2025 ZEUS Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: ZEUS's Market Position and Investment Value

ZEUS (Zeus Network) serves as a cross-chain communication layer implemented on the Solana Virtual Machine (SVM), designed to introduce Bitcoin liquidity to Solana through its first DApp, APOLLO. Since its launch in April 2024, ZEUS has established itself as an innovative infrastructure solution in the blockchain ecosystem. As of December 21, 2025, ZEUS has achieved a market capitalization of approximately $18.02 million, with a circulating supply of 788,092,181 ZEUS tokens trading at $0.01802 per unit. This infrastructure asset is playing an increasingly critical role in facilitating cross-chain interoperability and expanding decentralized finance capabilities.

This article will comprehensively analyze ZEUS's price trends and market dynamics, combining historical performance patterns, market supply-demand dynamics, ecosystem development progress, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies for the period through 2030.

I. ZEUS Price History Review and Current Market Status

ZEUS Historical Price Evolution Trajectory

- April 2024: Zeus Network reached its all-time high (ATH) of $1.1485, marking the peak of investor enthusiasm since the project's launch.

- December 2025: The token experienced a significant decline, reaching its all-time low (ATL) of $0.01716 on December 18, 2025, representing a sharp correction from historical peaks.

ZEUS Current Market Situation

As of December 21, 2025, Zeus Network (ZEUS) is trading at $0.01802, reflecting a 24-hour decline of -2.43%. Over the past week, the token has experienced a more pronounced downward pressure with a -19.24% decrease. The one-year performance shows a substantial loss of -97.82%, indicating severe underperformance since its launch price.

The token maintains a market capitalization of approximately $14.2 million with a fully diluted valuation (FDV) of $18.02 million. The circulating supply stands at 788,092,181.68 ZEUS tokens out of a maximum supply of 1 billion tokens, representing a circulation ratio of 78.81%. Daily trading volume is recorded at $97,994.55, with the token listed on 22 exchanges.

Current market sentiment reflects extreme fear conditions (VIX: 20), suggesting heightened risk aversion across the cryptocurrency sector. The 24-hour price range fluctuated between $0.0179 and $0.01938, with the token currently near the lower end of this range.

Click to view current ZEUS market price

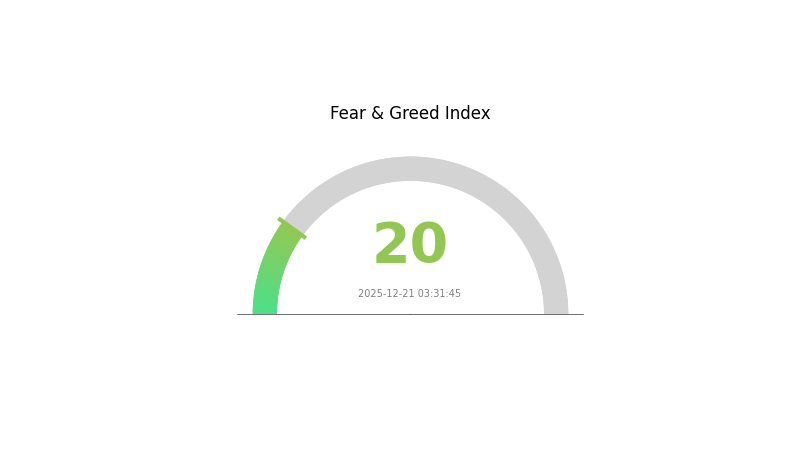

ZEUS Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently in a state of extreme fear, with the sentiment index reaching 20. This indicates significant market pessimism and heightened investor anxiety. During such periods, market volatility tends to increase as traders react to negative catalysts or broader economic concerns. Extreme fear conditions often present contrarian opportunities for long-term investors, as assets may be oversold. However, caution is warranted as further downside risks may persist. Monitor key support levels and maintain proper risk management strategies. Consider this environment as a potential accumulation phase for quality assets, while staying alert to market developments and fundamental changes in the crypto landscape.

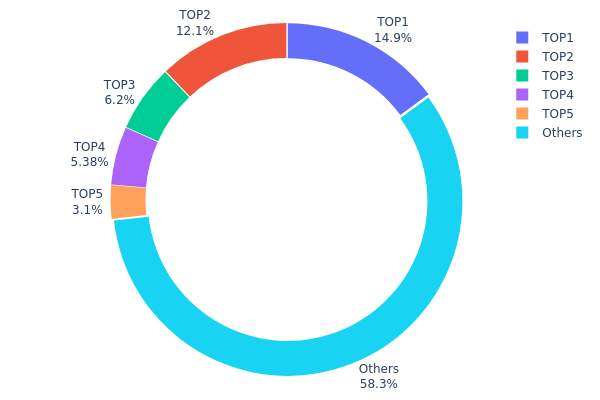

ZEUS Holdings Distribution

The address holdings distribution represents the concentration of ZEUS tokens across the blockchain's top wallet addresses, providing critical insight into the token's decentralization level and potential vulnerability to coordinated selling pressure or market manipulation. By analyzing how token supply is distributed among individual addresses, investors and analysts can assess the degree of concentration risk and evaluate the overall health of the token's ecosystem structure.

Current distribution data reveals a moderate concentration pattern in ZEUS's holder base. The top five addresses collectively control approximately 41.66% of the total token supply, with the largest holder commanding 14.90% of all circulating ZEUS tokens. The second-largest address holds 12.10%, followed by progressively smaller positions of 6.19%, 5.38%, and 3.09% respectively. This tiered distribution structure indicates that while significant ownership is concentrated among a limited number of addresses, the majority of tokens—58.34%—remain distributed among numerous smaller holders classified in the "Others" category.

The concentration level observed in ZEUS presents a balanced but cautiously optimistic decentralization profile. Unlike tokens with extreme concentration where top addresses exceed 30-40% of supply individually, ZEUS demonstrates no single dominant holder that poses an immediate systemic risk. However, the cumulative stake of the top five addresses warrants monitoring, as coordinated actions among these major stakeholders could substantially influence price dynamics. The substantial proportion held by dispersed smaller holders strengthens network resilience and reduces single-point-of-failure risks, suggesting a relatively mature distribution pattern that supports long-term market stability and organic price discovery mechanisms.

Click to view current ZEUS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Cpo9j...J93Zur | 149021.06K | 14.90% |

| 2 | 47ruHo...FX62n8 | 121042.11K | 12.10% |

| 3 | 8Cphks...p4LHiR | 61957.89K | 6.19% |

| 4 | C68a6R...XFdqyo | 53805.05K | 5.38% |

| 5 | FW6Nr6...MfaSMi | 30978.94K | 3.09% |

| - | Others | 583190.66K | 58.34% |

Core Factors Affecting ZEUS Future Price

Market Volatility and Liquidity Risks

-

High Price Volatility: ZEUS is susceptible to dramatic price fluctuations due to market conditions and investor sentiment, making it a high-risk asset for traders.

-

Insufficient Liquidity: Large transactions may encounter liquidity bottlenecks, potentially causing slippage and affecting price stability during significant trading volumes.

Competitive Pressure

- Cross-Chain Competition: Other cross-chain solutions may impact ZEUS's market share and adoption rates, presenting competitive challenges to the network's growth trajectory.

Centralization and Operational Risks

- Token Contract Centralization: The ZEUS token contract contains owner control functions, which increases centralization risks and operational control concerns that could affect investor confidence and price movements.

Investor Sentiment

- Market Confidence Impact: Investor sentiment and confidence directly influence ZEUS price movements. Market perception regarding the project's fundamentals and adoption potential plays a significant role in determining price direction.

Macroeconomic Factors

- Macroeconomic Influence: Future price volatility is expected to be significantly impacted by broader macroeconomic factors, which could cause substantial price swings in 2025 and beyond.

III. 2025-2030 ZEUS Price Forecast

2025 Outlook

- Conservative Forecast: $0.0131

- Neutral Forecast: $0.01794

- Bullish Forecast: $0.02601

2026-2027 Medium-term Outlook

- Market Phase Expectation: Early growth phase with gradual accumulation and market recognition expansion

- Price Range Forecast:

- 2026: $0.01758 - $0.02681

- 2027: $0.01268 - $0.02732

- Key Catalysts: Ecosystem development milestones, increased adoption metrics, and strengthened market liquidity

2028-2030 Long-term Outlook

- Base Case Scenario: $0.015 - $0.03336 (assuming steady ecosystem growth and moderate market adoption)

- Optimistic Scenario: $0.02754 - $0.04393 (assuming accelerated partnership announcements and institutional interest)

- Transformational Scenario: $0.04393+ (extreme positive conditions including major protocol upgrades and widespread integration across decentralized finance platforms)

- Expected Price Trajectory: ZEUS demonstrates a cumulative appreciation of approximately 71% from 2025 baseline by 2030, reflecting sustained market confidence and ecosystem maturation

Trading Recommendation: Monitor price movements on Gate.com for optimal entry and exit points aligned with the outlined forecast scenarios.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02601 | 0.01794 | 0.0131 | 0 |

| 2026 | 0.02681 | 0.02198 | 0.01758 | 21 |

| 2027 | 0.02732 | 0.02439 | 0.01268 | 35 |

| 2028 | 0.03336 | 0.02586 | 0.015 | 43 |

| 2029 | 0.03227 | 0.02961 | 0.01628 | 64 |

| 2030 | 0.04393 | 0.03094 | 0.02754 | 71 |

ZEUS Investment Strategy and Risk Management Report

IV. ZEUS Professional Investment Strategy and Risk Management

ZEUS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with high risk tolerance who believe in the long-term potential of cross-chain solutions and Bitcoin liquidity bridges to Solana

- Operational recommendations:

- Accumulate ZEUS tokens during market downturns, particularly when prices fall below the 30-day moving average

- Hold positions through market cycles while monitoring the development progress of the APOLLO DApp

- Reinvest any rewards from staking activities to compound your position

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price volatility indicators: Monitor the 24-hour trading range ($0.0179 to $0.01938) to identify entry and exit points

- Trend analysis: Track weekly performance patterns, as ZEUS experienced a -19.24% decline over 7 days as of December 21, 2025

- Trading operation key points:

- Utilize Gate.com's advanced trading pairs to identify arbitrage opportunities across different market conditions

- Set strict stop-loss orders at 10-15% below entry points given the token's historical volatility (down -97.82% over 1 year)

ZEUS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of portfolio allocation

- Active investors: 2-5% of portfolio allocation

- Professional investors: 5-10% of portfolio allocation

(2) Risk Hedging Solutions

- Portfolio diversification: Balance ZEUS holdings with established cryptocurrencies and stablecoins to mitigate concentration risk

- Position sizing: Never allocate more capital than you can afford to lose, given the project's speculative nature and early-stage development status

(3) Secure Storage Solutions

- Hot wallet option: Gate.com Web3 Wallet for active traders requiring frequent transactions and portfolio management

- Cold storage method: Transfer long-term holdings to self-custody solutions for enhanced security against exchange risks

- Security considerations: Enable two-factor authentication on all exchange accounts, use hardware security keys, and never share private keys or recovery phrases

V. ZEUS Potential Risks and Challenges

ZEUS Market Risk

- Extreme price volatility: The token has declined 97.82% from its peak, reflecting significant valuation adjustments and market sentiment shifts

- Low trading liquidity: With 24-hour volume of approximately $97,994.55 against a market cap of $14.2 million, liquidity concentration poses slippage risks for large transactions

- Market adoption uncertainty: Success depends entirely on the APOLLO DApp's ability to successfully bridge Bitcoin liquidity to Solana, which remains unproven

ZEUS Regulatory Risk

- Cross-chain regulatory ambiguity: As a cross-chain communication layer, ZEUS may face evolving regulatory scrutiny from multiple jurisdictions

- Decentralized asset handling: Regulatory frameworks governing bridge protocols and wrapped assets continue to develop, creating compliance uncertainty

- Jurisdictional enforcement: Different regulatory approaches in major markets could impact the project's operational capacity

ZEUS Technology Risk

- Cross-chain bridge security: Implementing secure cross-chain communication requires sophisticated cryptography and continuous security audits

- Smart contract vulnerabilities: Any bugs or exploits in the APOLLO DApp or underlying protocol could result in significant financial losses for users

- Scalability challenges: Maintaining performance and security while scaling cross-chain operations remains an ongoing technical challenge

VI. Conclusion and Action Recommendations

ZEUS Investment Value Assessment

Zeus Network represents a speculative investment in the cross-chain infrastructure space. The project's core value proposition—introducing Bitcoin liquidity to Solana through the APOLLO DApp—addresses a legitimate market need. However, the token's 97.82% decline from its all-time high of $1.1485 to current levels around $0.018 suggests significant market skepticism regarding execution or commercial viability. The circulating supply of 788 million tokens represents 78.81% of the total 1 billion cap, indicating substantial dilution risk. Investors should treat ZEUS as a high-risk, speculative holding rather than a core portfolio component.

ZEUS Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of portfolio) through Gate.com to understand cross-chain dynamics, with strict stop-loss orders and educational focus on bridge protocol risks

✅ Experienced investors: Consider 2-5% allocation during confirmed support levels, combining technical analysis with fundamental monitoring of APOLLO DApp development milestones and total value locked metrics

✅ Institutional investors: Conduct comprehensive due diligence on tokenomics, developer team credentials, and legal compliance before any allocation; consider derivative strategies to manage downside exposure

ZEUS Trading Participation Methods

- Spot trading: Purchase ZEUS directly on Gate.com's spot markets for straightforward long-term holding

- Limit orders: Set automated buy orders at key technical support levels to optimize entry timing

- DCA (Dollar-Cost Averaging): Invest fixed amounts at regular intervals to reduce timing risk and average out volatility

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose. Past performance does not guarantee future results.

FAQ

What is the price prediction for Zeus in 2030?

Zeus is forecasted to reach approximately $0.000000003337 in early March 2030, with potential fluctuations throughout the year. This projection is based on current market analysis and historical trend data.

How much is a Zeus coin worth?

As of December 21, 2025, Zeus coin is trading at $0.0000000001949 USD. The 24-hour trading amount reaches $143,164.19 USD, reflecting active market participation in this ultra-low-cap digital asset.

What factors influence Zeus cryptocurrency price predictions?

Zeus price predictions are influenced by supply and demand dynamics, block reward changes, protocol updates, market sentiment, trading volume, and real-world adoption rates. These factors collectively shape price movements and market trends.

Is Zeus a good investment for long-term price growth?

Zeus demonstrates strong long-term potential driven by favorable market fundamentals and growing demand. With solid technical indicators and positive momentum, Zeus is positioned for sustained price appreciation over time.

What is the historical price performance of Zeus coin?

Zeus Network demonstrated volatility in recent months. In late October 2025, prices ranged from $0.0627 to $0.07836, with fluctuations around $0.06836-$0.07096. The coin showed consistent trading activity with weekly price variations, reflecting typical market dynamics in the crypto sector.

Will Crypto Recover in 2025?

Will Crypto Recover ?

Is Zeta Markets (ZEX) a Good Investment?: Analyzing Growth Potential and Risks in the DeFi Options Market

2025 ZEXPrice Prediction: Analyzing Market Trends and Expert Forecasts for the Future of ZEX Token

How to Conduct a Competitive Analysis for Crypto Projects in 2025?

2025 JUP Price Prediction: Analyzing Market Trends and Potential Growth Factors for Jupiter's Native Token

Promising Crypto Tokens for December 2024 Investments

Explore Owlto Finance's Efficient Multi-Chain Transfers and New OWL Listing Date

Understanding Pledge Mining: Maximize Your Rewards in the Web3 Ecosystem

A Detailed Analysis of Cryptocurrency Mining Principles and Mechanisms

Unlocking Crypto Payment Solutions: How SPY Connects Digital Currency with Everyday Shopping