2025 GLM Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: GLM's Market Position and Investment Value

Golem (GLM) as a decentralized computing power leasing platform, has been making significant strides since its inception in 2016. As of 2025, Golem's market capitalization has reached $176,200,000, with a circulating supply of approximately 1,000,000,000 tokens, and a price hovering around $0.1762. This asset, often referred to as the "Ethereum of computation," is playing an increasingly crucial role in the field of decentralized computing resources.

This article will provide a comprehensive analysis of Golem's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. GLM Price History Review and Current Market Status

GLM Historical Price Evolution Trajectory

- 2016: GLM launched with an ICO price of $0.0105, reaching its all-time low of $0.00913753 on December 12.

- 2018: GLM achieved its all-time high of $1.32 on April 13, marking a significant milestone.

- 2020: GNT token was rebranded to GLM on November 19, continuing its market presence.

GLM Current Market Situation

As of October 19, 2025, GLM is trading at $0.1762, with a market cap of $176,200,000. The token has experienced a 0.22% increase in the last 24 hours, showing slight positive momentum. However, GLM has seen a significant decline of 29.94% over the past 30 days and a substantial 47.4% drop in the last year, indicating a bearish trend in the medium to long term.

The current price is considerably lower than its all-time high, suggesting potential for growth if market conditions improve. The 24-hour trading volume stands at $92,602.51, reflecting moderate market activity. With a circulating supply equal to its total supply of 1,000,000,000 GLM, the token has reached its maximum distribution.

Click to view the current GLM market price

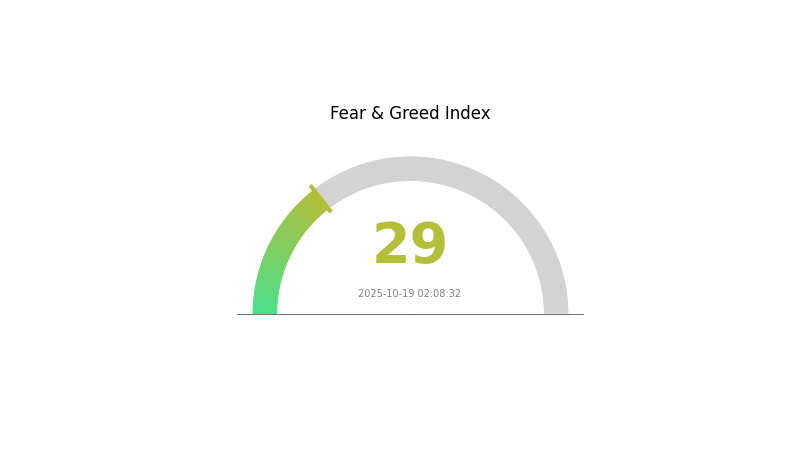

GLM Market Sentiment Indicator

2025-10-19 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 29, signaling a state of fear. This suggests investors are becoming increasingly wary, potentially creating buying opportunities for contrarian traders. However, it's crucial to approach with caution and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and it's essential to stay informed about broader market trends and developments in the crypto space.

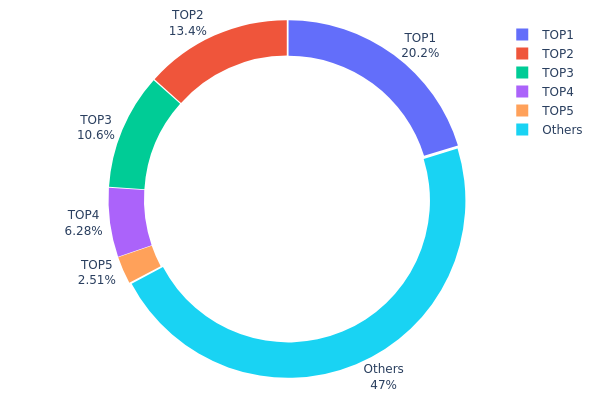

GLM Holdings Distribution

The address holdings distribution data for GLM reveals a relatively concentrated ownership structure. The top address holds 20.24% of the total supply, with the top five addresses collectively controlling 52.99% of GLM tokens. This concentration level indicates a significant imbalance in token distribution.

Such a concentrated distribution pattern could potentially impact market dynamics. With over half of the tokens held by just five addresses, there's an increased risk of price volatility and market manipulation. Large holders, often referred to as "whales," have the capacity to influence prices through substantial buy or sell orders. This concentration also raises concerns about the token's decentralization, as a small number of entities hold considerable sway over the network.

However, it's worth noting that 47.01% of GLM tokens are distributed among other addresses, suggesting some level of wider participation. While this provides a degree of balance, the overall structure still leans towards centralization. This distribution pattern may impact GLM's on-chain stability and could be a factor for investors to consider when assessing the token's long-term prospects and governance structure.

Click to view the current GLM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8791...af117c | 161074.94K | 20.24% |

| 2 | 0x413e...9c303f | 106599.41K | 13.39% |

| 3 | 0x70a0...10e476 | 84101.45K | 10.57% |

| 4 | 0x7da8...7f6cf9 | 50001.00K | 6.28% |

| 5 | 0x5a52...70efcb | 20000.00K | 2.51% |

| - | Others | 373849.46K | 47.01% |

II. Key Factors Influencing GLM's Future Price

Technical Development and Ecosystem Building

-

Golem Network Upgrade: The Golem Network is continuously improving its infrastructure, which could enhance the utility and demand for GLM tokens.

-

Ecosystem Applications: Golem Network supports various decentralized applications (DApps) that utilize distributed computing resources, potentially driving GLM token usage and value.

III. GLM Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.1496 - $0.176

- Neutral forecast: $0.176 - $0.20

- Optimistic forecast: $0.20 - $0.24112 (requires strong market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range prediction:

- 2027: $0.18443 - $0.26917

- 2028: $0.14515 - $0.32141

- Key catalysts: Technological advancements, wider adoption of GLM in AI applications

2029-2030 Long-term Outlook

- Base scenario: $0.2903 - $0.29466 (assuming steady market growth)

- Optimistic scenario: $0.29901 - $0.33002 (favorable market conditions and increased GLM utility)

- Transformative scenario: $0.35 - $0.40 (breakthrough in AI technology leveraging GLM)

- 2030-12-31: GLM $0.33002 (potential peak based on current projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.24112 | 0.176 | 0.1496 | 0 |

| 2026 | 0.2899 | 0.20856 | 0.12514 | 18 |

| 2027 | 0.26917 | 0.24923 | 0.18443 | 41 |

| 2028 | 0.32141 | 0.2592 | 0.14515 | 46 |

| 2029 | 0.29901 | 0.2903 | 0.16838 | 64 |

| 2030 | 0.33002 | 0.29466 | 0.22099 | 67 |

IV. GLM Professional Investment Strategies and Risk Management

GLM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate GLM during market dips

- Set price targets and rebalance portfolio periodically

- Store GLM in secure cold wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor Golem network adoption and development milestones

- Stay updated on decentralized computing industry trends

GLM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and traditional assets

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for GLM

GLM Market Risks

- Volatility: Cryptocurrency markets are known for extreme price fluctuations

- Competition: Emerging decentralized computing platforms may challenge Golem's market position

- Liquidity: Lower trading volumes compared to major cryptocurrencies may impact price stability

GLM Regulatory Risks

- Unclear regulations: Evolving cryptocurrency regulations may impact GLM's adoption and usage

- Cross-border restrictions: Potential limitations on international transfers of GLM

- Tax implications: Uncertain tax treatment of GLM transactions in various jurisdictions

GLM Technical Risks

- Smart contract vulnerabilities: Potential security flaws in the underlying Ethereum-based contracts

- Scalability challenges: Limitations in processing capacity of the Golem network

- Network attacks: Possibility of 51% attacks or other malicious activities targeting the network

VI. Conclusion and Action Recommendations

GLM Investment Value Assessment

GLM presents a unique value proposition in the decentralized computing space, with potential for long-term growth. However, short-term volatility and regulatory uncertainties pose significant risks.

GLM Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market dynamics ✅ Experienced investors: Consider a balanced approach, allocating a portion of the portfolio to GLM ✅ Institutional investors: Conduct thorough due diligence and consider GLM as part of a diversified crypto portfolio

GLM Trading Participation Methods

- Spot trading: Buy and sell GLM on Gate.com's spot market

- Staking: Participate in GLM staking programs if available

- DeFi integration: Explore decentralized finance options involving GLM tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of GLM coin?

GLM coin has a promising future in the Web3 ecosystem. As AI and decentralized computing grow, GLM's role in powering distributed computing networks will likely increase its value and adoption significantly by 2025.

What is the price prediction for GRT 2025?

Based on market trends and expert analysis, GRT's price is predicted to reach around $2.50 to $3.00 by 2025, showing significant growth potential for long-term investors.

Is Golem Network good?

Yes, Golem Network is promising. It offers decentralized computing power, enabling users to rent out idle resources. With its innovative approach and potential for growth, Golem is considered a solid project in the blockchain space.

What are the risks of investing in Golem?

Risks include market volatility, regulatory changes, technological challenges, and competition in the decentralized computing space. Golem's success depends on adoption and network growth.

What is FET: Understanding Field-Effect Transistors and Their Applications in Modern Electronics

What is SkyAI ($SKYAI)? Exploring its MCP infrastructure and role in on-chain AI.

What is the Core Logic Behind ChainOpera AI's (COAI) White Paper?

GAI vs RUNE: The Battle of Two Revolutionary Blockchain Protocols Transforming Digital Asset Markets

WAI vs VET: Comparing Web Accessibility Initiative and Vocational Education and Training

How Does Fetch.ai's White Paper Logic Drive Its Fundamental Value?

Top 10 Free Crypto Mining Tools for 2023

Effortlessly Shop Online with Crypto Wallet Cards and Earn Rewards

Is NEON EVM (NEON) a good investment?: A Comprehensive Analysis of Performance, Risk Factors, and Future Potential in the Solana Ecosystem

Is Forta (FORT) a good investment?: A Comprehensive Analysis of the Security-Focused Blockchain Platform's Potential Returns and Risk Factors

Is Portal (PORTAL) a good investment? A Comprehensive Analysis of Tokenomics, Market Potential, and Risk Factors for 2024