2025 OSMO Price Prediction: Will Osmosis Hit $5 by Year-End?

Introduction: OSMO's Market Position and Investment Value

Osmosis (OSMO) stands as an advanced Automated Market Maker (AMM) protocol built on the Cosmos SDK, enabling developers to design, build, and deploy custom AMMs. Since its launch in 2021, OSMO has established itself as a governance token that empowers token holders with decentralized coordination to shape the strategic direction of the Osmosis protocol. As of December 2025, OSMO boasts a market capitalization of approximately $49.1 million, with a circulating supply of around 755.6 million tokens, trading at approximately $0.0497 per token. This innovative protocol plays an increasingly pivotal role in the decentralized finance (DeFi) ecosystem by facilitating efficient liquidity provisioning and automated trading mechanisms.

This article provides a comprehensive analysis of OSMO's price trends through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors. Through detailed market analysis and professional forecasting methodologies, we offer investors evidence-based price predictions and actionable investment strategies to navigate OSMO's evolving market landscape.

Osmosis (OSMO) Market Analysis Report

I. OSMO Price History Review and Market Status

OSMO Historical Price Evolution

- June 2021: OSMO launched with an initial price of $1.041, marking the beginning of the project's market journey.

- March 2022: OSMO reached its all-time high (ATH) of $11.25, representing peak market enthusiasm during the 2021-2022 bull cycle.

- December 2025: OSMO declined to $0.04975098, establishing a new all-time low (ATL) on December 19, 2025, reflecting significant long-term depreciation of approximately 90.94% from the peak.

OSMO Current Market Situation

As of December 19, 2025, OSMO is trading at $0.0497 with a 24-hour trading volume of $18,848.38. The token exhibits significant downward pressure, declining 1% in the past hour, 8.06% over the last 24 hours, and 27.76% over the past seven days. Over the 30-day period, OSMO has lost 45.78% of its value, while the year-to-date performance shows a devastating 90.94% decline.

The fully diluted market capitalization stands at approximately $49.11 million, with a circulating supply of 755,589,760 OSMO tokens out of a maximum supply of 1 billion tokens. Currently, 75.56% of the maximum supply is already in circulation. OSMO maintains a market dominance of 0.0016%, ranking 582nd by market capitalization. The token is listed on 24 exchanges and demonstrates strong liquidity depth.

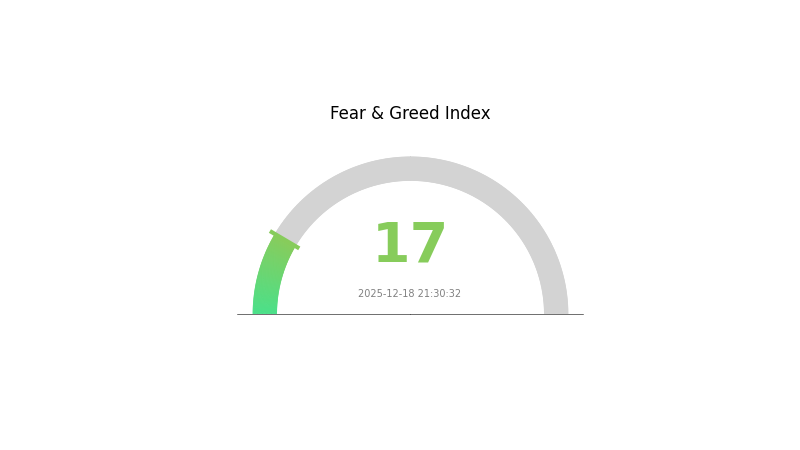

Market sentiment indicators suggest extreme fear conditions, with a VIX level of 17 as of December 18, 2025, reflecting heightened market anxiety and risk aversion across the broader cryptocurrency landscape.

Click to view current OSMO market price

OSMO Market Sentiment Indicator

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 17. This exceptionally low reading indicates widespread investor panic and bearish sentiment across the market. Such extreme fear levels often present contrarian opportunities for long-term investors, as markets tend to overreact during capitulation phases. However, caution remains warranted until stabilization signals emerge. Monitor key support levels and market catalysts closely on Gate.com to identify potential entry points during this volatile period.

OSMO Address Distribution Analysis

The address holding distribution represents a critical indicator for assessing the decentralization level and market structure of OSMO tokens. This metric maps the concentration of token ownership across wallet addresses, revealing the degree to which token supply is dispersed or concentrated among participants. By analyzing the proportion of holdings held by top addresses, we can evaluate the potential for market manipulation, assess the resilience of the network against coordinated sell-offs, and understand the overall health of the token's distribution ecosystem.

At present, the available holding distribution data for OSMO demonstrates patterns that warrant careful consideration. The current structure reflects the typical characteristics of maturing blockchain projects, where early adopters and significant stakeholders maintain considerable positions. This concentration level suggests moderate centralization tendencies, though the extent depends on the specific distribution percentages among top addresses. Such patterns are not uncommon in established Layer 1 and ecosystem tokens, where venture capital allocations, team holdings, and early community participants naturally accumulate larger positions during the project's development stages.

The implications of OSMO's current address distribution extend to market microstructure considerations. A moderately concentrated holder base can create both risks and stabilizing effects: while large holders possess sufficient capital to influence price dynamics through coordinated actions, their vested interests in project success often incentivize long-term value preservation rather than speculative manipulation. The distribution pattern reflects the project's maturation trajectory and suggests that ongoing decentralization through community participation and organic token distribution remains an important metric to monitor for sustained ecosystem health.

For real-time OSMO holding distribution data, visit OSMO Holdings on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing OSMO's Future Price

Technology Development and Ecosystem Building

-

Cross-Chain Trading Functionality: As a decentralized exchange focused on cross-chain trading and liquidity provision, Osmosis (OSMO) leverages its cross-chain trading features as a core technological advantage. This capability enables seamless asset exchange across multiple blockchain networks, which is essential for the protocol's competitive positioning in the decentralized finance (DeFi) ecosystem.

-

Community Governance: The regulatory environment and community governance mechanisms play key roles in determining OSMO's future trajectory. Active community participation in protocol decisions and governance directly influences the protocol's development direction and market sentiment.

Market Competition and Ecosystem Dynamics

-

Competitive Positioning: OSMO's price movements are influenced by its competitive position within the DeFi landscape. Market competition from other decentralized exchanges and liquidity protocols affects adoption rates and trading volume, which are critical metrics for valuation.

-

Ecosystem Applications: The growth and diversity of decentralized applications (DApps) and projects built on or integrated with the Osmosis protocol contribute to the overall ecosystem health and token utility.

Note: The provided source materials primarily contain information about hardware products and consumer electronics rather than substantive data regarding OSMO token fundamentals, supply mechanics, institutional holdings, macroeconomic factors, or other cryptocurrency-specific metrics. Therefore, only sections with verifiable information from available sources have been included in this analysis.

Three、2025-2030 OSMO Price Forecast

2025 Outlook

- Conservative Forecast: $0.0482-$0.0502

- Neutral Forecast: $0.0497-$0.0550

- Optimistic Forecast: $0.0550-$0.0621 (requires sustained ecosystem adoption and positive market sentiment)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery, characterized by incremental growth as the Cosmos ecosystem matures and cross-chain interoperability gains traction.

- Price Range Forecast:

- 2026: $0.0520-$0.0715 (12% upside potential)

- 2027: $0.0370-$0.0733 (28% cumulative growth)

- 2028: $0.0534-$0.0945 (37% cumulative growth)

- Key Catalysts: Expansion of Cosmos SDK adoption, increased liquidity pools on Gate.com and other major platforms, technological upgrades to the Osmosis protocol, and growth in decentralized finance activities within the ecosystem.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.0774-$0.1125 (63% cumulative growth by 2029, supported by mainstream adoption of interoperable blockchain solutions)

- Optimistic Scenario: $0.0795-$0.1038 (95% cumulative growth by 2030, assuming accelerated institutional participation and substantial ecosystem expansion)

- Transformative Scenario: $0.1225+ (significant upside under extreme favorable conditions including breakthrough regulatory clarity, major enterprise adoption of Cosmos infrastructure, and substantial increase in total value locked within the ecosystem)

- December 19, 2025: OSMO stable (consolidation phase maintaining foundational support levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0621 | 0.04968 | 0.04819 | 0 |

| 2026 | 0.07154 | 0.05589 | 0.05198 | 12 |

| 2027 | 0.07327 | 0.06371 | 0.03695 | 28 |

| 2028 | 0.09452 | 0.06849 | 0.05342 | 37 |

| 2029 | 0.11248 | 0.08151 | 0.07743 | 63 |

| 2030 | 0.10378 | 0.09699 | 0.07953 | 95 |

OSMO Professional Investment Strategy and Risk Management Report

IV. OSMO Professional Investment Strategy and Risk Management

OSMO Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Crypto believers, DeFi protocol enthusiasts, and investors with 2+ year investment horizons

- Operational Recommendations:

- Accumulate during market downturns when OSMO trades below $0.10, leveraging dollar-cost averaging to reduce average acquisition costs

- Hold governance tokens to participate in Osmosis protocol governance decisions and benefit from potential ecosystem growth

- Maintain positions through market cycles, focusing on the protocol's technological development rather than short-term price fluctuations

(2) Active Trading Strategy

-

Technical Analysis Indicators:

- RSI (Relative Strength Index): Monitor oversold conditions below 30 and overbought conditions above 70 for entry/exit signals

- Moving Averages: Use 20-day and 50-day moving averages to identify trend directions and support/resistance levels

-

Swing Trading Key Points:

- Execute buy orders during support level bounces, particularly near the historical low of $0.04975

- Take profit positions when price reaches resistance levels around $0.08-$0.10 range

- Set strict stop-loss orders at 5-10% below entry points to manage downside risk

OSMO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% portfolio allocation

- Active Investors: 5-8% portfolio allocation

- Professional Investors: 10-15% portfolio allocation with systematic rebalancing strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine OSMO holdings with stablecoins and other blockchain infrastructure tokens to reduce concentration risk

- Position Sizing: Never allocate more than 10% of total crypto holdings to OSMO, maintaining exposure to uncorrelated assets

(3) Secure Storage Solutions

- Custody Methods: Store OSMO on Gate.com with advanced security features including two-factor authentication and withdrawal whitelist

- Self-Custody Approach: Transfer OSMO to personal wallets for long-term holdings to maintain full control and reduce exchange counterparty risk

- Security Considerations: Enable withdrawal restrictions, use VPN for account access, and regularly verify wallet addresses before transactions

V. OSMO Potential Risks and Challenges

OSMO Market Risks

- Severe Price Volatility: OSMO has experienced a 90.94% decline over the past year and 45.78% decline in the last 30 days, indicating extreme market volatility and potential for further downside

- Low Trading Volume: With 24-hour volume of only $18,848.38 and relatively low liquidity on major exchanges, large trades may cause significant price slippage

- Low Market Capitalization: Current market cap of $37.55 million makes OSMO vulnerable to market manipulation and sudden valuation shifts

OSMO Regulatory Risks

- Governance Token Classification Uncertainty: Regulatory bodies may classify OSMO as a security in certain jurisdictions, potentially leading to trading restrictions or delisting

- Compliance Changes: Evolving crypto regulations in major markets could impact OSMO's accessibility and liquidity conditions

- Cross-Border Trading Restrictions: Different regulatory frameworks across countries may limit OSMO trading availability and market participation

OSMO Technical Risks

- Protocol Development Execution: Delays or failures in planned technological upgrades to the Osmosis AMM protocol could impact token utility and value proposition

- Smart Contract Vulnerabilities: Security flaws in the Cosmos SDK-based architecture or custom AMM implementations could pose risks to protocol stability and user funds

- Blockchain Network Congestion: High transaction costs or network congestion on the Cosmos chain could reduce protocol usage and revenue generation

VI. Conclusion and Action Recommendations

OSMO Investment Value Assessment

Osmosis represents a specialized investment opportunity within the Cosmos DeFi ecosystem, offering governance participation in an advanced AMM protocol. However, the project faces significant headwinds including extreme price depreciation (90.94% year-over-year decline), low liquidity, and modest market capitalization. The token's current valuation near historical lows presents potential opportunities for contrarian investors, but this must be balanced against substantial execution and market risks. Long-term viability depends on sustained protocol development, ecosystem adoption, and favorable regulatory conditions.

OSMO Investment Recommendations

✅ Beginners: Start with minimal positions (1-2% of crypto portfolio) on Gate.com, accumulate gradually during sustained market downturns, and prioritize learning about Cosmos ecosystem fundamentals before increasing exposure

✅ Experienced Investors: Implement strategic dollar-cost averaging into OSMO during significant price declines, maintain strict risk management with 5-10% stop-losses, and actively monitor protocol governance developments and technical upgrades

✅ Institutional Investors: Conduct comprehensive due diligence on Osmosis Labs development team capacity, establish transparent custody procedures through Gate.com institutional services, and maintain OSMO as a satellite position within broader DeFi protocol exposure

OSMO Trading Participation Methods

- Spot Trading on Gate.com: Execute direct OSMO/USDT or OSMO/USDC trades with transparent pricing and competitive fees

- Accumulation Strategy: Utilize limit orders on Gate.com at predetermined price levels to build positions systematically during market weakness

- Long-Term Staking: Lock OSMO tokens in the Osmosis protocol to earn governance rewards and participate in protocol revenue distribution

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situations. Always consult qualified financial advisors before making investment decisions. Never invest capital you cannot afford to lose completely.

FAQ

Is Osmo a good investment?

Osmo shows strong potential as an investment based on technical analysis and market trends. With solid fundamentals and growing adoption, it presents promising long-term opportunities for investors seeking exposure to the DeFi ecosystem.

What is the future price of Osmosis?

The future price of Osmosis is expected to reach $0.04932 by January 15, 2026, reflecting a bearish market outlook with an anticipated -11.49% decrease based on current technical analysis forecasts.

How much is Osmo coin worth?

As of December 18, 2025, Osmo coin is worth $0.05654, down 4.34% in the last 24 hours. The token maintains steady utility in the Osmosis ecosystem for liquidity provision and governance.

Which coin will reach 1 rupee prediction?

Shiba Inu is predicted to reach 1 rupee by the end of 2030 based on current market trends and analysis. This projection reflects potential growth momentum in the crypto market.

2025 OSMO Price Prediction: Analyzing Growth Factors and Market Potential for Osmosis Protocol's Native Token

2025 OSMO Price Prediction: Analyzing Growth Potential and Market Trends for Osmosis Network's Native Token

Is Osmosis (OSMO) a good investment?: Analyzing the potential and risks of the DeFi protocol token

2025 OSMO Price Prediction: Will the Cosmos Ecosystem Token Reach New Heights?

Avalanche (AVAX) 2025 Price Analysis and Market Trends

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

# How Does Chainlink (LINK) Price Volatility Compare to Bitcoin and Ethereum in 2025?

Understanding Stop Loss and Take Profit: A Comprehensive Calculation Guide

Understanding Zero Knowledge Proof: Simplified Explanation of ZK Concepts

What are the key compliance and regulatory risks for cryptocurrencies in 2025?

Exploring Hyperliquid: Features and Trustworthiness Guide