# Cryptoanalysis

19.99K

HarryCrypto

🚨 SUI Token Update – Short Pressure Building!

SUI is currently facing strong short pressure between $0.95 – $0.97.

This zone is acting as immediate resistance where sellers are actively defending the price.

🔥 Major Strong Seller Zone:

📍 $1.00 – $1.04

According to the heatmap levels and the marked price chart, heavy liquidity and sell orders are stacked in the $1.00 – $1.04 region. This confirms strong seller interest and potential rejection if price moves into this area.

📊 Technical Outlook:

If SUI fails to break above $1.04 with strong volume, expect rejection.

Sustained rejection could p

SUI is currently facing strong short pressure between $0.95 – $0.97.

This zone is acting as immediate resistance where sellers are actively defending the price.

🔥 Major Strong Seller Zone:

📍 $1.00 – $1.04

According to the heatmap levels and the marked price chart, heavy liquidity and sell orders are stacked in the $1.00 – $1.04 region. This confirms strong seller interest and potential rejection if price moves into this area.

📊 Technical Outlook:

If SUI fails to break above $1.04 with strong volume, expect rejection.

Sustained rejection could p

SUI-1,93%

- Reward

- 1

- Comment

- Repost

- Share

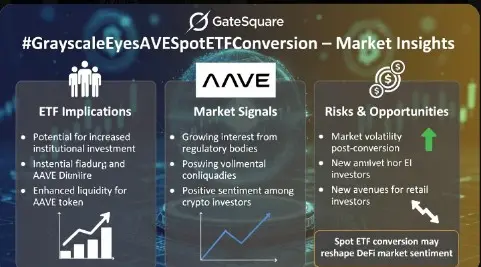

#GrayscaleEyesAVESpotETFConversion

Grayscale has announced that it is considering converting AAVE into a spot ETF, signaling a potentially significant shift for the crypto market. Here are the key insights:

1️⃣ ETF Implications:

Approval of a spot ETF would increase AAVE’s liquidity and market accessibility. Institutional investors would find it easier to enter, potentially driving price appreciation.

2️⃣ Market Signals:

News of the ETF conversion may trigger short-term volatility as both retail and institutional investors react. This creates an opportunity for strategic positioning.

3️⃣ Risk

Grayscale has announced that it is considering converting AAVE into a spot ETF, signaling a potentially significant shift for the crypto market. Here are the key insights:

1️⃣ ETF Implications:

Approval of a spot ETF would increase AAVE’s liquidity and market accessibility. Institutional investors would find it easier to enter, potentially driving price appreciation.

2️⃣ Market Signals:

News of the ETF conversion may trigger short-term volatility as both retail and institutional investors react. This creates an opportunity for strategic positioning.

3️⃣ Risk

AAVE2,6%

- Reward

- 3

- 4

- Repost

- Share

BeautifulDay :

:

To The Moon 🌕View More

Market Outlook 2026: The Rise of "Efficiency Layer" Narratives

As we navigate through February 2026, the crypto landscape has shifted from pure speculation to a "Proof of Utility" phase. While the market remains volatile, the smart money is rotating out of stagnant L1s and into ecosystems that solve the Liquidity Fragmentation problem.

🔍 Key Trends to Watch

AI-Infrastructure Integration: We are seeing a massive surge in tokens that provide decentralized compute for AI models. Assets like FET and RNDR are no longer just "AI coins"; they are the backbone of the new digital economy.

Modular Expa

As we navigate through February 2026, the crypto landscape has shifted from pure speculation to a "Proof of Utility" phase. While the market remains volatile, the smart money is rotating out of stagnant L1s and into ecosystems that solve the Liquidity Fragmentation problem.

🔍 Key Trends to Watch

AI-Infrastructure Integration: We are seeing a massive surge in tokens that provide decentralized compute for AI models. Assets like FET and RNDR are no longer just "AI coins"; they are the backbone of the new digital economy.

Modular Expa

- Reward

- like

- Comment

- Repost

- Share

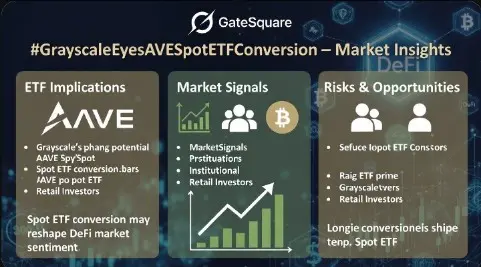

#What’sNextforBitcoin?

Bitcoin is currently standing at a critical crossroads. After recent volatility and rising market fear, the key question is whether this is consolidation before the next breakout — or preparation for another leg down.

Technically, price is reacting near major support zones while sentiment remains cautious. Historically, periods of extreme fear often appear near macro bottoms, but confirmation comes from volume expansion and strong spot demand.

If buyers defend support and reclaim key resistance levels, we could see momentum shift back to bullish continuation. However, fa

Bitcoin is currently standing at a critical crossroads. After recent volatility and rising market fear, the key question is whether this is consolidation before the next breakout — or preparation for another leg down.

Technically, price is reacting near major support zones while sentiment remains cautious. Historically, periods of extreme fear often appear near macro bottoms, but confirmation comes from volume expansion and strong spot demand.

If buyers defend support and reclaim key resistance levels, we could see momentum shift back to bullish continuation. However, fa

BTC1%

- Reward

- 3

- 4

- Repost

- Share

Crypto_Teacher :

:

“Top-tier stream — can’t wait for the next one!”View More

🚨$TRUMP /USDT Technical Analysis | 1D Chart

Current Price: $3.454 | +2.89%

📉 Trend Overview:

TRUMP crashed from its all-time high of $9.568 down to lows near $2.967, marking a brutal 69% drawdown. However, price is now attempting a relief bounce, showing early stabilization signals.

📊 Bollinger Bands (20,2):

Price hugging the Lower Band ($2.847) while midband sits at $3.652. A reclaim of the midband would signal trend reversal potential.

📈 RSI Analysis:

RSI(6): 45.458 | RSI(12): 35.326 | RSI(24): 33.720 All recovering from oversold zones, indicating bearish exhaustion with bullish divergen

Current Price: $3.454 | +2.89%

📉 Trend Overview:

TRUMP crashed from its all-time high of $9.568 down to lows near $2.967, marking a brutal 69% drawdown. However, price is now attempting a relief bounce, showing early stabilization signals.

📊 Bollinger Bands (20,2):

Price hugging the Lower Band ($2.847) while midband sits at $3.652. A reclaim of the midband would signal trend reversal potential.

📈 RSI Analysis:

RSI(6): 45.458 | RSI(12): 35.326 | RSI(24): 33.720 All recovering from oversold zones, indicating bearish exhaustion with bullish divergen

TRUMP-1,71%

- Reward

- 2

- Comment

- Repost

- Share

#What’sNextforBitcoin? 🚨 DAY 1 RECAP: The $70K Wall vs The 2.5% CPI Floor

It’s Wednesday, Feb 18, 2026 — and Bitcoin is NOT crashing… it’s compressing.

After reclaiming $70K yesterday, heavy resistance pushed BTC back into consolidation around $68K–$68.5K.

This isn’t weakness.

This is pressure building. ⚡

🔮 What’s Next for Bitcoin?

📊 Technical Structure

Bitcoin is forming a Symmetrical Triangle on the 4H chart — higher lows from $60K, but repeated rejection at $70K.

That means one thing:

A breakout is coming.

The trigger?

📰 FOMC Minutes today.

🏦 Macro Advantage

US Core CPI is at 2.5% (4-y

It’s Wednesday, Feb 18, 2026 — and Bitcoin is NOT crashing… it’s compressing.

After reclaiming $70K yesterday, heavy resistance pushed BTC back into consolidation around $68K–$68.5K.

This isn’t weakness.

This is pressure building. ⚡

🔮 What’s Next for Bitcoin?

📊 Technical Structure

Bitcoin is forming a Symmetrical Triangle on the 4H chart — higher lows from $60K, but repeated rejection at $70K.

That means one thing:

A breakout is coming.

The trigger?

📰 FOMC Minutes today.

🏦 Macro Advantage

US Core CPI is at 2.5% (4-y

BTC1%

- Reward

- 10

- 14

- Repost

- Share

Yusfirah :

:

LFG 🔥View More

#BitcoinMarketAnalysis

Bitcoin’s market over the past several months has reflected more than volatility — it illustrates structural evolution. BTC is no longer a purely speculative instrument; it has become macro-sensitive, institutionally relevant, and ecosystem-driven. Understanding its current dynamics requires integrating multiple dimensions: on-chain activity, liquidity flows, macroeconomic indicators, institutional behavior, and market psychology. Short-term charts tell only part of the story — volatility today often reflects transitions in liquidity, capital allocation, and adoption ra

Bitcoin’s market over the past several months has reflected more than volatility — it illustrates structural evolution. BTC is no longer a purely speculative instrument; it has become macro-sensitive, institutionally relevant, and ecosystem-driven. Understanding its current dynamics requires integrating multiple dimensions: on-chain activity, liquidity flows, macroeconomic indicators, institutional behavior, and market psychology. Short-term charts tell only part of the story — volatility today often reflects transitions in liquidity, capital allocation, and adoption ra

BTC1%

- Reward

- 16

- 20

- Repost

- Share

ShainingMoon :

:

LFG 🔥View More

#BitcoinMarketAnalysis

Bitcoin’s market over the past several months has reflected more than volatility — it illustrates structural evolution. BTC is no longer a purely speculative instrument; it has become macro-sensitive, institutionally relevant, and ecosystem-driven. Understanding its current dynamics requires integrating multiple dimensions: on-chain activity, liquidity flows, macroeconomic indicators, institutional behavior, and market psychology. Short-term charts tell only part of the story — volatility today often reflects transitions in liquidity, capital allocation, and adoption ra

Bitcoin’s market over the past several months has reflected more than volatility — it illustrates structural evolution. BTC is no longer a purely speculative instrument; it has become macro-sensitive, institutionally relevant, and ecosystem-driven. Understanding its current dynamics requires integrating multiple dimensions: on-chain activity, liquidity flows, macroeconomic indicators, institutional behavior, and market psychology. Short-term charts tell only part of the story — volatility today often reflects transitions in liquidity, capital allocation, and adoption ra

BTC1%

- Reward

- 3

- 4

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Wishing you great wealth in the Year of the Horse 🐴View More

📊 #BitcoinMarketAnalysis — Feb 12, 2026

Bitcoin is showing short-term volatility after slipping below $67K, with support likely near $64K–$66K.

🔹 Key Points:

Short-term pressure as crypto sentiment tilts toward fear.

Resistance around $70K, sideways trading expected in the near term.

Medium-term potential: Institutional demand and liquidity could push BTC toward $100K+ later this year.

Key drivers: Macro factors, ETF flows, and market sentiment will guide price action.

💡 Despite the dips, fundamentals remain strong — Bitcoin continues to attract institutional attention and long-term investo

Bitcoin is showing short-term volatility after slipping below $67K, with support likely near $64K–$66K.

🔹 Key Points:

Short-term pressure as crypto sentiment tilts toward fear.

Resistance around $70K, sideways trading expected in the near term.

Medium-term potential: Institutional demand and liquidity could push BTC toward $100K+ later this year.

Key drivers: Macro factors, ETF flows, and market sentiment will guide price action.

💡 Despite the dips, fundamentals remain strong — Bitcoin continues to attract institutional attention and long-term investo

BTC1%

- Reward

- like

- Comment

- Repost

- Share

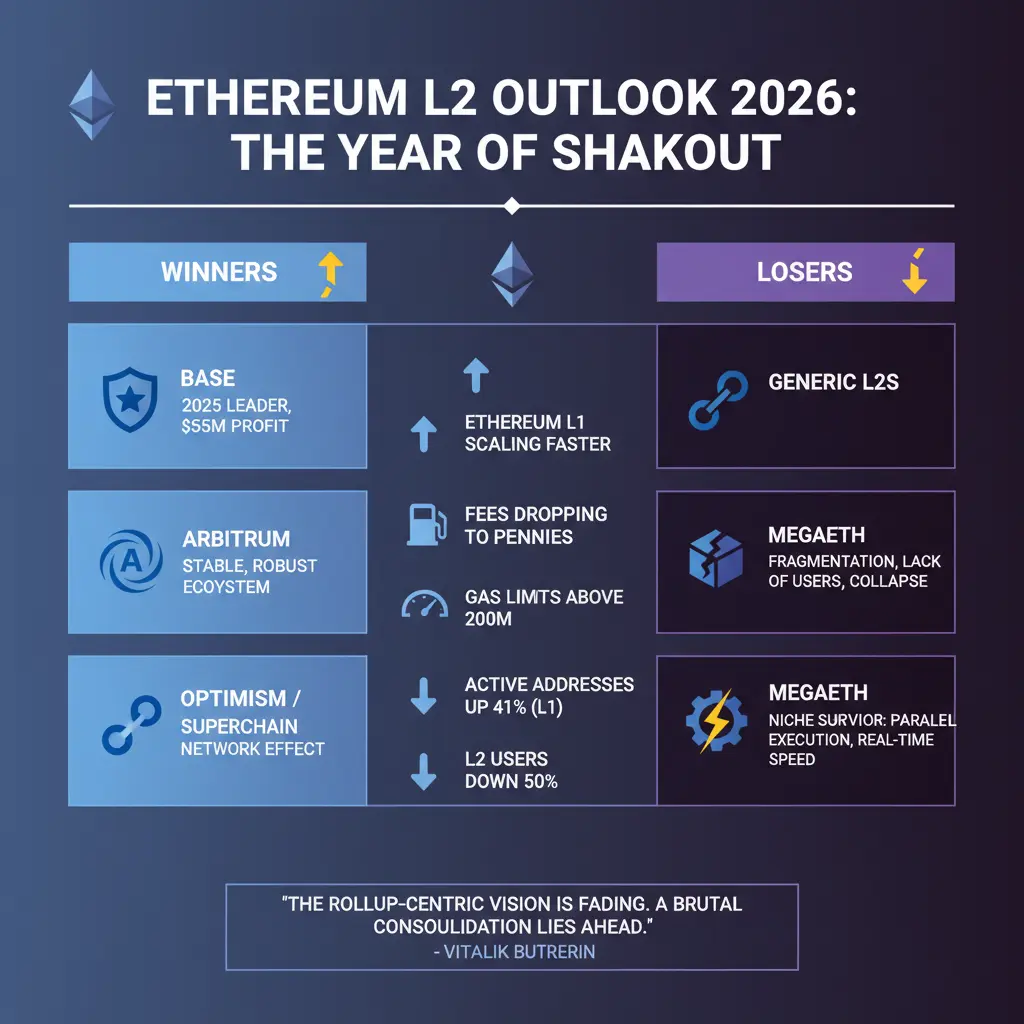

#EthereumL2Outlook 2026: The Year of Shakeout

Ethereum’s Layer 2 landscape is at a critical crossroads. The early dream of “cheap branded shards” is fading as Ethereum L1 scales faster than expected. With fees dropping to mere pennies and gas limits soaring above 200M thanks to the Fusaka/Heze upgrades, users are increasingly returning to the mainnet — active addresses are up over 41%, while L2 monthly users have declined roughly 50% from 2025 peaks.

Vitalik himself has acknowledged that the original rollup vision “no longer makes sense.” This signals a brutal consolidation ahead:

✅ Winners:

B

Ethereum’s Layer 2 landscape is at a critical crossroads. The early dream of “cheap branded shards” is fading as Ethereum L1 scales faster than expected. With fees dropping to mere pennies and gas limits soaring above 200M thanks to the Fusaka/Heze upgrades, users are increasingly returning to the mainnet — active addresses are up over 41%, while L2 monthly users have declined roughly 50% from 2025 peaks.

Vitalik himself has acknowledged that the original rollup vision “no longer makes sense.” This signals a brutal consolidation ahead:

✅ Winners:

B

- Reward

- 12

- 21

- Repost

- Share

CryptoFiler :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

299.49K Popularity

95.39K Popularity

415.64K Popularity

112.78K Popularity

19.62K Popularity

311.57K Popularity

67.74K Popularity

613.72K Popularity

35.95K Popularity

33.95K Popularity

35.49K Popularity

29.9K Popularity

33.56K Popularity

61.51K Popularity

News

View MorePunch increased by 51.89% after launching Alpha, current price is 0.0386119409101489 USDT

15 m

The Bitcoin white paper is being exhibited at the New York Stock Exchange.

17 m

Bloomberg Analyst: The unique value of Bitcoin lies in its user-driven nature, along with its censorship resistance and anti-inflation properties.

27 m

OpenClaw Founder: There are still "AI companies" requesting phone discussions about Claw integration and will not insert random features into the core for exposure

49 m

Vitalik advocates using personal LLMs to improve the efficiency of decentralized governance

1 h

Pin