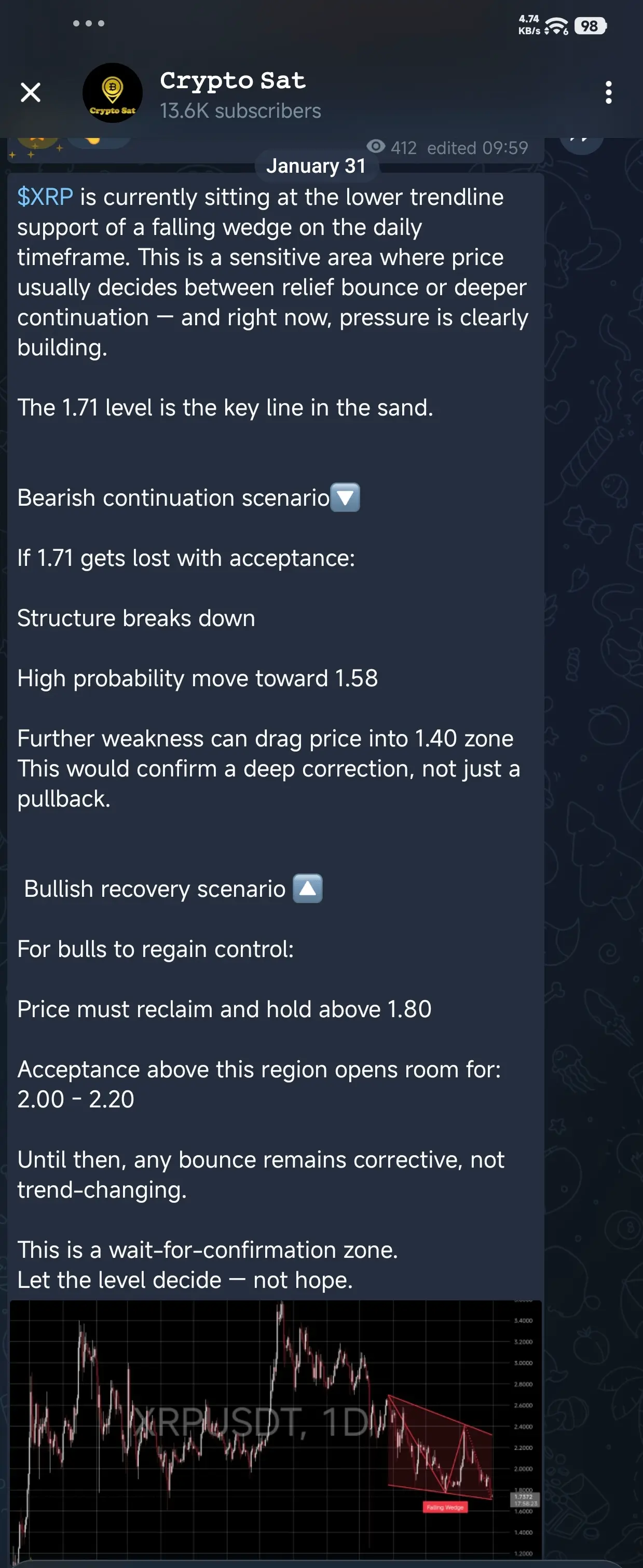

$XRP is currently sitting at the lower trendline support of a falling wedge on the daily timeframe. This is a sensitive area where price usually decides between relief bounce or deeper continuation — and right now, pressure is clearly building.

The 1.71 level is the key line in the sand.

Bearish continuation scenario🔽

If 1.71 gets lost with acceptance:

Structure breaks down

High probability move toward 1.58

Further weakness can drag price into 1.40 zone

This would confirm a deep correction, not just a pullback.

Bullish recovery scenario 🔼

For bulls to regain control:

Price must reclaim and hold above 1.80

Acceptance above this region opens room for: 2.00 - 2.20

Until then, any bounce remains corrective, not trend-changing.

This is a wait-for-confirmation zone.

Let the level decide — not hope.

The 1.71 level is the key line in the sand.

Bearish continuation scenario🔽

If 1.71 gets lost with acceptance:

Structure breaks down

High probability move toward 1.58

Further weakness can drag price into 1.40 zone

This would confirm a deep correction, not just a pullback.

Bullish recovery scenario 🔼

For bulls to regain control:

Price must reclaim and hold above 1.80

Acceptance above this region opens room for: 2.00 - 2.20

Until then, any bounce remains corrective, not trend-changing.

This is a wait-for-confirmation zone.

Let the level decide — not hope.