2025 SWAP Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: SWAP's Market Position and Investment Value

TrustSwap (SWAP) is a innovative payment platform designed to help people exchange funds safely and reliably through a fully automated system. Since its inception in 2020, TrustSwap has established itself as a distinctive solution in the decentralized finance space. As of December 2025, SWAP maintains a market capitalization of approximately $4.88 million with a circulating supply of around 99.99 million tokens, trading at $0.04877 per token. This asset, which enables secure and time-based fund transfers across Ethereum-based tokens, continues to play an increasingly important role in the automated payment ecosystem.

This article will provide a comprehensive analysis of TrustSwap's price movements from 2025 through 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this market segment.

TrustSwap (SWAP) Market Analysis Report

I. SWAP Price History Review and Current Market Status

SWAP Historical Price Evolution

- 2020: Project launch on July 10, 2020, with initial price of $0.03124961 (historical low)

- 2021: Peak performance reached on April 16, 2021, with all-time high of $5.00, representing approximately 1,500% appreciation from launch price

- 2021-2025: Extended bearish cycle, price declined by 54.50% over the past year, currently trading at $0.04877

SWAP Current Market Situation

As of December 23, 2025, SWAP is trading at $0.04877, reflecting significant depreciation from its historical peak. The token has experienced notable short-term volatility, with a 24-hour price decline of 11.41%, while demonstrating stronger recovery over the 7-day period with a gain of 40.42%. The 1-hour performance shows a modest uptick of 1.32%, suggesting slight stabilization in the immediate term.

The current market capitalization stands at approximately $4.88 million, with a circulating supply of 99,996,042.95 SWAP tokens out of a maximum supply of 100,000,000 tokens. Daily trading volume reaches $17,687.98, indicating moderate liquidity. The token maintains a presence on 5 cryptocurrency exchanges and is held by 17,664 unique holders.

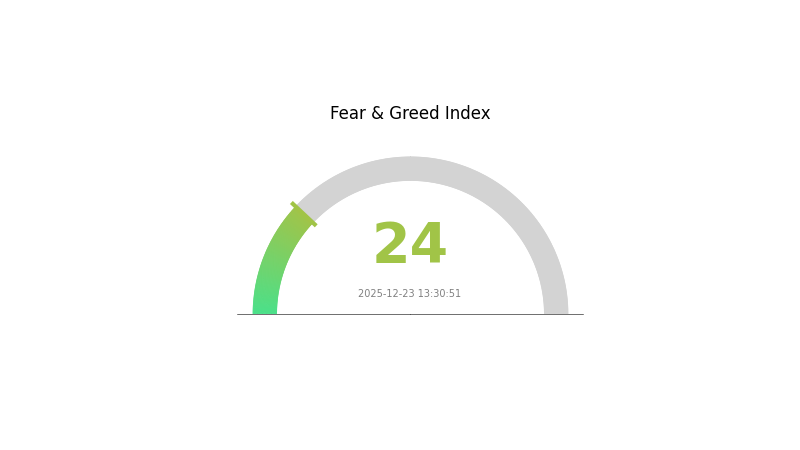

Market sentiment remains subdued, with the broader cryptocurrency market experiencing extreme fear conditions (VIX at 24). SWAP's dominance remains minimal at 0.00015% of the total cryptocurrency market capitalization.

Click to view current SWAP market price

SWAP Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This indicates significant market pessimism and heightened investor anxiety. During such periods, market volatility typically increases as risk aversion dominates trading sentiment. Experienced traders often view extreme fear as potential buying opportunities, while cautious investors may choose to reduce exposure. Monitor market movements closely and consider your risk tolerance when making investment decisions on Gate.com.

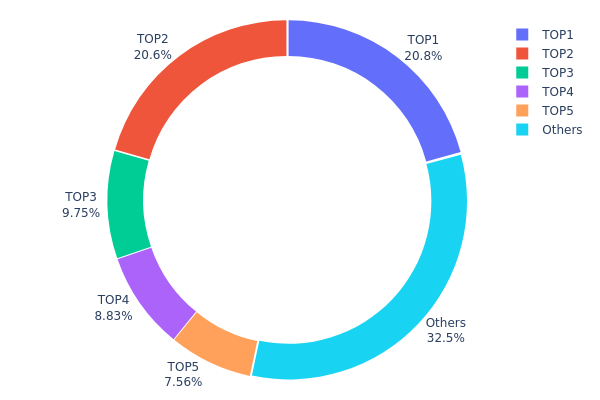

SWAP Address Holdings Distribution

An address holdings distribution chart illustrates the concentration of token ownership across blockchain wallets, revealing how SWAP tokens are allocated among major holders. This metric serves as a critical indicator for assessing market concentration risk, potential governance vulnerabilities, and the degree of decentralization within the ecosystem.

Current data demonstrates moderate concentration characteristics in SWAP's holder structure. The top five addresses collectively control approximately 67.45% of total holdings, with the two largest holders commanding 41.34% combined. Specifically, the leading address holds 20.79% while the second-largest accumulates 20.55%, representing near-parity distribution among elite holders. The third-ranking address maintains 9.74% of holdings, followed by progressively smaller stakes. Notably, the dispersed category of remaining addresses accounts for 32.55% of total tokens, indicating that roughly one-third of SWAP supply is distributed across numerous smaller holders. This distribution pattern suggests partial concentration risk without severe centralization, as no single entity dominates with an overwhelming majority.

The current holdings distribution reflects a market structure characterized by meaningful decentralization alongside concentrated capital influence. While the top five holders exercise significant market influence, the substantial proportion retained by smaller addresses provides countervailing force against unilateral price manipulation or governance capture. This configuration indicates reasonable on-chain structural stability, with sufficient distribution breadth to maintain ecosystem resilience. However, coordinated action among top holders remains a potential risk factor warranting ongoing monitoring of address behavior and fund movement patterns.

Click to view current SWAP Address Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x688e...8ad440 | 20797.89K | 20.79% |

| 2 | 0x5696...32263e | 20550.32K | 20.55% |

| 3 | 0x5a75...73d8cc | 9748.67K | 9.74% |

| 4 | 0x40ec...5bbbdf | 8826.28K | 8.82% |

| 5 | 0x43de...8398aa | 7556.02K | 7.55% |

| - | Others | 32516.85K | 32.55% |

Analysis of Core Factors Affecting SWAP Future Price

II. Core Factors Influencing SWAP Future Price Trends

Macroeconomic Environment

-

Monetary Policy Impact: Central bank policies play a significant role in SWAP price movements. Interest rate differentials between currencies are primary drivers of swap valuations. Market expectations regarding future rate decisions by major central banks, including the Federal Reserve, European Central Bank, and Bank of Japan, directly influence swap spreads and pricing structures.

-

Inflation Expectations: Inflation trends significantly impact interest rate swaps. Rising inflation expectations typically lead to higher interest rate expectations, which compress swap spreads and affect option-adjusted spreads (OAS). The market's inflation expectations, as reflected in inflation-protected securities and forward inflation rates, are critical factors in swap valuation.

-

Global Economic Conditions: Economic growth forecasts and employment data influence swap markets. Weakening labor market conditions and concerns about economic slowdown can impact interest rate expectations and create volatility in swap pricing. Global economic uncertainty increases market risk premiums and affects swap valuations across different maturity horizons.

-

Market Liquidity Conditions: Liquidity in swap markets is essential for price discovery and execution. Market participants' willingness to trade, the availability of counterparties, and bid-ask spreads all influence swap pricing. During periods of market stress or reduced liquidity, swap prices may deviate from theoretical levels based on covered interest rate parity (CIP).

Three、2025-2030 SWAP Price Forecast

2025 Outlook

- Conservative Forecast: $0.04008 - $0.04888

- Neutral Forecast: $0.04888 - $0.05279

- Optimistic Forecast: $0.05279+ (requires sustained market confidence and positive ecosystem development)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Consolidation with gradual recovery, transitioning toward moderate growth phase with increasing institutional adoption

- Price Range Forecast:

- 2026: $0.02745 - $0.07015

- 2027: $0.03085 - $0.06896

- Key Catalysts: Platform expansion, technological upgrades, increased utility adoption, market sentiment recovery, and strengthened fundamental metrics

2028-2030 Long-term Outlook

- Base Case Scenario: $0.03948 - $0.08221 (assuming steady ecosystem growth and stable market conditions through 2028)

- Optimistic Scenario: $0.06245 - $0.10432 (contingent on accelerated adoption, positive regulatory developments, and enhanced protocol functionality by 2029)

- Transformative Scenario: $0.04889 - $0.10578 (extreme favorable conditions including mainstream institutional participation, significant DeFi integration, and market expansion by 2030)

- 2030-12-23: SWAP projected at $0.08889 (mid-cycle valuation point representing approximately 82% cumulative appreciation from current baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05279 | 0.04888 | 0.04008 | 0 |

| 2026 | 0.07015 | 0.05084 | 0.02745 | 4 |

| 2027 | 0.06896 | 0.06049 | 0.03085 | 24 |

| 2028 | 0.08221 | 0.06473 | 0.03948 | 32 |

| 2029 | 0.10432 | 0.07347 | 0.06245 | 50 |

| 2030 | 0.10578 | 0.08889 | 0.04889 | 82 |

TrustSwap (SWAP) Professional Investment Strategy and Risk Management Report

IV. SWAP Professional Investment Strategy and Risk Management

SWAP Investment Methodology

(1) Long-term Holding Strategy

-

Target Audience: Risk-averse investors seeking exposure to automated payment platforms with long-term conviction in blockchain-based financial infrastructure.

-

Operational Recommendations:

- Accumulate SWAP tokens during periods of market weakness, particularly when the token trades significantly below historical resistance levels.

- Maintain a dollar-cost averaging (DCA) approach by allocating fixed capital amounts at regular intervals to reduce timing risk and average entry prices over time.

- Store accumulated SWAP securely in non-custodial solutions, prioritizing Gate Web3 Wallet for optimal security and accessibility.

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price Action Patterns: Monitor support levels around $0.047-$0.049 and resistance near $0.089-$0.090. The 24-hour high of $0.08973 represents a critical resistance zone for short-term traders.

- Volume Analysis: Current 24-hour trading volume of approximately 17,687 SWAP reflects moderate liquidity. Traders should exercise caution during periods of thin volume to avoid slippage.

-

Swing Trading Key Points:

- Leverage recent 7-day gains of 40.42% as potential reversal signals; consolidation patterns following strong uptrends often precede correction phases.

- Utilize the significant year-to-date decline of -54.50% as a contrarian indicator; oversold conditions may attract institutional accumulation.

SWAP Risk Management Framework

(1) Asset Allocation Principles

-

Conservative Investors: 1-2% of portfolio allocation

- Recommended position sizing given SWAP's market cap rank of 1548 and limited trading volume.

-

Active Investors: 3-5% of portfolio allocation

- Suitable for investors with higher risk tolerance and active portfolio management capabilities.

-

Institutional Investors: 2-4% of alternative asset allocation

- Restricted by liquidity constraints; position building should occur gradually over extended periods.

(2) Risk Hedging Solutions

-

Diversification Strategy: Combine SWAP holdings with established payment protocol tokens to mitigate concentration risk within a single platform ecosystem.

-

Stablecoin Pairing: Maintain complementary positions in Ethereum-based stablecoins (TUSD, DAI) to enable rapid position adjustments without external transaction costs.

(3) Secure Storage Solutions

-

Non-Custodial Wallet Recommendation: Gate Web3 Wallet provides institutional-grade security features combined with seamless integration for Ethereum-based token management, enabling efficient access to SWAP holdings.

-

Private Key Management: Implement hardware-backed security protocols; store seed phrases in physically secure, geographically distributed locations to prevent single-point-of-failure scenarios.

-

Critical Security Considerations:

- Verify smart contract addresses against official TrustSwap documentation (0xCC4304A31d09258b0029eA7FE63d032f52e44EFe on Ethereum) before conducting transactions.

- Maintain heightened vigilance against phishing attempts targeting Ethereum-based token holders.

- Never share private keys or seed phrases under any circumstances.

V. SWAP Potential Risks and Challenges

SWAP Market Risks

-

Extreme Volatility: The token has declined 54.50% over the past year while experiencing 40.42% gains over seven days, indicating pronounced price instability and susceptibility to sentiment-driven movements.

-

Liquidity Constraints: With only 5 exchange listings and daily trading volume of approximately 17,687 SWAP, the token faces significant slippage during large position entries or exits, particularly in adverse market conditions.

-

Market Capitalization Concentration: At rank 1548 with a fully diluted market cap of approximately $4.88 million, SWAP remains vulnerable to substantial price pressure from modest institutional selling.

SWAP Regulatory Risks

-

Evolving Payment Protocol Regulations: As jurisdictions worldwide implement stricter requirements for payment platforms and token-based financial infrastructure, regulatory compliance demands may increase operational costs or restrict market access.

-

Cross-border Transaction Scrutiny: Enhanced regulatory focus on automated fund transfers and cross-border payments could impose restrictions on TrustSwap's core functionality or user base expansion.

-

Stablecoin Regulatory Uncertainty: Given SWAP's integration with Ethereum-based stablecoins (TUSD, DAI), regulatory changes affecting stablecoin operations may directly impact platform utility and token demand.

SWAP Technology Risks

-

Smart Contract Vulnerabilities: Automated payment systems execute complex logic on-chain; undisclosed security vulnerabilities or logic errors could result in partial or complete loss of user funds.

-

Ethereum Network Dependencies: SWAP's functionality is entirely dependent on Ethereum network stability, transaction cost efficiency, and consensus security. Network congestion or catastrophic failures would impair platform accessibility.

-

Limited Technical Documentation: Insufficient publicly available information regarding upgrade roadmap, development velocity, or technical governance mechanisms creates uncertainty regarding long-term platform sustainability and innovation capabilities.

VI. Conclusion and Action Recommendations

SWAP Investment Value Assessment

TrustSwap presents a specialized use case within the automated payment protocol landscape, targeting users requiring reliable cross-border fund settlement with Ethereum-based tokens. However, the token's position at market rank 1548, coupled with minimal liquidity and substantial year-to-date losses, positions SWAP as a high-risk, speculative asset suitable exclusively for experienced investors with extended time horizons. The recent 40.42% seven-day rally requires cautious evaluation; this surge may reflect temporary momentum rather than fundamental ecosystem expansion or adoption acceleration.

SWAP Investment Recommendations

✅ Beginners: Exercise extreme caution; limit exposure to 0.5-1% of total portfolio allocation after conducting comprehensive fundamental research on TrustSwap's development roadmap, user adoption metrics, and competitive positioning within the automated payment ecosystem.

✅ Experienced Investors: Consider 2-4% tactical allocations during established technical support zones; implement strict stop-loss discipline at -20% below entry to manage downside exposure within defined risk parameters.

✅ Institutional Investors: Evaluate SWAP solely as a small-cap alternative allocation component; conduct extensive operational due diligence regarding liquidity provision mechanisms, exchange listing expansion plans, and institutional adoption pathways before committing capital.

SWAP Trading Participation Methods

-

Direct Token Acquisition: Purchase SWAP on Gate.com, which provides primary market access, real-time price discovery, and integrated custody solutions through Gate Web3 Wallet.

-

Technical Entry Strategies: Establish positions during consolidation phases following significant rallies, utilizing support levels near $0.047-$0.049 as optimal accumulation zones.

-

Risk-Managed Exit Planning: Establish predetermined profit targets at 30-50% gains and implement protective stop-losses at -15 to -20% losses to enforce disciplined capital preservation.

Cryptocurrency investment carries extreme risk and volatility. This report does not constitute investment advice. All investors must conduct independent research, assess personal risk tolerance, and consult professional financial advisors before making allocation decisions. Never invest capital exceeding your maximum loss threshold.

FAQ

What crypto will 1000x prediction?

DeepSnitch AI is predicted to achieve 1000x returns. It uses advanced AI agents to identify crypto opportunities and risks early. With its presale valuation and real-world utility in trading, DeepSnitch AI stands out as a high-potential candidate for significant growth.

What is the future of $XSwap?

$XSwap is projected to reach $0.120348 by 2027 with a 10.25% growth rate, driven by increasing market adoption and trading volume expansion in the DeFi ecosystem.

Which crypto will give 1000x in 2025?

Predicting exact 1000x returns is speculative. However, emerging tokens with strong fundamentals and community support show potential. Focus on projects with innovative use cases, solid development teams, and growing trading volume rather than relying on price predictions alone.

Which crypto will reach $1000 in 2030?

Several cryptocurrencies like BNB, Ethereum, and Solana have potential to reach $1000 by 2030 based on adoption growth and market expansion. However, price predictions depend on market conditions, technology development, and regulatory environment. No guarantees exist.

TRON ($TRX) AUD Price And Potential

Peer-to-Peer Explained: Cutting Out the Middleman in a Digital World

2025 CRVPrice Prediction: Analyzing Market Trends, Adoption Metrics, and Key Factors Driving Curve DAO Token Valuation

2025 LUNA Price Prediction: Analyzing Market Trends and Growth Potential in the Post-Recovery Era

2025 RESOLV Price Prediction: Analyzing Market Trends and Future Valuation Potential

ENA vs CRO: A Comparative Analysis of Two Leading Genomic Data Repositories

AI Predicts the 10 Cryptos Poised for Growth in 2025 | Expert Insights

What is SMTX: A Comprehensive Guide to Surface Mount Technology X and Its Applications in Modern Electronics Manufacturing

What is SOIL: Understanding the Foundation of Earth's Ecosystems and Agricultural Productivity

What is KONET: A Comprehensive Guide to Korea's National Optical Network Infrastructure

Tether Launches New USDT Payment Method for Citizens in the Philippines