2025 MLN Price Prediction: Expert Analysis and Market Forecast for Melon Token's Future Growth

Introduction: MLN's Market Position and Investment Value

Enzyme (MLN) serves as an Ethereum token powering the Enzyme protocol, which is designed to facilitate on-chain asset management in the DeFi ecosystem. Since its inception in 2017, MLN has established itself as a utility token enabling users to build, share, and explore DeFi investment strategies through decentralized vaults. As of December 2025, MLN's market capitalization has reached approximately $13.85 million, with a circulating supply of around 2.99 million tokens, currently trading at $4.635 per token. This utility asset, recognized for its role in democratizing DeFi asset management, is playing an increasingly critical function in enabling decentralized investment strategy creation and execution.

This article will provide a comprehensive analysis of MLN's price trends and market dynamics, combining historical performance patterns, market supply-demand dynamics, and ecosystem developments to deliver professional price forecasts and actionable investment guidance for stakeholders considering exposure to this DeFi infrastructure token.

Enzyme (MLN) Market Analysis Report

I. MLN Price History Review and Current Market Status

MLN Historical Price Evolution

- January 2018: MLN reached its all-time high of $258.26, marking the peak of the token's price history during the early cryptocurrency bull market cycle.

- March 2020: MLN hit its all-time low of $1.79, reflecting the market downturn during the global economic uncertainty period.

- December 2025: MLN is currently trading at $4.635, representing a significant 98.2% decline from its historical peak recorded in January 2018.

MLN Current Market Position

As of December 21, 2025, MLN demonstrates the following market characteristics:

Price Performance:

- Current Price: $4.635

- 24-hour Range: $4.578 - $4.711

- 24-hour Change: +0.15% (+$0.0069)

- 1-hour Change: +0.50%

Market Capitalization & Supply:

- Market Capitalization: $13,851,088.29

- Circulating Supply: 2,988,368.56 MLN tokens

- Circulation Ratio: 99.9985%

- Fully Diluted Valuation: $13,851,088.29

- Market Dominance: 0.00043%

Recent Price Trends:

- 7-day Performance: -7.82%

- 30-day Performance: -14.36%

- 1-year Performance: -76.22%

Market Liquidity:

- 24-hour Trading Volume: $14,271.75

- Listed on 19 exchanges

- Token Holders: 8,826 addresses

- Current Market Ranking: #1,018

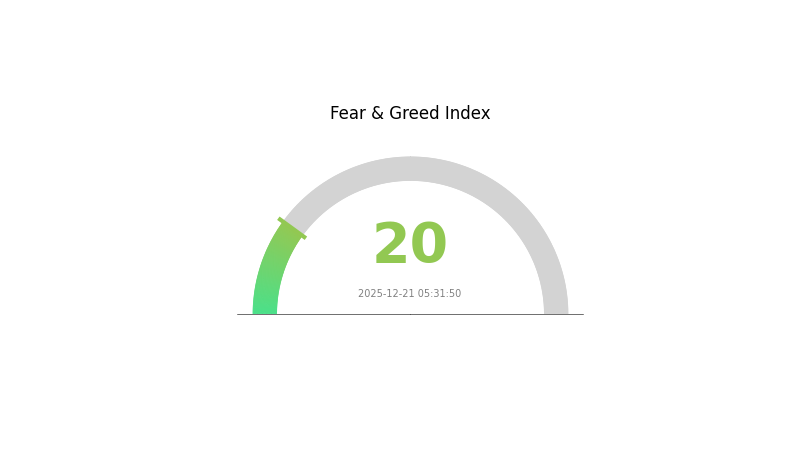

Market Sentiment: The current market sentiment index stands at "Extreme Fear" (VIX: 20), indicating heightened risk aversion among market participants.

Click to view current MLN market price

MLN Market Sentiment Indicator

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 20. This indicates investors are highly pessimistic about near-term price movements. During such periods, panic selling often dominates the market, creating potential opportunities for contrarian investors. Asset prices typically reach lower levels, which some traders view as attractive entry points for long-term positions. However, extreme fear can also signal further downside risks. Traders should exercise caution and conduct thorough analysis before making investment decisions on Gate.com.

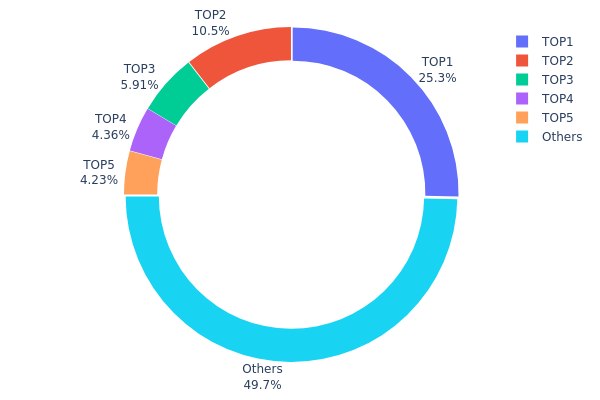

MLN Holdings Distribution

The holdings distribution map illustrates the concentration of MLN tokens across blockchain addresses, revealing the degree of decentralization and potential market structure dynamics. By analyzing the top holders and their proportional stakes, we can assess whether token ownership is concentrated among a small number of entities or distributed across a broader base of participants. This metric serves as a critical indicator of market maturity, vulnerability to manipulation, and overall ecosystem health.

The current MLN holdings distribution demonstrates moderate concentration characteristics. The top five addresses collectively control approximately 50.3% of the total token supply, with the largest holder commanding 25.29% of all MLN tokens. While this concentration level is noteworthy, the distribution does not reflect extreme centralization, as the remaining 49.7% is dispersed across numerous other addresses. This bifurcated structure suggests that while significant power is concentrated in a handful of major holders, a substantial portion of tokens exists among smaller participants, which provides some degree of market resilience against unilateral price manipulation.

The current address distribution pattern carries notable implications for market dynamics. The presence of such dominant holders introduces inherent risks regarding potential selling pressure, voting power concentration, and price volatility during large liquidation events. However, the distributed nature of the remaining half of the token supply indicates that the market maintains meaningful decentralization at the secondary level. This configuration reflects a nascent market structure typical of assets in growth phases, where institutional or strategic holders retain substantial positions while retail and smaller institutional participation continues to develop.

Click to view current MLN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 749.73K | 25.29% |

| 2 | 0xa6a6...a1fd37 | 311.78K | 10.51% |

| 3 | 0x1c36...37d2c7 | 175.31K | 5.91% |

| 4 | 0xa64e...24f61d | 129.35K | 4.36% |

| 5 | 0xd2dd...e6869f | 125.39K | 4.23% |

| - | Others | 1472.42K | 49.7% |

II. Core Factors Affecting MLN's Future Price

Macroeconomic Environment

Monetary Policy Impact: Research indicates that short-term financial market indicators such as the US Dollar Index, interest rates, and stock market volatility have more sensitive impacts on asset prices. Long-term trends are more influenced by macroeconomic and structural indicators, including inflation levels, economic growth, and central bank purchasing patterns. The Federal Reserve's rate decisions, particularly recent rate cuts, create market volatility that can affect risk asset valuations.

Inflation Hedge Properties: Stable value preservation depends on sound management of backing assets. In inflationary environments, assets that maintain purchasing power become increasingly important for investors seeking to hedge against currency devaluation and preserve capital.

Geopolitical Factors: International economic relationships and trade dynamics significantly influence global market sentiment. US-China trade relations and broader geopolitical tensions can impact capital flows and investor risk appetite, which cascades through cryptocurrency and alternative asset markets.

Supply Mechanism

Market Stability Requirements: Backed asset management is the core foundation supporting price stability. The effectiveness of collateral management directly determines whether MLN can maintain its value proposition and attract institutional adoption.

III. 2025-2030 MLN Price Forecast

2025 Outlook

- Conservative Forecast: $3.11 - $3.88

- Neutral Forecast: $4.65

- Optimistic Forecast: $4.93 (requires sustained market sentiment and ecosystem development)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery phase with volatility consolidation, supported by incremental ecosystem adoption and protocol improvements

- Price Range Forecast:

- 2026: $3.78 - $6.27

- 2027: $3.10 - $6.25

- 2028: $4.42 - $6.71

- Key Catalysts: Protocol upgrades, institutional adoption, DeFi integration expansion, and market sentiment recovery cycles

2029-2030 Long-term Outlook

- Base Case: $3.59 - $8.25 (assumes steady ecosystem growth and moderate market expansion)

- Optimistic Case: $5.00 - $8.25 (sustained institutional interest and major partnership announcements)

- Transformational Case: $7.06 - $7.57 (comprehensive protocol adoption, mainstream integration, and favorable regulatory environment)

- December 21, 2025: MLN trading near $4.65 (consolidation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4.92582 | 4.647 | 3.11349 | 0 |

| 2026 | 6.2702 | 4.78641 | 3.78126 | 3 |

| 2027 | 6.24698 | 5.5283 | 3.09585 | 19 |

| 2028 | 6.71191 | 5.88764 | 4.41573 | 27 |

| 2029 | 8.25271 | 6.29978 | 3.59087 | 35 |

| 2030 | 7.56729 | 7.27624 | 7.05796 | 56 |

Enzyme (MLN) Professional Investment Analysis Report

I. Executive Summary

Enzyme (MLN) is an Ethereum-based utility token that powers the Enzyme protocol (formerly known as the Melon Protocol), designed to facilitate decentralized asset management within the DeFi ecosystem. As of December 21, 2025, MLN is trading at $4.635 with a market capitalization of approximately $13.85 million, ranking #1018 by market cap.

Key Metrics:

- Current Price: $4.635

- 24H Change: +0.15%

- Market Cap: $13,851,088

- Circulating Supply: 2,988,368.56 MLN

- All-Time High: $258.26 (January 4, 2018)

- All-Time Low: $1.79 (March 13, 2020)

II. Enzyme Protocol Overview

Project Description

MLN is a utility token supporting Enzyme, a decentralized protocol that enables users to build, share, and explore DeFi investment strategies through composable smart contracts known as "vaults." The protocol filters these strategies by historical performance and risk profile, creating a transparent marketplace for asset management.

Core Functionality

Token Utility:

- Users pay MLN tokens for accessing various functions throughout vault creation and investment lifecycle management

- Developers and external contributors earn MLN tokens through grant submissions, aligning incentives across the ecosystem

- MLN token holders participate in governance decisions affecting the protocol

Market Position

With 8,826 token holders and presence on 19 exchanges, MLN maintains a modest but established presence in the DeFi infrastructure sector. The token's fully diluted valuation equals its market cap at $13.85 million, indicating that circulating supply represents 99.9985% of total supply.

III. Price Performance Analysis

Historical Price Trends

| Time Period | Change % | Absolute Change |

|---|---|---|

| 1 Hour | +0.50% | +$0.023 |

| 24 Hours | +0.15% | +$0.007 |

| 7 Days | -7.82% | -$0.393 |

| 30 Days | -14.36% | -$0.777 |

| 1 Year | -76.22% | -$14.856 |

MLN exhibits significant downward pressure over the medium to long term, with the token down approximately 76% over the past year. However, recent hourly and daily movements show stabilization with modest gains.

Price Range

- 24H High: $4.711

- 24H Low: $4.578

- Current Price: $4.635 (trading near mid-range)

IV. MLN Professional Investment Strategy and Risk Management

MLN Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: DeFi protocol enthusiasts, passive index investors, believers in decentralized asset management infrastructure

- Operational Guidance:

- Accumulate during periods of consolidation below $5 support levels

- Hold through market cycles given the protocol's fundamental use case in DeFi infrastructure

- Plan for 2-3 year minimum holding periods to allow protocol adoption to mature

(2) Active Trading Strategy

- Market Context: Given MLN's moderate liquidity ($14,271 daily volume) and market cap of $13.85 million, active trading carries elevated slippage risks

- Execution Considerations:

- Trade execution via Gate.com offers reliable order matching for this asset

- Position sizing should account for relatively thin order books

- Consider limit orders rather than market orders to minimize slippage on larger positions

MLN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-2% of alternative asset allocation (given high volatility)

- Aggressive Investors: 3-7% of alternative asset allocation (suitable for experienced traders)

- Professional Investors: 5-10% within dedicated DeFi infrastructure sub-allocations

(2) Risk Hedging Approaches

- Diversification Strategy: Combine MLN holdings with other DeFi infrastructure tokens to reduce single-project risk exposure

- Position Sizing: Never allocate more than 5-10% of total crypto portfolio to any single small-cap DeFi token like MLN

(3) Security Storage Solutions

- Self-Custody: Maintain MLN on Ethereum mainnet using secure wallet solutions with hardware wallet integration capability

- Staking Considerations: Verify whether MLN participates in any protocol-level rewards mechanisms before custody decisions

- Security Best Practices: Enable multi-signature wallets for holdings exceeding $10,000; maintain offline backups of recovery phrases; never share private keys or seed phrases

V. Potential Risks and Challenges

MLN Market Risks

- Liquidity Risk: With $14,271 in 24-hour volume and $13.85 million market cap, MLN faces significant liquidity constraints that could create substantial slippage for larger trades or sudden exit requirements

- Valuation Risk: The token trades at 98% below its all-time high of $258.26, reflecting either market pessimism about the protocol or genuine fundamental challenges in the asset management DeFi sector

- Low Trading Volume: Thin daily volumes relative to market cap indicate limited market depth and potential difficulty executing large position adjustments

MLN Regulatory Risks

- Regulatory Uncertainty: DeFi protocols and governance tokens face evolving regulatory treatment across major jurisdictions, potentially impacting MLN's utility and value

- Protocol Risk: Changes in Ethereum network regulations or treatment of DeFi protocols could directly impact Enzyme's operational viability

- Compliance Evolution: Future regulations requiring KYC/AML integration in DeFi asset management could fundamentally alter the protocol's value proposition

MLN Technical Risks

- Smart Contract Risk: All MLN functionality depends on Ethereum smart contract security; historical and future vulnerabilities could compromise token value

- Protocol Adoption Risk: Limited current adoption of Enzyme vaults compared to centralized asset management solutions; failure to achieve meaningful market share would undermine token utility

- Ethereum Dependency: Complete reliance on Ethereum mainnet means MLN inherits all Layer 1 risks, including network congestion, transaction costs, and protocol changes

VI. Conclusion and Action Recommendations

MLN Investment Value Assessment

MLN represents a niche investment in decentralized asset management infrastructure. The protocol addresses a genuine need within DeFi for transparent, verifiable investment strategy sharing. However, the token's 76% decline over the past year, modest market cap, and minimal trading volume reflect substantial adoption challenges and uncertain market demand. MLN should be considered a speculative infrastructure play suitable only for sophisticated investors with high risk tolerance and long-term conviction in decentralized asset management protocols.

MLN Investment Recommendations

✅ Beginners: Avoid direct MLN purchases; instead, gain DeFi exposure through higher-liquidity, more-established protocols with clearer tokenomics and adoption metrics

✅ Experienced Traders: Consider small speculative positions (1-3% of alternative asset allocation) only if you understand Enzyme's competitive position and have conviction in DeFi asset management adoption; use dollar-cost averaging to reduce timing risk

✅ Institutional Investors: Conduct detailed due diligence on protocol governance, development activity, user metrics, and competitive landscape before consideration; position sizing should not exceed 0.1-0.5% of institutional portfolios given liquidity and adoption constraints

MLN Trading Participation Methods

- Gate.com Trading: Access MLN spot trading with reliable liquidity and security for positions sized appropriately to the asset's trading volume

- Ethereum Direct Transactions: Interact with MLN smart contracts directly via Ethereum wallets for maximum transparency and self-custody control

- DeFi Protocol Integration: Participate as liquidity providers or vault creators within the Enzyme ecosystem itself if seeking deeper protocol involvement beyond token speculation

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must carefully evaluate their risk tolerance and consult professional financial advisors before making investment decisions. Never invest funds you cannot afford to lose completely.

FAQ

Will Enzyme go up?

Enzyme is expected to rise in 2026, potentially reaching $4.62. Market trends and increased DeFi adoption support this upward projection. Current data suggests a rise is likely.

What is MLN (Melon) and what does it do?

MLN is the governance token of Enzyme Finance, an Ethereum-based protocol enabling users to create, manage, and invest in customized crypto asset portfolios. It facilitates decentralized fund management and trading.

What factors could influence MLN price in the future?

Platform adoption, DeFi market trends, liquidity, and technical developments will significantly influence MLN price. Increased Enzyme protocol usage and broader crypto market sentiment also play crucial roles in price movements.

Is MLN a good investment for 2024-2025?

MLN shows strong potential for 2024-2025 growth, driven by expanding DeFi infrastructure and increasing institutional adoption. Market momentum and technical fundamentals suggest positive price trajectory ahead.

2025 UNI Price Prediction: Analyzing the Potential Growth and Challenges for Uniswap's Native Token

2025 PUFFER Price Prediction: Analyzing Future Growth Potential and Market Factors for This Emerging Cryptocurrency

Is Fluid (FLUID) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

2025 FERC Price Prediction: Navigating Regulatory Changes and Market Dynamics in the Energy Sector

THE vs ETH: Comparing Two Giants in the Cryptocurrency Ecosystem

ETHS vs UNI: Comparing the Performance of Ethereum and Uniswap in the DeFi Ecosystem

Discover the Secret to Unlocking Airdrop Rewards

Discover Gunz (GUN): A Guide to Acquiring Tokens for Web3 Gaming Experiences

Solaxy (SOLX) Overview: Launch Timeline, Future Forecast, and Purchase Guide

Innovative DeFi Lending Platform Built on TON with Enhanced Liquid Staking Options

Comprehensive Lil Pepe Token Presale Overview: Key Insights and Preparation for Listing