2025 HGET Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Token

Introduction: HGET's Market Position and Investment Value

Hedget (HGET), as a decentralized protocol for options trading, has been playing an increasingly important role in the DeFi sector since its inception. As of 2025, HGET's market capitalization has reached $88,728, with a circulating supply of approximately 1,751,448 tokens, and a price hovering around $0.05066. This asset, often referred to as a "risk mitigation tool" in decentralized finance, is playing a crucial role in options trading and risk hedging within the blockchain ecosystem.

This article will comprehensively analyze HGET's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. HGET Price History Review and Current Market Status

HGET Historical Price Evolution

- 2020: HGET launched, reaching its all-time high of $15.44 on September 13, 2020

- 2021-2024: Gradual price decline amid overall cryptocurrency market volatility

- 2025: HGET hit its all-time low of $0.03825506 on October 18, 2025

HGET Current Market Situation

As of November 29, 2025, HGET is trading at $0.05066, representing a significant drop from its all-time high. The token has experienced a 7.55% decrease in the last 24 hours and a 16.2% decline over the past 30 days. The current market capitalization stands at $88,728.36, with a circulating supply of 1,751,448 HGET tokens. The 24-hour trading volume is $12,982.55, indicating moderate market activity. Despite recent downward pressure, HGET has shown some resilience, maintaining a price above its recent all-time low.

Click to view the current HGET market price

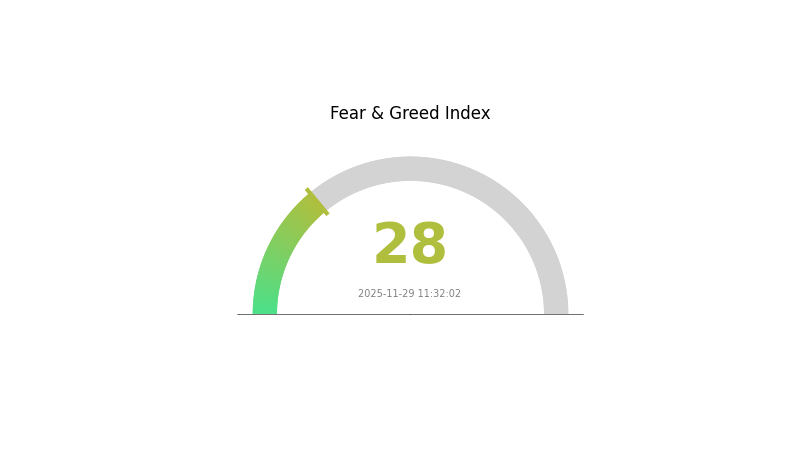

HGET Market Sentiment Index

2025-11-29 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 28, indicating a state of fear. This suggests that investors are hesitant and risk-averse in the current market climate. During such periods, it's crucial to remain vigilant and conduct thorough research before making investment decisions. Remember, market fear can sometimes present opportunities for those with a long-term perspective. However, always prioritize risk management and stay informed about market trends.

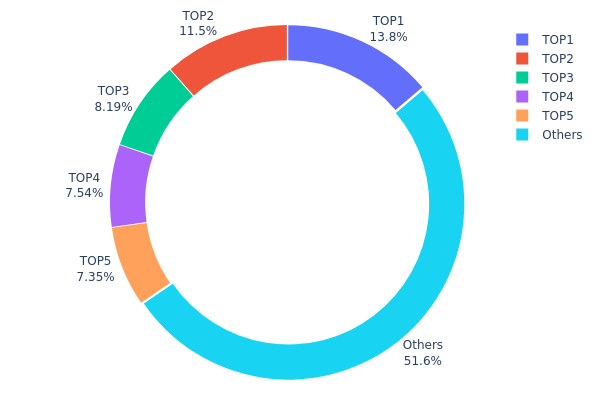

HGET Holdings Distribution

The address holdings distribution data for HGET reveals a moderately concentrated ownership structure. The top five addresses collectively hold 48.4% of the total HGET supply, with the largest holder possessing 13.81%. This concentration level suggests a significant influence of major holders on the token's market dynamics.

While not excessively centralized, this distribution pattern indicates potential volatility risks. The top holders have the capacity to impact market prices through large transactions. However, with 51.6% of tokens distributed among other addresses, there is still a considerable degree of decentralization, which may help mitigate some of the risks associated with high concentration.

This distribution reflects a market structure where major players have substantial sway, yet there's room for broader participation. It suggests a developing ecosystem with a mix of large stakeholders and a growing base of smaller holders, indicating a maturing but still evolving token economy for HGET.

Click to view the current HGET Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x75e4...37132a | 312.68K | 13.81% |

| 2 | 0x0d07...b492fe | 260.63K | 11.51% |

| 3 | 0x4d5e...3285f0 | 185.39K | 8.19% |

| 4 | 0xfe3c...d603a4 | 170.70K | 7.54% |

| 5 | 0x22d5...981c55 | 166.38K | 7.35% |

| - | Others | 1167.65K | 51.6% |

II. Key Factors Affecting HGET's Future Price

Supply Mechanism

- Fixed Supply: HGET has a fixed maximum supply, which creates scarcity and potentially impacts price as demand changes.

Technical Development and Ecosystem Building

- Ecosystem Expansion: Hedget is working on expanding its decentralized options trading platform, which could increase utility and demand for HGET tokens.

III. HGET Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.02634 - $0.0497

- Neutral prediction: $0.0497 - $0.06

- Optimistic prediction: $0.06 - $0.06511 (requires favorable market conditions)

2026-2027 Outlook

- Market stage expectation: Gradual recovery and growth

- Price range forecast:

- 2026: $0.04477 - $0.08438

- 2027: $0.0553 - $0.07727

- Key catalysts: Improved market sentiment, technological advancements

2028-2030 Long-term Outlook

- Base scenario: $0.07408 - $0.09512 (assuming steady market growth)

- Optimistic scenario: $0.09512 - $0.10372 (assuming strong market performance)

- Transformative scenario: $0.10372 - $0.11605 (assuming exceptional market conditions)

- 2030-12-31: HGET $0.11605 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06511 | 0.0497 | 0.02634 | -1 |

| 2026 | 0.08438 | 0.0574 | 0.04477 | 13 |

| 2027 | 0.07727 | 0.07089 | 0.0553 | 39 |

| 2028 | 0.10372 | 0.07408 | 0.0489 | 46 |

| 2029 | 0.10135 | 0.0889 | 0.05334 | 75 |

| 2030 | 0.11605 | 0.09512 | 0.09132 | 87 |

IV. Professional Investment Strategies and Risk Management for HGET

HGET Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term horizon

- Operational suggestions:

- Accumulate HGET during market dips

- Set a target holding period of at least 2-3 years

- Store HGET in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage risk

HGET Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Option strategies: Consider using options to hedge downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for HGET

HGET Market Risks

- High volatility: HGET price can experience significant fluctuations

- Low liquidity: Limited trading volume may impact price stability

- Market sentiment: Crypto market trends can heavily influence HGET's performance

HGET Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting DeFi projects

- Compliance challenges: Evolving legal landscape may impact Hedget's operations

- Cross-border restrictions: International regulatory differences could limit global adoption

HGET Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the protocol's code

- Scalability issues: Ethereum network congestion may affect Hedget's performance

- Oracle reliability: Dependence on external data sources for option pricing

VI. Conclusion and Action Recommendations

HGET Investment Value Assessment

HGET presents a high-risk, high-potential investment in the DeFi options space. While it offers innovative features, investors should be cautious due to market volatility and regulatory uncertainties.

HGET Investment Recommendations

✅ Newcomers: Invest only a small portion of your portfolio after thorough research

✅ Experienced investors: Consider HGET as part of a diversified DeFi portfolio

✅ Institutional investors: Evaluate HGET's potential within the context of broader DeFi exposure

HGET Trading Participation Methods

- Spot trading: Buy and sell HGET on Gate.com's spot market

- Staking: Participate in HGET staking programs if available

- DeFi integration: Use HGET within the Hedget protocol for options trading

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Hydra Coin a good investment?

Yes, Hydra Coin shows potential as a good investment. Its innovative technology and growing adoption in the Web3 space suggest promising future value and returns for investors.

Will hot coin reach $1?

It's possible, but unlikely in the near future. HGET would need significant growth and adoption to reach $1, which may take years if it happens at all.

How high will helium hnt go?

Helium (HNT) could potentially reach $50-$75 by 2025, driven by increased IoT adoption and network expansion.

What is the target price for hut in 2025?

Based on market analysis and expert predictions, the target price for HUT in 2025 is estimated to be around $15 to $20, reflecting potential growth in the crypto market and the company's expansion plans.

2025 GEARPrice Prediction: Analyzing Market Trends, Technical Indicators and Growth Potential for GEAR Token

Is Thetanuts Finance (NUTS) a good investment?: Analyzing the potential and risks of this DeFi protocol

Is Bella Protocol (BEL) a Good Investment?: Analyzing Its Performance, Market Potential, and Long-Term Viability in the DeFi Landscape

NPC vs SNX: The Battle for Digital Identity in the Metaverse

Is Nomina (NOM) a Good Investment?: Evaluating the Potential and Risks of This Emerging DeFi Protocol

Is Primex Finance (PRIMEX) a good investment?: Analyzing the potential and risks of this DeFi protocol

Enhancing Security for Network Login Credentials

How to Safely Store Cryptocurrency Assets: Gate Safe Box Insurance Protection and Web3 Wallet Security Features Compared

Gate Meme Go: One-Click Meme Token Creation Platform for Fast Meme Coin Issuance

How to Buy Meme Coins on Gate.com: Meme Go Zero Fee Trading Platform Guide

The Latest NFT Project Unveiled: A Can't-Miss Opportunity for Digital Collectors