2025 POL Price Prediction: Analyzing Potential Growth Factors and Market Trajectories for Polygon's Native Token

Introduction: POL's Market Position and Investment Value

Polygon Ecosystem Token (POL), as a key player in the Ethereum scaling and infrastructure development space, has made significant strides since its inception. As of 2025, POL's market capitalization has reached $2.81 billion, with a circulating supply of approximately 10.5 billion tokens, and a price hovering around $0.2678. This asset, often referred to as the "Ethereum Scaling Solution," is playing an increasingly crucial role in enhancing blockchain scalability and interoperability.

This article will provide a comprehensive analysis of POL's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. POL Price History Review and Current Market Status

POL Historical Price Evolution Trajectory

- 2023: Market low, price bottomed at $0.0921 on November 16

- 2024: Bull market peak, price reached all-time high of $1.5711 on April 22

- 2025: Market correction, price declined to current level of $0.2678

POL Current Market Situation

As of September 10, 2025, POL is trading at $0.2678, down 3.98% in the last 24 hours. The token has experienced mixed performance across different timeframes, with a 0.04% increase in the past hour, a 9.56% gain over the last 30 days, but a significant 30.04% decline year-over-year. POL's market capitalization stands at $2,810,890,606, ranking it 54th in the cryptocurrency market with a 0.067% market share. The circulating supply is 10,496,230,792.90537 POL, which is also the total supply, indicating no additional tokens will be minted. The current price represents a 82.95% decrease from its all-time high and a 190.77% increase from its all-time low, suggesting the token is in a consolidation phase following the recent market cycle.

Click to view the current POL market price

POL Market Sentiment Indicator

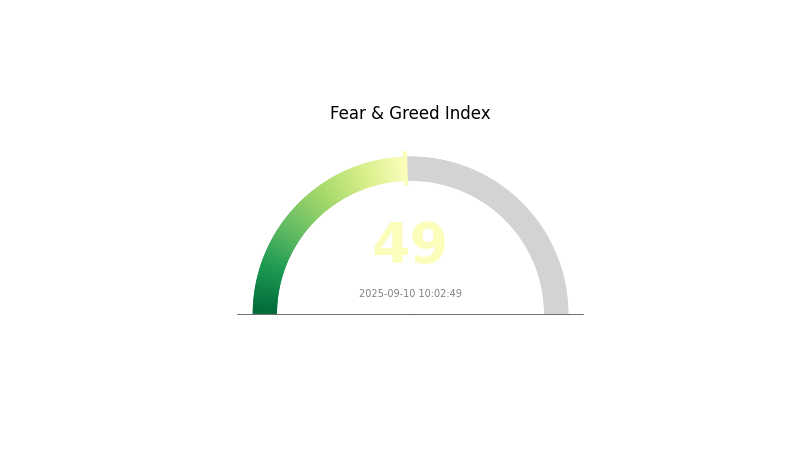

2025-09-10 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index at 49, indicating a neutral stance. This suggests that investors are neither overly pessimistic nor excessively optimistic about the current market conditions. Traders should remain cautious and consider both potential risks and opportunities. As always, it's advisable to conduct thorough research and diversify investments to navigate the ever-changing crypto landscape effectively.

POL Holdings Distribution

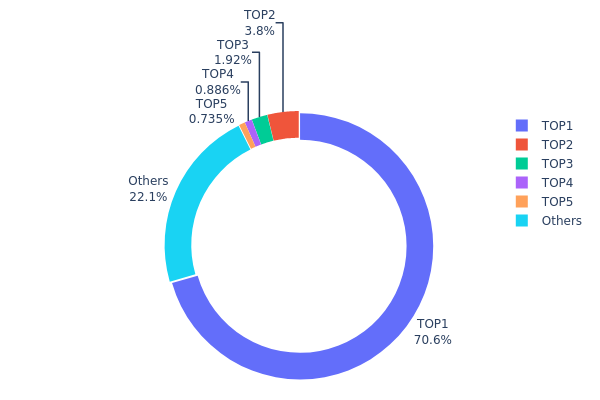

The address holdings distribution data provides crucial insights into the concentration of POL tokens among different addresses. Analysis of this data reveals a highly centralized distribution pattern. The top address holds a staggering 70.56% of all POL tokens, indicating significant control by a single entity. The next four largest holders collectively account for only 7.34% of the total supply, while the remaining addresses hold 22.1%.

This extreme concentration raises concerns about market manipulation and price volatility. With one address controlling over two-thirds of the supply, there's a potential for large-scale market movements if this holder decides to sell or transfer significant amounts. Such concentration also challenges the principles of decentralization that many cryptocurrency projects aim to achieve.

The current distribution structure suggests a less robust on-chain ecosystem for POL. It may deter smaller investors due to perceived risks of price manipulation and could impact overall market liquidity. However, it's worth noting that the identity and intentions of the largest holder (possibly a foundation or development fund) could provide context to this concentration and its potential long-term implications for the project.

Click to view the current POL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...001010 | 7405721.86K | 70.56% |

| 2 | 0x4c56...989ff4 | 398337.84K | 3.80% |

| 3 | 0x0d50...df1270 | 201692.82K | 1.92% |

| 4 | 0x79b4...c2cf38 | 93026.38K | 0.89% |

| 5 | 0x7d34...c4777e | 77147.01K | 0.73% |

| - | Others | 2320304.89K | 22.1% |

II. Key Factors Affecting POL's Future Price

Supply Mechanism

- Historical Pattern: Past supply changes have influenced POL's price movements.

- Current Impact: The current total supply of POL is 10,496,230,792.90537531, with 10,496,230,782.90537531 in circulation.

Institutional and Whale Dynamics

- Enterprise Adoption: Tether deployed USDT and gold-backed XAUt0 on Polygon in August 2025, enhancing cross-chain liquidity.

Macroeconomic Environment

- Inflation Hedging Properties: POL has shown potential as a hedge against inflation in the current economic climate.

Technical Development and Ecosystem Building

- Ethereum Scalability: POL's future price is influenced by Ethereum's scalability improvements.

- Ecosystem Applications: Major DApps in the Polygon ecosystem include QuickSwap and Polymarket, which have contributed to the growth in Total Value Locked (TVL).

As of early 2025, Polygon's Total Value Locked (TVL) has increased by 43% year-to-date, reaching $1.23 billion.

III. POL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.20345 - $0.25

- Neutral prediction: $0.25 - $0.28

- Optimistic prediction: $0.28 - $0.31053 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.2027 - $0.51919

- 2028: $0.31493 - $0.60362

- Key catalysts: Increasing adoption, technological advancements, and overall crypto market growth

2030 Long-term Outlook

- Base scenario: $0.45 - $0.60 (assuming steady market growth)

- Optimistic scenario: $0.60 - $0.71799 (assuming strong market performance)

- Transformative scenario: $0.71799+ (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: POL $0.54393 (potential average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.31053 | 0.2677 | 0.20345 | 0 |

| 2026 | 0.42211 | 0.28912 | 0.23708 | 7 |

| 2027 | 0.51919 | 0.35561 | 0.2027 | 32 |

| 2028 | 0.60362 | 0.4374 | 0.31493 | 63 |

| 2029 | 0.56736 | 0.52051 | 0.48407 | 94 |

| 2030 | 0.71799 | 0.54393 | 0.31004 | 103 |

IV. Professional Investment Strategies and Risk Management for POL

POL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Polygon ecosystem

- Operational advice:

- Accumulate POL tokens during market dips

- Stake POL tokens to earn additional rewards

- Store in secure hardware wallets for long-term holding

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps in identifying overbought or oversold conditions

- Key points for swing trading:

- Monitor Polygon ecosystem developments and announcements

- Keep track of overall market sentiment in the crypto space

POL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-7% of crypto portfolio

- Aggressive investors: 7-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Layer 2 solutions

- Stop-loss orders: Set appropriate stop-loss levels to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term storage

- Security precautions: Use two-factor authentication, store private keys securely

V. Potential Risks and Challenges for POL

POL Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Competition: Increasing competition in the Layer 2 scaling solutions space

- Market sentiment: Sudden shifts in investor sentiment can impact price

POL Regulatory Risks

- Regulatory uncertainty: Potential for increased regulation in the crypto space

- Cross-border restrictions: Varying regulatory approaches in different jurisdictions

- Compliance requirements: Changing compliance standards for blockchain projects

POL Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability challenges: Unforeseen issues in implementing Polygon 2.0

- Interoperability issues: Potential difficulties in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

POL Investment Value Assessment

POL presents a compelling long-term value proposition as part of the Polygon ecosystem, which aims to scale Ethereum. However, short-term volatility and competition in the Layer 2 space pose significant risks.

POL Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the Polygon ecosystem ✅ Experienced investors: Consider allocating as part of a diversified crypto portfolio ✅ Institutional investors: Evaluate POL as part of a broader Layer 2 scaling solution strategy

POL Trading Participation Methods

- Spot trading: Buy and hold POL tokens on reputable exchanges

- Staking: Participate in POL staking to earn additional rewards

- DeFi participation: Explore DeFi applications built on the Polygon network

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will POL reach 1$?

POL reaching $1 is possible but uncertain. Market trends and project developments will be key factors in determining its future price potential.

What will a Polygon be worth in 2025?

Based on current projections, Polygon's price in 2025 is expected to range between $0.53 and $0.78, influenced by market conditions and technological advancements.

How much is pol coin worth in 2025?

Based on market predictions, POL coin is expected to be worth between $0.53 and $0.78 in 2025, depending on market conditions and technological developments.

Is Pol a buy or sell?

Based on current market analysis, POL is considered a buy. Its technical indicators suggest positive momentum, but always monitor market changes.

2025 OPPrice Prediction: Analyzing Optimism's Long-Term Value Potential in Layer 2 Scaling Solutions

2025 LINEA Price Prediction: Analyzing Market Trends, Technical Developments and Adoption Factors for the Layer 2 Solution

Is LightLink (LL) a good investment?: Analyzing the potential of this emerging blockchain platform in the DeFi landscape

CORE vs ETH: Comparing Scalability Solutions for DeFi Ecosystems

YFII vs OP: A Battle of Yield Farming Protocols in the DeFi Space

Is Arbitrum (ARB) a good investment?: Evaluating the potential of this Layer 2 scaling solution in the evolving crypto landscape

Exploring Token 2049: Singapore's Leading Crypto Conference and Event

Exploring the Prospects and Forecasts for MONKY Token in Crypto Markets

Exploring Singapore's Premier Web3 Gathering: Insights from Token 2049

Exploring TOKEN 2049: Singapore's Premier Crypto Conference

Unveiling Satoshi Nakamoto: The Enigma Behind Bitcoin's Creator and His Legendary Fortune