2025 XRP价格预测:区块链支付巨头有望突破10美元大关的潜在因素分析

引言:xrp 的市场地位与投资价值

XRP(XRP)作为加密货币市场中的重要参与者,自2012年诞生以来已经在数字支付领域取得了显著成就。截至2025年,XRP市值已达180261261389.664美元,流通量约59610205486枚,价格维持在3.024美元左右。这种被誉为"银行币"的资产,正在跨境支付和金融科技领域发挥着日益关键的作用。

本文将全面分析XRP 2025-2030年的价格走势,结合历史规律、市场供需、生态发展和宏观经济环境,为投资者提供专业的价格预测和实用的投资策略。

一、XRP 价格历史回顾与市场现状

XRP 历史价格演变轨迹

- 2014年:XRP 首次上市交易,价格最低达到 0.00268621 美元

- 2017年:加密货币牛市,价格大幅上涨

- 2025年:XRP 创下历史新高 3.65 美元

XRP 当前市场态势

截至2025年9月9日,XRP当前价格为3.024美元,24小时交易量为200,895,950.755014美元。过去24小时内,XRP价格上涨了3.98%。XRP目前市值排名第3位,总市值为302,357,083,458.528美元,流通市值为180,261,261,389.664美元。XRP的市场占有率为7.26%。

当前XRP价格较历史最高点3.65美元有所回落,但仍保持在较高水平。过去一年XRP价格涨幅显著,达到471.61%。短期内,XRP在过去7天上涨了8.3%,显示出较强的上升动能。然而,30天价格走势呈现-5.050%的下跌,表明近期可能存在一定回调压力。

目前XRP的流通量为59,610,205,486枚,占总供应量的59.61%。最大供应量设定为100,000,000,000枚。XRP在80家交易所上市交易,持有者数量达到6,958,554。

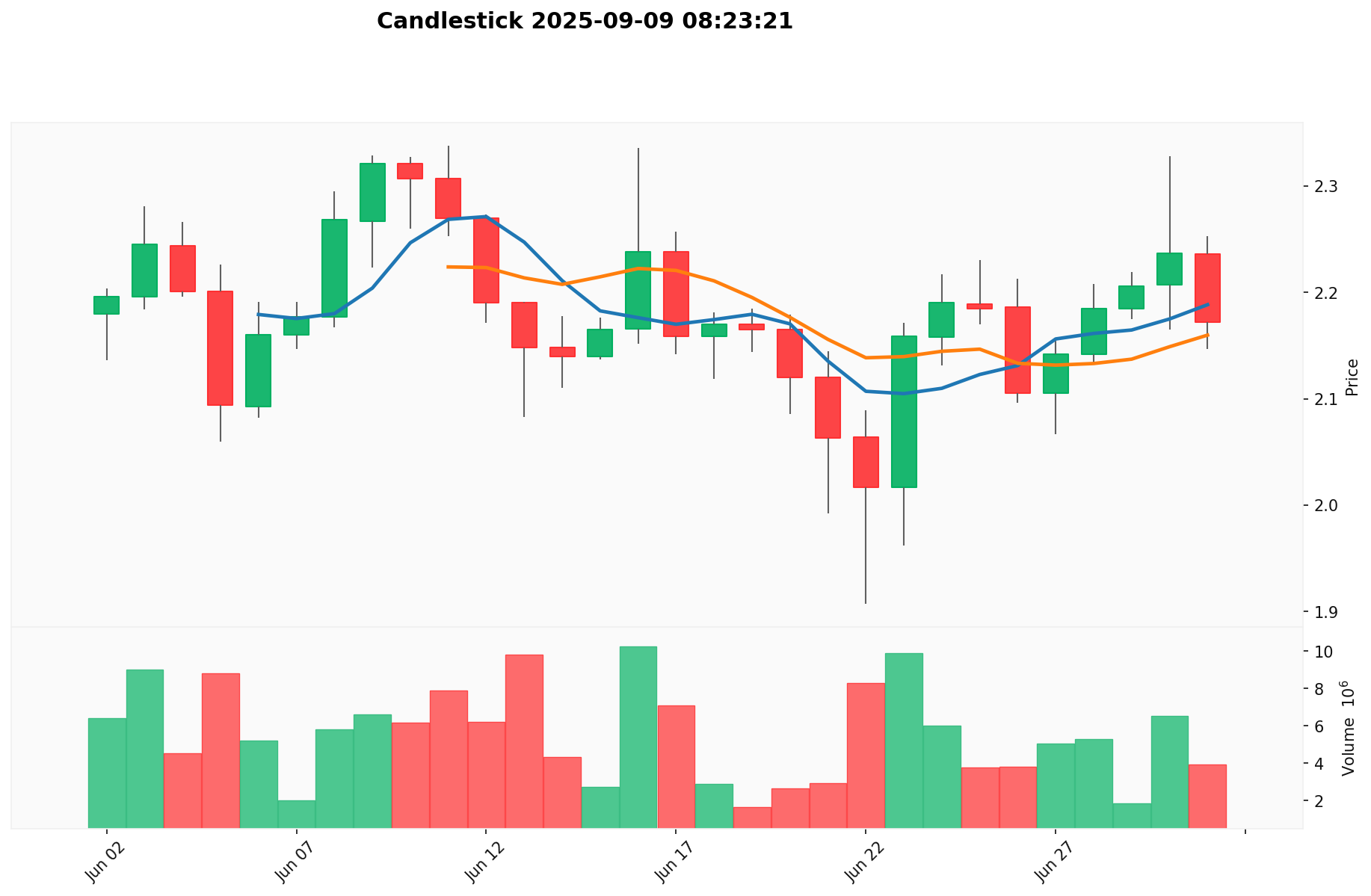

点击可查看当前 XRP 市场价格

xrp 市场情绪指标

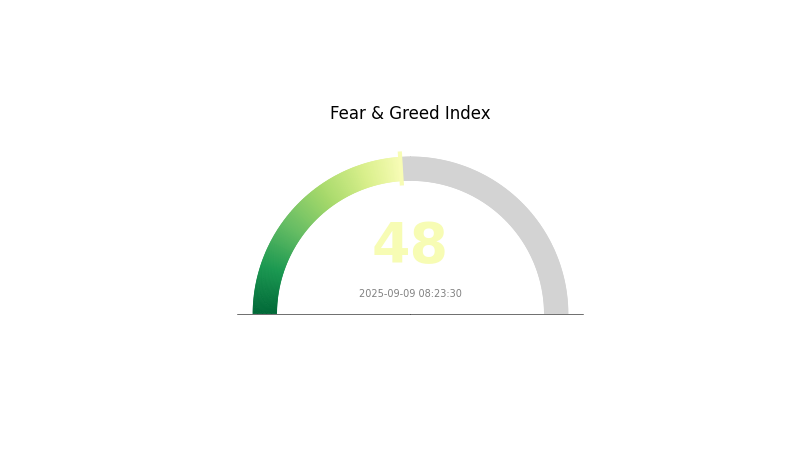

2025-09-09 恐惧与贪婪指数:48(正常)

点击可查看当前恐慌&贪婪指数

今日xrp市场情绪呈现中性状态,恐惧与贪婪指数为48,处于相对平衡的位置。这表明市场参与者对当前行情持谨慎乐观态度,既没有过度恐慌,也没有盲目乐观。投资者似乎在观望中寻找机会,既不急于抛售,也不急于大举买入。这种平衡状态可能预示着市场即将迎来新的变化,建议投资者密切关注市场动向,做好风险管理。

xrp 持仓分布

地址持仓分布图反映了 xrp 在不同钱包地址中的分布情况,展示了资产集中度和所有权结构。从当前数据来看,xrp 呈现出一定程度的集中化特征。前五大地址各持有 5% 的 xrp 供应量,共计占总量的 25%,而其余 75% 分布在其他地址中。

这种集中度虽然不算极端,但仍值得关注。前五大地址拥有相当大的市场影响力,可能对价格走势产生显著影响。然而,75% 的供应量分散在其他地址中,在一定程度上平衡了市场结构,有助于维持一定的流动性和价格稳定性。

总体而言,xrp 当前的地址分布反映出一个相对平衡的市场结构。虽然存在一定程度的集中,但并未达到过度集中的程度。这种分布有利于维持市场的多元化,同时也为潜在的大规模交易提供了足够的流动性支持。

点击可查看当前 xrp 持仓分布

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | rB3WNZ...oqscPn | 5000000.23K | 5.00% |

| 2 | r9UUEX...M6HiYp | 5000000.22K | 5.00% |

| 3 | rDdXiA...CFWeCK | 5000000.22K | 5.00% |

| 4 | rMhkqz...6bDyb1 | 5000000.21K | 5.00% |

| 5 | r9NpyV...BdsEN3 | 5000000.20K | 5.00% |

| - | Others | 74999998.92K | 75% |

二、影响 xrp 未来价格的核心因素

供应机制

- 固定总量:XRP 的最大供应量为 1000 亿枚,目前流通量约为 596 亿枚。

- 当前影响:有限的供应可能在需求增加时推动价格上涨。

机构与大户动态

- 机构持仓:多家知名投资机构如 Arrington XRP Capital、Galaxy Digital、a16z 和 Pantera Capital 等都持有 XRP。

- 企业采用:XRP 被定位为企业解决方案,可能吸引更多企业使用。

- 国家政策:XRP 被列入"美国战略加密储备",可能影响其未来发展。

宏观经济环境

- 通胀对冲属性:作为加密货币,XRP 可能被视为对冲通胀的工具。

技术发展与生态建设

- 生态应用:XRP 生态系统正在不断发展,包括各种基于 XRP Ledger 的应用。

三、2025-2030年 NEAR 价格预测

2025年展望

- 保守预测:2.29748美元至3.023美元

- 中性预测:3.023美元至4.05082美元

- 乐观预测:4.05082美元以上(需市场整体向好)

2027-2028年展望

- 市场阶段预期:持续增长阶段

- 价格区间预测:

- 2027年:3.0854234385美元至5.07192894美元

- 2028年:4.4632974672美元至6.27651206325美元

- 关键催化剂:市场需求增加、技术升级

2030年长期展望

- 基准情景:3.742626027463537美元至6.036493592683125美元(假设市场稳定增长)

- 乐观情景:6.036493592683125美元至6.7608728238051美元(假设市场大幅增长)

- 变革情景:6.7608728238051美元以上(极端利好条件下)

- 2030-09-09:NEAR 6.036493592683125美元(稳定增长)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4.05082 | 3.023 | 2.29748 | 0 |

| 2026 | 4.9163049 | 3.53691 | 2.0160387 | 16 |

| 2027 | 5.07192894 | 4.22660745 | 3.0854234385 | 39 |

| 2028 | 6.27651206325 | 4.649268195 | 4.4632974672 | 53 |

| 2029 | 6.61009705624125 | 5.462890129125 | 3.98790979426125 | 80 |

| 2030 | 6.7608728238051 | 6.036493592683125 | 3.742626027463537 | 99 |

四、XRP 专业投资策略与风险管理

XRP 投资方法论

(1)长期持有策略

- 适合人群:看好 XRP 长期发展前景的投资者

- 操作建议:

- 定期定额购买,分散投资时点

- 关注 XRP 生态系统发展和应用落地情况

- 使用硬件钱包等冷存储方案保管资产

(2)主动交易策略

- 技术分析工具:

- 移动平均线:观察短期和长期均线的交叉情况

- RSI 指标:判断超买超卖区间

- 波段操作要点:

- 关注重要支撑位和阻力位

- 结合成交量分析市场情绪

XRP 风险管理框架

(1)资产配置原则

- 保守投资者:5% 以下

- 积极投资者:10-15%

- 专业投资者:根据市场情况动态调整,不超过 30%

(2)风险对冲方案

- 资产多元化:配置其他加密资产和传统资产

- 止损策略:设置合理的止损位

(3)安全存储方案

- 硬件钱包推荐:Ledger、Trezor 等知名品牌

- 软件钱包方案:选择知名度高、安全性强的多签名钱包

- 安全注意事项:妥善保管私钥,警惕钓鱼网站和社交工程攻击

五、XRP 潜在风险与挑战

XRP 市场风险

- 价格波动:加密货币市场波动剧烈,XRP 价格可能出现大幅波动

- 流动性风险:在极端市场条件下可能面临流动性不足的问题

- 竞争风险:其他支付类加密货币可能对 XRP 构成竞争压力

XRP 监管风险

- 法律地位:各国对 XRP 的监管态度可能影响其使用和流通

- 合规要求:金融机构使用 XRP 可能面临合规挑战

- 政策变动:监管政策的突然变化可能影响 XRP 的市场表现

XRP 技术风险

- 网络安全:XRP Ledger 可能面临黑客攻击或技术漏洞

- 扩容问题:随着用户增加,可能需要进一步提高交易处理能力

- 去中心化程度:相比其他加密货币,XRP 的去中心化程度较低

六、结论与行动建议

XRP 投资价值评估

XRP 作为快速、低成本的跨境支付解决方案具有长期发展潜力,但短期内可能面临监管不确定性和市场波动风险。投资者需权衡其技术优势与潜在风险。

XRP 投资建议

✅ 新手:从小额投资开始,学习 XRP 的基本原理和市场动态

✅ 经验投资者:根据风险承受能力设定合理的仓位,关注行业发展和监管动向

✅ 机构投资者:深入研究 XRP 的应用场景和市场需求,评估长期投资价值

XRP 交易参与方式

- 中心化交易所:通过 Gate.com 等平台直接购买 XRP

- 去中心化交易所:使用支持 XRP 的 DEX 进行交易

- 场外交易(OTC):适合大额交易,可减少对市场的影响

加密货币投资风险极高,本文不构成投资建议。投资者应根据自身风险承受能力谨慎决策,建议咨询专业财务顾问。永远不要投资超过你能承受损失的资金。

2025 XRP价格预测:区块链支付技术的未来发展与潜在投资回报分析

XRP's SEC Lawsuit is over?

What Are the Key Factors Driving XRP's Fundamental Analysis in 2025?

TEER vs XRP: Battle of the Blockchain Titans in Cross-Border Payments

Is XRP (XRP) a good investment?: Analyzing the potential and risks of Ripple's cryptocurrency in 2023

How to Evaluate a Crypto Project's Fundamentals in 5 Key Areas?

Mastering the Closure of Vertical Call Spreads in Digital Asset Trading

Mastering Options: An In-depth Look at Crypto Loss Spread Strategies

Understanding the Role of Hard Spoon in Blockchain Technology

Understanding KYC in the Blockchain Ecosystem

Tomarket Daily Combo 20 december 2025