The Rise of Machine Economy: How Web3 is Enabling Robots to Operate as Autonomous Systems

Introduction

In recent years, the robotics industry has reached a twisting point in both technology and commercial paradigms. Traditionally, robots were largely viewed as “tools”—dependent on centralized enterprise scheduling systems, incapable of autonomous collaboration, and lacking any form of economic agency. However, with the convergence of AI Agents, on-chain payments (x402), and the emerging Machine Economy, the robotics ecosystem is rapidly evolving. Competition is no longer limited to hardware capabilities alone, but is transforming into a multi-layered, complex system composed of “physical embodiment, intelligence, payments, and organizational structures”.

What makes this shift even more noteworthy is that global capital markets are now rapidly pricing in this trend. Morgan Stanley projects that by 2050, the humanoid robot market could reach $5 trillion, while driving massive growth across supply chains, operations, and service industries. In the same timeframe, the number of humanoid robots deployed globally could exceed 1 billion units, marking a transition from industrial equipment to “truly large-scale social participants.” (1)

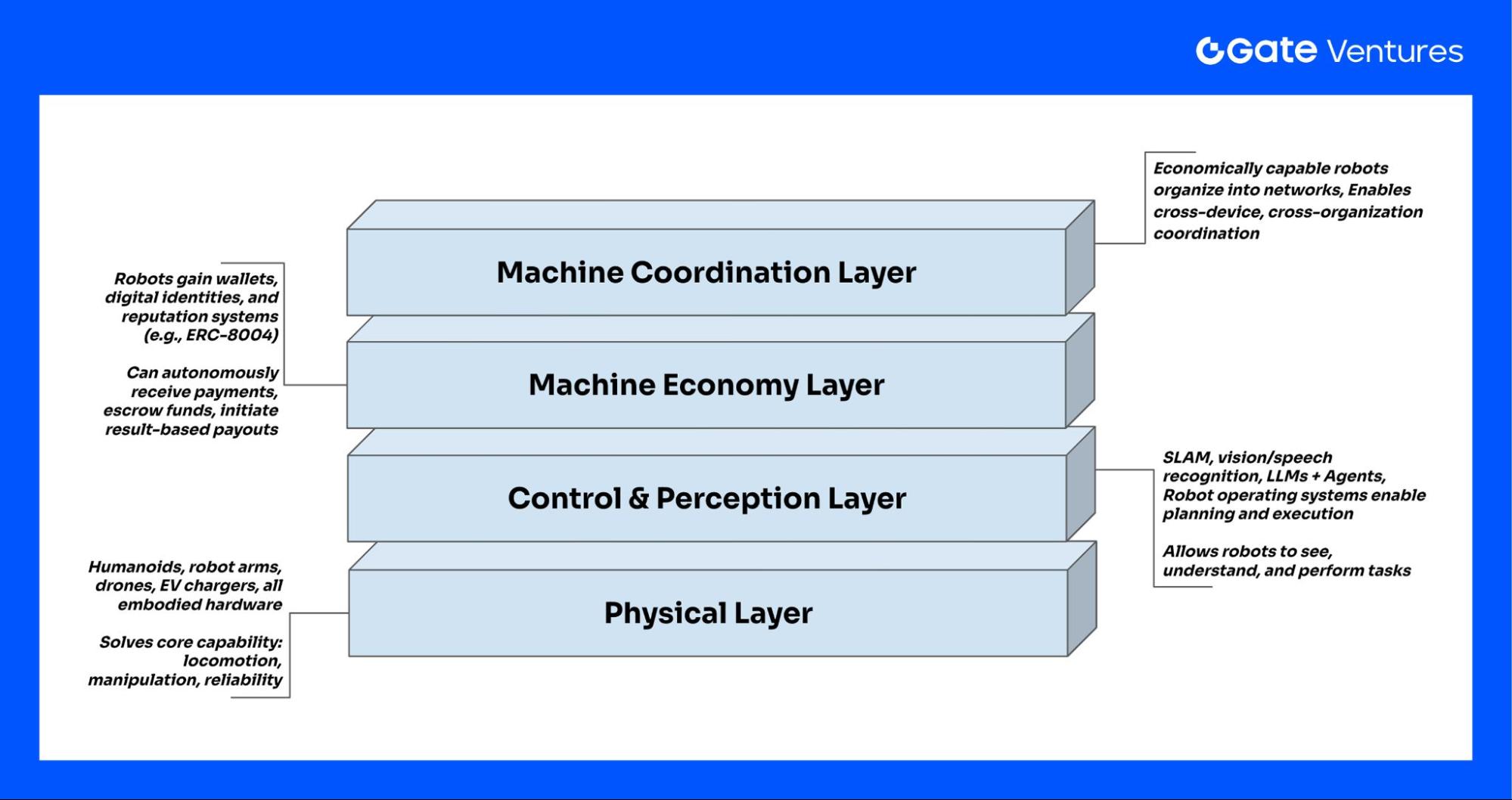

To better understand the future trajectory of robotics, the ecosystem can be viewed as four clearly defined layers:

Source: Gate Ventures

- Physical Layer: The Physical Layer includes all embodied carriers such as humanoid robots, robotic arms, drones, and EV charging robots. This layer addresses fundamental questions like “Can it move?” and “Can it perform physical work?”—covering locomotion, manipulation, mechanical reliability, and cost efficiency. At this stage, robots still lack economic agency: they cannot receive payments, purchase services, or manage resources autonomously.

- Control & Perception Layer: The Control & Perception Layer spans traditional robotics control systems, SLAM, perception systems, speech and vision recognition, and today’s LLM + Agent architectures, along with advanced robot operating systems such as ROS and OpenMind OS. This layer enables robots to “see, hear, understand, and execute tasks”, but economic activities, such as payments, contracts, and identity management—still require human intervention in the background.

- Machine Economy Layer: The true transformation begins at the Machine Economy Layer. Here, machines are equipped with wallets, digital identities, and reputation systems (e.g., ERC-8004). Through mechanisms like x402, on-chain settlement, and on-chain callbacks, robots can directly pay for compute, data, energy, and access rights. They can also autonomously receive payments, escrow funds, and initiate result-based payments. At this stage, robots transition from being “corporate assets” to becoming “economic entities” capable of market participation.

- Machine Coordination & Governance Layer: Once robots possess autonomous identities and payment capabilities, they can organize into fleets and networks, such as drone swarms, cleaning robot networks, or EV energy networks. These systems can dynamically price services, schedule tasks, bid for work, share revenue, and even form DAO-based autonomous economic collectives.

Through these four layers, we can see that:

The future of robotics is not merely a hardware revolution, it represents a systemic restructuring of “physical systems, intelligence, finance, and organizational models”.

This evolution redefines not only what machines can do, but also how value is created and captured. Robotics firms, AI developers, infrastructure providers, and crypto-native payment and identity protocols will all find their place in this emerging machine-driven economy.

Why Is the Robotics Industry Taking Off Now?

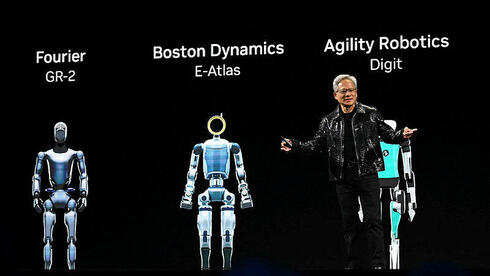

For decades, robotics oscillated between labs, exhibitions, and niche industrial use cases—always just one step away from mass adoption. Post-2025, that final step is being crossed. Capital markets, technology readiness, and insights from industry leaders, such as NVIDIA CEO Jensen Huang, all point to the same conclusion:

“The ChatGPT moment for general robotics is just around the corner.”

This is not marketing hype, but a conclusion grounded in three converging signals:

- Simultaneous maturation of enabling technologies: compute, models, simulation, perception, and control

- A shift from closed-loop control to LLM/Agent-driven open decision-making

A leap from single-machine capability to system-level intelligence: robots are evolving from merely being able to “act” to being able to “collaborate, reason, and operate economically”

Jensen Huang further predicts that humanoid robots will enter widespread commercial use within five years, aligning closely with real-world industry deployments and capital flows in 2025.

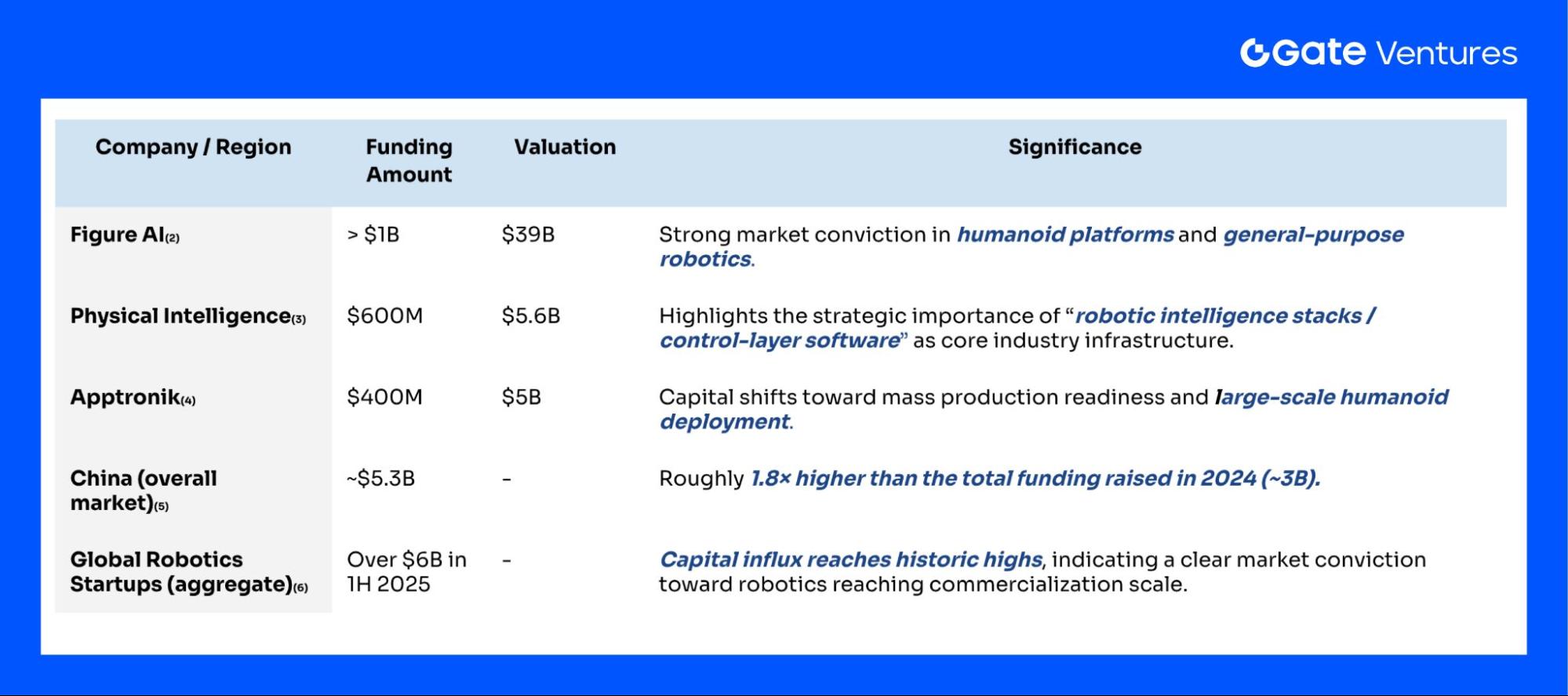

Capital Perspective: The “Robotics Inflection Point” Is Priced In

Between 2024 and 2025, the robotics sector experienced unprecedented funding density and deal size. In 2025 alone, multiple funding rounds exceeded $500 million to $1 billion, surpassing total funding from previous years.

Source: Gate Ventures

Capital markets have made their position clear: robotics has entered an investment-verifiable stage.

Common traits across these funding rounds include:

- They are not “concept-driven investments”, but are focused on production lines, supply chains, general intelligence, and real-world commercial deployment.

- Rather than isolated projects, they emphasize integrated hardware–software stacks, full-stack architectures, and end-to-end robotic lifecycle service systems.

Capital does not commit at the scale of tens or hundreds of billions without reason—these investments reflect strong conviction in the industry’s growing maturity.

Technology Perspective: Multiple Breakthroughs Converge

In 2025, robotics experienced an unprecedented “convergence of technological breakthroughs”. Advances in AI Agents and LLMs upgraded robots from instruction-following machines to “understanding agents” capable of reasoning across language, vision, and touch. Multimodal perception and next-generation control models (e.g., RT-X, Diffusion Policy) laid the groundwork for near-general intelligence.

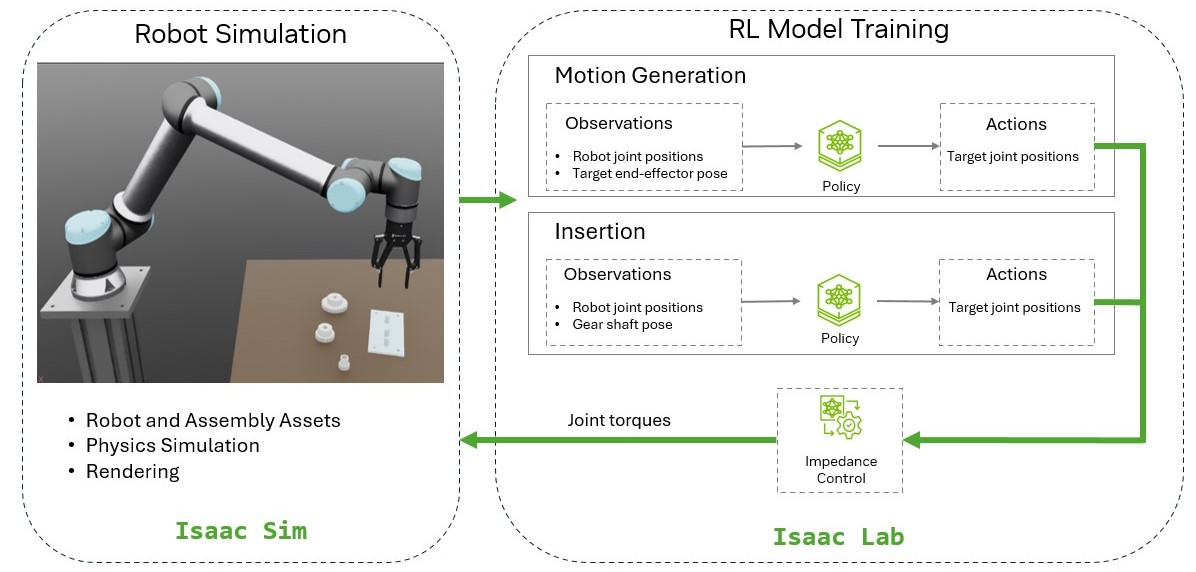

Source: Nvidia

Meanwhile, simulation and transfer technologies are rapidly maturing. High-fidelity simulation environments such as Isaac and Rosie have significantly narrowed the Sim-to-Real gap, enabling robots to undergo large-scale training in virtual environments at extremely low cost and reliably transfer those capabilities to the real world. This fundamentally addresses long-standing bottlenecks in robotics, including slow learning cycles, high data acquisition costs, and the elevated risks associated with training in real-world environments.

On the hardware side, economies of scale in motors, joints, and sensors—combined with China’s rising dominance in the robotics supply chain—significantly reduced costs. As mass production ramps up, robots have become “replicable and deployable” at scale.

Crucially, improvements in reliability and energy efficiency have enabled robots to meet the minimum requirements for commercial deployment. Enhanced motor control, redundant safety systems, and real-time operating systems now allow robots to operate stably over long periods in enterprise-grade environments.

Taken together, these factors have enabled the robotics industry— for the first time— to move beyond the “laboratory demo” stage and toward large-scale, real-world deployment. This is the fundamental reason why the robotics boom is unfolding right now.

Commercialization: From Prototypes → Mass Production → Real-World Deployment

2025 marks the first year in which the commercialization path of robotics becomes truly clear. Leading companies such as Apptronik, Figure, and Tesla Optimus have successively announced mass-production plans, signaling that humanoid robots are transitioning from prototype models to reproducible, industrialized products. At the same time, enterprises have begun pilot deployments in high-demand scenarios such as warehousing logistics and factory automation, validating robots’ efficiency and reliability in real-world environments.

As hardware manufacturing scales up, the Operations-as-a-Service (OaaS) model has gained market validation. Instead of paying high upfront purchase costs, enterprises can subscribe to robotic services on a monthly basis, significantly improving ROI structures. This model has become a key commercial innovation driving large-scale robot adoption.

Meanwhile, the industry is rapidly filling gaps in supporting service infrastructure, including maintenance networks, spare parts supply chains, remote monitoring, and operations platforms. As these capabilities mature, robots are increasingly equipped with the conditions required for sustained operations and closed-loop commercialization.

Overall, 2025 is a milestone year—the robotics industry shifts from asking “Can this be built?” to “Can this be sold, deployed, and affordably used?” For the first time, a sustainable and positive commercialization cycle has emerged.

Web3 × Robotics Ecosystem

As the robotics industry enters full-scale expansion in 2025, blockchain technology has also found a clear role—supplementing several critical capabilities within the robotic ecosystem. These can be summarized into three core directions: i) Data collection for robotics; ii) Cross-device machine coordination networks; iii) Machine economy networks enabling autonomous market participation.

Decentralization + Token Incentives: New Data Sources for Robot Training

A major bottleneck in training Physical AI models lies in the scarcity of large-scale, diverse, and high-quality real-world interaction data. The emergence of DePIN / DePAI introduces new Web3 solutions to the questions of who contributes data and how sustained contributions are incentivized.

However, academic research consistently shows that decentralized data is not inherently high-quality training data. Backend data engines remain essential for filtering, cleaning, and bias control before such data can be used for large-scale model training.

In essence, Web3 solves the “data supply incentive” problem—not the “data quality” problem itself.

Traditional robot training data has been limited to laboratories, small fleets, or internal enterprise collection, resulting in severe scalability constraints.

DePIN/DePAI models leverage token incentives to mobilize everyday users, device operators, and remote controllers as data contributors, dramatically expanding data scale and diversity.

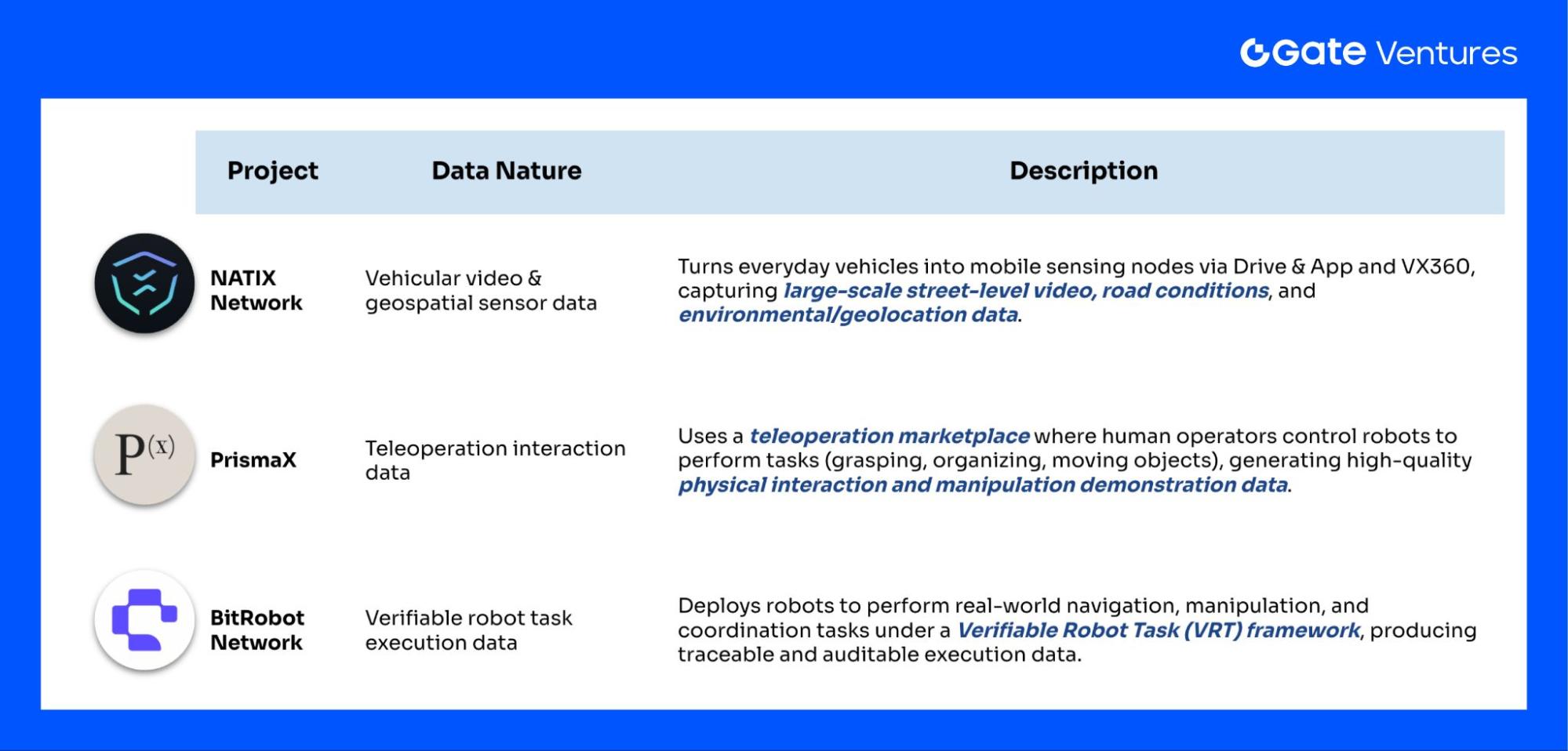

Representative projects include:

- NATIX Network: Converts everyday vehicles into mobile data nodes via Drive& App and VX360, collecting video, geospatial, and environmental data.

- PrismaX: Gathers high-quality physical interaction data (grasping, organizing, object movement) through a remote-control marketplace.

- BitRobot Network: Enables robot nodes to perform Verifiable Robot Tasks (VRT), generating real navigation, operation, and collaboration data.

These initiatives demonstrate how Web3 can effectively expand the data supply side, covering real-world and long-tail scenarios that traditional systems struggle to reach.

However, academic research indicates that crowdsourced or decentralized data typically exhibit structural characteristics such as limited accuracy, high noise levels, and notable bias. Extensive studies in crowdsourcing and mobile crowdsensing have shown that:

1. Large variance in data quality, noise, and format inconsistency

Significant contributor-based discrepancies require detection and filtering.

2.Structural bias is widespread

Participants tend to cluster in specific regions or demographic groups, resulting in sampling distributions that do not accurately reflect real-world conditions.

3. Raw crowdsourced data cannot be used directly for model training

Research in autonomous driving, embodied AI, and robotics emphasizes that high-quality datasets must undergo a full pipeline: collection → quality review → redundancy alignment → data augmentation → long-tail completion → label consistency correction, rather than “collect and use”.

Therefore, Web3 expands data availability, but whether that data becomes trainable depends on backend data engineering.

The real value of DePIN lies in providing “continuous, scalable, and lower-cost” data infrastructure for Physical AI.

Rather than saying Web3 immediately solves data accuracy challenges, it is more accurate to say that it addresses the following fundamental questions:

Who is willing to contribute data on a long-term basis?

How can more real-world devices be incentivized to participate?

How can data collection evolve from centralized models to a sustainable, open network?

In other words, DePIN/DePAI provides the foundation for scalable data volume and broader coverage, positioning Web3 as a critical piece of the data sourcing layer in the Physical AI era—but it is not, by itself, a guarantee of data quality.

General-Purpose OS as the Communication Layer for Robot Collaboration

The robotics industry is evolving from single-machine intelligence to multi-agent collaboration, but a core bottleneck remains: robots across brands, form factors, and tech stacks cannot share information or interoperate. Collaboration is thus confined to closed, vendor-specific systems, severely limiting scalability.

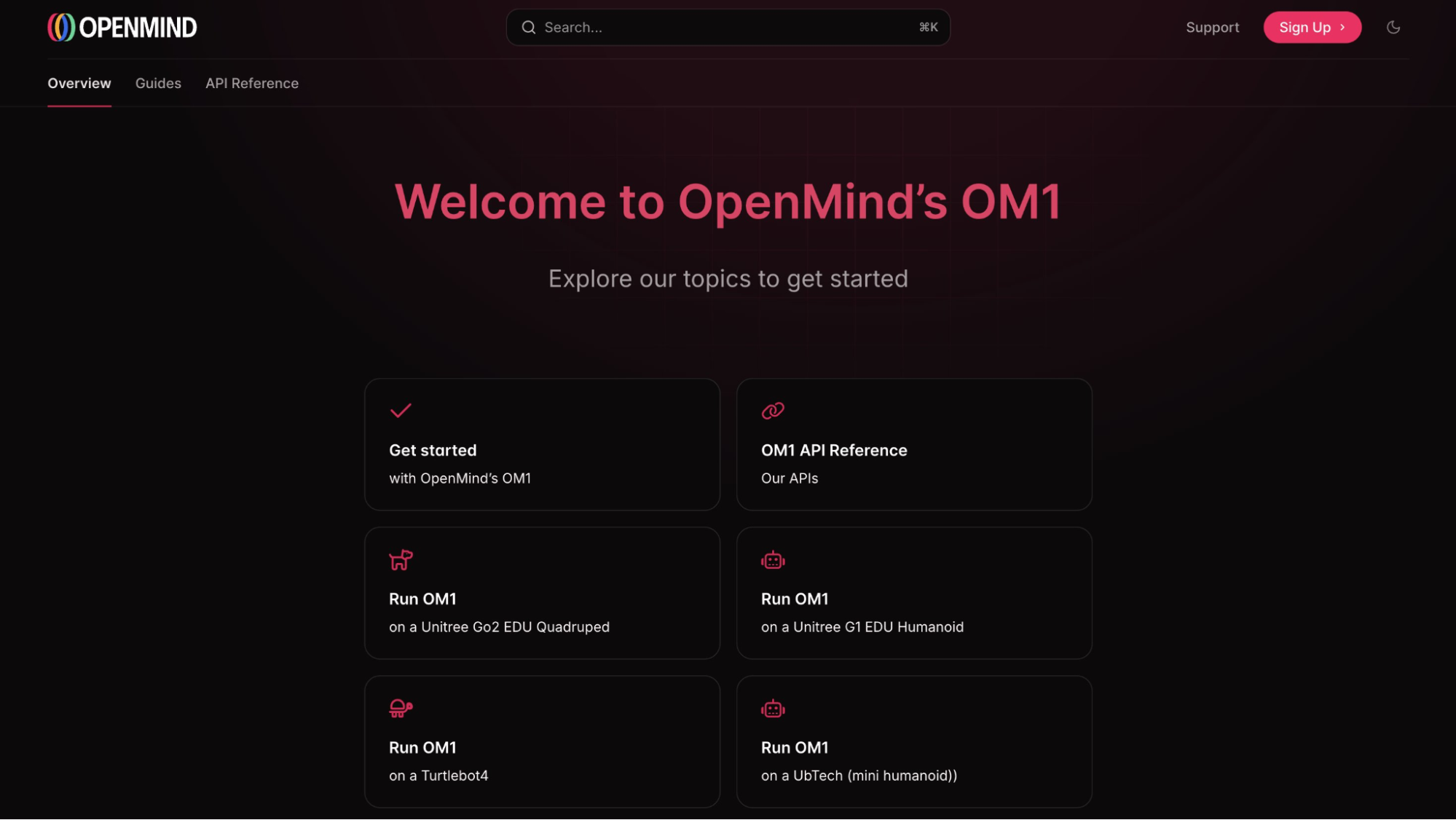

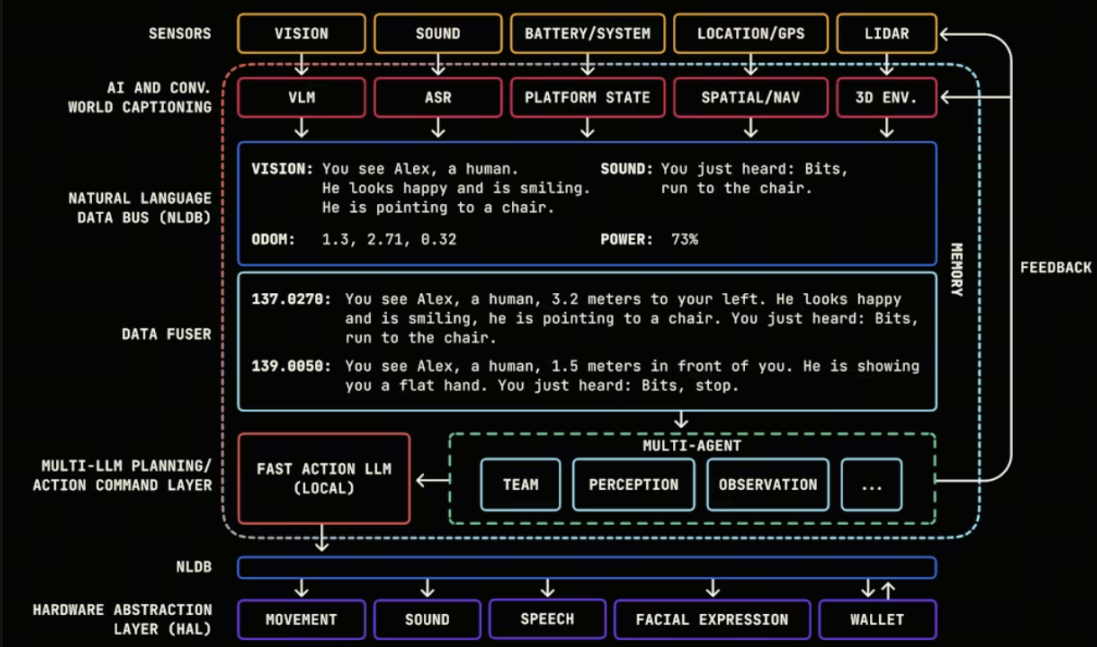

The emergence of general-purpose Robot OS layers, such as OpenMind, offers a new solution. These systems are not traditional control software, but cross-embodiment intelligent operating systems, playing a role similar to Android in smartphones, providing a shared language and infrastructure for robot communication, cognition, and collaboration. (8)

In traditional architectures, a robot’s internal sensors, controllers, and reasoning modules are siloed, making it impossible to share semantic information across devices. By contrast, a unified robot operating system layer standardizes perception interfaces, decision formats, and task-planning methods—enabling robots, for the first time, to achieve:

Abstract environmental representations (vision / sound / tactile → structured semantic events)

Unified interpretation of instructions (natural language → action planning)

Shareable multimodal state representations

This is effectively equivalent to installing a cognitive layer at the foundational level—one that enables robots to understand, express, and learn.

As a result, robots are no longer “isolated executors”. Instead, they gain unified semantic interfaces, allowing them to be integrated into larger-scale, coordinated machine networks.

Moreover, the most significant breakthrough of a general-purpose robot OS lies in cross-embodiment compatibility. For the first time, robots of different brands, form factors, and architectures can effectively “speak the same language”. Diverse robotic systems can connect to a shared data bus and unified control interfaces through a single OS, laying the groundwork for true interoperability.

Source: Openmind

This cross-brand interoperability enables the industry, for the first time, to meaningfully explore:

Multi-robot collaboration

Task bidding and scheduling

Shared perception and shared maps

Cross-space coordinated task execution

The prerequisite for collaboration is a “shared understanding of information formats”. General-purpose robot operating systems (OS) are addressing this foundational language layer challenge.

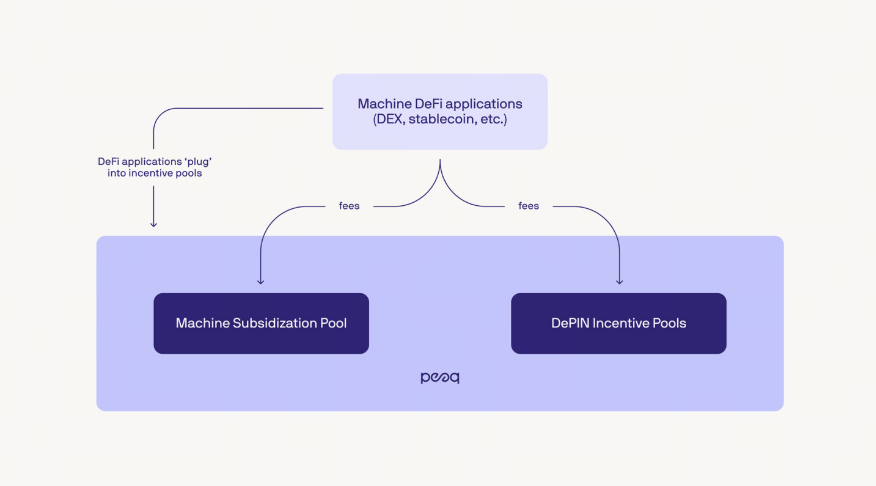

Within cross-device machine collaboration systems, peaq represents another critical infrastructure direction: a protocol layer that provides machines with verifiable identity, economic incentives, and network-level coordination capabilities. (9)

peaq does not solve “how robots understand the world”, but rather how robots participate as independent entities within a network.

Its core design includes:

1. Machine Identity

peaq provides decentralized identity registration for robots, devices, and sensors, enabling them to:

Join any network as independent entities

Participate in trusted task allocation and reputation systems

This is a prerequisite for machines to become true “network nodes”.

2. Autonomous Economic Accounts

Source: Peaq

Robots are granted economic autonomy. With native stablecoin payments and automated billing logic, robots can independently reconcile accounts and make payments without human intervention, including:

Usage-based settlement for sensor data

Per-call payments for compute and model inference

Instant settlement between robots after service delivery (e.g., transport, delivery, inspection)

Autonomous payments for infrastructure usage such as charging and space rental

Robots can also adopt conditional payments:

Task completed → automatic payment

Outcome fails to meet criteria → funds automatically frozen or refunded

This makes robot collaboration trustworthy, auditable, and automatically enforceable—capabilities that are essential for large-scale commercial deployment.

Furthermore, revenue generated by robots providing services and resources in the real world can be tokenized and mapped on-chain, allowing value and cash flows to be represented in a transparent, traceable, tradable, and programmable manner, thus forming asset representations centered on machines themselves.

As AI and on-chain systems mature, the goal is for machines to autonomously earn, pay, borrow, and invest—directly conducting M2M transactions, forming self-organizing machine economies governed via DAO-based coordination and governance.

3. Multi-Device Task Coordination

At a higher level, peaq provides coordination frameworks that enable machines to:

- Share state and availability information

- Participate in task bidding and matching

- Coordinate resource allocation (compute, mobility, sensing capabilities)

This allows robots to operate like a network of nodes rather than isolated units. Only when language and interfaces are unified can robots truly enter collaborative networks instead of remaining trapped in siloed ecosystems.

General-purpose cross-robot OS platforms such as OpenMind aim to standardize how robots understand the world and interpret instructions, while peaq-style Web3 coordination networks explore how heterogeneous devices can achieve verifiable, organized collaboration at the network level. These are representative efforts among many, reflecting an industry-wide shift toward unified communication layers and open interoperability.

Machine Economy Networks That Enable Autonomous Market Participation

If cross-device operating systems solve “how robots communicate”, and coordination networks solve “how robots collaborate”, then machine economy networks address a more fundamental question: how to convert robotic productivity into sustainable capital flows, allowing robots to pay for their own operation and form closed economic loops.

A long-missing piece in the robotics industry is “autonomous economic capability”. Traditional robots can execute predefined instructions but cannot independently allocate external resources, price their services, or settle costs. Once deployed in complex environments, they must rely on human backends for accounting, approvals, and scheduling, severely limiting collaboration efficiency and making large-scale deployment difficult.

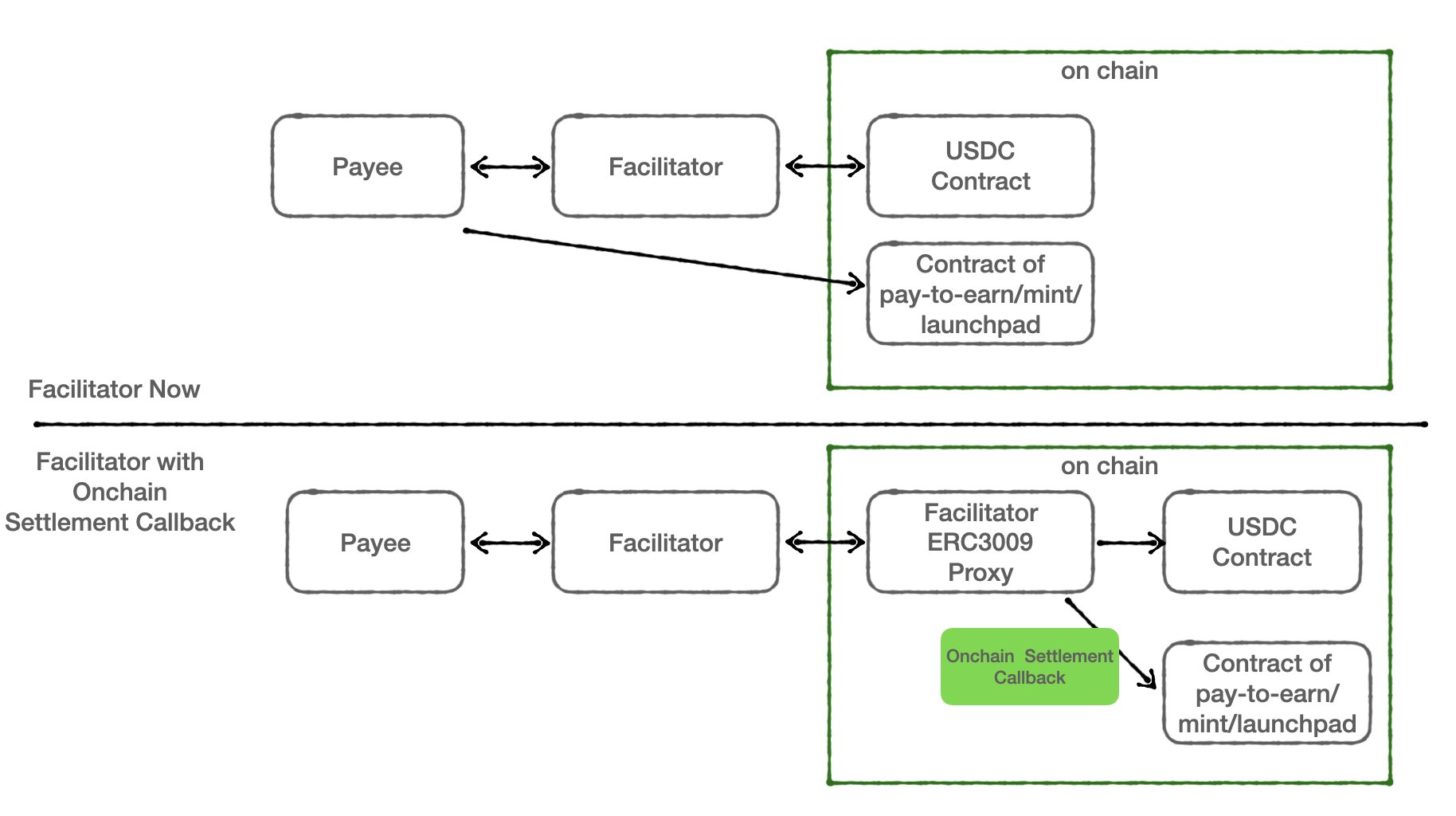

x402: Granting Robots Economic Subject Status

Source: X@ CPPP2443_

x402, a next-generation Agentic Payment standard, fills this fundamental gap. Robots can initiate payment requests directly at the HTTP layer and complete atomic settlements using programmable stablecoins such as USDC. This allows robots not only to complete tasks, but also to autonomously purchase everything required to perform them:

- Compute resources (LLM inference / control model inference)

- Scene access and equipment rental

- Labor services provided by other robots

For the first time, robots can autonomously consume and produce value like economic agents.

In recent years, collaborations between robotics manufacturers and crypto infrastructure providers have produced representative real-world implementations, demonstrating that machine economy networks are transitioning from concept to deployment.

OpenMind × Circle: Native Stablecoin Payments for Robots

Source: Openmind

OpenMind integrates its cross-device robot OS with Circle’s USDC, enabling robots to complete payments and settlements natively within task execution flows.

This represents two major breakthroughs:

- Robot task pipelines can directly integrate financial settlement without relying on backend systems

- Robots can conduct “borderless payments” across platforms and brands

For machine collaboration, this capability is foundational for progressing toward autonomous economic collectives.

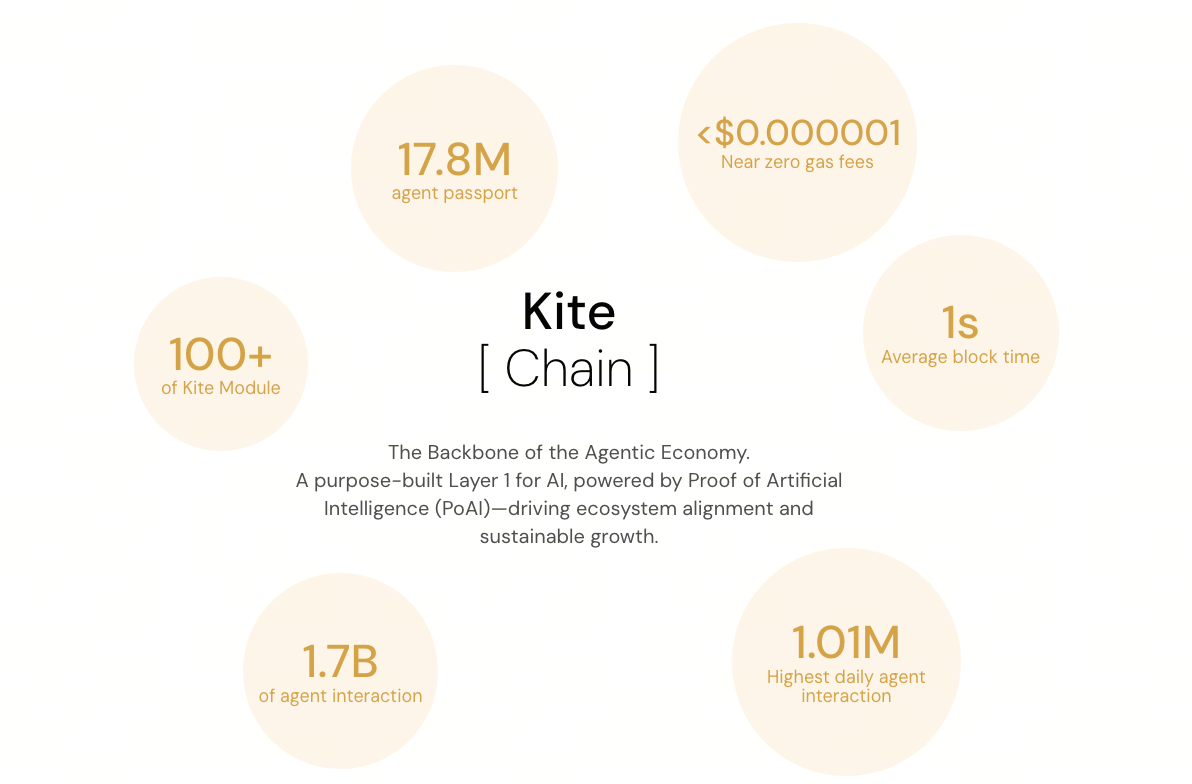

Kite AI: An Agent-Native Blockchain Foundation for the Machine Economy

Source: Kite AI

Kite AI further advances the underlying infrastructure of the machine economy by designing on-chain identities, composable wallets, and automated payment and settlement systems specifically for AI agents, allowing agents to autonomously execute transactions on-chain. (10)

It provides a complete autonomous agent economic runtime, highly aligned with the goal of enabling robots to independently participate in markets.

- Agent / Machine Identity Layer (Kite Passport): Issues cryptographic identities and multi-layer key systems to each AI agent (and potentially mapped to physical robots), enabling fine-grained control over who spends funds and on whose behalf, with revocation and accountability—prerequisites for treating agents as independent economic actors.

- Native Stablecoin + x402 Primitives: Kite integrates the x402 payment standard at the chain level, using USDC and other stablecoins as default settlement assets. Agents can send, receive, and reconcile payments via standardized intent authorization, optimized for high-frequency, low-value, machine-to-machine transactions (sub-second confirmation, low fees, full auditability).

- Programmable Constraints and Governance: On-chain policies define spending limits, merchant and contract allow lists, risk controls, and audit trails, balancing security and autonomy when “giving machines wallets.”

In other words, if OpenMind’s OS enables robots to understand the world and collaborate, Kite AI’s blockchain infrastructure enables robots to survive and operate within economic systems.

Through these technologies, machine economy networks establish collaboration incentives and value-closed loops. Beyond merely enabling robots to pay, they allow robots to:

- Earn income based on performance (result-based settlement)

- Purchase resources on demand (autonomous cost structures)

- Compete in markets using on-chain reputation (verifiable execution)

For the first time, robots can fully participate in economic incentive systems: work → earn → spend → optimize autonomously.

Conclusion

Summary & Outlook

Across the three major dimensions discussed above, Web3’s role in the robotics industry is becoming increasingly clear:

Data Layer: Provides scalable, multi-source data acquisition incentives and improves long-tail scenario coverage

Collaboration Layer: Introduces unified identity, interoperability, and task governance for cross-device coordination

Economic Layer: Enables programmable economic behavior for robots through on-chain payments and verifiable settlement

Together, these capabilities lay the foundation for a future Machine Internet, enabling robots to collaborate and operate within more open, auditable technological environments.

Uncertainty

Despite the rare breakthroughs seen in 2025, the transition from technical feasibility to scalable and sustainable deployment still faces multiple uncertainties—stemming not from a single bottleneck, but from complex interactions across engineering, economics, markets, and institutions.

Economic Viability

Although robots have achieved breakthroughs in perception, control, and intelligence, large-scale deployment ultimately depends on whether real commercial demand and economic returns can be sustained. Most humanoid and general-purpose robots remain in pilot and validation phases. Whether enterprises are willing to pay for robot services long-term, and whether OaaS/RaaS models can consistently deliver ROI across industries, remains under-supported by long-term data.

In many complex, unstructured environments, traditional automation or human labor remains cheaper and more reliable. Technical feasibility does not automatically translate into economic inevitability, and uncertainty in commercialization pace will directly influence industry expansion.

Engineering Reliability and Operational Complexity

The most pressing real-world challenge in robotics is not whether tasks can be completed, but whether systems can operate reliably, continuously, and cost-effectively over time. At scale, hardware failure rates, maintenance costs, software updates, energy management, safety, and liability rapidly compound into systemic risks.

Even with OaaS models reducing upfront capital expenditure, hidden costs related to operations, insurance, responsibility, and compliance may erode overall business viability. Without meeting minimum reliability thresholds for commercial scenarios, visions of robot networks and machine economies will struggle to materialize.

Ecosystem Coordination, Standards, and Regulation

The robotics ecosystem is undergoing rapid evolution across OS layers, agent frameworks, blockchain protocols, and payment standards, but remains highly fragmented. High coordination costs across devices, vendors, and systems persist, while universal standards have yet to converge, risking ecosystem fragmentation and inefficiency.

At the same time, robots with autonomous decision-making and economic behavior challenge existing regulatory and legal frameworks. Accountability, payment compliance, data boundaries, and safety responsibilities remain unclear. Without institutional adaptation keeping pace with technological progress, machine economy networks may face regulatory and deployment uncertainty.

Overall, the conditions for large-scale robotic adoption are gradually forming, and early versions of machine economies are emerging through industry practice.

While Web3 × Robotics remains in its early stages, it already demonstrates long-term potential worthy of close attention.

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Gate, https://www.gate.com/trade/GT_USDT

- Gate, https://www.gate.com/price

- Coindesk, https://www.coindesk.com/web3/2025/12/20/crypto-user-loses-usd50-million-in-address-poisoning-scam

- The Block, https://www.theblock.co/post/383442/hilbert-group-bolsters-institutional-crypto-push-with-25-million-enigma-nordic-deal

- The Block, https://www.theblock.co/post/383439/tether-backed-northern-data-sold-bitcoin-mining-arm-to-companies-run-by-tethers-own-executives-ft

Related Articles

Gate Ventures Research Insights: The Bittensor Revolution – The Rise of AI’s Bitcoin and the New Economic Landscape

How On-Chain TCGs Could Unlock the Next $2 Billion Market: Landscape Overview and Valuation Outlook

In-Depth Research: The Road Ahead: When Will the Fed End Quantitative Tightening and What Could It Mean for the Crypto Market?

Gate Ventures Research Insights: The Third Browser War – The Battle for the Gateway in the AI Agent Era

In-Depth Research: Exploring Liquidity Fragmentation Challenges in the Layer 2 Era