# CryptoMarketWatch

151.26K

Recent market volatility has intensified, with growing divergence between bulls and bears. Are you leaning bullish or cautious on what comes next? What signals are you watching and how are you positioning? Share your views.

HighAmbition

#CryptoMarketWatch

📌 Bitcoin (BTC):

≈ $88,295 — trading near a strong support zone after a pullback from higher levels.

📌 Ethereum (ETH):

≈ $2,940 — trading below recent resistance, showing consolidation pressure.

📌 Solana (SOL):

≈ $126.01 — lower than prior months, reflecting broader altcoin weakness.

📌 XRP (Ripple):

≈ $1.88 — moderate level, weaker than some recent bullish expectations.

📌 Gold (XAU/USD):

≈ $4,760–$4,780 per ounce — gold is at or near record highs as investors seek safe havens amid market uncertainty.

🟡 1. Bitcoin (BTC)

Trend:

• Recently pulled back from weekly highs,

📌 Bitcoin (BTC):

≈ $88,295 — trading near a strong support zone after a pullback from higher levels.

📌 Ethereum (ETH):

≈ $2,940 — trading below recent resistance, showing consolidation pressure.

📌 Solana (SOL):

≈ $126.01 — lower than prior months, reflecting broader altcoin weakness.

📌 XRP (Ripple):

≈ $1.88 — moderate level, weaker than some recent bullish expectations.

📌 Gold (XAU/USD):

≈ $4,760–$4,780 per ounce — gold is at or near record highs as investors seek safe havens amid market uncertainty.

🟡 1. Bitcoin (BTC)

Trend:

• Recently pulled back from weekly highs,

- Reward

- 8

- 12

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch

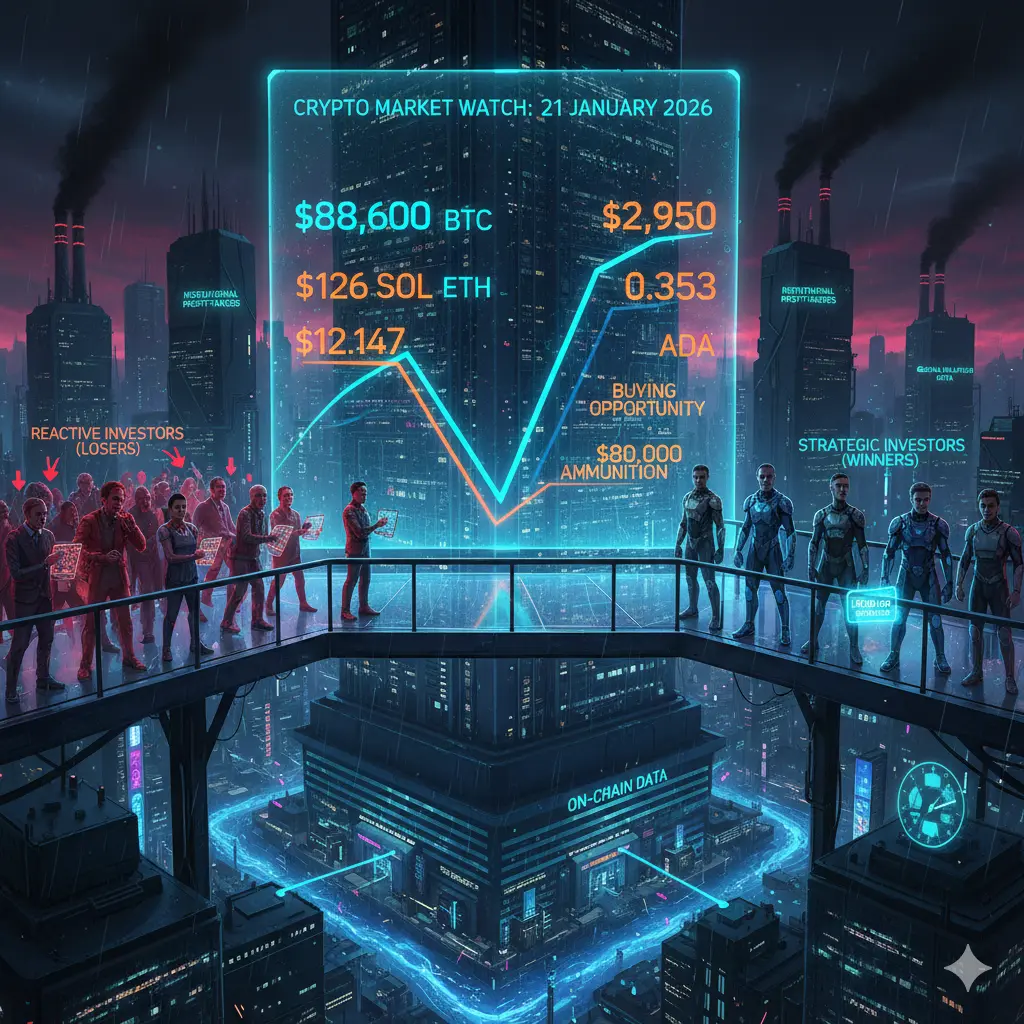

It's timely for January 21, 2026, focusing on the current crypto market dip, key prices, and insights. Engaging, informative, and branded with your style.

#CryptoMarketWatch: Market in Correction Mode – BTC Dips Below $90K Amid Tariff Fears! 📉🚨

As of January 21, 2026 (early PKT hours), the global crypto market is feeling the heat. Global market cap has dropped to around $3 Trillion, down ~4% in the last 24 hours (some sources show $3.0T–$3.2T range with varying updates). Over $150B wiped out recently as risk-off sentiment grips investors.

Bitcoin (BTC) is leading the blee

It's timely for January 21, 2026, focusing on the current crypto market dip, key prices, and insights. Engaging, informative, and branded with your style.

#CryptoMarketWatch: Market in Correction Mode – BTC Dips Below $90K Amid Tariff Fears! 📉🚨

As of January 21, 2026 (early PKT hours), the global crypto market is feeling the heat. Global market cap has dropped to around $3 Trillion, down ~4% in the last 24 hours (some sources show $3.0T–$3.2T range with varying updates). Over $150B wiped out recently as risk-off sentiment grips investors.

Bitcoin (BTC) is leading the blee

- Reward

- 6

- 9

- Repost

- Share

Yusfirah :

:

HODL Tight 💪View More

Bitcoin and altcoins status: Market overview (January 19)

Bitcoin is trading at around $91,524, down 1%, and approximately 3,962,076 TRY against the Turkish lira.

Ethereum (ETH) is down 1% at $3,167, BNB (BNB) has decreased by 0.4% to $920, Ripple (XRP) has increased by 0.2% to $1.96, Dogecoin (DOGE) is up 0.7% at $0.1279, Solana (SOL) has decreased by 0.3% to $132.93, and TRON (TRX) is down 2.2% at $0.3129.

In the last 24 hours, Canton (CC) experienced the highest increase among altcoins with an 8.8% rise, while Provenance Blockchain (HASH) saw the largest decrease with an 8.7% drop.

At the t

View OriginalBitcoin is trading at around $91,524, down 1%, and approximately 3,962,076 TRY against the Turkish lira.

Ethereum (ETH) is down 1% at $3,167, BNB (BNB) has decreased by 0.4% to $920, Ripple (XRP) has increased by 0.2% to $1.96, Dogecoin (DOGE) is up 0.7% at $0.1279, Solana (SOL) has decreased by 0.3% to $132.93, and TRON (TRX) is down 2.2% at $0.3129.

In the last 24 hours, Canton (CC) experienced the highest increase among altcoins with an 8.8% rise, while Provenance Blockchain (HASH) saw the largest decrease with an 8.7% drop.

At the t

- Reward

- 6

- 8

- Repost

- Share

ybaser :

:

New Year Wealth Explosion 🤑View More

#CryptoMarketWatch

The cryptocurrency market is facing one of its first major tests of 2026 today. Bitcoin's drop below the $90,000 mark and the pullbacks in altcoins have led investors to wonder if the rally is over, but in reality, this is a cooling-off phase for an overheated market.

Today's market structure is a struggle between institutional profit-taking and global inflation data. While Bitcoin's fall to the $88,600 level has tightened overall market liquidity, this is not a collapse, but a healthy correction to the aggressive rise expected at the end of 2025. The main reason for t

The cryptocurrency market is facing one of its first major tests of 2026 today. Bitcoin's drop below the $90,000 mark and the pullbacks in altcoins have led investors to wonder if the rally is over, but in reality, this is a cooling-off phase for an overheated market.

Today's market structure is a struggle between institutional profit-taking and global inflation data. While Bitcoin's fall to the $88,600 level has tightened overall market liquidity, this is not a collapse, but a healthy correction to the aggressive rise expected at the end of 2025. The main reason for t

- Reward

- 15

- 15

- Repost

- Share

Unoshi :

:

Thanks for sharingView More

#CryptoMarketWatch — Market Status & In-Depth Analysis

The global cryptocurrency market is undergoing a healthy correction after the aggressive rally of late 2025. Despite short-term weakness, the underlying market structure remains strong, supported by institutional accumulation and rising on-chain activity.

📊 Global Market Overview

Total Market Capitalization: ~$3.13T–$3.22T, down ~2.8%–2.85% in 24 hours, but early signs of stabilization are appearing.

24-Hour Trading Volume: $88B–$96B (+48%), indicating active participation from traders and institutions rather than panic selling.

Bitcoin D

The global cryptocurrency market is undergoing a healthy correction after the aggressive rally of late 2025. Despite short-term weakness, the underlying market structure remains strong, supported by institutional accumulation and rising on-chain activity.

📊 Global Market Overview

Total Market Capitalization: ~$3.13T–$3.22T, down ~2.8%–2.85% in 24 hours, but early signs of stabilization are appearing.

24-Hour Trading Volume: $88B–$96B (+48%), indicating active participation from traders and institutions rather than panic selling.

Bitcoin D

- Reward

- 6

- 5

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch

Crypto Market Watch Rising Volatility, Bull–Bear Divergence, and How I’m Reading the Next Move

Recent market volatility has clearly intensified, and the growing divergence between bulls and bears is becoming more visible with every major price swing. On one side, bullish participants continue to focus on long-term adoption, liquidity cycles, and historical market behavior, while on the other, cautious traders are reacting to macro uncertainty, policy risks, and weakening short-term momentum. This split in sentiment is creating sharp intraday moves, false breakouts, and fas

Crypto Market Watch Rising Volatility, Bull–Bear Divergence, and How I’m Reading the Next Move

Recent market volatility has clearly intensified, and the growing divergence between bulls and bears is becoming more visible with every major price swing. On one side, bullish participants continue to focus on long-term adoption, liquidity cycles, and historical market behavior, while on the other, cautious traders are reacting to macro uncertainty, policy risks, and weakening short-term momentum. This split in sentiment is creating sharp intraday moves, false breakouts, and fas

BTC-3,17%

- Reward

- 4

- 8

- Repost

- Share

EagleEye :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch Bermuda Aims to Build a 'Fully Onchain' Economy with Coinbase and Circle

Bermuda partnering with Coinbase and Circle to build a "fully onchain" economy is a pioneering move for a sovereign nation. This demonstrates a commitment to innovation and positions Bermuda as a leader in digital economy integration. The initiative could serve as a vital proof-of-concept for other nations and further drives institutional adoption of crypto and stablecoins within a regulatory framework.

Bermuda partnering with Coinbase and Circle to build a "fully onchain" economy is a pioneering move for a sovereign nation. This demonstrates a commitment to innovation and positions Bermuda as a leader in digital economy integration. The initiative could serve as a vital proof-of-concept for other nations and further drives institutional adoption of crypto and stablecoins within a regulatory framework.

- Reward

- 1

- 1

- Repost

- Share

PleaseLearnToSpeakProperly. :

:

What exactly is Narrative coin?Crypto Market Watch Navigating Heightened Volatility: My Honest Perspective on Market Uncertainty, Bull-Bear Divergence, and How I’m Positioning for What Comes Next

The current phase of the crypto market feels fundamentally different from the strong directional moves we experienced earlier. Volatility has intensified, but more importantly, it has become unpredictable and emotionally charged. Sharp intraday swings, failed breakouts, and sudden reversals are now common, reflecting a market that is struggling to agree on its next direction. This growing divergence between bulls and bears signals

The current phase of the crypto market feels fundamentally different from the strong directional moves we experienced earlier. Volatility has intensified, but more importantly, it has become unpredictable and emotionally charged. Sharp intraday swings, failed breakouts, and sudden reversals are now common, reflecting a market that is struggling to agree on its next direction. This growing divergence between bulls and bears signals

BTC-3,17%

- Reward

- 6

- 10

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

#CryptoMarketWatch

Crypto Market Watch Intensifying Volatility, Bull–Bear Polarization, and How I’m Interpreting the Market’s Next Major Decision Point

The current phase of the crypto market is increasingly defined by heightened volatility and a clear divergence between bullish and bearish participants, making it one of the most psychologically demanding environments in recent months. Price action across Bitcoin and major altcoins has become less directional and more reactive, with sharp moves in both directions often occurring within short timeframes. This kind of behavior usually emerges wh

Crypto Market Watch Intensifying Volatility, Bull–Bear Polarization, and How I’m Interpreting the Market’s Next Major Decision Point

The current phase of the crypto market is increasingly defined by heightened volatility and a clear divergence between bullish and bearish participants, making it one of the most psychologically demanding environments in recent months. Price action across Bitcoin and major altcoins has become less directional and more reactive, with sharp moves in both directions often occurring within short timeframes. This kind of behavior usually emerges wh

BTC-3,17%

- Reward

- 5

- 7

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch 🔍 Market Watch — Institutions Move While Retail Panics

The crypto market is going through a classic transition phase: price weakness, institutional repositioning, and silent capital rotation.

On January 20, 2026, Ethereum treasury firm FG Nexus sold 2,500 ETH (~$8.04M) as part of its portfolio rebalancing strategy. This move comes while ETH remains under pressure and treasury firms are facing shrinking market-to-NAV ratios.

But this is not a panic exit.

It’s tactical risk management.

FG Nexus still holds 37,594 ETH (~$120M), proving this is not a loss of confidence — it's a

The crypto market is going through a classic transition phase: price weakness, institutional repositioning, and silent capital rotation.

On January 20, 2026, Ethereum treasury firm FG Nexus sold 2,500 ETH (~$8.04M) as part of its portfolio rebalancing strategy. This move comes while ETH remains under pressure and treasury firms are facing shrinking market-to-NAV ratios.

But this is not a panic exit.

It’s tactical risk management.

FG Nexus still holds 37,594 ETH (~$120M), proving this is not a loss of confidence — it's a

- Reward

- 6

- 7

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

19.04K Popularity

168 Popularity

55.51K Popularity

43.36K Popularity

339.78K Popularity

92 Popularity

96 Popularity

11.26K Popularity

107.68K Popularity

19.23K Popularity

185.28K Popularity

15.2K Popularity

6.67K Popularity

10.61K Popularity

151.26K Popularity

News

View MoreSnap Store experiences domain hijacking attack, tampering with wallet applications to steal cryptocurrency assets

2 m

Snap Store security vulnerability allows hackers to steal users' crypto assets by hijacking expired domains

3 m

Data: If Bitcoin rebounds and breaks through $97,000, the total liquidation strength of long positions on mainstream CEXs will reach 1.489 billion.

7 m

Data: If BTC breaks through $93,803, the total liquidation strength of short positions on mainstream CEXs will reach $2.616 billion.

9 m

Data: If ETH breaks through $3,128, the total liquidation strength of mainstream CEX short positions will reach $1.464 billion.

9 m

Pin