Bitcoin (BTC) News Today

Latest crypto news and price forecasts for BTC: Gate News brings together the latest updates, market analysis, and in-depth insights.

Bitcoin Bulls Might Need to Wait Until 2026 for a Price Reversal

Bitcoin Price Outlook Forecasts Extended Downtrend with Potential for Long-Term Rebound

Latest analysis suggests Bitcoin may not hit its lowest point until 2026, with a potential rebound to nearly $99,000 on the horizon if sell-side pressure diminishes. Despite recent declines, traders are

BTC-2.08%

CryptoBreaking·3m ago

What Happens to Bitcoin if the World Loses Power?

We often call Bitcoin indestructible — decentralized, censorship-resistant and unstoppable. But all of that assumes one critical condition: electricity still exists. So what happens if the world suddenly loses power? Imagine a global blackout lasting 10 years. No computers, no exchanges, no

BTC-2.08%

ICOHOIDER·21m ago

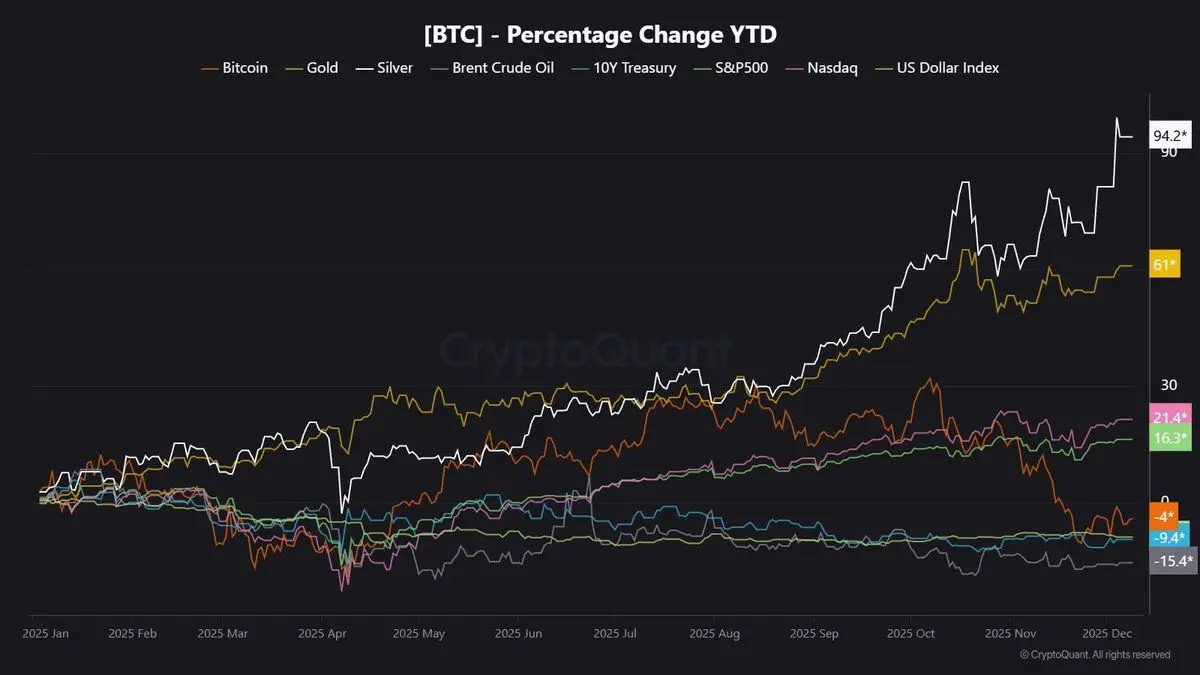

What does the new all-time high (ATH) in silver prices mean for Bitcoin?

Silver prices just hit a new all-time high of $63/ounce, marking a significant milestone in the precious metals market. In stark contrast, the cryptocurrency market collectively declined by 2.74% over the past 24 hours, with all 20 top coins ( except for stablecoins ) falling into the red.

TapChiBitcoin·33m ago

American Bitcoin boosts treasury as SPS jumps after 416 BTC accumulation

American Bitcoin Corp. acquired 416 BTC, raising its total holdings to approximately 4,783 BTC. Despite increasing Satoshis Per Share, the company's stock is down over 70% from its peak amid Bitcoin market volatility.

BTC-2.08%

Cryptonews·1h ago

Bitcoin Hyper Price Prediction December 2025: Senate Crypto Bill Update Sends DeepSnitch AI Presa...

A long-awaited crypto market structure bill may finally advance in Congress next week, according to remarks by Senator Cynthia Lummis at the Blockchain Association Policy Summit. The announcement has triggered renewed attention across crypto markets, particularly in tokens that stand to benefit

CaptainAltcoin·2h ago

Bitcoin, Ethereum Enter ‘Supercycle,’ Says Lee

Lee links the ISM’s first expansion reading in 3+ years to early-stage crypto rallies, citing BTC and ETH sensitivity to ISM turns.

Fed balance-sheet stabilization is viewed as stealth liquidity easing, helping fuel recent Bitcoin and Ethereum strength.

Historical patterns show BTC reacts early to

CryptoFrontNews·2h ago

Can Bitcoin restart its bullish trend?

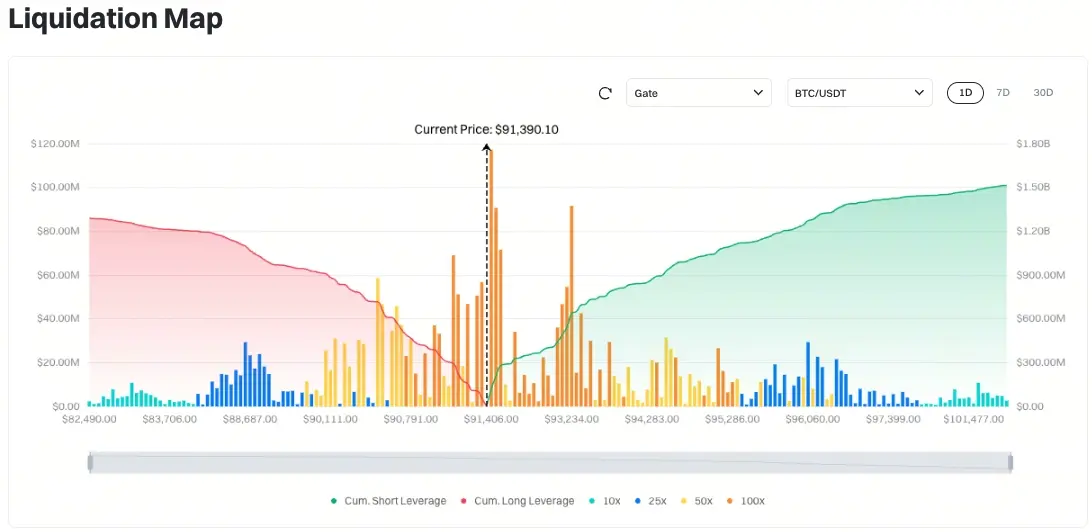

Bitcoin (BTC) once again fell below the 90,000 USD threshold, despite the market showing positive signals from macroeconomic factors.

According to an expert, the main reason for Bitcoin's weakness is the sharp decline in stablecoin inflows into the market. The expert emphasized,

TapChiBitcoin·2h ago

Is The Market Changing Right Now? – Why Bitcoin Could Be On The Verge Of A Historic Leap

The end of quantitative tightening marks a fundamental turning point in the monetary policy environment.

This removes a key factor that had been weighing on the performance of risk assets and Bitcoin.

As a leading indicator, Bitcoin is sensitive to this shift toward more stable liquidity.

The Bi

Blockzeit·2h ago

Has the Federal Reserve been hijacked by politics? Is Bitcoin's historic opportunity here?

The Federal Reserve cut interest rates, but the market is in panic.

On December 10, 2025, the Federal Reserve announced a 25 basis point rate cut and purchased $40 billion worth of Treasury bonds within 30 days. Traditionally, this is a significant positive signal, but the market reaction was unexpected: short-term interest rates fell, while long-term Treasury yields rose instead of falling.

Behind this abnormal phenomenon lies a more dangerous signal: investors are pricing in the systemic risk of "loss of Federal Reserve independence." For crypto investors, this is a critical moment to reassess asset allocation.

Rate Cuts Are Not Simple

On the surface, a 25 basis point rate cut is a routine response to economic slowdown. From an economics textbook perspective, rate cuts are usually seen as standard tools to stimulate the economy, reduce corporate financing costs, and boost market confidence.

But the timing was too "coincidental."

Before the announcement, Trump's economic advisor and leading Fed chair candidate Kevin

金色财经_·2h ago

Jerome Powell: Interest Rate Cuts May Be Paused, Bitcoin Drops from $94K

In response to the Fed Chair's hints at pausing interest rate cuts, market expectations shifted, causing Bitcoin to decline from its peak. Powell noted risks to the labor market and inflation, suggesting minimal cuts ahead while attributing some inflation to past tariffs.

BTC-2.08%

Moon5labs·3h ago

Trump and Bitcoin: Policy, Strategic Reserve, and Market Impact

Last Updated: December 11, 2025

Donald Trump’s stance on Bitcoin has undergone a significant transformation. Once skeptical of cryptocurrency, the Trump administration has now positioned the United States as a potential leader in Bitcoin adoption through unprecedented policy actions, including the

CryptoNews·3h ago

HIVE Digital Expands into Colombia with Green AI and Bitcoin Focus

This news release constitutes a “designated news release” for the purposes of the Company’s prospectus supplement dated November 25, 2025 to its short form base shelf prospectus dated October 31, 2025.

San Antonio, Texas–(Newsfile Corp. – December 11, 2025) –

BTC-2.08%

CryptoBreaking·3h ago

Bitcoin Bulls Retain Profit Despite 27% Drop from $125K Peak

Despite a 27% drop in Bitcoin's price from its all-time high, 67% of its circulating supply remains in profit, indicating investor resilience and market stability. This suggests a moderate bearish outlook rather than a full bear phase.

BTC-2.08%

Cryptoknowmics·3h ago

Bitcoin Breakout CONFIRMED – $120K–$150K Targets Now in Play

Bitcoin has broken a downtrend, with potential targets of $120,000 to $150,000 if the trend continues. Indicators suggest a possible reversal in favor of BTC against gold, which has outperformed BTC recently.

BTC-2.08%

CryptoDaily·3h ago

Bitcoin Price Drops to $90K as Market Reacts to Weak Tech Stock Outlook

The crypto market witnessed renewed selling on December 11 as the Bitcoin price dropped to nearly $90,000. Traders reacted to sharp weakness in major US tech stocks, and the broader market felt the pressure. Investors moved cautiously as risk appetite shrank and volatility returned across digital as

Coinfomania·3h ago

Bitcoin bulls still in profit as price drops 27% from $125k peak

Bitcoin trades about 27% below its $125k high, yet 67% of supply remains in profit above the key 50% band, signaling only moderate bearish pressure so far.

Summary

Bitcoin has corrected roughly 27--35% from its October all-time high near $125k, but two-thirds of supply still sits in profit ve

BTC-2.08%

Cryptonews·3h ago

Bitwise CIO Predicts Bitcoin to Reach $1.3M by 2035, Driven by Institutional Demand

Bitwise Chief Investment Officer Matt Hougan has outlined a long-term forecast for Bitcoin, projecting its price could reach $1.3 million by 2035. The prediction is based on a unique valuation model that ties Bitcoin’s potential growth to the performance of the gold market. Hougan emphasized the

BTC-2.08%

CryptoBreaking·4h ago

Taiwan's Central Bank once again says No to Bitcoin reserves! Responds to legislator's "research report" and refuses to follow the experiments of the US and Czech Republic

Taiwan's Central Bank submitted a report to the Legislative Yuan, explicitly ruling out Bitcoin from entering the $600 billion foreign exchange reserves, emphasizing volatility, liquidity, and operational risks.

(Background recap: Trump officially nominates Paul Atkins as the new SEC Chair, what is his stance on cryptocurrencies?)

(Additional context: Is Wall Street resisting DAT? MSCI considering excluding "crypto reserve companies" like MicroStrategy from its indices?)

The Taiwan Central Bank recently responded to a report submitted to Legislator Ge Rujun, which was nearly ten thousand words long, addressing whether "Bitcoin is suitable for inclusion in foreign exchange reserves."

The conclusion is unequivocal: high volatility, low liquidity, and operational risks mean Bitcoin cannot shoulder the responsibility of $600 billion in reserves.

Faced with the U.S. listing confiscated Bitcoin as a strategic asset and Prague attempting a million-dollar reserve sandbox, Taiwan's Central Bank chose to remain inactive, maintaining a cautious distance from the crypto reserve craze.

動區BlockTempo·4h ago

Reputed Crypto Experts and Bitcoin Traders Watch BTC Price Movement As Critical Level Approaches

Bitcoin is at a critical price range of $90,000, with analysts divided on its direction. They predict potential upward movement towards $104,000 if it holds above $100,000, but caution remains due to the ongoing battle between bullish and bearish traders.

BTC-2.08%

CryptoNewsLand·4h ago

Gate Research Institute: Rate Cuts Trigger Severe Market Fluctuations | Large Banks Accelerate Bitcoin Collateralization Strategies

Summary

The market sentiment warmed up driven by the strong performance of BTC and ETH, with weekly gains in sectors such as prediction markets, GambleFi, and ZK reaching 18%–35%.

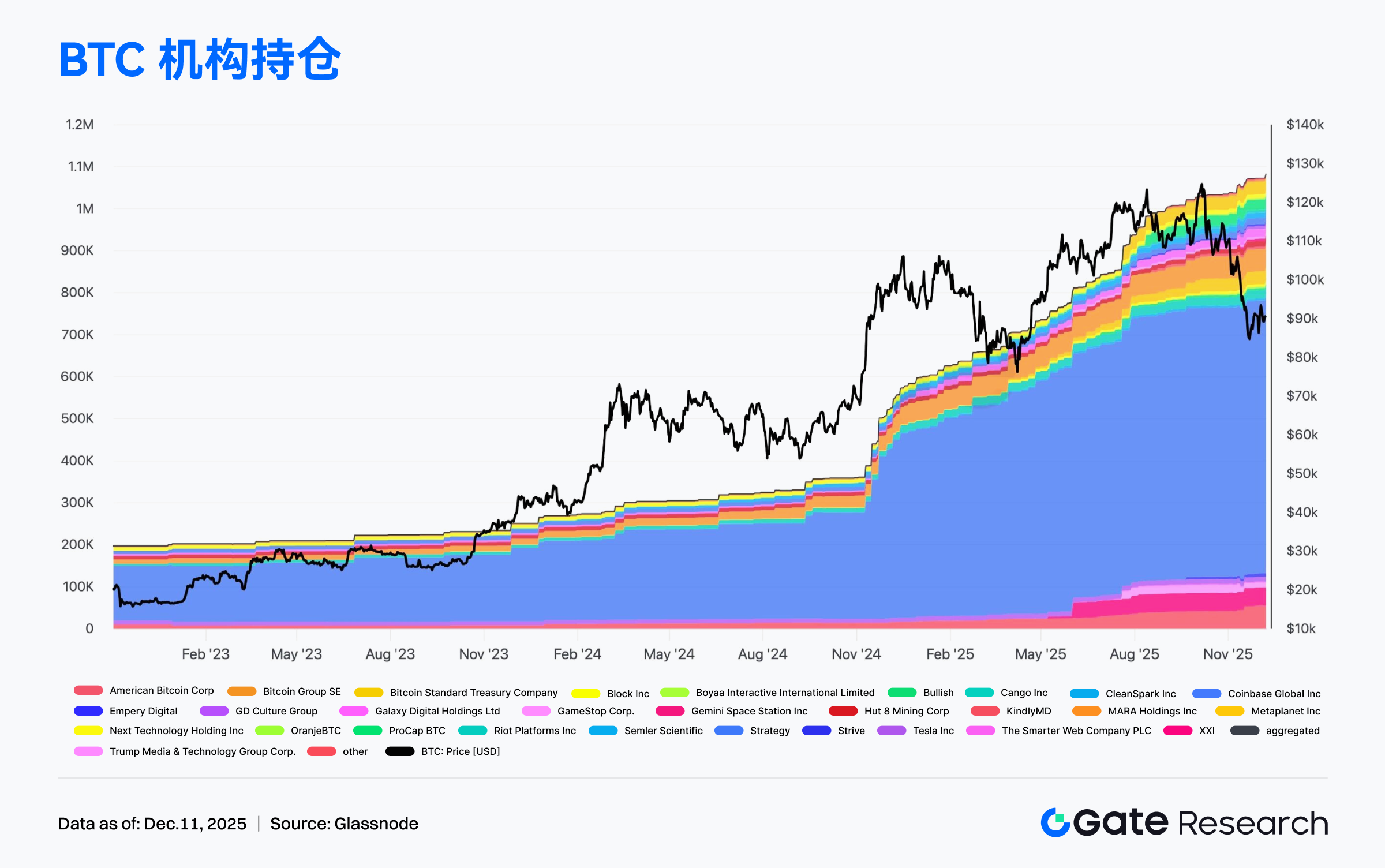

Institutional Bitcoin holdings surged significantly, and capital allocation structures continued to deepen.

Major banks accelerated their deployment of Bitcoin collateral services, and institutional-grade funding acceptance continued to rise.

Rate cuts triggered intense market volatility, with Ethereum and Bitcoin experiencing large fluctuations in response to macro signals.

Digital Asset completed a $50 million funding round, led by DRW Venture.

CONX, APT, and ARB will unlock approximately $21.83 million, $19.68 million, and $19.58 million worth of tokens respectively over the next 7 days.

Market Commentary

Market Analysis

BTC Market — BTC showed a "fluctuating" trend over the past day

GateResearch·6h ago

Gate Research Institute: Implied volatility remains high with oscillations, Gate exclusively launches a rolling sell options tool

Recent options market trends show a decline in implied volatility for BTC and ETH, with market expectations for future volatility weakening. Block trades are concentrated in bullish spreads, mainly involving large-scale options transactions for BTC and ETH. The Gate platform has launched a rolling sell options tool to help users automate options trading, improve trading efficiency, and enhance risk management.

GateResearch·7h ago

Ethereum King Returns: Surges 8% in a Day, Outselling Bitcoin. Can the Staking ETF Trigger a New Bull Market?

Ethereum has recently led the rally in the cryptocurrency market, with prices soaring over 8% within 24 hours, reaching a high of around $3400, outperforming Bitcoin's 4.5% increase. The surge is driven by multiple positive factors: BlackRock officially filed for an Ethereum staking trust, introducing a new narrative of "yield-generating ETFs" for ETH; after the Fusaka upgrade, network fees have decreased significantly, enhancing ecosystem appeal; on-chain data shows that whales have accumulated approximately $3.15 billion worth of ETH over the past three weeks. Technical analysis indicates that ETH price has successfully regained the key 50-week moving average, with similar historical patterns previously signaling gains of over 100%, and market sentiment has turned notably optimistic.

MarketWhisper·7h ago

Gate Research Institute: Tempo Testnet Officially Launched | Institutional Bitcoin Holdings Significantly Increase

Crypto Asset Panorama

BTC (-2.76% | Current price 89,972 USDT)

BTC has recently shown a pattern of "slight weakness after volatile correction." The price repeatedly faces resistance above $92,000, and has been sliding continuously around $91,000, indicating a weakening short-term momentum. On the technical side, the MA5 and MA10 have turned downward and broken below the MA30, with the three moving averages converging, suggesting the short-term trend is shifting from strong to neutral or slightly weak. If the price cannot quickly regain the MA10, the rebound will be limited. Regarding MACD, the fast and slow lines have been decreasing after a death cross at high levels, with the red histogram shrinking and turning green, indicating diminishing bullish momentum. In the short term, focus should be on the support zone at $90,500–$90,800. If this area holds, there is still potential to attempt recovery near the moving averages; otherwise, a break below could lead to further decline towards 8

GateResearch·7h ago

Bitcoin (BTC) Dips To Test Key Support — Could This Pattern Trigger an Rebound?

The cryptocurrency market is experiencing a pullback after Bitcoin hit nearly $94,500. Despite this short-term weakness, an ascending triangle pattern indicates potential bullish momentum if key support levels hold, targeting a rise to $108,000.

BTC-2.08%

CoinsProbe·8h ago

Gold's "Long Bull" Meets Silver's "Soaring": A "Stress Test" Revealing the Future of Assets

The precious metals market is currently showcasing a thought-provoking "ice and fire" scenario. After the Federal Reserve's internal split on rate cuts, gold prices slightly retreated to around $4,210.72 due to uncertainties about future easing paths. Meanwhile, silver disregarded macro uncertainties, surging to a historic high of $62.88 on December 11, with an annual increase of up to 113%. This divergence coincides with a significant prediction from top investment bank Goldman Sachs, which believes that core drivers such as central bank gold purchases and private wealth allocation will push gold to $4,900 by 2026. This internal "stress test" of traditional safe-haven assets may serve as a crucial mirror for understanding the unique logic of cryptocurrencies like Bitcoin in a complex macro environment.

MarketWhisper·8h ago

Federal Reserve's "hawkish rate cut" tears apart consensus; Bitcoin's 2026 liquidity narrative faces a challenge

Beijing Time December 10, the Federal Reserve completed its third rate cut of the year amid serious internal disagreements, lowering the federal funds rate target range by 25 basis points to 3.50% - 3.75%. This decision was passed with a rare 9-3 split vote and sent a strong signal of policy shift: according to the latest "dot plot" forecast, the pace of future rate cuts will be extremely slow, with possibly only one cut each in 2026 and 2027. For the crypto market, which has fully priced in easing expectations, this "dovish with hawkish signals" decision indicates that macro liquidity-driven logic is weakening. Bitcoin's key battle near $92,000 will rely more on its technical structure and market sentiment.

BTC-2.08%

MarketWhisper·8h ago

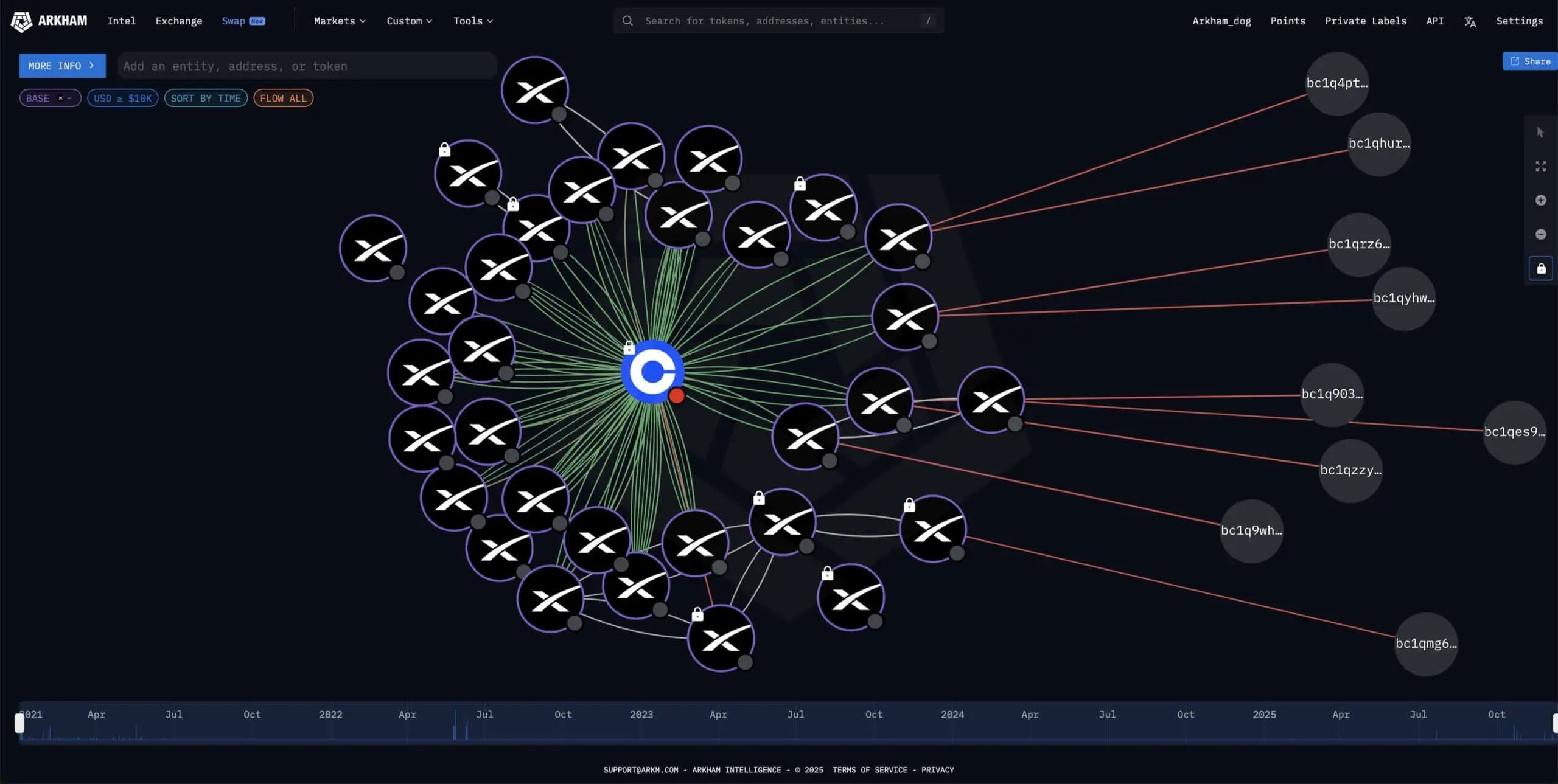

SpaceX transfers nearly 100 million USD worth of Bitcoin sparks speculation: paving the way for the largest IPO in history, or a major shift in crypto assets?

On-chain monitoring platform Lookonchain data shows that Elon Musk's space exploration company SpaceX recently conducted a large-scale Bitcoin transfer, moving 1021 BTC (worth approximately $94.48 million) to a new address possibly associated with Coinbase Prime. This is the third large-scale on-chain transfer detected from SpaceX in just over a month, sparking widespread market speculation about its intentions. The transfer coincides with reports that SpaceX is planning a record-breaking IPO valued at over $30 billion with a target valuation of $1.5 trillion. How to handle its Bitcoin assets worth $368 million has become a focal point connecting the crypto market and traditional capital markets.

MarketWhisper·8h ago

Metaplanet President Gerovich shares the journey from transforming a Japanese ryokan group into a Bitcoin gateway asset company

Japanese listed company Metaplanet has transitioned from the lodging industry to a Bitcoin capital company, increasing its Bitcoin holdings from 1,000 to 30,000 coins, becoming the fourth largest enterprise-level holder globally. The company has launched innovative financial products and is committed to building Japan's Bitcoin financial ecosystem, aiming to lead market transformation in a low-interest-rate environment.

BTC-2.08%

ChainNewsAbmedia·8h ago

What Is Bitcoin's Asia-Driven Strength and Can BTC Hold If U.S./EU Keep Selling in December 2025

A striking regional divergence has emerged in Bitcoin’s price action: Asia is single-handedly keeping BTC afloat while U.S. and European trading sessions continue to sell aggressively.

BTC-2.08%

CryptoPulseElite·8h ago

What Is Strategy's Response to MSCI's Bitcoin Treasury Exclusion Proposal and Why It Matters in 2025

Strategy (NASDAQ: MSTR), the world's largest corporate Bitcoin holder with over 660,624 BTC on its balance sheet, fired back at index provider MSCI's proposed rule change that could boot digital asset treasury companies (DATs) from its Global Investable Market Indexes if crypto holdings exceed 50% of total assets.

BTC-2.08%

CryptoPulseElite·9h ago

What Is Bitcoin Trading Near $92,500 Ahead of the Fed Rate Decision in December 2025

Bitcoin (BTC) is hovering around \$92,500, reflecting cautious consolidation after a volatile week marked by the Federal Reserve's recent 25 basis point rate cut and anticipation for its broader implications on monetary policy.

CryptoPulseElite·9h ago

What Is the High-IQ Claimant's Bitcoin \$100K Prediction and Why It's Sparking Buzz in December 2025

As of December 11, 2025, self-proclaimed "world's highest IQ holder" YoungHoon Kim has ignited fresh controversy with a bold forecast: Bitcoin could surge to \$100,000 within the next seven days.

BTC-2.08%

CryptoPulseElite·9h ago

I don't regret dedicating eight years of my life to the crypto industry.

Author: Nic Carter, Partner at Castle Island Ventures; Translation by: Golden Finance

> No one can serve two masters. Either you will hate the one and love the other, or you will be devoted to the one and despise the other. You cannot serve both God and Mammon.

>

> Matthew 6:24

>

金色财经_·9h ago

Eric Trump and Pompliano Increase Bitcoin Reserves of U.S. Companies

Two major players in the American crypto landscape — American Bitcoin Corp. (ABTC) and ProCap Financial (BRR) — have announced significant additions to their corporate Bitcoin reserves. The news arrives at a time when institutions and publicly traded companies are rapidly increasing BTC exposure in

BTC-2.08%

Moon5labs·10h ago

December rate cut of 25 basis points! Fed internal disagreements intensify, marking a macro turning point in Bitcoin's battle to reach the "hundred thousand mark"

Beijing Time December 10th, the Federal Reserve announced a 25 basis point cut in the federal funds rate target range to 3.50%-3.75%, completing the third rate cut of the year. However, this decision revealed rare and deep disagreements within the Federal Open Market Committee, with a 9-3 voting result, the most divided since 2019. More importantly, the latest "dot plot" indicates that the future rate cuts will be extremely slow and limited, with only one cut each expected in 2026 and 2027. For markets that have fully priced in rate cut expectations, this "dovish with hawkish undertones" decision is more like a tightening warning, which could reshape the short-term liquidity environment for all risk assets, including Bitcoin.

BTC-2.08%

MarketWhisper·11h ago

The crypto market generally retraced, with the DePIN sector leading the decline by over 4%, and BTC falling below $91,000.

December 11th, the crypto market generally retreated, with the DePIN sector experiencing the largest decline, with Filecoin dropping 7.50%. Bitcoin and Ethereum also declined, and sectors such as CeFi and DeFi all saw drops, while some projects like AI and Meme sectors performed relatively well. Historical market index data shows that all sectors experienced varying degrees of decline.

DeepFlowTech·11h ago

MicroStrategy fiercely counters MSCI's delisting threat, defending the legitimacy of corporate Bitcoin holdings

MicroStrategy, the world's largest corporate Bitcoin holder, is facing a major crisis of being excluded from mainstream stock indices. The international index provider MSCI has proposed to remove companies with cryptocurrency assets accounting for more than 50% of their total assets from its indices. MicroStrategy Executive Chairman Michael Saylor and CEO Phong Le jointly issued a letter strongly criticizing the proposal as "misleading and harmful," and warned that it would directly conflict with the U.S. government's pro-innovation policies. This clash is not only about the potential $2.8 billion passive fund outflow faced by MicroStrategy itself, but also a "battle of standards" that will determine the positioning of crypto assets within the traditional financial system.

BTC-2.08%

MarketWhisper·12h ago

Gate Daily (December 11): After Powell's rate cut, "two sentences" ignite market bullishness; Japan's cryptocurrency shifts to securities law

Bitcoin (BTC) surged briefly before pulling back, currently trading around $91,220 as of December 11. The Federal Reserve announced a 25 basis point cut to the benchmark interest rate, with Chair Powell stating that "rate hikes are not anyone's basic expectation." Starting from December 12, a 30-day period of purchasing $40 billion in government bonds ignited bullish sentiment. Japan is preparing to move crypto asset regulation out of the country's payment system and into a framework specifically designed for investment and securities markets.

MarketWhisper·12h ago

The crossroads of US, European, and Canadian crypto regulation: testing ground or museum?

Author: Castle Labs

Translation: Yangz, Techub News

When Satoshi Nakamoto released the white paper, mining Bitcoin was very simple; any player with a mainstream CPU could easily accumulate wealth worth millions of dollars in the future. Instead of playing "The Sims" on your home computer, why not build a lucrative family business that allows descendants to avoid hard labor, with an investment return rate of about 250,000 times.

However, most players still indulge in "Halo 3" on Xbox, while only a few teenagers using home computers have earned wealth surpassing that of modern tech giants. Napoleon created legends by conquering Egypt and even Europe, while you just need to click "Start Mining."

Over the past fifteen years, Bitcoin has evolved into a global asset, with its mining relying on large-scale operations supported by billions of dollars in funding, hardware, and energy input. The average electricity consumption per Bitcoin is high.

BTC-2.08%

PANews·13h ago

Technical analysis for December 11: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, BCH, LINK, HYPE

Bitcoin cooled down from the peak of $94,589 on Tuesday, but the bulls are still trying to keep the price above the important level of $92,000. Investors are now watching the market reaction after

TapChiBitcoin·13h ago

SpaceX moves 1021 more bitcoins! Musk transfers 900 million throughout the year to push for an IPO

SpaceX, under Elon Musk, transferred another 1021 bitcoins (approximately $94.5 million) on December 10th, marking the company's second large transfer this month and the ninth this year. The total BTC moved this year is approximately 8910 coins (about $924 million). SpaceX is advancing toward an IPO with a target valuation of $1.5 trillion, planning to go public between mid and late 2026.

MarketWhisper·13h ago

MicroStrategy writes back to counter MSCI delisting order! January implementation may trigger a Bitcoin sell-off wave

The largest Bitcoin treasury company MicroStrategy (MSTR) has sent a letter to index provider MSCI opposing a proposed policy change that would exclude crypto asset pools (DAT) holding 50% or more cryptocurrencies on their balance sheets from stock market indexes. MicroStrategy states that DAT are operating companies capable of actively adjusting their businesses and questions why MSCI does not exclude real estate investment trusts, oil companies, and other enterprises focused on single assets.

MarketWhisper·13h ago

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27

Vesting Kilidi Gecikti

Router Protocol, ROUTE tokeninin Hakediş kilidinin 6 aylık bir gecikme ile açılacağını duyurdu. Ekip, projenin Open Graph Architecture (OGA) ile stratejik uyum sağlamak ve uzun vadeli ivmeyi koruma hedefini gecikmenin başlıca nedenleri olarak belirtiyor. Bu süre zarfında yeni kilit açılımları gerçekleşmeyecek.

2026-01-28