2025 ON Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of ON

Orochi Network (ON) is a Verifiable Data Infrastructure designed to ensure data integrity and privacy through advanced cryptographic techniques. Since its launch in 2025, the project has established itself as a secure foundation for processing and proving data without compromising confidentiality. As of December 2025, ON has achieved a market capitalization of approximately $107.7 million with a circulating supply of 144.27 million tokens, trading around $0.1077 per unit. This innovative asset, recognized for its advanced cryptographic primitives and dual focus on transparency and privacy, is increasingly playing a critical role in applications requiring both data verification and confidentiality protection.

This article provides a comprehensive analysis of ON's price trends and market performance, combining historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment guidance for the period ahead.

Orochi Network (ON) Market Analysis Report

I. ON Price History Review and Current Market Status

ON Historical Price Evolution

- October 24, 2025: All-Time High (ATH) reached at $0.40, marking the peak of the token's price performance to date.

- November 16, 2025: All-Time Low (ATL) recorded at $0.0888, representing a significant decline of approximately 77.8% from the ATH, reflecting substantial market correction.

- December 21, 2025: Current trading price at $0.1077, showing partial recovery from the ATL but still 73.1% below the historical peak.

ON Current Market Stance

As of December 21, 2025, Orochi Network (ON) is trading at $0.1077 with a 24-hour trading volume of $101,708.08. The token exhibits modest short-term resilience with a 24-hour price change of +0.18%, while showing weakness in intermediate timeframes with a 7-day decline of -1.82%. However, the 30-day performance displays recovery momentum at +5.48%, contrasting sharply with the severe year-to-date decline of -58.74%.

The token maintains a market capitalization of approximately $15.54 million with a fully diluted valuation of $107.7 million, indicating a circulating supply utilization rate of 14.43%. With 144,275,000 tokens currently in circulation out of a total supply of 1 billion, ON ranks 959th by market capitalization. The token is listed on 11 exchanges and currently holds 40 token holders on record.

Recent price action shows high volatility within the 24-hour range of $0.1036 to $0.1097. The current market sentiment reflects "Extreme Fear" (VIX score: 20 on December 20, 2025), suggesting heightened risk aversion across the broader cryptocurrency market, which may be exerting downward pressure on ON's valuation.

Click to view current ON market price

ON 市场情绪指标

2025-12-20 恐惧与贪婪指数:20(Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear & Greed Index dropping to 20. This level typically indicates panic selling and capitulation among investors. During such periods, long-term investors often view significant price declines as buying opportunities, while risk-averse traders may prefer to hold cash positions. Market volatility remains elevated, and investors should exercise caution when making investment decisions. Monitor key support levels closely and consider dollar-cost averaging strategies to mitigate timing risks in such fearful market conditions.

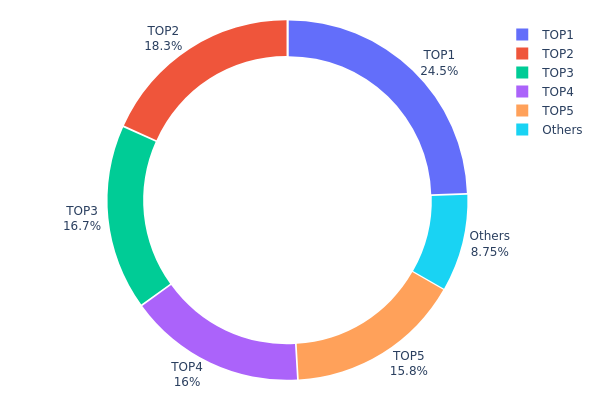

ON Holdings Distribution

The holdings distribution map illustrates the concentration of ON tokens across different wallet addresses, providing critical insights into the token's ownership structure and potential market dynamics. By analyzing the top holders and their respective percentages of total supply, we can assess the degree of decentralization and identify concentration risks that may influence price stability and market behavior.

Current data reveals a notably concentrated ownership structure. The top five addresses collectively hold approximately 91.23% of ON tokens, with the leading address commanding 24.50% of the total supply. This concentration pattern indicates substantial centralization, where a limited number of stakeholders maintain significant control over the asset. The first address alone holding nearly one-quarter of circulating tokens presents a considerable concentration threshold, while the combined grip of the top five addresses suggests potential vulnerability to coordinated actions or large-scale liquidation events.

Such extreme centralization poses material implications for market structure and price dynamics. The concentrated holder base creates asymmetric information advantages and potential for significant price volatility if major stakeholders execute large transactions. The remaining 8.77% held by other addresses underscores the limited distribution among smaller retail participants, potentially constraining organic market participation and liquidity depth. This distribution pattern reflects relatively early-stage tokenomics, where venture capital or core team allocations remain dominant, indicating that ON has not yet achieved the decentralized holder base typical of mature digital assets. The structural concentration warrants close monitoring of major holder movements and unlock schedules.

Click to view current ON Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x28d7...b3f8a4 | 147000.00K | 24.50% |

| 2 | 0xadc5...7452d8 | 109725.00K | 18.28% |

| 3 | 0xa054...759be1 | 100000.00K | 16.66% |

| 4 | 0x059a...eb19e3 | 95800.00K | 15.96% |

| 5 | 0x4ee9...7e1d86 | 95000.00K | 15.83% |

| - | Others | 52475.00K | 8.77% |

II. Core Factors Affecting ON's Future Price

Supply Mechanism

-

Limited Supply Model: Cryptocurrencies with capped supply demonstrate heightened price sensitivity to demand fluctuations. When the available supply remains constrained while demand increases, price appreciation typically follows. Conversely, excessive selling pressure from market participants can drive prices downward despite supply limitations.

-

Historical Patterns: Supply dynamics have historically proven critical in determining cryptocurrency price trajectories. Markets exhibiting supply scarcity relative to demand have historically experienced sustained price premiums, while periods of increased supply or reduced demand have corresponded with price corrections.

-

Current Impact: The current supply-demand balance will continue to exert significant influence on ON's valuation. Any adjustments to token distribution mechanisms or changes in market absorption capacity will directly influence future price movements.

Macroeconomic Environment

-

Monetary Policy Impact: Broader economic conditions, including interest rates and inflation dynamics, substantially influence cryptocurrency investor behavior. During periods of economic uncertainty or elevated inflation, cryptocurrencies may attract capital seeking alternative value stores, thereby supporting price appreciation. Conversely, improving macroeconomic conditions may redirect investment flows toward traditional assets.

-

Inflation Hedge Properties: Cryptocurrencies with limited supplies can serve as potential hedges against currency debasement. In inflationary environments, such assets may demonstrate price resilience and attract capital preservation-focused investors, supporting long-term value retention.

-

Geopolitical Factors: International political developments and trade policy shifts can substantially impact cryptocurrency market sentiment. Policy changes, including tariff implementations and regulatory announcements, create market uncertainty that may influence investment decisions and price volatility.

Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice or recommendations from Gate.com. Cryptocurrency investments carry substantial risk. Please exercise caution and conduct thorough due diligence before making investment decisions.

Three: 2025-2030 ON Price Forecast

2025-2026 Outlook

- Conservative Forecast: $0.0966-$0.1599

- Neutral Forecast: $0.1073-$0.1830

- Optimistic Forecast: $0.1599-$0.1830 (requires sustained market recovery and increased institutional adoption)

2027-2028 Mid-term Outlook

- Market Stage Expectation: Consolidation phase with gradual upward momentum as market participants accumulate positions and fundamental development progresses.

- Price Range Forecast:

- 2027: $0.0823-$0.1789

- 2028: $0.0860-$0.1737

- Key Catalysts: Enhanced protocol functionality, ecosystem expansion, institutional investor participation, and macroeconomic market sentiment improvement.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.1608-$0.1848 (assumes moderate adoption growth and stable regulatory environment)

- Optimistic Scenario: $0.1709-$0.2189 (assumes accelerated ecosystem development and mainstream integration)

- Transformative Scenario: $0.1809-$0.2189 (extreme favorable conditions including breakthrough technological innovations and widespread enterprise adoption)

- December 21, 2025: ON trading at $0.1073 (consolidation phase with positive long-term trajectory)

Note: Price predictions are based on historical trend analysis and market cycle patterns. Investors should conduct comprehensive due diligence and consult with financial advisors before making investment decisions. Monitor market developments regularly through Gate.com and other official channels for real-time information.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.15988 | 0.1073 | 0.09657 | 0 |

| 2026 | 0.18302 | 0.13359 | 0.08683 | 24 |

| 2027 | 0.17888 | 0.1583 | 0.08232 | 46 |

| 2028 | 0.17365 | 0.16859 | 0.08598 | 56 |

| 2029 | 0.18481 | 0.17112 | 0.16085 | 58 |

| 2030 | 0.2189 | 0.17797 | 0.09432 | 65 |

Orochi Network (ON) Professional Investment Strategy and Risk Management Report

I. Executive Summary

Orochi Network (ON) is a Verifiable Data Infrastructure token designed to ensure data integrity and privacy through advanced cryptographic techniques. As of December 21, 2025, ON is trading at $0.1077 with a market capitalization of $15.54 million and a fully diluted valuation of $107.7 million. The token operates on both BSC and Ethereum networks and is currently ranked 959 in market cap.

II. Market Performance Analysis

Current Market Metrics

| Metric | Value |

|---|---|

| Current Price | $0.1077 |

| 24H Change | +0.18% |

| 7D Change | -1.82% |

| 30D Change | +5.48% |

| 1Y Change | -58.74% |

| Market Cap | $15.54 Million |

| Fully Diluted Valuation | $107.7 Million |

| 24H Trading Volume | $101,708 |

| Circulating Supply | 144,275,000 ON (14.43%) |

| Total Supply | 1,000,000,000 ON |

| All-Time High | $0.4 (October 24, 2025) |

| All-Time Low | $0.0888 (November 16, 2025) |

Price Trend Analysis

- 1-Hour Performance: -0.37%, indicating near-term selling pressure

- 24-Hour Performance: +0.18%, showing slight stabilization

- Medium-term Outlook: 30-day gains of 5.48% suggest recovery momentum

- Long-term Concern: 58.74% yearly decline indicates significant investor losses from previous highs

III. Orochi Network Foundation Overview

Project Description

Orochi Network is a verifiable data infrastructure platform that combines advanced cryptographic primitives to enable secure data processing and verification. The platform addresses the critical need for solutions that require both transparency and privacy, without compromising confidentiality during data handling operations.

Technical Infrastructure

- Supported Networks: BSC (Binance Smart Chain), Ethereum

- Token Standards: BEP-20, ERC-20

- Listed Exchanges: 11 exchanges

- Token Holders: 40 addresses

- Market Dominance: 0.0033%

Official Channels

- Website: https://orochi.network/#home

- Documentation: https://docs.orochi.network/orochi-network

- Twitter: https://x.com/OrochiNetwork

- Discord: https://discord.com/invite/sTU4TUh8H3

IV. ON Professional Investment Strategy and Risk Management

ON Investment Methodology

(1) Long-Term Holding Strategy

Suitable For: Conservative investors and believers in privacy-preserving data infrastructure

Operational Recommendations:

- Establish positions during market corrections and periods of high volatility to maximize entry value

- Maintain a diversified portfolio allocation with ON representing no more than 3-5% of total cryptocurrency holdings

- Implement dollar-cost averaging over 6-12 months to reduce timing risk

- Set realistic long-term price targets based on comparable privacy-focused infrastructure projects

- Monitor development milestones and network adoption metrics for rebalancing triggers

Storage Solution:

- Utilize Gate.com Web3 Wallet for secure, non-custodial token storage with multi-chain support

- Implement 2FA (Two-Factor Authentication) and security keys for enhanced account protection

- Maintain backup seed phrases in secure, offline locations

- Consider cold storage solutions for holdings exceeding your emergency fund equivalent

(2) Active Trading Strategy

Technical Analysis Tools:

- Moving Averages (MA): Deploy 20-day, 50-day, and 200-day MAs to identify trend direction and support/resistance levels; crossover signals indicate potential entry and exit points

- RSI (Relative Strength Index): Monitor RSI readings above 70 (overbought) and below 30 (oversold) conditions; trading signals emerge when RSI diverges from price action

- Volume Analysis: Confirm price breakouts with above-average volume; price movements on declining volume suggest weakening momentum

- Support and Resistance Levels: Track price levels at $0.0888 (ATL), $0.1077 (current), $0.15, and $0.4 (ATH) for predicting reversals

Swing Trading Key Points:

- Execute buy orders near identified support levels with confirmed volume indicators

- Set profit-taking targets at 15-25% gains over a 2-4 week trading window

- Implement stop-loss orders at 8-12% below entry points to limit downside exposure

- Monitor bid-ask spreads; trading may be limited due to relatively low daily volume of $101,708

V. Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total cryptocurrency allocation

- Experienced Investors: 2-5% of total cryptocurrency allocation

- Professional Investors: 5-10% of total cryptocurrency allocation with hedging strategies

(2) Risk Hedging Strategies

- Portfolio Diversification: Balance ON holdings with established Layer-1 chains and blue-chip DeFi protocols to mitigate project-specific risks

- Stablecoin Reserves: Maintain 30-50% of intended cryptocurrency allocation in USDT or USDC for opportunistic accumulation during market declines

- Inverse Position Hedging: Consider short positions on correlated assets through Gate.com derivatives markets to offset downside exposure during bear markets

(3) Secure Storage Solutions

- Hot Wallet Approach: Gate.com Web3 Wallet provides convenient access with institutional-grade security protocols for active traders

- Hardware Security Option: Offline storage solutions are recommended for holdings exceeding $5,000 equivalent; however, users should ensure compatibility with both BSC and Ethereum networks

- Security Considerations:

- Never share private keys or recovery phrases with any third party

- Verify website authenticity before accessing accounts

- Enable all available security features including withdrawal whitelisting

- Regularly audit wallet activity for unauthorized transactions

- Use hardware authentication devices for critical account operations

VI. Potential Risks and Challenges

Market Risks

- Extreme Volatility: ON has exhibited 350% price swings from ATL to ATH within months, creating significant liquidation risks for leveraged traders

- Low Liquidity: Trading volume of approximately $101,708 daily creates slippage concerns for positions exceeding $50,000; market orders may impact price substantially

- Market Sentiment Decline: 58.74% annual decline indicates weakened investor confidence; recovery would require significant positive developments or market-wide liquidity improvement

Regulatory Risks

- Evolving Compliance Framework: Privacy-focused infrastructure projects face increasing regulatory scrutiny from financial authorities investigating potential illicit use cases

- Cross-Border Jurisdictional Issues: Operations across BSC and Ethereum networks create complexity in regulatory compliance across multiple jurisdictions

- Institutional Adoption Barriers: Regulatory uncertainty may prevent major financial institutions from integrating privacy-preserving infrastructure solutions

Technical Risks

- Network Adoption Uncertainty: Limited network effects visible from low transaction volumes; project viability depends on achieving critical mass adoption

- Competitive Pressure: Multiple established privacy and data infrastructure projects command greater development resources and market recognition

- Smart Contract Vulnerabilities: Advanced cryptographic implementations carry elevated audit risks; past contract exploits in similar protocols resulted in significant capital losses

VII. Conclusion and Action Recommendations

ON Investment Value Assessment

Orochi Network represents a specialized investment in privacy-preserving data infrastructure with strong technical foundations but faces significant adoption and market challenges. The project's 58.74% annual decline reflects broader market skepticism regarding profitability pathways for privacy-focused solutions. Success depends on achieving enterprise adoption, demonstrating clear use cases, and navigating regulatory constraints. Current valuation provides opportunities for risk-tolerant investors, but positions should be sized appropriately given market immaturity and liquidity limitations.

Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of crypto allocation) through Gate.com's spot trading with strict stop-loss discipline; prioritize understanding project fundamentals before increasing exposure

✅ Experienced Investors: Establish positions during market weakness with 2-4% allocation; implement technical analysis-driven swing trading with defined entry/exit criteria; use 3-5 year holding horizons for core positions

✅ Institutional Investors: Conduct thorough due diligence on regulatory compliance and enterprise adoption metrics; consider small strategic positions (2-3% of alternative asset allocation) for blockchain infrastructure diversification; engage with project leadership regarding roadmap execution and market traction

Trading Participation Methods

- Spot Trading: Purchase ON directly through Gate.com's spot trading market with fiat on-ramps for accessible entry points

- Dollar-Cost Averaging: Execute recurring weekly or monthly purchases regardless of price to mitigate timing risk over extended periods

- Gate.com Wallet Integration: Combine spot purchases with immediate transfer to Gate Web3 Wallet for self-custody and enhanced security

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and financial circumstances. Consult professional financial advisors before committing capital. Never invest funds you cannot afford to lose completely.

FAQ

What is the price target for ON in 2025?

Based on market analysis, ON is expected to trade between $54.87 and $62.07 in 2025, with an average annualized price around these levels. This forecast reflects current market trends and technical analysis.

What factors influence ON price movements?

ON price movements are driven by market demand and supply, trading volume, broader cryptocurrency market trends, investor sentiment, technological developments, regulatory news, and macroeconomic factors including interest rate changes.

Is ON a good investment for 2024-2025?

ON presents strong investment potential for 2024-2025, supported by favorable market conditions, positive earnings outlook, and growing AI sector momentum. The combination of easing monetary policy and robust economic fundamentals creates an attractive opportunity window for investors.

What is the historical price trend of ON?

ON has demonstrated strong upward momentum, with recent peaks reaching 387.35 and experiencing notable gains including a +41.01% surge. The current price stands at 274.70, reflecting significant historical appreciation and positive long-term trend dynamics.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HTX Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset Exchange Token

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 LTCPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Litecoin

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

Exploring FIFA Coin: Purchasing Guide and Its Impact on Sport Crypto's Future

Blum Token Launch Timeline: Key Dates and Price Outlook

Exploring Volt (XVM): A Rising Star in the Solana Ecosystem with Impressive Market Activity

What is NIZA: A Comprehensive Guide to Understanding Neural Integration and Zero-Allocation Architecture

What is OMG: Understanding the Evolution and Impact of the Popular Internet Acronym