#AIAgentProjectsI’mWatching

Artificial Intelligence and Cryptocurrency: The Future Is No Longer a Prediction, But an Algorithm!

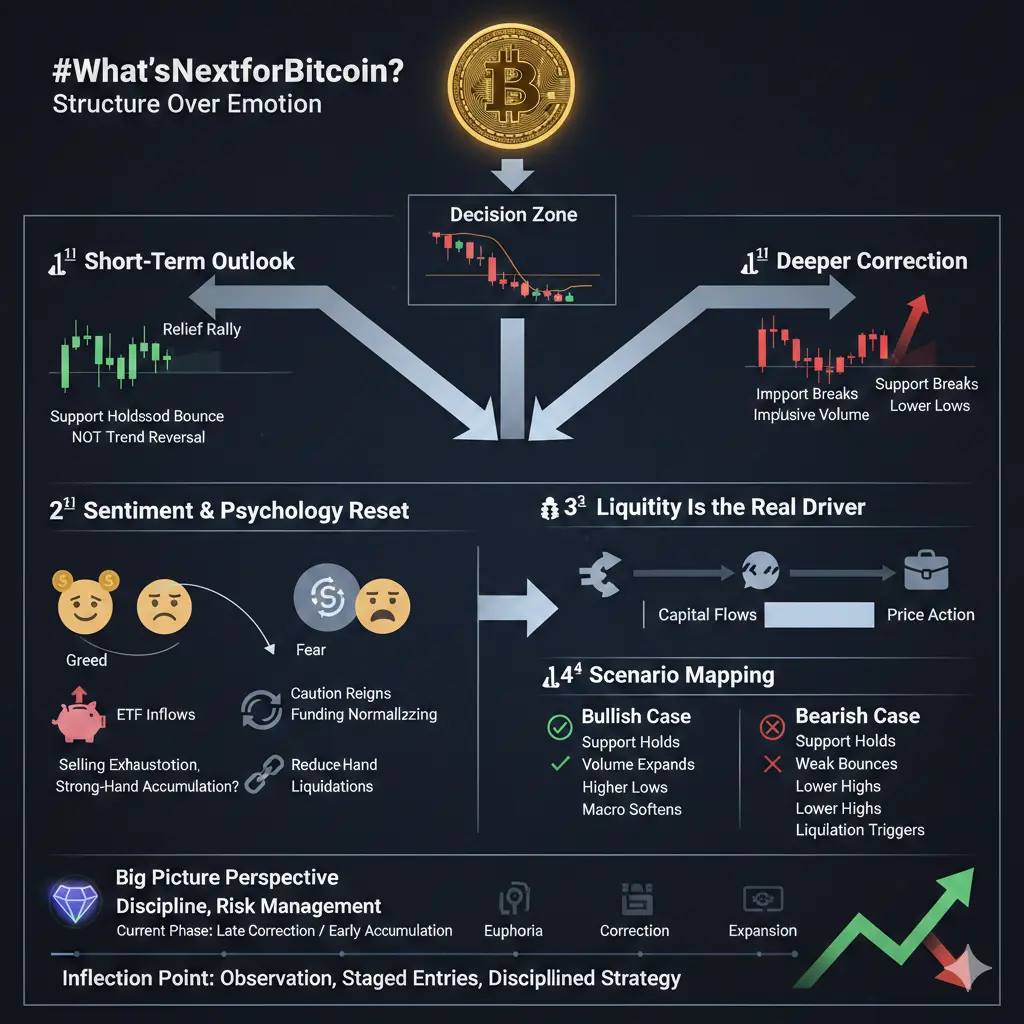

In the world of cryptocurrencies, the winds change rapidly, but there is only one truth at the storm's center now: AI Agents. We are no longer just talking about tools that process data, but about core technologies capable of autonomous decision-making, executing trades, and managing ecosystems on-chain.

So, in this revolution, which projects truly have a “brain,” and which are just riding the hype? Here are some key points I’m focusing on that have exciting technical architectures:

The Era of Autonomous Economy Is Coming

In the future, managing wallets may no longer be done by us directly, but by AI agents operating according to strategies we set. When researching AI projects on Gate.io, you shouldn’t just look at price charts; you should pay attention to the project’s “learning ability.” Those that can turn data into value, provide decentralized computing power, or audit smart contracts are destined to be the stars of this bull market.

Why now?

Because artificial intelligence has evolved from an auxiliary tool into a true “market maker.” These structures can analyze massive amounts of data within seconds, seize opportunities while we sleep, and redefine “financial freedom.” Among the projects I track, the primary trait I look for is: does it truly solve real-world problems?

Which AI agent do you believe in the most?

Although the market moves at dizzying speeds, the power of the community is always the most accurate compass. In your portfolio, which AI projects do you trust for their technology, or believe will “absolutely change the game”?

Let’s analyze this revolution together. Please share your projects and reasons in the comments, and let’s uncover the most promising opportunities!

Artificial Intelligence and Cryptocurrency: The Future Is No Longer a Prediction, But an Algorithm!

In the world of cryptocurrencies, the winds change rapidly, but there is only one truth at the storm's center now: AI Agents. We are no longer just talking about tools that process data, but about core technologies capable of autonomous decision-making, executing trades, and managing ecosystems on-chain.

So, in this revolution, which projects truly have a “brain,” and which are just riding the hype? Here are some key points I’m focusing on that have exciting technical architectures:

The Era of Autonomous Economy Is Coming

In the future, managing wallets may no longer be done by us directly, but by AI agents operating according to strategies we set. When researching AI projects on Gate.io, you shouldn’t just look at price charts; you should pay attention to the project’s “learning ability.” Those that can turn data into value, provide decentralized computing power, or audit smart contracts are destined to be the stars of this bull market.

Why now?

Because artificial intelligence has evolved from an auxiliary tool into a true “market maker.” These structures can analyze massive amounts of data within seconds, seize opportunities while we sleep, and redefine “financial freedom.” Among the projects I track, the primary trait I look for is: does it truly solve real-world problems?

Which AI agent do you believe in the most?

Although the market moves at dizzying speeds, the power of the community is always the most accurate compass. In your portfolio, which AI projects do you trust for their technology, or believe will “absolutely change the game”?

Let’s analyze this revolution together. Please share your projects and reasons in the comments, and let’s uncover the most promising opportunities!