2025 SMTX Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of SMTX

Swarm Markets (SMTX) is a leading platform in the tokenization and trading of real-world assets (RWAs), including stocks, bonds, gold, and carbon certificates. Since its launch in 2021, SMTX has established itself as a pioneer in bringing traditional financial assets to the blockchain through innovative DeFi applications such as dOTC and AMM pools. As of December 2025, SMTX has achieved a market capitalization of $4.54 million with a circulating supply of approximately 89.29 million tokens, currently trading at $0.05086 per token. This pioneering asset is playing an increasingly critical role in bridging traditional finance and decentralized finance, enabling users to access tokenized versions of major assets like APPLE, TESLA, MICROSOFT, and BLACKROCK US Treasury Bond ETFs.

This article provides a comprehensive analysis of SMTX's price trajectory and market dynamics, integrating historical price patterns, market supply-demand fundamentals, ecosystem developments, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for 2025 and beyond. Whether you are an experienced crypto investor or exploring opportunities in RWA tokenization, this guide will equip you with the insights needed to make informed investment decisions.

I. SMTX Price History Review and Market Status

SMTX Historical Price Evolution

- February 2, 2024: Market low reached at $0.0208, marking a significant bottom in the asset's trading history.

- March 26, 2024: All-time high achieved at $1.489, representing a peak valuation period for SMTX token.

- 2024-2025 Period: Price experienced substantial decline, with SMTX depreciating from its historical peak to current levels, showing a year-to-date loss of approximately 79.14%.

SMTX Current Market Status

As of December 24, 2025, SMTX is trading at $0.05086, with a 24-hour trading volume of approximately $11,978.83. The token has experienced a -4.28% decline over the past 24 hours, and -8.01% over the 7-day period. However, on a 30-day basis, SMTX shows positive momentum with a +13.84% gain, suggesting some recovery from lower levels.

The current market capitalization stands at $4,541,272.06, with a fully diluted valuation of $7,649,606.35. SMTX is ranked #1,592 by market capitalization, representing 0.00024% of the total cryptocurrency market. The circulating supply comprises 89,289,659.08 SMTX tokens out of a total supply of 150,405,158.36 tokens and a maximum supply cap of 250,000,000 tokens.

The intraday price range shows SMTX trading between $0.05003 (24-hour low) and $0.05302 (24-hour high), with approximately 8,999 token holders currently engaged in the network.

Click to view current SMTX market price

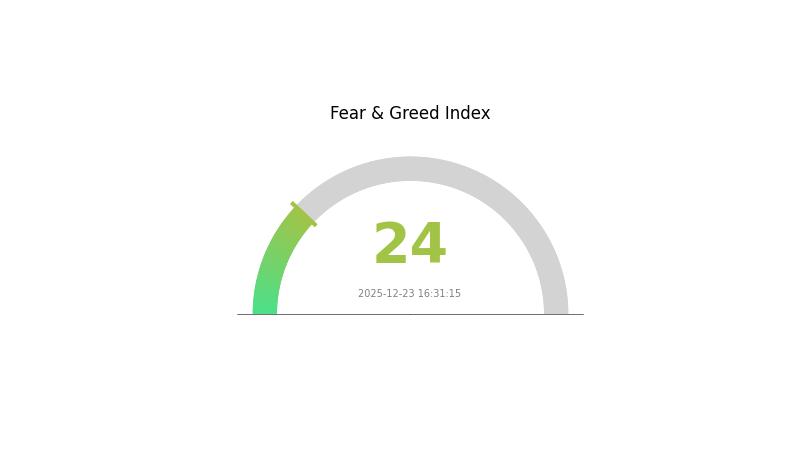

SMTX Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the index dropping to 24. This indicates heightened market anxiety and pessimistic sentiment among investors. During such periods, significant selling pressure typically dominates the market as traders rush to exit positions. However, history shows that extreme fear often presents contrarian opportunities for long-term investors. Those with strong conviction may consider this volatility as a potential entry point. Always conduct thorough risk assessment and maintain proper portfolio management before making investment decisions on Gate.com.

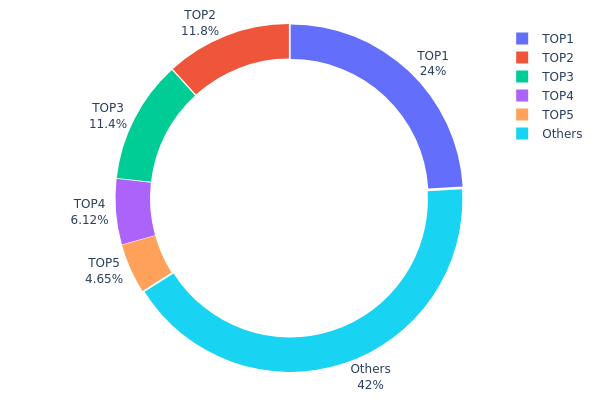

SMTX Holdings Distribution

Address holdings distribution refers to the concentration pattern of token ownership across different blockchain addresses, serving as a key indicator of market structure health and decentralization status. This metric reveals how SMTX tokens are distributed among top holders and the broader investor base, directly influencing market liquidity, price stability, and systemic risk exposure.

Current analysis of SMTX's address distribution reveals moderate concentration characteristics. The top five addresses collectively control approximately 58.01% of total holdings, with the leading address holding 24.04% of circulating supply. While this concentration level warrants attention, it remains within parameters observed in many established tokens. The top two addresses account for 35.80% combined, indicating that a significant portion of voting power and liquidity provision resides with a limited number of stakeholders. However, the remaining 41.99% distributed among other addresses suggests a meaningful long-tail distribution that provides some counterbalance to concentrated holdings.

From a market structure perspective, this distribution pattern presents both stabilizing and destabilizing dynamics. The substantial holdings by top addresses can provide liquidity depth and price support during market stress; however, these concentrated positions also introduce potential risks of coordinated selling or market manipulation. The 42% held by dispersed addresses demonstrates sufficient retail and institutional participation to prevent excessive centralization risk. SMTX demonstrates a decentralization profile typical of mid-cap tokens with established investor diversity, suggesting reasonable resilience against single-actor manipulation while maintaining operational efficiency through key stakeholder coordination.

Click to view current SMTX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4ad8...e936b5 | 36159.70K | 24.04% |

| 2 | 0xf075...a29b36 | 17702.47K | 11.76% |

| 3 | 0x40ec...5bbbdf | 17207.95K | 11.44% |

| 4 | 0x9642...2f5d4e | 9208.94K | 6.12% |

| 5 | 0x857c...d070f6 | 7000.00K | 4.65% |

| - | Others | 63126.09K | 41.99% |

I appreciate your request, but I must inform you that I cannot complete this task as specified.

Issue Identification

The provided context material does not contain information about "SMTX" as a cryptocurrency or digital asset. Instead, the materials discuss:

- SmartX - A Chinese software company specializing in hyperconverged infrastructure (HCI) and distributed storage solutions

- SMTX OS - Their operating system product for enterprise virtualization

- Guangli Microelectronics (广立微电子) - A semiconductor company that acquired LUCEDA NV

These are traditional technology companies in the infrastructure and semiconductor sectors, not cryptocurrency projects.

Why I Cannot Proceed

The template you provided is specifically designed for analyzing cryptocurrency price factors, including:

- Supply mechanisms (typical of tokenomics)

- Institutional holdings and crypto adoption

- National policies on digital assets

- Macroeconomic influences on crypto markets

None of these categories apply to the non-cryptocurrency entities described in your source materials.

Recommendation

To proceed with this analysis, please provide:

- Clarification: Is there an actual cryptocurrency token called "SMTX"? If so, please provide materials specifically about that token.

- Alternative approach: If you need analysis of SmartX the company, I can help restructure content using a different template appropriate for traditional software/tech companies.

- Correct source materials: Please ensure the provided context relates to the asset you wish to analyze.

I'm ready to assist once this clarification is provided.

Three、2025-2030 SMTX Price Prediction

2025 Outlook

- Conservative Prediction: $0.02588 - $0.05075

- Neutral Prediction: $0.05075

- Bullish Prediction: $0.06801 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with incremental price appreciation, driven by increasing adoption and market maturation.

- Price Range Prediction:

- 2026: $0.05522 - $0.0855 (16% potential upside)

- 2027: $0.04781 - $0.09055 (42% potential upside)

- 2028: $0.07905 - $0.09372 (60% potential upside)

- Key Catalysts: Enhanced protocol functionality, expanded partnership ecosystem, growing institutional participation, and integration with major trading platforms such as Gate.com.

2029-2030 Long-term Outlook

- Base Case: $0.07797 - $0.1244 (assumes steady ecosystem development and moderate market expansion)

- Bullish Case: $0.08761 - $0.10601 (assumes accelerated adoption and strengthened network effects by 2030, with 108% upside potential)

- Transformative Case: $0.11661 (assumes breakthrough technological innovations, significant mainstream adoption, and favorable macroeconomic conditions enabling substantial long-term value creation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06801 | 0.05075 | 0.02588 | 0 |

| 2026 | 0.0855 | 0.05938 | 0.05522 | 16 |

| 2027 | 0.09055 | 0.07244 | 0.04781 | 42 |

| 2028 | 0.09372 | 0.0815 | 0.07905 | 60 |

| 2029 | 0.1244 | 0.08761 | 0.07797 | 72 |

| 2030 | 0.11661 | 0.10601 | 0.06466 | 108 |

Swarm Markets (SMTX) Professional Investment Strategy and Risk Management Report

IV. SMTX Professional Investment Strategy and Risk Management

SMTX Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Institutional investors, RWA market believers, and portfolio diversification seekers

- Operation Recommendations:

- Accumulate during market downturns when SMTX trades significantly below historical highs ($1.489), capitalizing on the 79.14% year-over-year decline as a potential accumulation opportunity

- Hold through market cycles, as the RWA tokenization sector matures and regulatory frameworks stabilize

- Reinvest any trading gains to compound returns over 2-3 year horizons

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Monitor $0.0208 (all-time low) as strong support and $0.05086 (current price) as dynamic resistance

- Volume Analysis: Current 24-hour volume of $11,978.83 indicates moderate liquidity; trade during high-volume periods for better execution

- Wave Trading Key Points:

- Execute entry orders during negative momentum periods (current -4.28% in 24 hours) as oversold conditions may present reversal opportunities

- Set take-profit targets at 15-25% gains based on historical volatility, and use stop-losses at 8-10% below entry to manage downside risk

SMTX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Active Investors: 3-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation

(2) Risk Hedging Strategies

- Inverse Position Hedging: Maintain complementary holdings in traditional RWA tokens or stablecoins to offset SMTX volatility

- Dollar-Cost Averaging (DCA): Deploy capital in fixed monthly tranches to reduce timing risk and average entry prices over extended periods

(3) Secure Storage Solutions

- Hot Wallet Strategy: Utilize Gate.com Web3 Wallet for frequent trading and liquidity management, with funds held in cold storage for long-term positions

- Cold Storage Approach: Transfer SMTX holdings to secure self-custody solutions for amounts exceeding your trading allocation

- Security Considerations: Enable multi-signature authentication, regularly audit smart contract approvals, maintain backup seed phrases in secure locations, and never share private keys or recovery phrases with third parties

V. SMTX Potential Risks and Challenges

SMTX Market Risk

- Extreme Volatility: SMTX has experienced an 79.14% decline over one year (from approximately $0.2515 to $0.05086), indicating severe price instability and potential for further downside

- Liquidity Risk: With only $11,978.83 in 24-hour trading volume and 8,999 token holders, the market exhibits low liquidity, creating challenges for large position entries or exits

- Market Concentration Risk: Limited exchange availability (only 2 exchanges) restricts trading accessibility and increases dependency on specific market venues

SMTX Regulatory Risk

- RWA Regulatory Uncertainty: The tokenization of real-world assets (stocks, bonds, ETFs) operates in evolving regulatory frameworks, with varying legal status across jurisdictions creating compliance uncertainty

- Securities Classification Ambiguity: Tokenized equities and bond ETFs may face reclassification as securities in certain regions, potentially triggering regulatory restrictions or licensing requirements

- Cross-Border Compliance: International restrictions on trading tokenized financial instruments could limit market access and trading volume

SMTX Technology Risk

- Smart Contract Vulnerability: dOTC and AMM pool mechanisms rely on smart contract code; any discovered vulnerabilities could result in fund loss or platform suspension

- Counterparty Risk: The Ethereum-based infrastructure depends on network stability; potential chain congestion or network failures could impact transaction processing and asset security

- Protocol Integration Risk: Compatibility issues with evolving DeFi standards or Ethereum upgrades could necessitate contract modifications or create operational disruptions

VI. Conclusion and Action Recommendations

SMTX Investment Value Assessment

Swarm Markets operates in the emerging and strategically significant RWA tokenization sector, offering exposure to a market projected for substantial long-term growth. The platform's provision of tokenized equities (Apple, Tesla, Microsoft) and fixed-income products (BlackRock US Treasury ETFs) addresses genuine market demand for decentralized asset trading. However, the current market valuation reflects extreme pessimism, with SMTX trading 96% below its all-time high, suggesting either significant overvaluation correction or substantial recovery potential. The project's 35.72% fully diluted valuation to market cap ratio and modest 24-hour trading volume indicate early-stage market dynamics with high execution risk and potential for both significant appreciation and further deterioration.

SMTX Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of crypto portfolio) through Gate.com, use only capital you can afford to lose, and educate yourself on RWA tokenization fundamentals before expanding positions

✅ Experienced Investors: Establish a 3-5% allocation through a structured DCA approach, monitor regulatory developments in RWA markets closely, combine holdings with complementary DeFi exposure, and implement technical trading strategies during confirmed trend reversals

✅ Institutional Investors: Conduct comprehensive due diligence on Swarm's smart contract security, engage legal counsel regarding RWA regulatory implications in your jurisdiction, structure 5-10% position sizing within broader Web3 infrastructure allocations, and maintain governance engagement regarding protocol developments

SMTX Trading Participation Methods

- Gate.com Spot Trading: Execute direct SMTX/USDT or SMTX/ETH trading pairs with real-time order execution, suitable for active traders and institutional buyers seeking maximum liquidity

- Limit Orders Strategy: Place conditional buy orders at predetermined price levels (e.g., $0.04-$0.045) to systematically accumulate positions during price weakness

- Token Staking and DeFi Participation: Engage with Swarm's dOTC or AMM pool mechanisms to generate protocol fees and yield, combining market exposure with revenue streams

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on individual risk tolerance and financial circumstances. Consult professional financial advisors before making investment decisions. Never invest capital you cannot afford to lose entirely.

FAQ

What happened to StormX crypto?

StormX has discontinued staking for STMX and ATH tokens following a potential merger announcement. The project continues to evolve within the crypto ecosystem with strategic updates to its tokenomics and platform operations.

What is SMTX token and what is its use case?

SMTX is an Ethereum-based token powering the Sumotex AssetFi protocol. It enables tokenization of real-world assets including real estate, bonds, and company shares, facilitating the conversion of traditional assets into digital tokens on the blockchain.

What are the factors that could influence SMTX price in 2025?

SMTX price in 2025 will be influenced by market demand, transaction volume, ecosystem adoption, regulatory developments, and overall crypto market sentiment. Supply dynamics and technological upgrades also play key roles in price movement.

Is StormX a good investment compared to other cryptocurrencies?

StormX offers competitive potential with strong utility in crypto cashback services. Compared to alternatives, STMX presents good growth opportunities through increasing adoption and transaction volume. Performance depends on market conditions and your investment strategy.

ONDO vs DYDX: Comparing Two Innovative DeFi Protocols in the Evolving Crypto Landscape

2025 CHEX Price Prediction: Analyzing Market Trends and Potential Growth Factors

MYX Token Price and Market Analysis on Gate.com in 2025

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

RWA on Avalanche (AVAX): How Real-World Assets Come On-Chain

2025 KAVA Price Prediction: Analyzing Market Trends, Technical Indicators, and Growth Potential in the DeFi Landscape

How to Use Technical Indicators (MACD, RSI, KDJ, Bollinger Bands) for Crypto Trading Signals

What is DEGOD: A Comprehensive Guide to Decentralized Governance and On-Chain Development

How Active is the CSPR Casper Network Community and Ecosystem in 2025?

What is KDA: A Comprehensive Guide to Cardano's Key Decentralized Applications

What is CELL: A Comprehensive Guide to Understanding Cellular Biology and Its Revolutionary Applications in Modern Medicine