# BuyTheDipOrWaitNow?

287.42K

MrFlower_XingChen

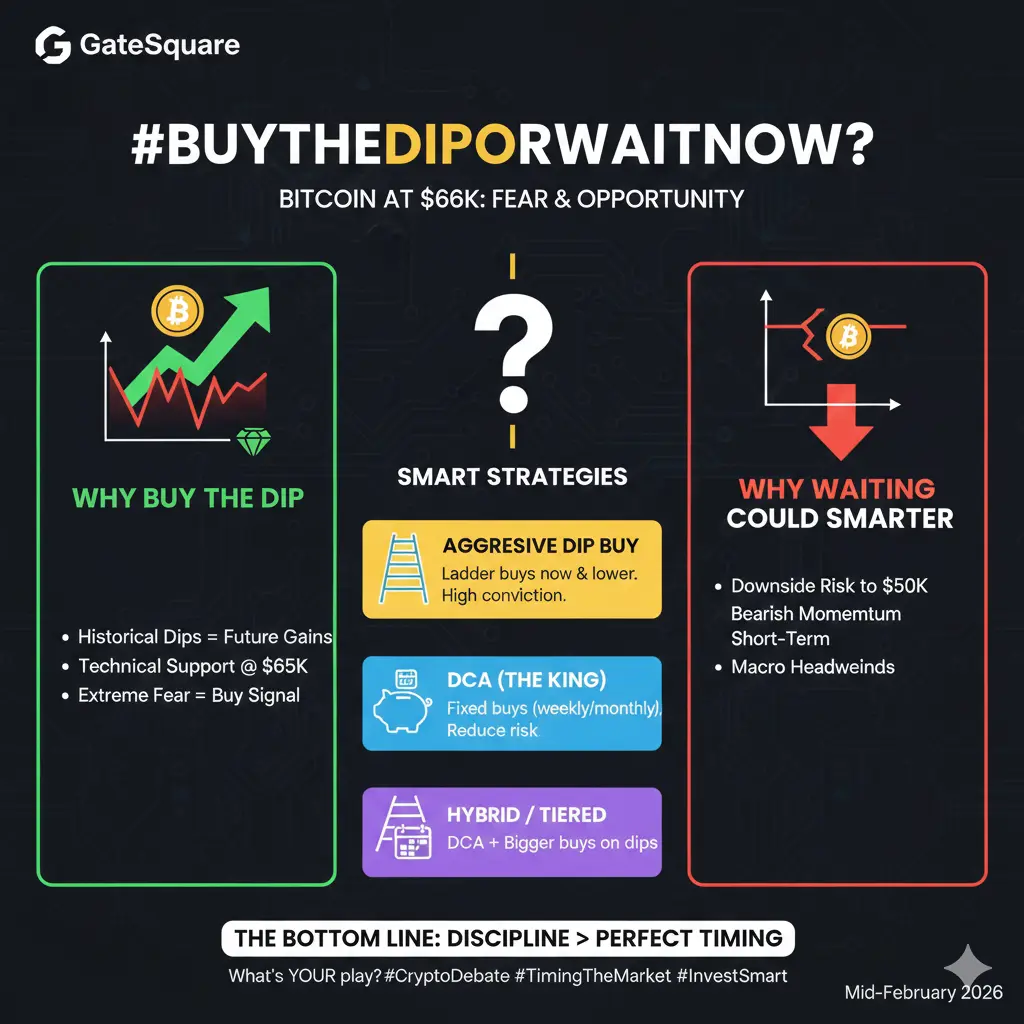

#BuyTheDipOrWaitNow? Bitcoin at the Mid-$66K Crossroads 🚦💎

The cryptocurrency market has entered one of its most pivotal phases of 2026. Bitcoin (BTC) is trading in the $66K–$67K range after a sharp February correction from highs above $70K, dipping briefly to around $60K. This 15–20% retracement has reignited debate among retail traders, institutional investors, and analysts alike: Is now the time to buy the dip, or is patience wiser?

Sentiment is cautious. The Fear & Greed Index is in deep red, signaling extreme fear, yet on-chain data shows a blend of whale accumulation and measured reta

The cryptocurrency market has entered one of its most pivotal phases of 2026. Bitcoin (BTC) is trading in the $66K–$67K range after a sharp February correction from highs above $70K, dipping briefly to around $60K. This 15–20% retracement has reignited debate among retail traders, institutional investors, and analysts alike: Is now the time to buy the dip, or is patience wiser?

Sentiment is cautious. The Fear & Greed Index is in deep red, signaling extreme fear, yet on-chain data shows a blend of whale accumulation and measured reta

- Reward

- 6

- 6

- Repost

- Share

Ryakpanda :

:

Wishing you great wealth in the Year of the Horse 🐴View More

#BuyTheDipOrWaitNow? Bitcoin at the Mid-$66K Crossroads

The cryptocurrency market is currently in one of its most pivotal moments of 2026. Bitcoin (BTC) is trading in the $66,000–$67,000 range following a sharp February pullback from highs above $70K, touching lows near $60K. This 15–20% correction has reignited questions from retail, institutional investors, and analysts alike: is this the ideal time to buy the dip, or should one wait for more clarity? While retail sentiment remains jittery and the Fear & Greed Index reflects extreme caution, on-chain data shows a mix of whale accumulation an

The cryptocurrency market is currently in one of its most pivotal moments of 2026. Bitcoin (BTC) is trading in the $66,000–$67,000 range following a sharp February pullback from highs above $70K, touching lows near $60K. This 15–20% correction has reignited questions from retail, institutional investors, and analysts alike: is this the ideal time to buy the dip, or should one wait for more clarity? While retail sentiment remains jittery and the Fear & Greed Index reflects extreme caution, on-chain data shows a mix of whale accumulation an

BTC-0,61%

- Reward

- 10

- 12

- Repost

- Share

HighAmbition :

:

LFG 🔥View More

#BuyTheDipOrWaitNow? As of mid-February 2026, Bitcoin is fluctuating near the $67,000 zone after rejecting higher resistance levels. The volatility has cooled compared to peak momentum phases, but uncertainty remains elevated. Traders are split between two classic strategies: accumulate the dip or wait for clearer confirmation. The correct answer depends less on prediction — and more on structure, liquidity conditions, and personal risk tolerance.

From a structural standpoint, Bitcoin is currently trading between major support and resistance clusters. Near-term support sits around $65,000–$66,

From a structural standpoint, Bitcoin is currently trading between major support and resistance clusters. Near-term support sits around $65,000–$66,

BTC-0,61%

- Reward

- 1

- 1

- Repost

- Share

Yusfirah :

:

To The Moon 🌕#BuyTheDipOrWaitNow?

The burning question right now in crypto circles: #BuyTheDipOrWaitNow?

Bitcoin is hovering in the mid-$66K range (around $66,000–$67,000 as of mid-February 2026), after a brutal February sell-off that saw it crash from recent highs near $70K+ down to brief lows around $60K–$61K. That's a sharp 15–20%+ drawdown in a short span, triggering extreme fear across the market. Retail is dipping in (Coinbase CEO Brian Armstrong noted users are "buying the dip" with diamond hands), institutions appear to be accumulating on weakness, but sentiment is fragile—fear & greed index in de

The burning question right now in crypto circles: #BuyTheDipOrWaitNow?

Bitcoin is hovering in the mid-$66K range (around $66,000–$67,000 as of mid-February 2026), after a brutal February sell-off that saw it crash from recent highs near $70K+ down to brief lows around $60K–$61K. That's a sharp 15–20%+ drawdown in a short span, triggering extreme fear across the market. Retail is dipping in (Coinbase CEO Brian Armstrong noted users are "buying the dip" with diamond hands), institutions appear to be accumulating on weakness, but sentiment is fragile—fear & greed index in de

- Reward

- 10

- 10

- Repost

- Share

repanzal :

:

thanks for the outstanding information sharing with us its realy informative.View More

#BuyTheDipOrWaitNow? Bitcoin at the Mid-$66K Crossroads🌹🌟🌹🌟🌹🌟

The cryptocurrency market is currently in one of its most pivotal moments of 2026. Bitcoin (BTC) is trading in the $66,000–$67,000 range following a sharp February pullback from highs above $70K, touching lows near $60K. This 15–20% correction has reignited questions from retail, institutional investors, and analysts alike: is this the ideal time to buy the dip, or should one wait for more clarity? While retail sentiment remains jittery and the Fear & Greed Index reflects extreme caution, on-chain data shows a mix of whale acc

The cryptocurrency market is currently in one of its most pivotal moments of 2026. Bitcoin (BTC) is trading in the $66,000–$67,000 range following a sharp February pullback from highs above $70K, touching lows near $60K. This 15–20% correction has reignited questions from retail, institutional investors, and analysts alike: is this the ideal time to buy the dip, or should one wait for more clarity? While retail sentiment remains jittery and the Fear & Greed Index reflects extreme caution, on-chain data shows a mix of whale acc

BTC-0,61%

- Reward

- 3

- 5

- Repost

- Share

AylaShinex :

:

Good morningView More

Eric Trump says

“I’m a huge proponent of Bitcoin.

I think it hits $1,000,000.

I’ve never been more bullish.”

#BuyTheDipOrWaitNow?

“I’m a huge proponent of Bitcoin.

I think it hits $1,000,000.

I’ve never been more bullish.”

#BuyTheDipOrWaitNow?

BTC-0,61%

- Reward

- 2

- 1

- Repost

- Share

MasterOfLongAndShort :

:

why not $WLFI📊 #BuyTheDipOrWaitNow? $BTC $GT $ETH 🤔

Bitcoin is hovering near key support while momentum is still slightly negative ⚠️

RSI is neutral, MACD is below zero, and sellers still have some pressure.

So what’s the move? 👇

🟢 Buy the dip?

Only if we see strong bounce from support + volume confirmation.

🟡 Wait?

If price is still below EMA and momentum is negative, patience is power.

🔴 Break below support?

Then it’s not a dip — it’s continuation.

Smart traders don’t guess.

They wait for confirmation. 📈

Bitcoin is hovering near key support while momentum is still slightly negative ⚠️

RSI is neutral, MACD is below zero, and sellers still have some pressure.

So what’s the move? 👇

🟢 Buy the dip?

Only if we see strong bounce from support + volume confirmation.

🟡 Wait?

If price is still below EMA and momentum is negative, patience is power.

🔴 Break below support?

Then it’s not a dip — it’s continuation.

Smart traders don’t guess.

They wait for confirmation. 📈

- Reward

- 2

- Comment

- Repost

- Share

Eric Trump says

“I’m a huge proponent of Bitcoin.

I think it hits $1,000,000.

I’ve never been more bullish.”

#BuyTheDipOrWaitNow?

“I’m a huge proponent of Bitcoin.

I think it hits $1,000,000.

I’ve never been more bullish.”

#BuyTheDipOrWaitNow?

BTC-0,61%

- Reward

- like

- 1

- Repost

- Share

AhmadShah :

:

To The Moon 🌕📉 #BuyTheDipOrWaitNow?

The market is showing signs of a dip — but the big question is: should you buy now or wait it out? 🤔

Here’s what to consider:

1️⃣ Market Trends: Look at recent movements. Are we in a short-term pullback or a potential long-term downtrend?

2️⃣ Risk Appetite: Only invest what you can afford to lose. Dips can turn into recoveries… or further drops.

3️⃣ Opportunities: Smart buying during dips can lead to strong gains if the market rebounds.

4️⃣ Patience Pays: Sometimes waiting for a clear signal is safer than chasing the bottom.

💡 Pro Tip: Diversify your entries. Instead

The market is showing signs of a dip — but the big question is: should you buy now or wait it out? 🤔

Here’s what to consider:

1️⃣ Market Trends: Look at recent movements. Are we in a short-term pullback or a potential long-term downtrend?

2️⃣ Risk Appetite: Only invest what you can afford to lose. Dips can turn into recoveries… or further drops.

3️⃣ Opportunities: Smart buying during dips can lead to strong gains if the market rebounds.

4️⃣ Patience Pays: Sometimes waiting for a clear signal is safer than chasing the bottom.

💡 Pro Tip: Diversify your entries. Instead

- Reward

- 2

- 2

- Repost

- Share

Korean_Girl :

:

To The Moon 🌕View More

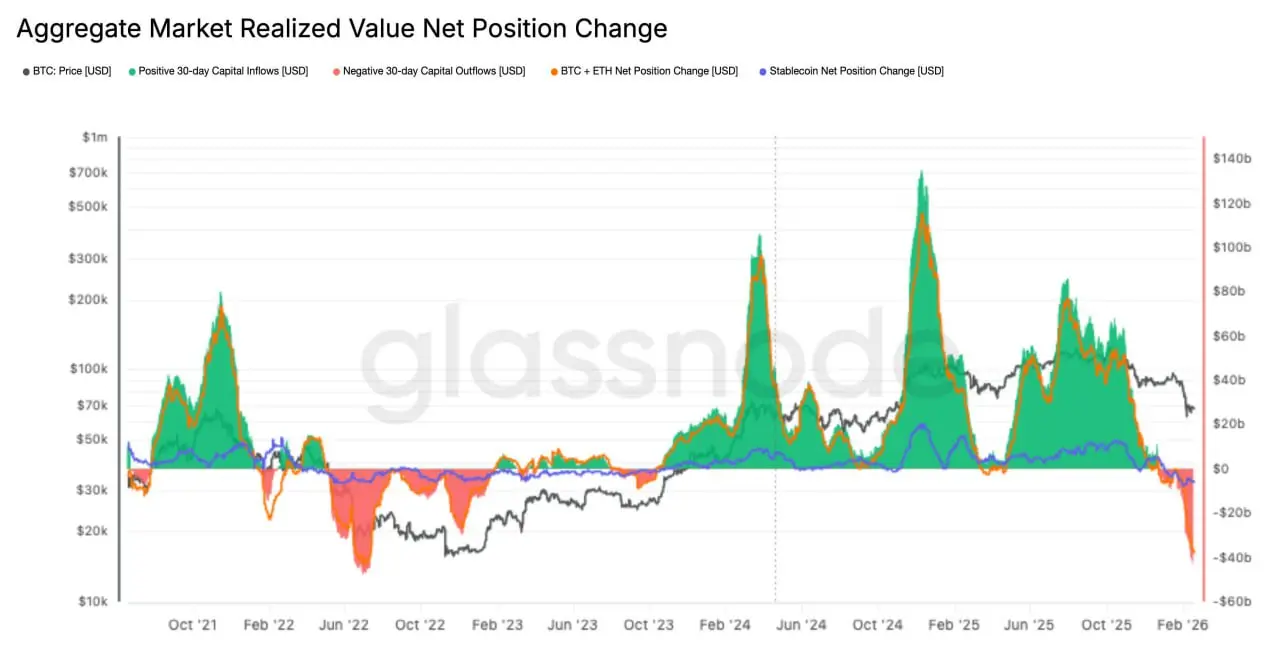

Capital is quietly leaving the room.

According to Glassnode, aggregate 30D Realized Cap flows have rolled sharply negative — one of the deepest outflow phases since the 2022 bear market. That’s not noise. That’s capital exiting at scale.

$BTC + $ETH net position change has flipped decisively lower. At the same time, stablecoin growth is stalling near neutral — meaning fresh sidelined liquidity isn’t building.

This isn’t panic. It’s contraction.

When realized cap flows turn this negative, it signals distribution pressure and reduced conviction. Until stablecoin expansion resumes and net positio

According to Glassnode, aggregate 30D Realized Cap flows have rolled sharply negative — one of the deepest outflow phases since the 2022 bear market. That’s not noise. That’s capital exiting at scale.

$BTC + $ETH net position change has flipped decisively lower. At the same time, stablecoin growth is stalling near neutral — meaning fresh sidelined liquidity isn’t building.

This isn’t panic. It’s contraction.

When realized cap flows turn this negative, it signals distribution pressure and reduced conviction. Until stablecoin expansion resumes and net positio

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

209.52K Popularity

14.17K Popularity

46.26K Popularity

87.23K Popularity

851.68K Popularity

287.42K Popularity

450.6K Popularity

34.18K Popularity

22.74K Popularity

21.14K Popularity

21.55K Popularity

19.24K Popularity

20.75K Popularity

48.46K Popularity

News

View MoreData: Hyperliquid platform whales currently hold positions worth $2.832 billion, with a long-short position ratio of 0.96.

5 m

Market Report: Top 5 Cryptocurrency Gainers on February 19, 2026, led by Injective

6 m

Uniswap has launched a proposal to expand protocol fees

14 m

Eric Trump: Based on the historical average annual increase of 70%, Bitcoin will reach $1 million

26 m

Pump.fun-Linked Wallet Sells Over 2 Billion PUMP Tokens for $4.55M

30 m

Pin