# ETHEREUM

604.81K

DragonFlyOfficial

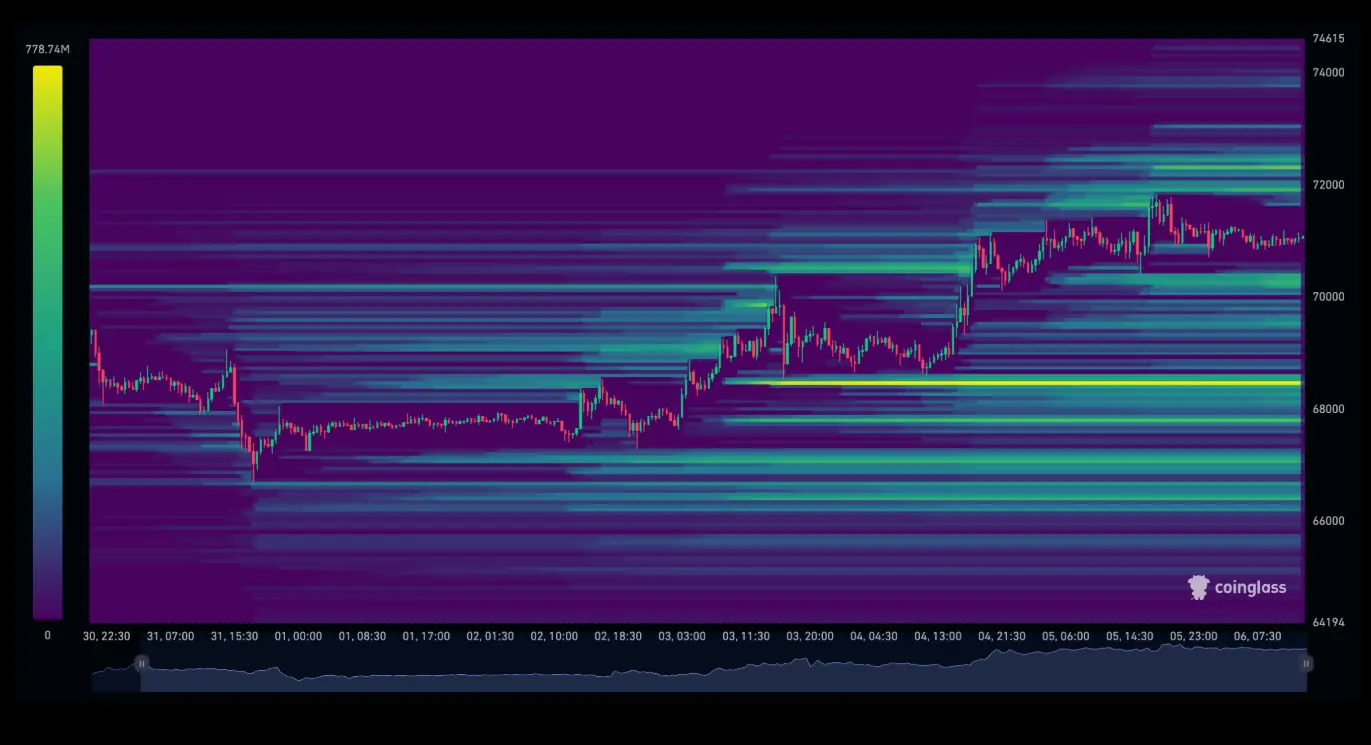

🚨 $60M Short Liquidated Amid Market Spike

According to BlockBeats News (Jan 24) and EmberCN monitoring, crypto market volatility struck again:

At around 1:00 a.m., Bitcoin briefly surged above $91,000 and Ethereum climbed past $3,000, triggering the liquidation of a massive short position held by “Rolling Trader 0xD83…Fd7”.

🔻 Key Details:

• Liquidation size: ~$60 million

• Total short position reduced from $300M → $238M

• Unrealized gains fell from $24M (2 days ago) to ~$4M

⚠️ This move once again highlights how high leverage + sudden volatility can quickly wipe out even large positions.

💬

According to BlockBeats News (Jan 24) and EmberCN monitoring, crypto market volatility struck again:

At around 1:00 a.m., Bitcoin briefly surged above $91,000 and Ethereum climbed past $3,000, triggering the liquidation of a massive short position held by “Rolling Trader 0xD83…Fd7”.

🔻 Key Details:

• Liquidation size: ~$60 million

• Total short position reduced from $300M → $238M

• Unrealized gains fell from $24M (2 days ago) to ~$4M

⚠️ This move once again highlights how high leverage + sudden volatility can quickly wipe out even large positions.

💬

- Reward

- 12

- 12

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

🔥 Nasdaq Moves to Lift Position Limits on BTC & ETH ETF Options 🔥

Big signal from traditional finance 👀

Nasdaq has officially applied to remove the 25,000-contract position limit on spot Bitcoin & Ethereum ETF options, submitting a rule change to the U.S. SEC.

📌 What’s changing?

• ❌ Removes the 25,000 contract cap

• ⚖️ Treats crypto ETF options the same as commodity ETF options

• 🏦 Eliminates what Nasdaq calls “unfair restrictions”

• 🗣️ SEC comment period is now open

• ⏰ Final decision expected by end of February

💡 Why this matters:

This could unlock larger institutional participation,

Big signal from traditional finance 👀

Nasdaq has officially applied to remove the 25,000-contract position limit on spot Bitcoin & Ethereum ETF options, submitting a rule change to the U.S. SEC.

📌 What’s changing?

• ❌ Removes the 25,000 contract cap

• ⚖️ Treats crypto ETF options the same as commodity ETF options

• 🏦 Eliminates what Nasdaq calls “unfair restrictions”

• 🗣️ SEC comment period is now open

• ⏰ Final decision expected by end of February

💡 Why this matters:

This could unlock larger institutional participation,

- Reward

- 16

- 15

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

#CryptoETFDivergence

Day by day, still here. Still observing the market.

The crypto market is showing divergent signals between spot price movements and ETF flows. While Bitcoin and Ethereum are attempting short-term rebounds, ETF inflows are not fully aligned, creating a temporary disconnect in momentum.

📊 Market Overview

Ethereum (ETH):

Price stabilized near 3000 after failing to hold resistance around 3170–3180.

Recent rebound near 3130 is weak; a retest below 3100, potentially toward 3070, is likely.

Volatility remains high, and ETF flows are cautious, limiting strong upward moves.

Bitcoi

Day by day, still here. Still observing the market.

The crypto market is showing divergent signals between spot price movements and ETF flows. While Bitcoin and Ethereum are attempting short-term rebounds, ETF inflows are not fully aligned, creating a temporary disconnect in momentum.

📊 Market Overview

Ethereum (ETH):

Price stabilized near 3000 after failing to hold resistance around 3170–3180.

Recent rebound near 3130 is weak; a retest below 3100, potentially toward 3070, is likely.

Volatility remains high, and ETF flows are cautious, limiting strong upward moves.

Bitcoi

ETH0,1%

MC:$3.55KHolders:1

0.00%

- Reward

- 7

- 10

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

🔥 Nasdaq Moves to Lift Position Limits on BTC & ETH ETF Options 🔥

A major signal from traditional finance 👀

Nasdaq has officially filed a proposal with the U.S. SEC to remove the 25,000-contract position limit on options for spot Bitcoin and Ethereum ETFs.

📌 What’s Changing?

• ❌ The 25,000 contract cap will be eliminated

• ⚖️ Crypto ETF options would be regulated the same way as commodity ETF options

• 🏦 Nasdaq calls the current limit an “unfair restriction”

• 🗣️ The SEC comment period is now open

• ⏰ A final decision is expected by the end of February

💡 Why This Matters:

If approved, t

A major signal from traditional finance 👀

Nasdaq has officially filed a proposal with the U.S. SEC to remove the 25,000-contract position limit on options for spot Bitcoin and Ethereum ETFs.

📌 What’s Changing?

• ❌ The 25,000 contract cap will be eliminated

• ⚖️ Crypto ETF options would be regulated the same way as commodity ETF options

• 🏦 Nasdaq calls the current limit an “unfair restriction”

• 🗣️ The SEC comment period is now open

• ⏰ A final decision is expected by the end of February

💡 Why This Matters:

If approved, t

- Reward

- 4

- 4

- Repost

- Share

EagleEye :

:

Buy To Earn 💎View More

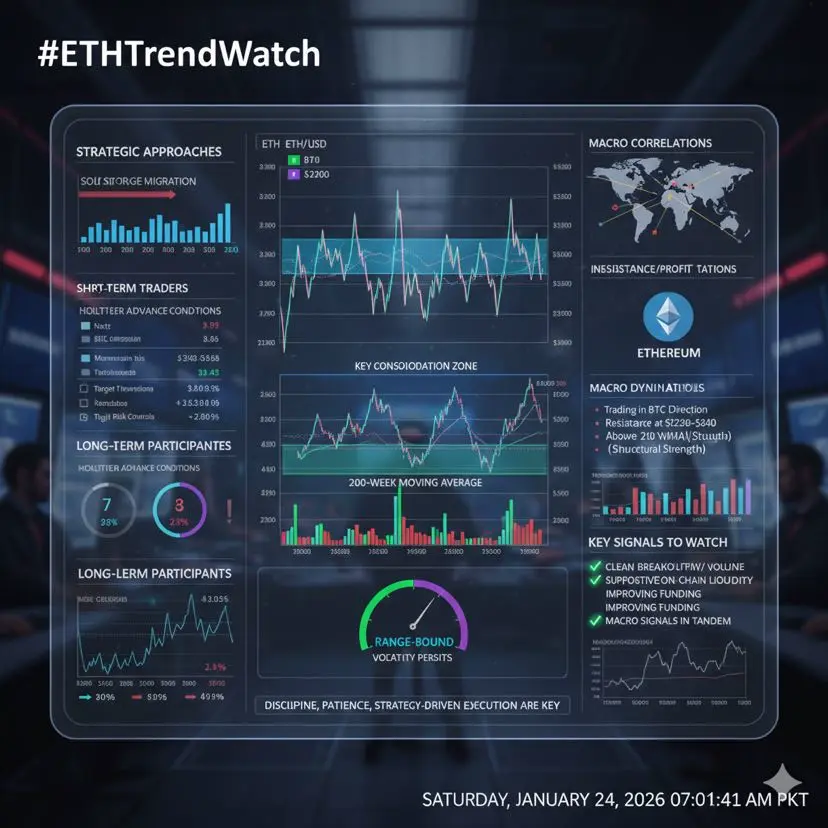

🔥 #ETHTrendWatch | Ethereum in Consolidation Mode

Ethereum (ETH) is currently navigating a range-bound consolidation, balancing technical structure with macro uncertainty. No panic—just calculated price discovery.

💹 Price Action Snapshot • Range: $2,970 – $3,200

• Choppy movement after recent highs

• Strong demand zone: $3,100–$3,200

• Key resistance: $3,250–$3,400 (profit-taking area)

📊 Technical Outlook • ETH holds above the 200-week MA → long-term strength intact

• A clean breakout above $3,400–$3,450 could unlock bullish momentum

• Accumulation at support, distribution near resistance

•

Ethereum (ETH) is currently navigating a range-bound consolidation, balancing technical structure with macro uncertainty. No panic—just calculated price discovery.

💹 Price Action Snapshot • Range: $2,970 – $3,200

• Choppy movement after recent highs

• Strong demand zone: $3,100–$3,200

• Key resistance: $3,250–$3,400 (profit-taking area)

📊 Technical Outlook • ETH holds above the 200-week MA → long-term strength intact

• A clean breakout above $3,400–$3,450 could unlock bullish momentum

• Accumulation at support, distribution near resistance

•

- Reward

- 1

- Comment

- Repost

- Share

🔥 Nasdaq Moves to Lift Position Limits on BTC & ETH ETF Options! 🔥

Traditional finance is making a bold move 👀

Nasdaq has filed a proposal with the U.S. SEC to remove the 25,000-contract cap on options for spot Bitcoin and Ethereum ETFs.

📌 Key Changes:

• ❌ 25,000 contract limit removed

• ⚖️ Crypto ETF options treated like commodity ETF options

• 🏦 Nasdaq calls the current cap an “unfair restriction”

• 🗣️ SEC comment period now open

• ⏰ Final decision expected by end of February

💡 Why This Matters:

If approved, expect larger institutional participation, deeper liquidity, and more sophist

Traditional finance is making a bold move 👀

Nasdaq has filed a proposal with the U.S. SEC to remove the 25,000-contract cap on options for spot Bitcoin and Ethereum ETFs.

📌 Key Changes:

• ❌ 25,000 contract limit removed

• ⚖️ Crypto ETF options treated like commodity ETF options

• 🏦 Nasdaq calls the current cap an “unfair restriction”

• 🗣️ SEC comment period now open

• ⏰ Final decision expected by end of February

💡 Why This Matters:

If approved, expect larger institutional participation, deeper liquidity, and more sophist

- Reward

- 1

- 1

- Repost

- Share

Yusfirah :

:

Happy New Year! 🤑🔥 Dual-Currency Long Positions Continue to Surge

💰 Total Profit Exceeds 1,900 USDT | Returns Above 200%+

📊 Real-Time Position Performance

✅ BTC Long Position – Profits Expanding

Entry Avg Price: 88,150.0

Current Price: 89,943.3

Return Rate: +227.85%

Profit: 856.48 USDT

Status: Trend remains intact — continue holding

✅ ETH Long Position – Strong & Stable

Entry Avg Price: 2,905.00

Current Price: 2,980.00

Return Rate: +287.60%

Profit: 1,086.75 USDT

Status: Key resistance broken — next target 3,050

🔥 Total Dual-Currency Profit: 1,943.23 USDT

📈 Average Holding Return: 257.7%

---

🎯 Holding Log

💰 Total Profit Exceeds 1,900 USDT | Returns Above 200%+

📊 Real-Time Position Performance

✅ BTC Long Position – Profits Expanding

Entry Avg Price: 88,150.0

Current Price: 89,943.3

Return Rate: +227.85%

Profit: 856.48 USDT

Status: Trend remains intact — continue holding

✅ ETH Long Position – Strong & Stable

Entry Avg Price: 2,905.00

Current Price: 2,980.00

Return Rate: +287.60%

Profit: 1,086.75 USDT

Status: Key resistance broken — next target 3,050

🔥 Total Dual-Currency Profit: 1,943.23 USDT

📈 Average Holding Return: 257.7%

---

🎯 Holding Log

- Reward

- 4

- 4

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

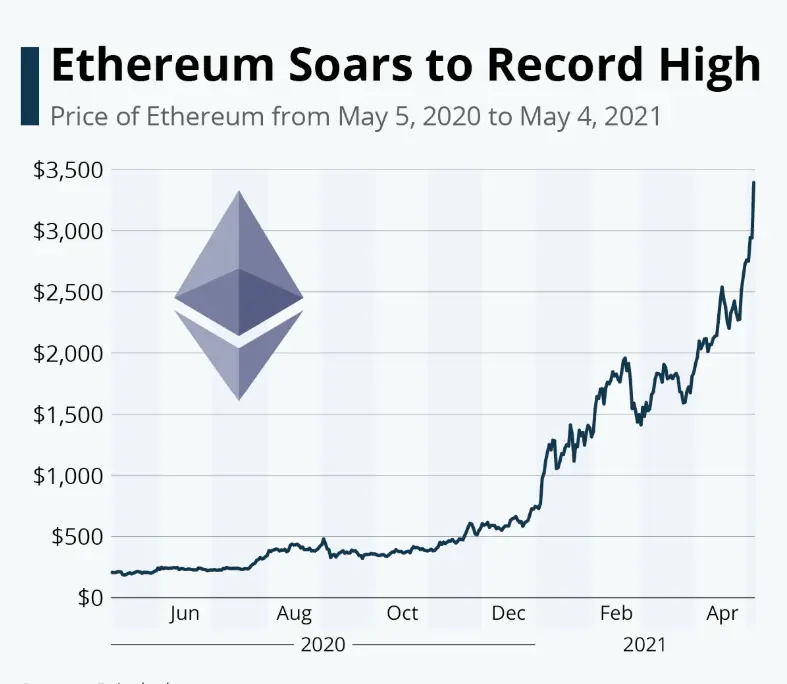

ETH Technical Outlook | Structured Recovery Within a Broader Correction

Ethereum ($ETH) is showing signs of stabilization after a deep corrective move that followed a strong rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection confirmed a distribution top and pushed price into the $2,620 macro demand area, where buyers stepped in decisively.

From this long-term demand, ETH is now attempting a rounded, structured recovery, printing higher lows—more consistent with early accumulation than panic-driven selling. While short-term momentum is improving, the higher-timefra

Ethereum ($ETH) is showing signs of stabilization after a deep corrective move that followed a strong rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection confirmed a distribution top and pushed price into the $2,620 macro demand area, where buyers stepped in decisively.

From this long-term demand, ETH is now attempting a rounded, structured recovery, printing higher lows—more consistent with early accumulation than panic-driven selling. While short-term momentum is improving, the higher-timefra

ETH0,1%

- Reward

- like

- Comment

- Repost

- Share

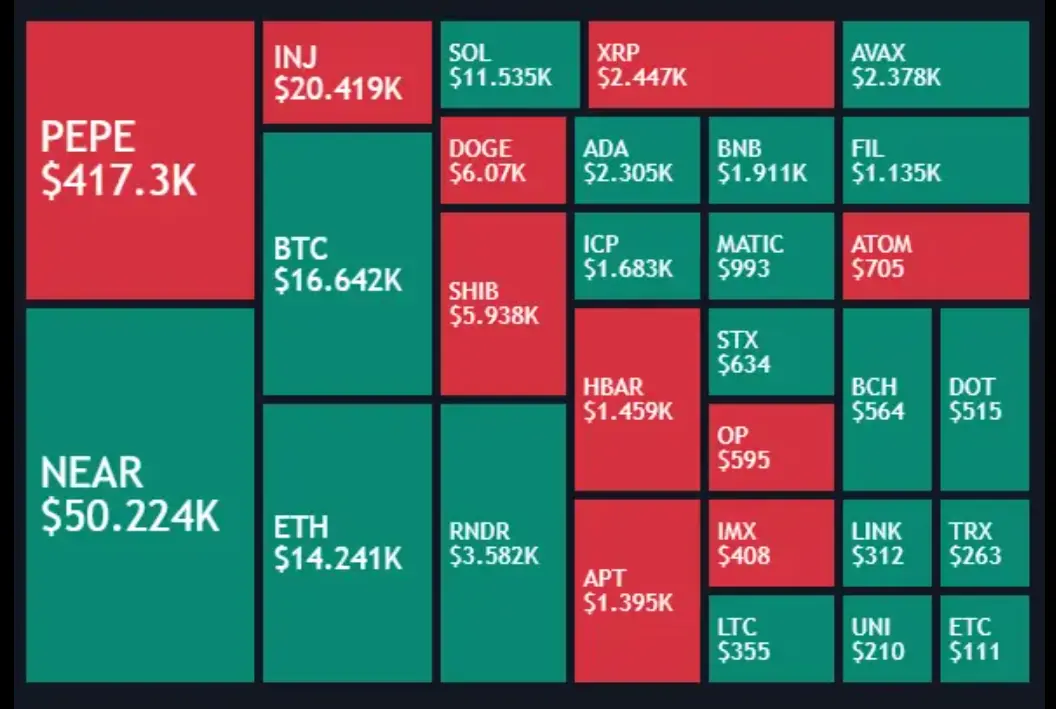

#CryptoMarketWatch 📊 | Market Snapshot

The crypto market is sending mixed signals as volatility stays elevated.

🔹 Bitcoin (BTC) is hovering near key support levels, holding firm amid cautious market sentiment.

🔹 Ethereum (ETH) remains under pressure but continues to defend its short-term support zone.

📌 Market Highlights ▪️ Institutional interest in crypto keeps growing — a strong signal for long-term confidence

▪️ Traders are closely monitoring macroeconomic data and upcoming policy decisions

▪️ Short-term consolidation could set the stage for heightened volatility

⚠️ Market Sentiment Neu

The crypto market is sending mixed signals as volatility stays elevated.

🔹 Bitcoin (BTC) is hovering near key support levels, holding firm amid cautious market sentiment.

🔹 Ethereum (ETH) remains under pressure but continues to defend its short-term support zone.

📌 Market Highlights ▪️ Institutional interest in crypto keeps growing — a strong signal for long-term confidence

▪️ Traders are closely monitoring macroeconomic data and upcoming policy decisions

▪️ Short-term consolidation could set the stage for heightened volatility

⚠️ Market Sentiment Neu

- Reward

- 1

- Comment

- Repost

- Share

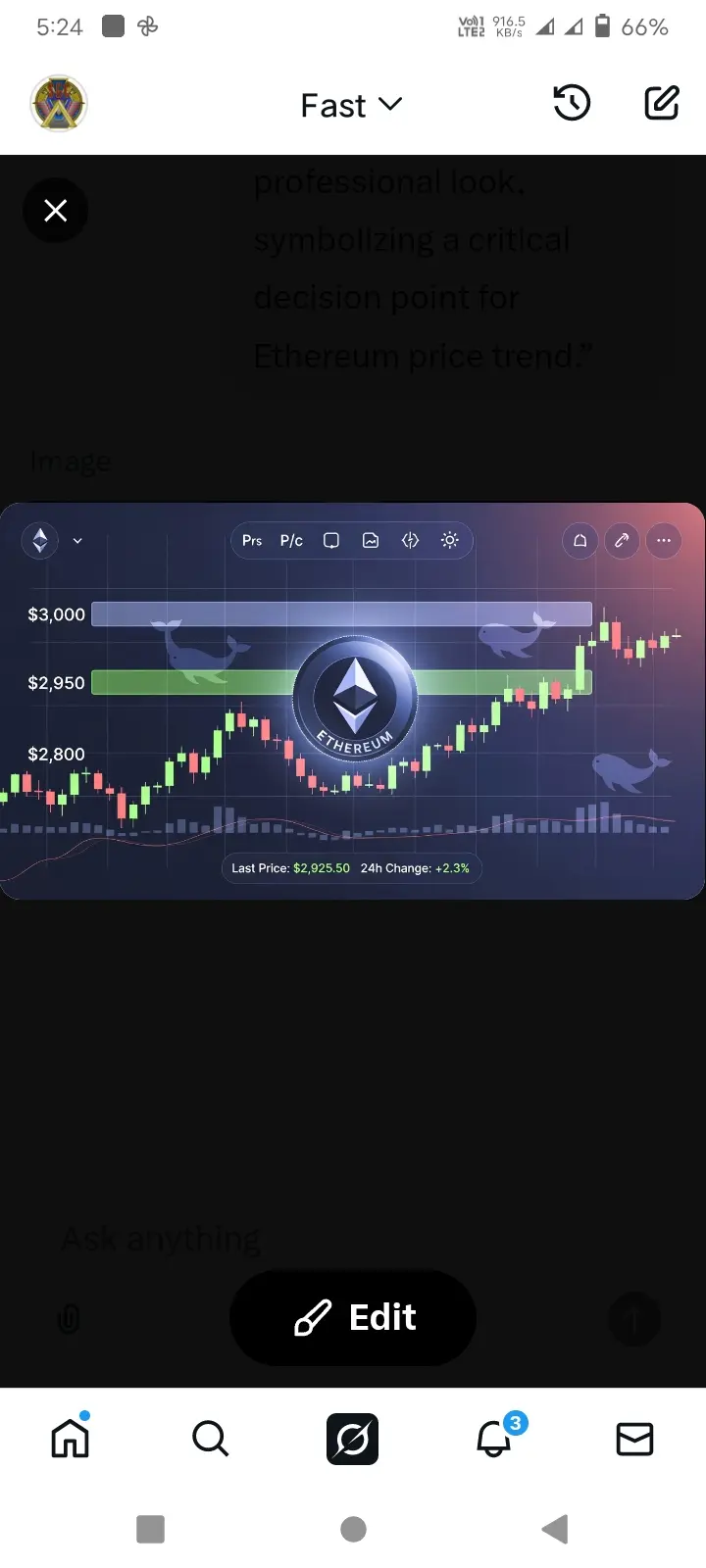

#ETHTrendWatch

Ethereum (ETH) is currently trading around $2,950, with the market showing clear indecision.

The $3,000 level has once again turned into a strong resistance, while buyers remain active in the $2,800–$2,900 support zone.

🔍 Current Market Snapshot

Short-term trend: Sideways to Bearish

ETH has failed to deliver a clear breakout so far

Trading volume remains cautious as traders wait for confirmation

🐳 On-Chain Signals

Whales are gradually accumulating ETH

Staking activity and network fundamentals re

Ethereum (ETH) is currently trading around $2,950, with the market showing clear indecision.

The $3,000 level has once again turned into a strong resistance, while buyers remain active in the $2,800–$2,900 support zone.

🔍 Current Market Snapshot

Short-term trend: Sideways to Bearish

ETH has failed to deliver a clear breakout so far

Trading volume remains cautious as traders wait for confirmation

🐳 On-Chain Signals

Whales are gradually accumulating ETH

Staking activity and network fundamentals re

ETH0,1%

- Reward

- 3

- 3

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

55.97K Popularity

32.52K Popularity

26.29K Popularity

9.34K Popularity

20.18K Popularity

14.88K Popularity

12.58K Popularity

79.57K Popularity

41.89K Popularity

24.21K Popularity

13.14K Popularity

1.72K Popularity

258.64K Popularity

23.55K Popularity

182.21K Popularity

News

View MoreData: 297.79 BTC transferred from an anonymous address, routed through a relay, and sent to another anonymous address

3 h

Data: In the past 24 hours, the total liquidation across the network was $80,035,800,000, with long positions liquidated at $44,110,900,000 and short positions at $35,924,900,000.

3 h

Data: If BTC breaks through $93,845, the total liquidation strength of mainstream CEX short positions will reach $861 million.

4 h

Data: If ETH breaks through $3,111, the total liquidation strength of mainstream CEX short positions will reach $610 million.

4 h

Data: Over the past 24 hours, the entire network has liquidated $252 million, with long positions liquidated at $63.1456 million and short positions at $189 million.

6 h

Pin