2025 MBOX Price Prediction: Expert Analysis and Market Forecast for the Metabox Token

Introduction: MBOX's Market Position and Investment Value

Mobox (MBOX), a gaming platform that combines yield mining and NFT mining to create a play-to-earn ecosystem, has been operational since 2021. As of December 2025, MBOX has achieved a market capitalization of approximately $17.04 million, with a circulating supply of around 500.32 million tokens, trading at approximately $0.03097. This asset, recognized for its innovative GameFi mechanics and NFT interoperability vision, is increasingly playing a critical role in the metaverse and decentralized gaming sectors.

This article will provide a comprehensive analysis of MBOX's price trajectory through 2030, integrating historical performance patterns, market supply dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasting and practical investment strategies for investors.

MBOX Market Analysis Report

I. MBOX Price History Review and Current Market Status

MBOX Historical Price Evolution Trajectory

-

2021: Project fair launch on Binance Smart Chain, initial publication price of $1.603. MBOX reached its all-time high (ATH) of $15.44 on December 1, 2021, representing a significant appreciation from the launch price as the GameFi and NFT sectors experienced substantial growth during this period.

-

2021-2025: Extended bear market phase, with the token experiencing a dramatic 84.44% decline over the one-year period. The price deteriorated from its peak, reflecting broader market cycles and shifting investor sentiment in the GameFi sector.

-

December 2025: Recent price action shows MBOX trading near historical lows, with the all-time low (ATL) of $0.02861809 recorded on December 19, 2025, just two days prior to the current date.

MBOX Current Market Status

As of December 21, 2025, MBOX is trading at $0.03097, representing a marginal decline of -0.8% over the past 24 hours. The token is experiencing minor downward pressure with a 1-hour change of -0.19% and a more significant 7-day decline of -8.70%.

Market Metrics:

- 24-hour trading volume: $43,319.24

- Market capitalization: $15,494,986.80 (fully diluted valuation: $17,043,486.80)

- Market ranking: 961st by market cap

- Market dominance: 0.00053%

- Circulating supply: 500,322,467 MBOX (50.03% of total supply)

- Total supply: 550,322,467 MBOX

- Maximum supply: 1,000,000,000 MBOX

- 24-hour price range: $0.03061 - $0.03128

- Token holders: 189,539 addresses

- Exchange listings: 23 exchanges

The token is currently trading significantly below its historical peak, with price performance reflecting the extended downturn in the GameFi sector. The market shows limited 24-hour volume relative to market capitalization, suggesting relatively modest trading activity at current price levels.

Click to view current MBOX market price

MBOX Market Sentiment Index

2025-12-20 Fear and Greed Index: 20(Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates significant market pessimism and risk aversion among investors. When fear reaches such extreme levels, historically, it often presents contrarian buying opportunities for long-term investors. However, extreme fear also suggests heightened volatility and potential further downside. Traders should exercise caution and maintain proper risk management. Consider dollar-cost averaging strategies rather than making large lump-sum investments. Monitor key support levels closely and stay informed about market catalysts that could shift sentiment.

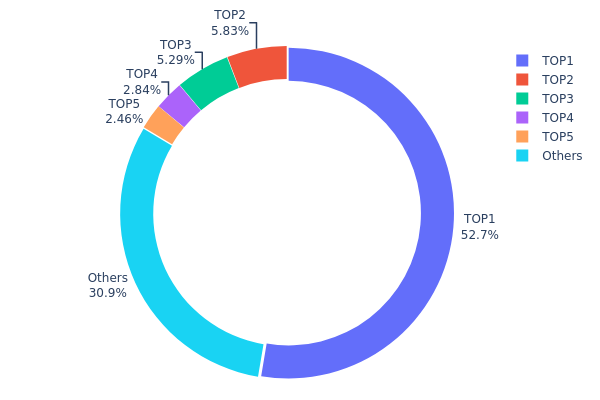

MBOX Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across blockchain addresses, revealing the degree of decentralization and potential market structure risks. By analyzing the top token holders and their respective percentages, we can assess the vulnerability of the token to potential price manipulation and evaluate the overall health of its on-chain ecosystem.

The MBOX token exhibits pronounced concentration characteristics, with the top holder commanding 52.65% of total supply—a level that raises significant concerns about centralization risk. The top five addresses collectively control approximately 69.06% of the circulating supply, while the remaining 30.94% is distributed among other participants. This highly skewed distribution pattern indicates that decision-making power and price influence are concentrated within a limited number of entities, creating substantial asymmetry in market structure.

Such extreme concentration poses considerable risks to market stability and fair price discovery mechanisms. The dominant holder's substantial stake grants disproportionate influence over token economics and governance dynamics, potentially enabling large-scale position exits or coordinated trading activities that could trigger significant price volatility. The steep drop-off from the first to second holder (52.65% to 5.83%) further emphasizes the concentration hierarchy, suggesting that the primary stakeholder holds veto-like power over protocol decisions and market movements. While the presence of distributed smaller holders provides some resilience, the overall architectural imbalance reflects elevated systemic risk and reduced decentralization maturity compared to more evenly distributed token ecosystems.

Click to view current MBOX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 283482.44K | 52.65% |

| 2 | 0x8fa5...7a7c3f | 31397.62K | 5.83% |

| 3 | 0x4368...26f042 | 28463.27K | 5.28% |

| 4 | 0x5e7e...d7c28f | 15305.99K | 2.84% |

| 5 | 0xc312...303878 | 13244.42K | 2.46% |

| - | Others | 166449.55K | 30.94% |

II. Core Factors Affecting MBOX's Future Price

Market Sentiment and Platform Dynamics

-

Market Sentiment: Investor sentiment plays a significant role in MBOX price fluctuations. Overall market conditions and trader emotions directly influence buying and selling pressure on the token.

-

Platform Updates: Changes and updates within the MOBOX platform ecosystem impact price movements. Regular platform improvements and feature releases affect user engagement and token utility.

-

User Growth: The expansion of the user base on the MOBOX platform serves as a key driver for price appreciation. Increased user adoption translates to higher demand for the MBOX token.

Macroeconomic Environment

-

Overall Economic Trends: Broader cryptocurrency market conditions and general economic trends significantly influence MBOX price performance. The token's value is subject to systemic cryptocurrency market movements.

-

Regulatory Policies: Policy and regulatory developments within the cryptocurrency sector impact MBOX's price trajectory. Changes in regulatory frameworks can either facilitate or hinder market activity.

-

Technology Innovation: Advancements in blockchain technology and innovations within the MOBOX ecosystem contribute to long-term price dynamics. Technical improvements enhance the platform's value proposition.

III. 2025-2030 MBOX Price Forecast

2025 Outlook

- Conservative Forecast: $0.01983 - $0.02500

- Neutral Forecast: $0.02500 - $0.03500

- Optimistic Forecast: $0.03500 - $0.04275 (requires positive market sentiment and increased platform adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with steady ecosystem expansion

- Price Range Forecast:

- 2026: $0.02654 - $0.05346

- 2027: $0.03658 - $0.06052

- 2028: $0.04333 - $0.07873

- Key Catalysts: Platform utility enhancement, user base growth, DeFi integration developments, and overall market cycle progression

2029-2030 Long-term Outlook

- Base Case Scenario: $0.06184 - $0.08749 (assuming moderate ecosystem adoption and stable market conditions)

- Optimistic Scenario: $0.08749 - $0.10116 (sustained growth in platform usage and positive macroeconomic environment)

- Transformation Scenario: $0.10116+ (breakthrough in mainstream adoption, major partnership announcements, or significant protocol upgrades)

Key Observations: The forecast suggests a compound appreciation trajectory with MBOX potentially reaching 147% gains by 2030 from 2025 baseline levels, reflecting anticipated medium-to-long term value creation through platform development and market maturation.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04275 | 0.03098 | 0.01983 | 0 |

| 2026 | 0.05346 | 0.03687 | 0.02654 | 19 |

| 2027 | 0.06052 | 0.04516 | 0.03658 | 45 |

| 2028 | 0.07873 | 0.05284 | 0.04333 | 70 |

| 2029 | 0.08749 | 0.06578 | 0.06184 | 112 |

| 2030 | 0.10116 | 0.07664 | 0.06284 | 147 |

MBOX Investment Strategy and Risk Management Report

IV. MBOX Professional Investment Strategy and Risk Management

MBOX Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: GameFi enthusiasts, NFT ecosystem believers, and long-term crypto asset holders seeking exposure to play-to-earn mechanics

- Operational Recommendations:

- Accumulate MBOX during market downturns when the token shows weakness, as demonstrated by the current 84.44% decline over the past year

- Hold MBOX tokens to participate in governance proposals and influence platform development direction

- Stake MOMO NFTs in liquidity pools to earn consistent MBOX rewards through platform activities

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour high of $0.03128 and low of $0.03061 to identify breakout opportunities

- Volatility Metrics: Track the 24-hour volume of $43,319.24 to assess liquidity conditions before executing trades

- Wave Trading Key Points:

- Execute buy orders during oversold conditions when MBOX trades near its all-time low of $0.02861809

- Take profit targets at previous resistance levels or when the token recovers 10-15% from entry points

MBOX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total cryptocurrency portfolio

- Active Investors: 3-7% of total cryptocurrency portfolio

- Professional Investors: 5-10% of total cryptocurrency portfolio allocation with hedging strategies

(2) Risk Mitigation Strategies

- Portfolio Diversification: Avoid concentrating more than 10% of GameFi holdings in MBOX; diversify across other gaming tokens with different utility mechanisms

- Dollar-Cost Averaging: Implement systematic purchasing at regular intervals to reduce the impact of price volatility and improve average entry costs

(3) Secure Storage Solutions

- Hardware Wallet Option: Use industry-standard hardware wallets for MBOX holdings exceeding $10,000 in value

- Hot Wallet Solution: For active trading and staking purposes, utilize Gate.com's native wallet for seamless platform integration and reduced transaction friction

- Security Considerations: Enable two-factor authentication (2FA), use strong passwords, regularly audit wallet activity, never share private keys or seed phrases, and verify contract addresses before conducting transactions

V. MBOX Potential Risks and Challenges

MBOX Market Risks

- Extreme Price Volatility: MBOX has declined 84.44% over the past year and recently hit an all-time low, indicating severe market pressure and potential further downside risk

- Liquidity Concentration: With only $43,319.24 in 24-hour volume and 189,539 holders, MBOX faces liquidity challenges that could result in significant slippage during large transactions

- Market Sentiment Deterioration: The token's market emotion indicator reflects weak sentiment, suggesting reduced investor confidence and potential continued selling pressure

MBOX Regulatory Risks

- GameFi Regulatory Uncertainty: Play-to-earn gaming mechanics face increasing scrutiny from global regulators concerning token classification and gaming licensing requirements

- NFT Market Regulation: The NFT market component of MBOX's ecosystem may face evolving regulatory treatment regarding securities classification and consumer protection requirements

- Jurisdiction-Specific Restrictions: Several jurisdictions have implemented or are considering restrictions on GameFi platforms, potentially limiting MBOX's addressable market and platform expansion

MBOX Technical Risks

- Blockchain Network Dependency: MBOX operates on the Binance Smart Chain (BSC), creating exposure to BSC network congestion, security vulnerabilities, and ecosystem risks

- Smart Contract Vulnerability: NFT marketplace and liquidity mining smart contracts face potential exploitation risks that could result in fund loss or platform disruption

- NFT Interoperability Challenges: Achieving cross-game and cross-platform NFT interoperability remains technically challenging and may not materialize as envisioned

VI. Conclusion and Action Recommendations

MBOX Investment Value Assessment

MBOX presents a speculative investment opportunity within the GameFi and NFT gaming space. While the project demonstrates innovative mechanics combining play-to-earn, NFT mining, and governance features, the token's severe 84.44% annual decline, recent all-time low, and weak market sentiment indicate significant challenges in market adoption and token value retention. The fair launch structure and governance capabilities provide some positive fundamentals, but current market conditions suggest caution. This asset remains suitable only for investors with high risk tolerance and a long-term conviction in the GameFi sector recovery.

MBOX Investment Recommendations

✅ Beginners: Start with micro-allocations (0.5-1% of crypto portfolio) through Gate.com to gain exposure while learning the GameFi ecosystem; prioritize understanding the platform mechanics before increasing position size

✅ Experienced Investors: Consider accumulating MBOX during extreme weakness as a speculative long-term bet, implementing dollar-cost averaging over 6-12 months while actively participating in governance and NFT staking rewards

✅ Institutional Investors: Conduct comprehensive due diligence on smart contract security, monitor regulatory developments affecting GameFi classification, and establish position limits with strict stop-loss parameters given current market conditions

MBOX Trading Participation Methods

- Direct Purchase on Gate.com: Execute spot trades directly on Gate.com's trading platform where MBOX pairs are available with real-time pricing and order execution

- Liquidity Mining: Deposit MBOX into platform liquidity pools to earn additional token rewards while providing market liquidity

- NFT staking: Stake MOMO NFTs through the platform to generate passive MBOX rewards and participate in exclusive NFT auctions and blind box opportunities

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and are strongly encouraged to consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is mbox coin?

MBOX is the native token of the Mobox platform, which combines NFTs and decentralized finance (DeFi). It enables transactions, governance, and participation in the ecosystem's various features and rewards mechanisms.

How much is the MBOX coin worth today?

The MBOX coin is currently worth approximately $0.043 USD. The price fluctuates in real-time based on market demand and trading volume. For the most accurate current price, please check a reliable cryptocurrency data source.

What is the total supply of Mobox?

The total supply of Mobox (MBOX) is 1,000,000,000 tokens. The current circulating supply is approximately 985,257,076.841 tokens.

What is the future of Mobox?

Mobox is positioned for strong growth, with projections reaching $0.118573 by 2029. The platform continues expanding its gaming ecosystem and user base, driving long-term value appreciation and market adoption.

2025 PYM Price Prediction: Analyzing Market Trends and Growth Potential for the Emerging Cryptocurrency

2025 RON Price Prediction: Analyzing Growth Potential in the Play-to-Earn Gaming Ecosystem

2025 ILV Price Prediction: Bullish Trends and Key Factors Shaping Illuvium's Future Value

2025 SUPER Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 TLMPrice Prediction: Analyzing Market Trends and Future Value Potential for Alien Worlds' Token

2025 GST Price Prediction: Analyzing Market Trends and Potential Growth Factors for Green Satoshi Token

Is NEM (XEM) a good investment?: A Comprehensive Analysis of Price Performance, Use Cases, and Future Prospects in the Cryptocurrency Market

Comprehensive Guide to Velodrome Finance's Decentralized Trading Protocol

Is Niza Global (NIZA) a good investment?: A Comprehensive Analysis of Tokenomics, Market Performance, and Future Potential

Is Acala (ACA) a good investment?: A Comprehensive Analysis of Token Potential, Market Position, and Risk Factors for 2024

Is Quai Network (QUAI) a good investment?: A Comprehensive Analysis of Performance, Technology, and Market Potential