total supply of 27.18 million tokens, representing a 68.74% circulation ratio.

Daily trading volume reached $197,164.84, indicating moderate liquidity with the token listed on 22 exchanges globally. The market dominance stands at 0.0026% of the total cryptocurrency market, positioning EUL at rank #463 by market capitalization. Current market sentiment reflects "Extreme Fear" conditions with a VIX score of 17.

Click to view current EUL market price

EUL Market Sentiment Indicator

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 17. This indicates significant market pessimism and heightened investor anxiety. When the index reaches such low levels, it typically signals potential oversold conditions where risk assets may present opportunities for contrarian investors. However, traders should exercise caution and conduct thorough research before making investment decisions. Monitor market developments closely on Gate.com to stay informed of sentiment shifts and market dynamics during this volatile period.

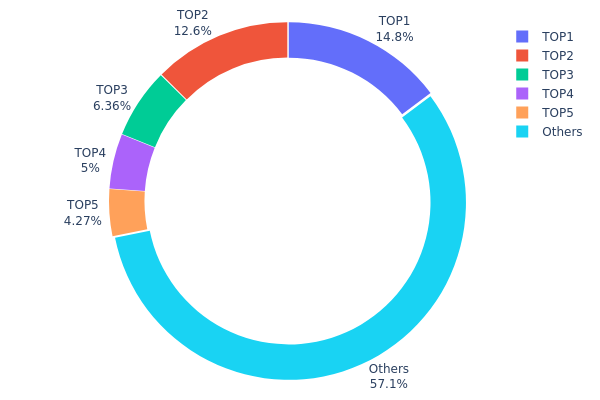

EUL Holdings Distribution

The address holdings distribution map illustrates the concentration of EUL tokens across wallet addresses on the blockchain. It provides critical insight into token ownership structure by ranking the top holders and quantifying their proportional stake in the total circulating supply. This metric serves as a fundamental indicator for assessing decentralization levels and potential concentration risks within the EUL ecosystem.

Current data reveals a moderately concentrated holder structure. The top five addresses collectively control approximately 42.9% of the token supply, with the leading address commanding 14.74% and the second-largest holder maintaining 12.55%. While this concentration level is significant, the fact that the remaining 57.1% of tokens are distributed among numerous other addresses suggests a relatively fragmented long-tail distribution. The concentration is neither extreme nor negligible, positioning EUL within a mid-range decentralization profile compared to industry standards.

This distribution pattern carries meaningful implications for market dynamics and ecosystem stability. The substantial stake held by top holders creates potential for significant price volatility, as coordinated movements or large liquidation events could disproportionately impact market conditions. However, the presence of a substantial dispersed holder base provides a stabilizing counterweight, reducing the likelihood of extreme price manipulation by any single entity. The current structure indicates an ecosystem with adequate checks and balances, though ongoing monitoring of top holder activity remains prudent for stakeholders concerned with long-term market integrity and decentralization trajectory.

Click to view current EUL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7597...b33a95 | 4009.47K | 14.74% |

| 2 | 0xc7c5...b5c550 | 3412.62K | 12.55% |

| 3 | 0x25aa...126992 | 1729.84K | 6.36% |

| 4 | 0x7ba1...76eaa4 | 1359.14K | 4.99% |

| 5 | 0xfb91...444bd5 | 1160.22K | 4.26% |

| - | Others | 15511.53K | 57.1% |

II. Core Factors Influencing EUL's Future Price

DeFi Utility and Protocol Cash Flow

-

Protocol Revenue Model: EUL generates value through governance mechanisms and fee distribution structures within the Euler lending protocol. The token's utility is tied to the protocol's ability to generate stable, sustainable cash flows from lending activities and risk management functions.

-

Real Yield Distribution: Unlike speculative tokens, EUL is positioned as a cash flow-generating asset. The protocol's revenue sharing model with token holders creates genuine economic utility, making EUL attractive to institutional capital seeking protocols with transparent revenue streams rather than speculative narratives.

-

Current Market Impact: As DeFi markets transition from "APY-chasing models" to "sustainable cash flow models," protocols like Euler that emphasize transparent revenue distribution and risk management are gaining institutional adoption. This structural shift favors EUL's long-term valuation anchoring.

Institutional Adoption and Capital Structure

-

Institutional Interest in DeFi Infrastructure: According to market research, capital is increasingly flowing toward protocols with mature governance mechanisms, transparent fee structures, and stable revenue distribution capabilities. EUL, as a governance token for a recognized lending protocol, benefits from this institutional reallocation away from speculative tokens.

-

Enterprise Participation in Crypto Finance: Traditional financial institutions are beginning to participate directly in on-chain financial markets. This institutional capital flow toward regulated, yield-generating DeFi protocols creates demand for tokens like EUL that represent ownership in productive financial infrastructure.

Macroeconomic Environment

-

Monetary Policy and Risk Asset Revaluation: Global central banks have shifted toward looser monetary policies, with increased capital supply seeking higher risk-adjusted returns. This environment favors cryptocurrency assets and DeFi tokens, particularly those with sustainable yield generation capabilities.

-

Capital Flow Dynamics: The shift from speculative market participation to institutional capital allocation is creating structural support for cash flow-generating tokens. As risk capital reallocates from meme tokens toward productive DeFi infrastructure, protocols like Euler attract more stable institutional funding.

-

Selective Bull Market Thesis: The current market environment is characterized by "selective bull market" dynamics where only protocols meeting institutional criteria—real yields, transparent governance, and sustainable revenue models—receive capital inflows. EUL's positioning aligns with these criteria.

Regulatory and Compliance Developments

-

Regulatory Clarity for DeFi Protocols: Increasing regulatory acceptance of DeFi infrastructure, particularly in jurisdictions like Hong Kong, Singapore, and the UAE, creates legitimate pathways for institutional capital deployment in protocols like Euler.

-

Compliance Integration: As DeFi protocols integrate with traditional financial infrastructure through staking ETFs and institutional custody solutions, governance tokens that represent productive, fee-generating protocols gain compliance advantages and institutional appeal.

III. EUL Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $1.78 - $2.40

- Neutral Forecast: $2.40 - $3.02

- Bullish Forecast: $3.02 - $3.93 (requires sustained ecosystem adoption and positive market sentiment)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery phase with stabilizing fundamentals and increasing institutional interest in Layer 2 solutions

- Price Range Predictions:

- 2026: $1.84 - $4.34 (14% potential upside)

- 2027: $2.46 - $5.20 (29% potential upside)

- 2028: $3.42 - $4.96 (50% potential upside)

- Key Catalysts: Enhanced protocol performance, expanded DeFi integrations, growing developer ecosystem, and increased trading volume on platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case: $2.43 - $5.62 (57% potential growth by 2029, assuming steady market conditions and protocol development)

- Optimistic Case: $3.68 - $6.64 (71% potential growth by 2030, assuming strong adoption of decentralized finance solutions and expansion into new use cases)

- Transformational Case: $6.64+ (breakthrough scenario with mainstream institutional adoption, revolutionary protocol upgrades, and significant market capitalization expansion)

Note: All price forecasts are based on historical data analysis and market trend projections. Actual market performance may vary significantly due to regulatory changes, technological developments, and macroeconomic conditions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 3.9286 | 3.022 | 1.78298 | 0 |

| 2026 | 4.34413 | 3.4753 | 1.84191 | 14 |

| 2027 | 5.19992 | 3.90971 | 2.46312 | 29 |

| 2028 | 4.96475 | 4.55482 | 3.41611 | 50 |

| 2029 | 5.61654 | 4.75978 | 2.42749 | 57 |

| 2030 | 6.64085 | 5.18816 | 3.6836 | 71 |

Euler (EUL) Professional Investment Strategy and Risk Management Report

IV. EUL Professional Investment Strategy and Risk Management

EUL Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: DeFi protocol believers, passive income seekers, and long-term cryptocurrency portfolios diversifiers

- Operational Recommendations:

- Accumulate EUL during market downturns when prices show weakness, particularly when the token is trading below historical support levels

- Hold positions for a minimum of 12-24 months to capture potential protocol adoption and governance value appreciation

- Participate in governance voting to maximize protocol involvement and potential rewards

(2) Active Trading Strategy

- Key Trading Points:

- Monitor the 24-hour price volatility range ($3.002 - $3.235) for short-term trading opportunities

- Use support levels established during recent market corrections (current 7-day decline of -13.30%)

- Take advantage of market sentiment shifts during major protocol updates or governance announcements

EUL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation

- Active Investors: 3-7% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation

(2) Risk Hedging Strategies

- Position Sizing: Implement strict position limits to prevent overexposure to a single protocol token

- Dollar-Cost Averaging (DCA): Regular periodic purchases reduce the impact of price volatility and average down entry costs

(3) Secure Storage Solutions

- Hardware Wallet Method: Self-custody through hardware wallets provides maximum security for long-term holdings

- Exchange Custody: Gate.com offers secure storage with professional-grade security infrastructure for active traders

- Security Best Practices: Enable two-factor authentication, use hardware security keys, maintain secure backups of private keys, and never share sensitive information

V. EUL Potential Risks and Challenges

EUL Market Risks

- Token Price Volatility: EUL has experienced significant price swings, trading from a historical high of $15.81 (July 2025) to current levels around $3.03, representing an 81% decline from peak valuations

- Liquidity Concentration: With only 22 exchanges listing EUL and a 24-hour trading volume of approximately $197,164, liquidity may be limited during high-volatility periods

- Market Capitalization Dominance: At $0.0026% market dominance, EUL remains a micro-cap token with limited institutional adoption

EUL Regulatory Risks

- DeFi Protocol Scrutiny: Regulatory frameworks around lending protocols continue to evolve globally, potentially impacting protocol operations and token utility

- Jurisdiction-Specific Restrictions: Different countries may impose varying restrictions on decentralized lending protocols and their governance tokens

- Compliance Requirements: Future regulatory requirements could necessitate protocol modifications affecting EUL's utility and value proposition

EUL Technical Risks

- Smart Contract Vulnerabilities: As an Ethereum-based protocol, Euler faces inherent risks from smart contract bugs or security exploits

- Liquidity Provider Risks: The protocol's functionality depends on sufficient liquidity providers; reduced participation could impact borrowing/lending functionality

- Ethereum Network Dependency: EUL's value is directly tied to Ethereum's network performance, security, and adoption rates

VI. Conclusion and Action Recommendations

EUL Investment Value Assessment

Euler represents a specialized DeFi lending protocol opportunity with governance token utility. EUL demonstrates moderate market adoption with 4,638 token holders and presence across 22 exchanges. However, significant recent price depreciation (-31.89% over 30 days) indicates market challenges. The token's utility within the Euler ecosystem and potential for protocol growth present long-term opportunities, yet considerable volatility and micro-cap characteristics present material risks.

EUL Investment Recommendations

✅ Beginners: Start with small allocation (1-2% of portfolio) through Gate.com's secure trading infrastructure; focus on understanding Euler protocol fundamentals before increasing exposure

✅ Experienced Investors: Consider dollar-cost averaging into positions during weakness; participate in protocol governance to maximize value capture; implement strict stop-loss orders at -15-20% below entry points

✅ Institutional Investors: Conduct comprehensive due diligence on protocol smart contracts and team credentials; evaluate Euler's competitive positioning versus alternative lending protocols; structure positions with appropriate hedging strategies

EUL Trading Participation Methods

- Spot Trading on Gate.com: Direct EUL purchases for long-term holding or short-term trading with real-time price discovery

- Gate.com Wallet Integration: Secure custody solutions combining exchange access with self-custody security options

- Over-the-Counter Trading: For substantial positions, direct negotiation may provide better execution prices than retail markets

Cryptocurrency investments carry extremely high risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial circumstances. Consult with professional financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

What is the price of EUL?

The price of EUL is $3.155600 as of 2025-12-18. It has decreased by 3.71% over the last 24 hours. EUL price fluctuates based on market conditions and trading volume.

Which coin price prediction 2030?

EUL price predictions for 2030 vary among analysts. Based on current market trends and development momentum, experts forecast EUL could potentially reach between $8-15 by 2030. However, prices depend on adoption rates, market conditions, and ecosystem growth. Long-term predictions remain speculative.

What is the crypto prediction for 2025?

2025 is expected to be a massive year for crypto as the market enters its fourth cycle year. Experts predict significant bullish trends and substantial growth potential across the sector, with many anticipating considerable gains.

What is the price prediction for XRP in 2030?

XRP price predictions for 2030 remain highly speculative. Analysts project ranges from $5 to $50+ based on adoption, regulatory clarity, and market evolution. Long-term value depends on technological advancement and institutional adoption.

2025 BYN Price Prediction: Analyzing Economic Factors and Market Trends for Belarus's Currency

2025 BAKE Price Prediction: Will This DeFi Token Rise to New Heights in the Crypto Market?

How Has the SwissCheese (SWCH) Price Surged 39.53% in 24 Hours?

Avalanche (AVAX) 2025 Price Analysis and Market Trends

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

Where to Find Alpha in the 2025 Crypto Spot Market

Is Cobak (CBK) a good investment?: A Comprehensive Analysis of Tokenomics, Market Performance, and Future Potential

Guide to Safely Borrowing Digital Assets

Is Gravity (G) a good investment?: A Comprehensive Analysis of the Gravity Protocol Token's Potential and Market Outlook

Is Aevo (AEVO) a good investment?: A Comprehensive Analysis of Risk, Potential, and Market Positioning in 2024

Dự Đoán Giá CRV 2025-2028: Xu Hướng và Triển Vọng Thị Trường