2025 LUMINT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: LUMINT's Market Position and Investment Value

LUMINT (LUMINT) is a global initiative led by the Neural Trust Foundation that combines blockchain and artificial intelligence technologies to deliver sustainable rewards for token holders and node operators. Since its launch, LUMINT has established itself as a distinctive asset in the cryptocurrency market. As of December 2025, LUMINT's market capitalization has reached approximately $55.49 million USD, with a circulating supply of 3 billion tokens trading at around $0.018497. This innovative asset, characterized by its integration of decentralized finance with AI-driven services, is playing an increasingly important role in advancing hybrid blockchain ecosystems.

This article will comprehensively analyze LUMINT's price trajectory through 2030, combining historical market patterns, supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasting and practical investment strategies.

LUMINT Price History Review and Market Status

I. LUMINT Price History Review and Current Market Situation

LUMINT Historical Price Evolution

- November 19, 2025: LUMINT reached its all-time high of $0.08162, marking the peak of its initial market cycle.

- November 30, 2025: LUMINT hit its all-time low of $0.00799, representing a significant correction period within the same month.

- December 2025: LUMINT has stabilized around $0.018497, recovering from the late November lows but remaining substantially below the all-time high.

LUMINT Current Market Status

As of December 18, 2025, LUMINT is trading at $0.018497 with a 24-hour trading volume of $373,624.40. The token exhibits a market capitalization of $55.491 million with a fully diluted valuation matching this figure, given that all 3 billion tokens are currently in circulation (100% circulating ratio).

The 24-hour price change reflects a modest positive momentum of 2.32%, while the 7-day performance shows an encouraging gain of 14.39%. However, the longer-term perspective presents a more challenging picture, with the 30-day performance declining by 75.88% and the 1-year performance down 73.76%.

In the current 1-hour timeframe, LUMINT has experienced a slight pullback of 1.64%. The 24-hour trading range spans from a low of $0.016016 to a high of $0.019548.

LUMINT holds a market ranking of 471 among cryptocurrencies by market capitalization, with a market dominance of 0.0017%. The token is supported by 2,145 holders across 2 exchange listings, with Gate.com being a primary trading venue.

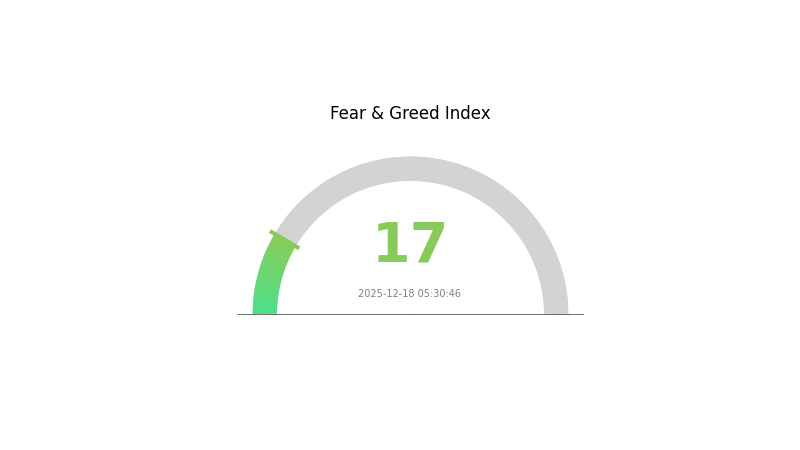

The current market sentiment indicates "Extreme Fear" with a VIX reading of 17, reflecting broader market risk aversion conditions during this period.

Click to view current LUMINT market price

LUMINT Market Sentiment Index

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

Market sentiment has reached extreme fear levels, with the Fear and Greed Index at 17. This indicates widespread panic and risk aversion among investors, suggesting potential capitulation in the market. Extreme fear often precedes market reversals, presenting opportunities for long-term investors to accumulate quality assets at discounted prices. However, caution is advised as further downside is possible. Monitor key support levels and consider dollar-cost averaging strategies. This sentiment extreme typically reflects maximum negative sentiment, which historically can signal potential market bottoms for strategic investors.

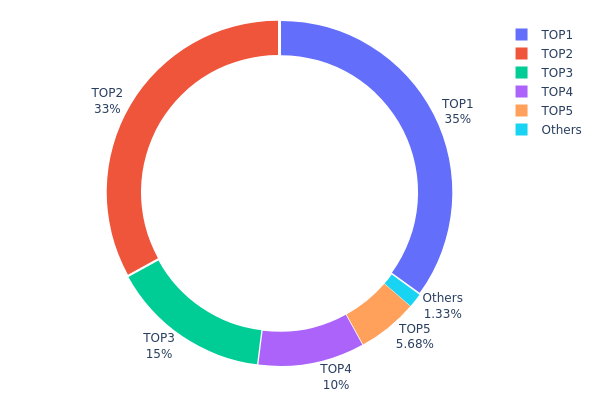

LUMINT Holding Distribution

The address holding distribution map illustrates the concentration of token ownership across blockchain addresses, serving as a critical indicator of market structure and potential risks related to token centralization. By analyzing the top holders and their respective percentages, investors and analysts can assess the degree of decentralization, evaluate vulnerability to large-scale liquidations, and identify potential market manipulation risks.

LUMINT currently exhibits a highly concentrated holding structure, with the top four addresses controlling approximately 93% of the total supply. The largest holder (0xbd7f...ccb9a0) alone accounts for 34.99% of all tokens, while the second-largest address (0x636f...d744f6) holds 33.00%. This duopoly concentration presents a significant structural concern, as these two entities collectively command 67.99% of the circulating supply. The remaining top holders show a gradual decline in proportion, with the third, fourth, and fifth addresses holding 15.00%, 10.00%, and 5.67% respectively. The fragmented "Others" category, representing merely 1.34% across all remaining addresses, underscores the extreme imbalance in token distribution.

Such pronounced concentration levels pose considerable risks to market stability and decentralization principles. The dominance of a handful of addresses creates vulnerabilities to coordinated selling pressure, potential price manipulation, and reduced market resilience. With over two-thirds of tokens held by just two addresses, LUMINT's market structure demonstrates limited distribution diversity, which typically correlates with higher volatility and lower market maturity. This centralized holding pattern suggests that price movements and market sentiment may be disproportionately influenced by the actions of top holders, potentially constraining organic market development and retail participation.

Click to view current LUMINT Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xbd7f...ccb9a0 | 1049706.00K | 34.99% |

| 2 | 0x636f...d744f6 | 990000.00K | 33.00% |

| 3 | 0xed6b...e575ad | 450000.00K | 15.00% |

| 4 | 0xe15d...a17869 | 300000.00K | 10.00% |

| 5 | 0x11e0...f400fa | 170272.59K | 5.67% |

| - | Others | 40021.41K | 1.34% |

II. Core Factors Influencing LUMINT's Future Price

Market Sentiment and Adoption

-

Investor Confidence Impact: Investor sentiment and confidence directly influence LUMINT price movements. Positive news regarding widespread LUMINT adoption or major technological breakthroughs typically triggers market optimism and drives upward price momentum.

-

Market Adoption Level: The degree of market adoption of LUMINT serves as a key factor affecting its valuation. Increased adoption by users and integration into more platforms can support sustained price appreciation.

Supply Mechanism

- Supply Dynamics: The supply mechanism of LUMINT plays a critical role in price determination. Changes in supply conditions and market trends are essential factors shaping future price trajectories.

Macroeconomic Environment

-

Economic Trends: Overall economic trends, regulatory policies, and technological innovation across multiple dimensions influence LUMINT price volatility.

-

Technology Innovation: Continuous technological advancements in the crypto ecosystem impact investor confidence and market valuation of LUMINT.

III. 2025-2030 LUMINT Price Forecast

2025 Outlook

- Conservative Estimate: $0.00978 - $0.01845

- Neutral Estimate: $0.01845

- Optimistic Estimate: $0.0262 (requiring sustained market interest and ecosystem development)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual accumulation and consolidation phase with incremental growth trajectory

- Price Range Forecast:

- 2026: $0.01697 - $0.02656

- 2027: $0.01736 - $0.03495

- 2028: $0.02851 - $0.04009

- Key Catalysts: Enhanced protocol adoption, strategic partnerships, improved market liquidity, and positive sentiment shifts in the broader cryptocurrency market

2029-2030 Long-term Outlook

- Base Case: $0.03001 - $0.03594 (assuming moderate ecosystem expansion and sustained development momentum)

- Optimistic Case: $0.03542 - $0.04817 (contingent upon mainstream institutional interest and significant technological breakthroughs)

- Transformational Case: $0.04817+ (under conditions of breakthrough adoption, transformative use cases, and favorable macroeconomic conditions)

- 2030-12-18: LUMINT projected at $0.04817 (representing 91% cumulative appreciation from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0262 | 0.01845 | 0.00978 | 0 |

| 2026 | 0.02656 | 0.02232 | 0.01697 | 20 |

| 2027 | 0.03495 | 0.02444 | 0.01736 | 32 |

| 2028 | 0.04009 | 0.0297 | 0.02851 | 60 |

| 2029 | 0.03594 | 0.0349 | 0.03001 | 88 |

| 2030 | 0.04817 | 0.03542 | 0.02302 | 91 |

LUMINT Professional Investment Strategy and Risk Management Report

IV. LUMINT Professional Investment Strategy and Risk Management

LUMINT Investment Methodology

(1) Long-Term Holding Strategy

- Suitable Investors: Risk-averse investors seeking sustainable passive income through node staking and AI-driven services

- Operation Recommendations:

- Accumulate LUMINT tokens during market downturns to benefit from the project's hybrid staking and intelligent mining system

- Participate in node operator programs to earn sustainable rewards while supporting network infrastructure

- Maintain a minimum 12-month holding period to capture the full value of AI-driven service integrations and DeFi innovations

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: LUMINT demonstrates significant volatility with all-time high of $0.08162 (November 19, 2025) and all-time low of $0.00799 (November 30, 2025). Monitor these key price levels for entry and exit signals

- Volume Analysis: Current 24-hour volume stands at $373,624.40. Watch for volume spikes above average to confirm trend reversals and breakouts

- Wave Trading Key Points:

- Execute buy orders during the 30-day drawdown period (-75.88%) when prices approach historical lows, positioning for potential recovery

- Take profit targets at resistance levels established during the project's peak valuation period

LUMINT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% maximum allocation of total portfolio

- Active Investors: 5-7% maximum allocation with dollar-cost averaging over 6-12 months

- Professional Investors: 10-15% allocation with structured hedging strategies and continuous rebalancing

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance LUMINT holdings with established blockchain infrastructure tokens and traditional DeFi assets to mitigate concentration risk

- Position Sizing: Implement strict position limits based on individual risk tolerance, with stop-loss orders set at 20-30% below entry points

(3) Secure Storage Solutions

- Cold wallet Storage: For long-term holdings exceeding 6 months, transfer tokens to hardware wallets to eliminate exchange counterparty risk and ensure complete asset control

- Exchange Custody: For active traders, maintain working balances on Gate.com, which provides institutional-grade security protocols and insurance coverage for stored digital assets

- Security Best Practices: Enable two-factor authentication, use hardware security keys, maintain offline backup records, and never share private keys or recovery phrases

V. LUMINT Potential Risks and Challenges

LUMINT Market Risk

- Price Volatility: LUMINT exhibits extreme volatility with -75.88% monthly decline and -73.76% annual decline, indicating high liquidation risk for leveraged positions and severe drawdown exposure for unprepared investors

- Limited Liquidity: With only 2 exchange listings and $373,624.40 in daily volume, large position exits may face significant slippage and price impact challenges

- Early-Stage Project Risk: As a recently launched token (published January 2025), LUMINT lacks sufficient historical price data and long-term performance validation

LUMINT Regulatory Risk

- Blockchain Compliance Uncertainty: DeFi projects combining AI and staking mechanisms face evolving regulatory frameworks globally, with potential restrictions on yield-bearing token structures in certain jurisdictions

- Securities Classification: If regulators classify node operator rewards as security offerings, the project may face licensing requirements or operational restrictions

- International Jurisdiction Variations: Different countries may impose conflicting regulatory requirements on AI-driven financial services, creating compliance complexity

LUMINT Technology Risk

- Smart Contract Vulnerabilities: The BEP-20 implementation on BSC blockchain may contain undiscovered vulnerabilities that could result in fund loss or protocol exploitation

- AI Integration Execution Risk: The promised advanced AI-driven services may face development delays, performance shortfalls, or failure to deliver anticipated token value enhancement

- Cross-Chain Scalability: Current limitation to BSC (Binance Smart Chain) constrains accessibility and liquidity compared to multi-chain alternatives

VI. Conclusion and Action Recommendations

LUMINT Investment Value Assessment

LUMINT represents a speculative investment in an emerging intersection of blockchain, artificial intelligence, and decentralized finance technologies. The project's hybrid model combining node staking, intelligent mining, and AI-driven services presents innovative value propositions for sustainable token holder returns. However, extreme price volatility (-75.88% monthly), limited exchange liquidity (2 listings), and early-stage implementation risks create substantial downside exposure. The project's current market capitalization of $55.49 million reflects both emerging technology premium and significant execution risk. Success depends entirely on delivering promised AI integration capabilities and maintaining node operator incentives through market cycles.

LUMINT Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% of portfolio) through Gate.com dollar-cost averaging over 6-12 months. Do not use leverage. Focus on understanding the project fundamentals and blockchain technology before increasing exposure.

✅ Experienced Investors: Consider 5-7% portfolio allocation with defined entry points at 30% below recent highs and exit strategies at resistance levels. Combine active trading with long-term staking participation to capture both price appreciation and protocol rewards.

✅ Institutional Investors: Evaluate the Neural Trust Foundation's team credentials and AI technology capabilities through direct due diligence. Conduct smart contract audits before significant capital deployment. Consider structured positions with defined risk parameters and 12-24 month investment horizons.

LUMINT Trading Participation Methods

- Gate.com Spot Trading: Execute direct LUMINT/USDT trades with transparent pricing and institutional-grade order matching through Gate.com's established trading infrastructure

- Node Operator Participation: Engage with the project's core value proposition by becoming a node operator to earn sustainable rewards and governance participation rights

- Staking Programs: Lock tokens in foundation-approved staking mechanisms to benefit from protocol incentive distributions while maintaining long-term price exposure

Cryptocurrency investment carries extreme risk and can result in total capital loss. This report does not constitute investment advice. All investors must conduct independent research, assess personal risk tolerance, and consult qualified financial advisors before making investment decisions. Never invest funds you cannot afford to lose completely. Past performance does not guarantee future results. Market conditions, regulatory changes, and technological developments can significantly impact token valuations.

FAQ

What is the price prediction for XRP in 2030?

Based on expert analysis, XRP is projected to reach approximately $5.25 by 2030. This prediction is derived from a Finder panel consensus estimate referenced in recent market analysis.

Does the Lunc coin have a future?

LUNC's future depends on community-driven development and new use cases. With growing ecosystem initiatives and renewed investor interest, the coin shows potential for recovery and long-term value growth in the crypto market.

Which coin will reach 1 rupee prediction?

Based on market analysis, Shiba Inu (SHIB) is predicted to potentially reach 1 rupee by the end of 2030. With strong community support and increasing adoption, SHIB demonstrates significant growth potential in the coming years.

What is the price prediction for XLM in 2030?

Analysts forecast Stellar (XLM) could reach approximately $1.09 by 2030, assuming continued adoption trends and network development. This prediction reflects moderate price growth based on current market analysis.

How Does the Token Burn Mechanism Impact AITECH's Deflationary Model?

How Does NMR Token Flow Affect Its Price and Market Dynamics in 2025?

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

Why Is Cosmos Staking So High? Full Explanation for ATOM Holders

QFS Crypto Explained: What the Quantum Financial System Means for Digital Assets

What is Moni ? A Guide

Understanding KYC: Essential Verification for Cryptocurrency Platforms in India

Worldcoin thành World: Khám phá chuỗi Worldchain Layer 2 và dự án 1 tỷ đô la!

Optimal Times for Trading Cryptocurrencies

Comprehensive Guide to the Nexo Crypto Lending Platform

Guide to Transferring Assets to the Arbitrum Network