Building a Balanced Crypto Investment Portfolio

This module teaches you to allocate crypto assets scientifically based on your risk tolerance and market cycles, achieving a dynamic balance between risk and return to build a sustainable, long-term portfolio.

Why Build a “Balanced” Portfolio?

In the crypto market, single assets can be extremely volatile; any unexpected event may trigger sharp price swings. A balanced portfolio allows you to share in market gains during uptrends and minimize losses during downturns.

This reflects the core logic of asset allocation: Don’t put all your eggs in one basket.

Common causes of imbalance include:

Going all-in on BTC or a single trending token

Ignoring stablecoins and liquidity positions

Overlooking differences between sectors (Layer 1s, DeFi, AI, GameFi, etc.)

In contrast, professional investors typically:

Combine blue chips + growth tokens + stablecoins + hedging assets, maintaining flexibility across different market phases.

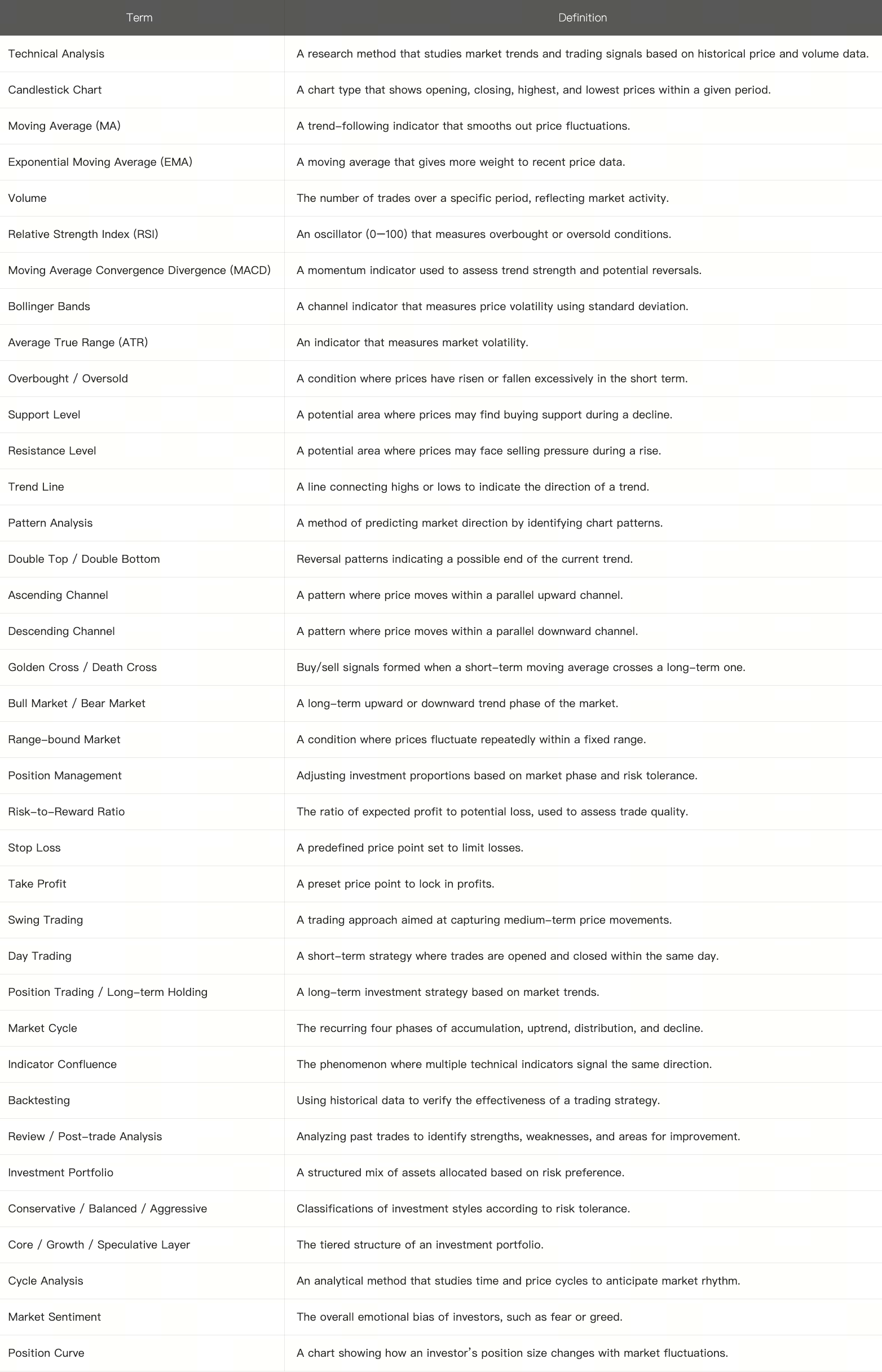

The Three-Layer Structure of a Crypto Portfolio

A well-structured crypto portfolio usually consists of three layers: Core, Growth and Speculative.

- Core Layer

Recommended allocation: 50%–70%

Objective: Long-term stability and steady growth

Typical assets: BTC, ETH, USDT—highly liquid and well-established

Features: Low volatility, lower risk, high capital safety

Strategy: Dollar-cost averaging (DCA), holding, low trading frequency

- Growth Layer

Recommended allocation: 20%–40%

Objective: Capture industry growth opportunities

Typical assets: Mid-cap tokens with strong fundamentals and communities — e.g., SOL, AVAX, OP, LINK

Features: Medium risk and return; requires ongoing project tracking

Strategy: Mid-term holding, trend following

- Speculative Layer

Recommended allocation: ≤10%

Objective: Pursue high-risk, high-reward opportunities

Typical assets: Newly launched tokens, meme coins, or small-cap innovative projects

Features: Extremely volatile, high short-term risk

Strategy: Short-term trading, strict stop-loss management

Visual Example: Three-Layer Portfolio Pyramid

Asset Allocation Mindset: Diversified, Not Fragmented

The key to portfolio construction is correlation management. Even if you hold many assets, if they belong to the same sector or are affected by the same events (for example, all are Layer 1 tokens), they may still rise and fall together.

Dimension 1: Asset Type

Mainstream Tokens (BTC, ETH): Provide value anchoring and long-term stability

Layer 1 & Layer 2 Projects: Capture ecosystem growth potential

Application Sectors (DeFi, GameFi, AI): Benefit from innovation and emerging trends

Stablecoins: Offer liquidity and downside protection

Dimension 2: Investment Horizon

Short-Term Positions: Capture market momentum and swing opportunities

Medium-Term Positions: Follow projects with solid fundamentals

Long-Term Positions: Hold core value assets

Dimension 3: Risk Exposure

Maintain 20–30% of your portfolio in stablecoins as a reserve

Limit any single token position to no more than 20%

Define stop-loss levels and expected returns before entering any trade

Dynamic Rebalancing

Market volatility constantly shifts portfolio weights.

Example: You initially allocate BTC 50%, ETH 30%, SOL 20%. If ETH rises 80% during a bull run, its share may grow to 45% of your portfolio.

This changes your risk profile without you realizing it.

Solution: Regular Rebalancing.

Common methods include:

Periodic Rebalancing: Review and adjust weights monthly or quarterly

Threshold Rebalancing: Adjust when an asset deviates ±10% from its original allocation

Automated Rebalancing: Use bots or grid strategies to maintain balance dynamically

The goal of rebalancing is not to “chase gains or cut losses,” but to maintain a consistent risk profile so your investment plan always aligns with your risk tolerance.

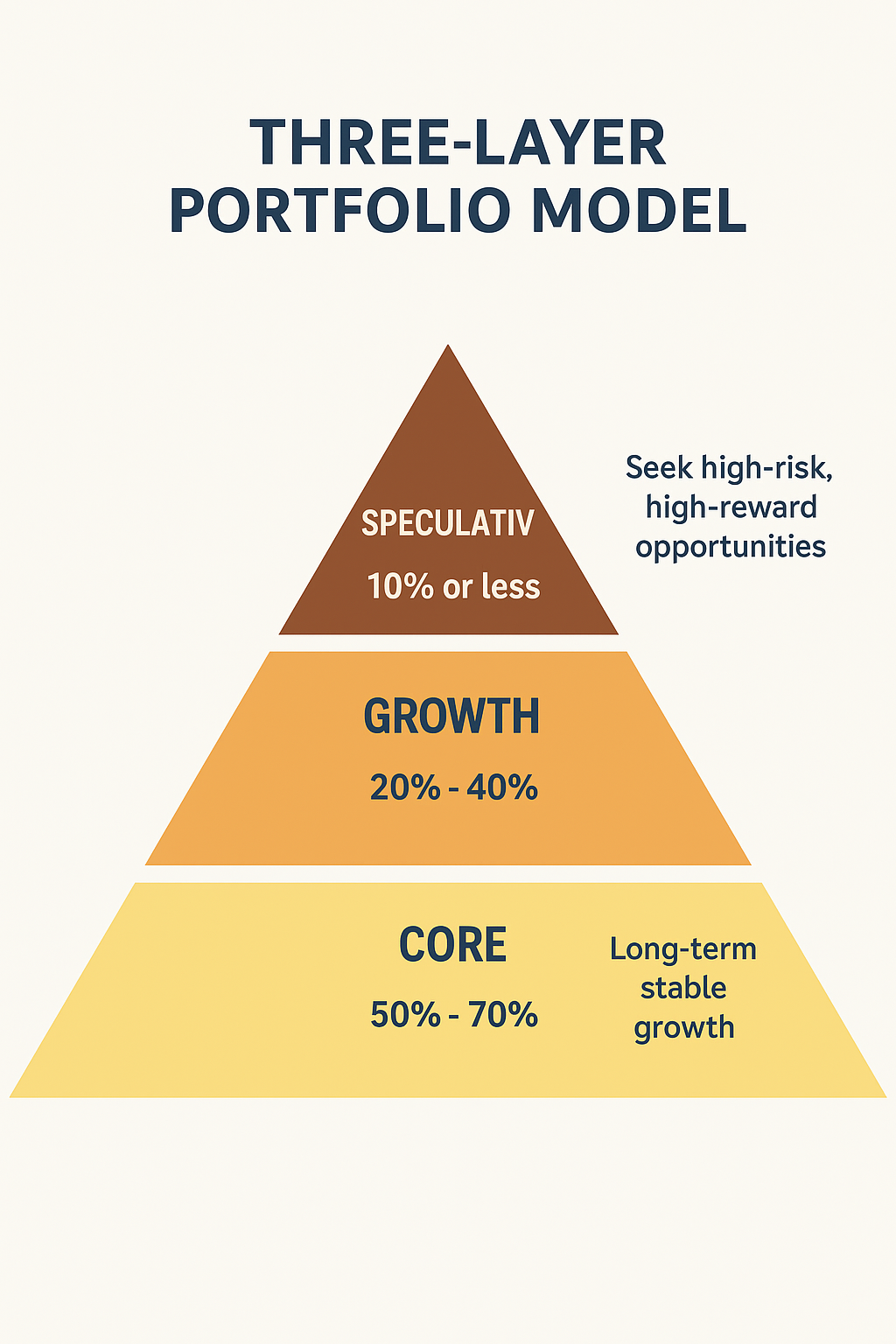

Portfolio Examples for Different Risk Profiles

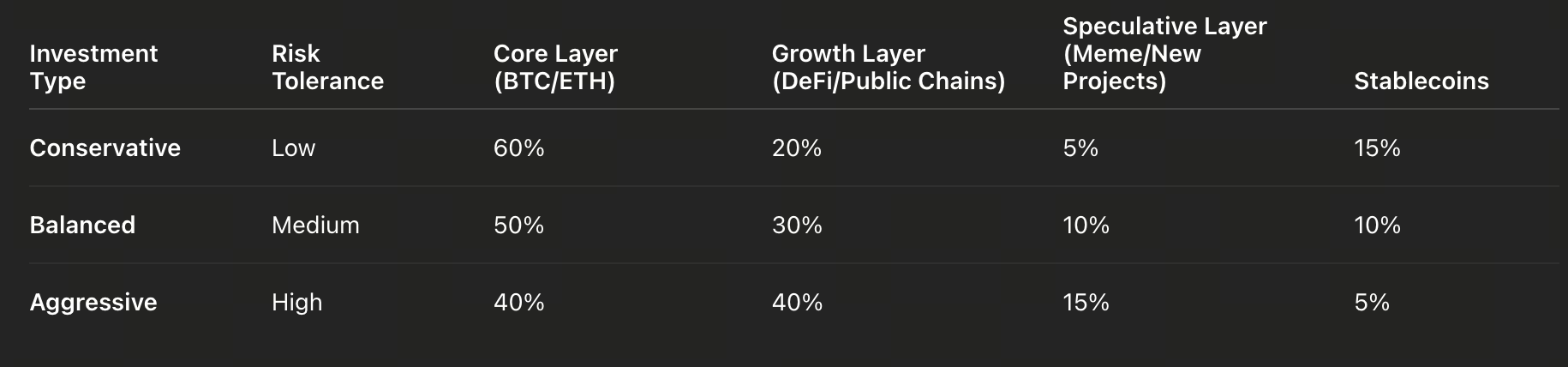

Portfolio Strategies Across Market Cycles

Market cycles can generally be divided into four phases:

Accumulation Phase: Market sentiment is weak and prices are near the bottom.

Strategy: Accumulate mainstream cryptocurrencies through periodic investments.

Markup Phase: Uptrend confirmed, capital flows back into the market.

Strategy: Increase exposure to growth-oriented assets.

Distribution Phase: Prices consolidate near the top amid mixed sentiment.

Strategy: Gradually take profits and reduce risk exposure.

Markdown Phase: Capital outflows lead to broad market corrections.

Strategy: Hold stablecoins and defensive assets to preserve capital.

Market Cycle Rotation & Position Adjustment Chart

Case Study: Building Your First Crypto Investment Portfolio

Assume you have 10,000 USDT and a balanced risk profile, with a target of achieving an annualized return of 10% over three years.

The following example is for educational purposes only and does not constitute financial advice. Always DYOR (Do Your Own Research) and choose assets based on your financial situation and risk tolerance.

1. Initial Allocation

BTC 40% → 4,000 USDT

ETH 20% → 2,000 USDT

SOL + LINK (Growth Layer) 20% → 2,000 USDT

New projects (Speculative Layer) 10% → 1,000 USDT

USDT (liquidity reserve) 10% → 1,000 USDT

2. Operating Principles

Adjust positions according to market trends every quarter.

Each individual investment should not exceed 10% of total capital.

Record your rationale, emotional state, and exit plan for every trade.

3. Risk Management

Set a 10–15% stop-loss for each position.

If the market experiences a major correction, increase stablecoin holdings temporarily.

If a project loses fundamental support, cut losses and exit promptly.

Summary & Reflection

Building a balanced crypto portfolio is not about predicting the market, but about managing risk, controlling emotions, and maintaining structural balance.

Core layer: steady growth

Growth layer: capture upside opportunities

Speculative layer: manage high-risk bets

Stablecoins: preserve liquidity and safety margin

Over the long run, structure and discipline matter more than prediction. Outstanding investors rarely buy at the lowest point or sell at the peak—they simply ensure their portfolios stay alive through every market cycle.

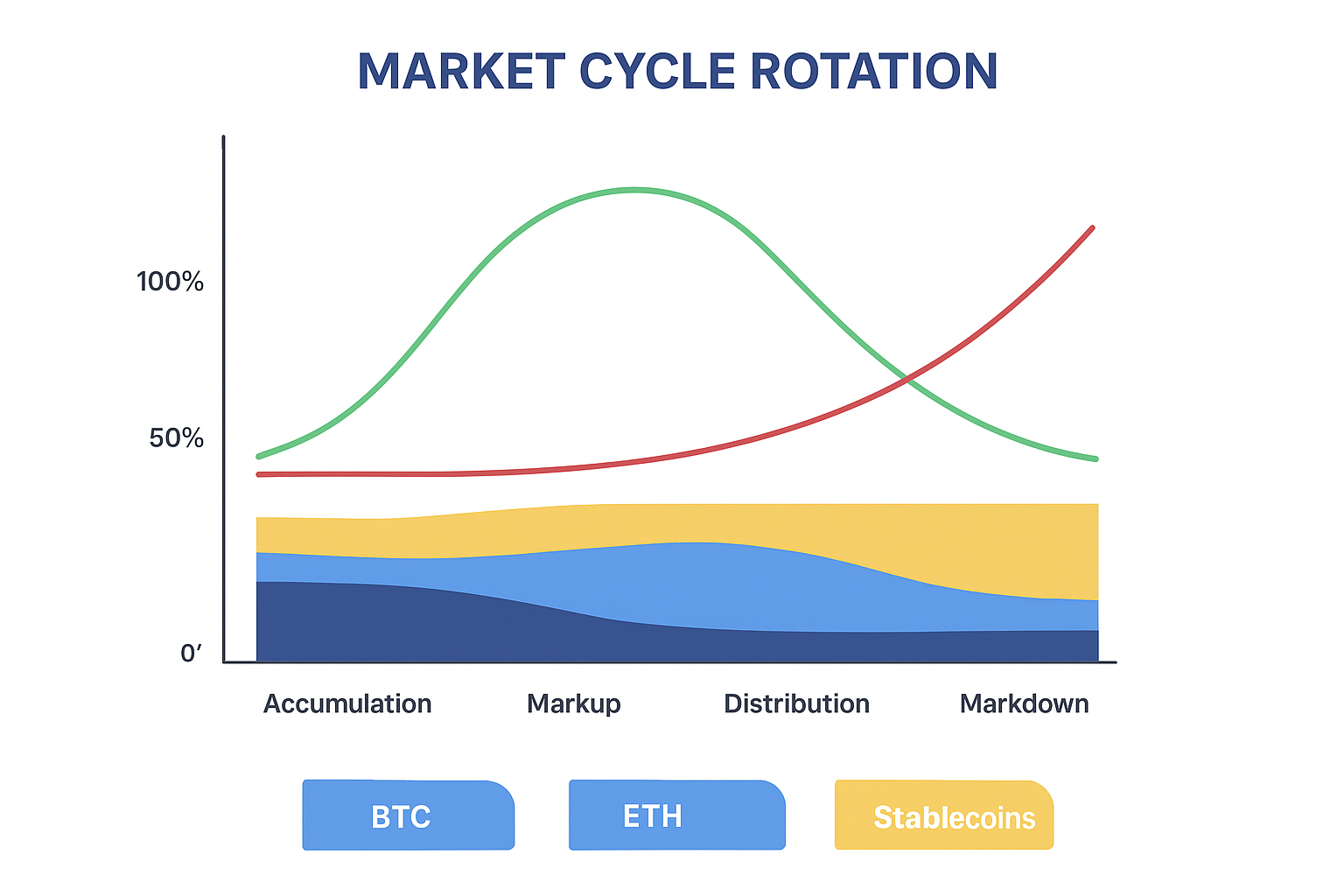

Supplementary Material: Glossary of Technical Analysis Terms