EagleEye

No content yet

EagleEye

#ETHLongShortBattle

Ethereum is currently at a critical inflection point, with bulls and bears locked in one of the fiercest battles we’ve seen this month. Despite whales retreating from the market, accumulation traders have quietly purchased 2.5 million ETH coins in February, signaling that long-term holders are confident in Ethereum’s future. At the same time, the $2,000 level has over $2 billion in shorts stacked, creating a high-stakes setup where a strong move in either direction could trigger cascading liquidations and a short-term volatility spike. From my perspective, this is an oppor

Ethereum is currently at a critical inflection point, with bulls and bears locked in one of the fiercest battles we’ve seen this month. Despite whales retreating from the market, accumulation traders have quietly purchased 2.5 million ETH coins in February, signaling that long-term holders are confident in Ethereum’s future. At the same time, the $2,000 level has over $2 billion in shorts stacked, creating a high-stakes setup where a strong move in either direction could trigger cascading liquidations and a short-term volatility spike. From my perspective, this is an oppor

ETH11,64%

- Reward

- 10

- 14

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#ETH多空对决

🔥 My Take & Strategy

Ethereum is at a pivotal moment bulls and bears are in a heated battle!

Despite whales retreating, accumulation traders bought 2.5M ETH in February, signaling strong conviction. At the same time, over $2B in shorts are stacked at $2,000, creating a highly volatile setup. This is a moment where careful observation and smart positioning can make a huge difference.

My Thoughts & Insights:

Rebound or Decline?

Over $2B in shorts at $2,000 makes this level critical. If bulls break through, we could see a violent short squeeze. Personally, I’m watching for a strong

🔥 My Take & Strategy

Ethereum is at a pivotal moment bulls and bears are in a heated battle!

Despite whales retreating, accumulation traders bought 2.5M ETH in February, signaling strong conviction. At the same time, over $2B in shorts are stacked at $2,000, creating a highly volatile setup. This is a moment where careful observation and smart positioning can make a huge difference.

My Thoughts & Insights:

Rebound or Decline?

Over $2B in shorts at $2,000 makes this level critical. If bulls break through, we could see a violent short squeeze. Personally, I’m watching for a strong

ETH11,64%

- Reward

- 8

- 9

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#LatestMarketInsights

Comprehensive Analysis of Global Markets, Crypto, and Trading Opportunities

Global markets are currently navigating a complex landscape of macroeconomic uncertainty, geopolitical tension, and sector-specific developments. Investors are reacting not only to news about interest rate adjustments, inflation data, and trade policies but also to large-scale movements in cryptocurrencies and tech equities. This combination has led to heightened volatility, creating both challenges and opportunities for traders. Personally, I view this as a time to adopt a measured approach, mon

Comprehensive Analysis of Global Markets, Crypto, and Trading Opportunities

Global markets are currently navigating a complex landscape of macroeconomic uncertainty, geopolitical tension, and sector-specific developments. Investors are reacting not only to news about interest rate adjustments, inflation data, and trade policies but also to large-scale movements in cryptocurrencies and tech equities. This combination has led to heightened volatility, creating both challenges and opportunities for traders. Personally, I view this as a time to adopt a measured approach, mon

- Reward

- 9

- 8

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#TrumpAnnouncesNewTariffs

In-Depth Market Analysis and Strategic Insights

The recent announcement by former President Donald Trump introducing new tariffs has sent shockwaves across global markets, reigniting concerns about trade policy uncertainty and its potential economic consequences. These tariffs, aimed at protecting domestic industries, will inevitably impact international trade flows, increase the cost of imported goods, and may prompt retaliatory measures from trading partners. From my perspective, while the long-term goal is to strengthen domestic manufacturing, the immediate effec

In-Depth Market Analysis and Strategic Insights

The recent announcement by former President Donald Trump introducing new tariffs has sent shockwaves across global markets, reigniting concerns about trade policy uncertainty and its potential economic consequences. These tariffs, aimed at protecting domestic industries, will inevitably impact international trade flows, increase the cost of imported goods, and may prompt retaliatory measures from trading partners. From my perspective, while the long-term goal is to strengthen domestic manufacturing, the immediate effec

- Reward

- 9

- 8

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#ETHLongShortBattle

Ethereum is at a critical juncture as bulls and bears face off in one of the most intense battles this month. Despite whales retreating from the market, accumulation traders have quietly been buying 2.5 million ETH coins against the trend in February, signaling conviction among long-term holders. At the same time, the $2,000 level has become a battleground, with over $2 billion in short positions stacked, waiting for a potential price reversal. This creates a volatile setup where every move could trigger massive reactions from leveraged traders. In my view, this is a momen

Ethereum is at a critical juncture as bulls and bears face off in one of the most intense battles this month. Despite whales retreating from the market, accumulation traders have quietly been buying 2.5 million ETH coins against the trend in February, signaling conviction among long-term holders. At the same time, the $2,000 level has become a battleground, with over $2 billion in short positions stacked, waiting for a potential price reversal. This creates a volatile setup where every move could trigger massive reactions from leveraged traders. In my view, this is a momen

ETH11,64%

- Reward

- 10

- 10

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#BitcoinBouncesBack

Deep Analysis of BTC’s Recovery, Market Sentiment, Key Support & Resistance Levels, and Next Potential Price Targets Amid Volatility

Bitcoin has shown renewed strength after testing the $60,000–$62,000 support zone, where buyers stepped in to absorb selling pressure and prevent a deeper breakdown. This short-term recovery indicates that bulls remain active, but overall market structure remains range-bound until key resistance levels are reclaimed. Volatility is still high, reflecting the ongoing battle between buyers and sellers, with traders carefully watching for signs

Deep Analysis of BTC’s Recovery, Market Sentiment, Key Support & Resistance Levels, and Next Potential Price Targets Amid Volatility

Bitcoin has shown renewed strength after testing the $60,000–$62,000 support zone, where buyers stepped in to absorb selling pressure and prevent a deeper breakdown. This short-term recovery indicates that bulls remain active, but overall market structure remains range-bound until key resistance levels are reclaimed. Volatility is still high, reflecting the ongoing battle between buyers and sellers, with traders carefully watching for signs

BTC7,37%

- Reward

- 7

- 6

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#BitcoinMarketAnalysis

As I spend time observing Bitcoin’s movements, I can’t help but feel that I’m watching a living story unfold. It’s more than price charts or candlestick patterns; it’s a reflection of human behavior, global macro trends, and the evolving belief in cryptocurrency as a legitimate asset class.

For me, understanding Bitcoin goes beyond day-to-day fluctuations it’s about interpreting the signals embedded in market behavior, sentiment, and adoption trends.

I have noticed how volatile yet remarkably resilient Bitcoin has become. There are days when the price surges sharply,

As I spend time observing Bitcoin’s movements, I can’t help but feel that I’m watching a living story unfold. It’s more than price charts or candlestick patterns; it’s a reflection of human behavior, global macro trends, and the evolving belief in cryptocurrency as a legitimate asset class.

For me, understanding Bitcoin goes beyond day-to-day fluctuations it’s about interpreting the signals embedded in market behavior, sentiment, and adoption trends.

I have noticed how volatile yet remarkably resilient Bitcoin has become. There are days when the price surges sharply,

BTC7,37%

- Reward

- 15

- 21

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#LatestMarketInsights

Lately, I’ve been watching financial markets with a sense of both curiosity and caution. Every time I look at the markets, it feels like I’m reading a story not just numbers on a chart, but sentiment, psychology, risk tolerance, and global context all woven together. From equities and commodities to crypto and fixed income, what’s happening right now tells me something deeper about investor behavior, macro trends, and where confidence stands in a world of uncertainty.

One of the first things I’ve noticed is how volatility has become more persistent, not episodic. It’s n

Lately, I’ve been watching financial markets with a sense of both curiosity and caution. Every time I look at the markets, it feels like I’m reading a story not just numbers on a chart, but sentiment, psychology, risk tolerance, and global context all woven together. From equities and commodities to crypto and fixed income, what’s happening right now tells me something deeper about investor behavior, macro trends, and where confidence stands in a world of uncertainty.

One of the first things I’ve noticed is how volatility has become more persistent, not episodic. It’s n

BTC7,37%

- Reward

- 15

- 21

- 1

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

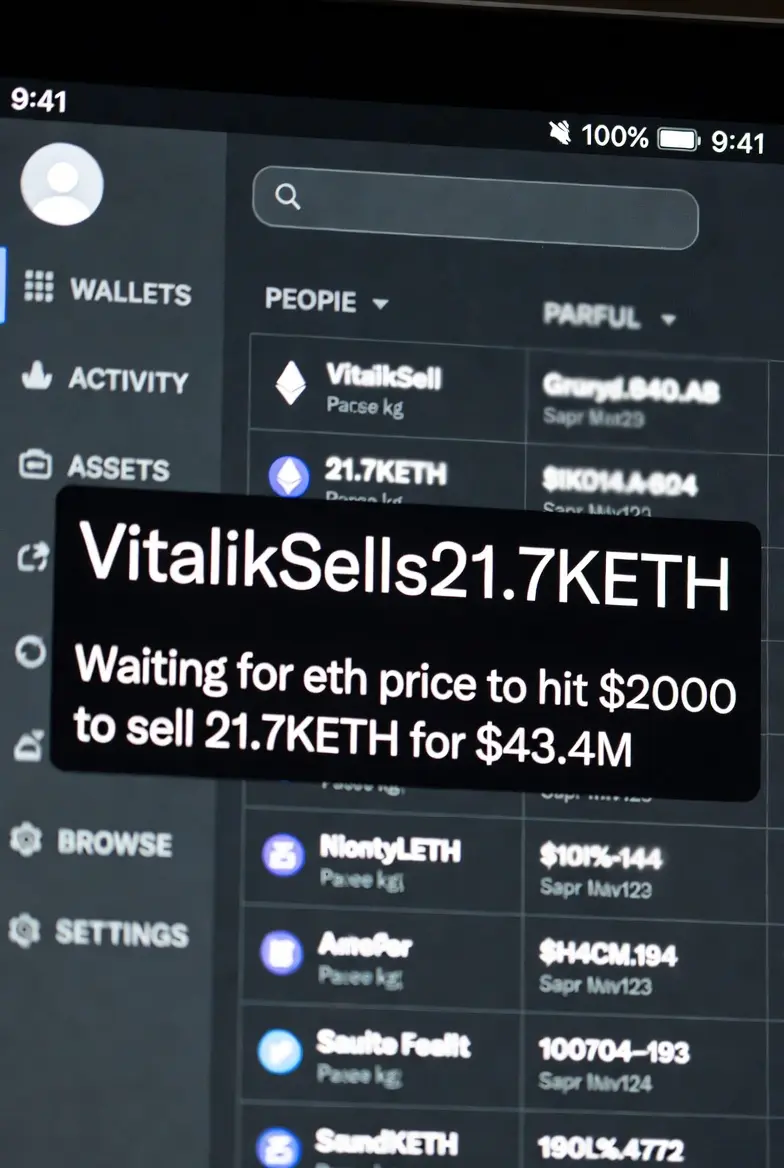

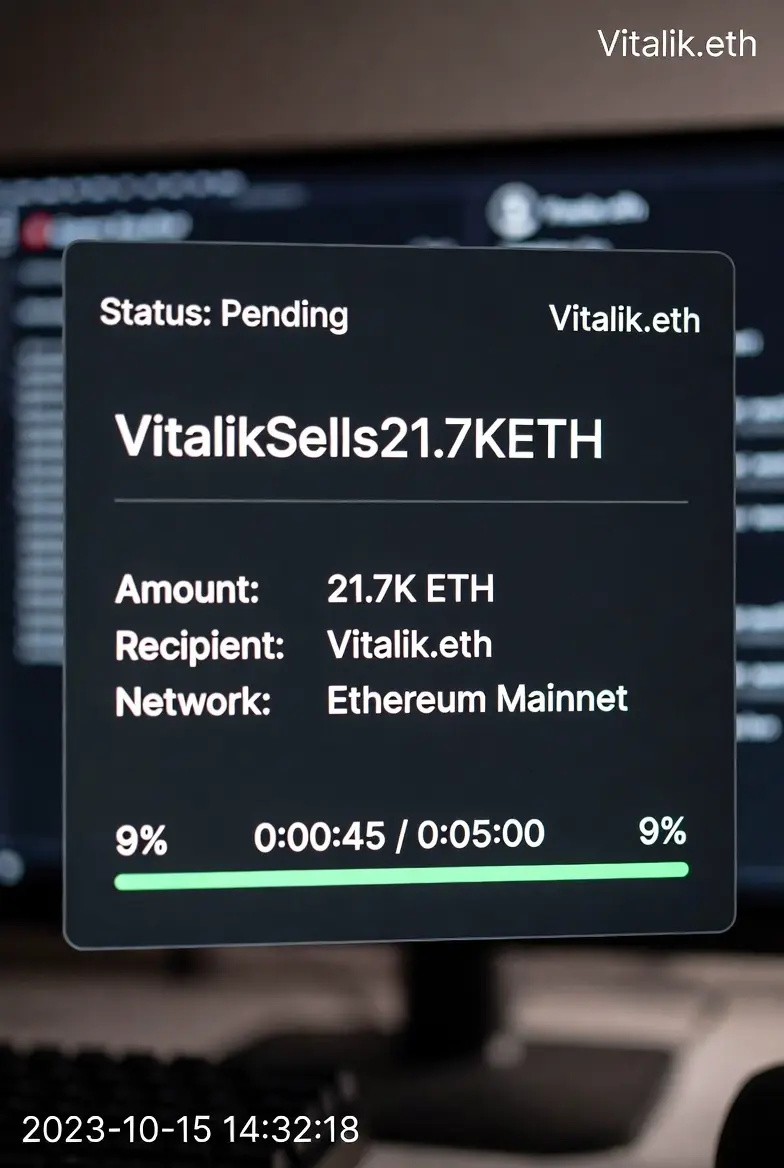

#VitalikSells21.7KETH

When I first saw the news that Vitalik Buterin had sold 21,700 ETH, I’ll admit, my first reaction was a mix of surprise and curiosity. It’s hard not to read that headline and immediately start thinking about market implications. But as I stepped back, I realized that the story is far more nuanced than just a simple sell-off. For me, it’s a lesson in separating human decisions, market psychology, and ecosystem fundamentals.

Understanding the “Why” Behind the Sale

The first thing I asked myself was: Why would Vitalik sell such a large sum? From what I know, he has consiste

When I first saw the news that Vitalik Buterin had sold 21,700 ETH, I’ll admit, my first reaction was a mix of surprise and curiosity. It’s hard not to read that headline and immediately start thinking about market implications. But as I stepped back, I realized that the story is far more nuanced than just a simple sell-off. For me, it’s a lesson in separating human decisions, market psychology, and ecosystem fundamentals.

Understanding the “Why” Behind the Sale

The first thing I asked myself was: Why would Vitalik sell such a large sum? From what I know, he has consiste

- Reward

- 16

- 22

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#GateSquare$50KRedPacketGiveaway

Seeing GateSquare launch a $50,000 Red Packet Giveaway recently made me stop and think about how promotional campaigns are shaping the crypto space today. On the surface, giveaways can feel like a simple marketing tactic an incentive to attract users or drive engagement. But personally, I view initiatives like this as much more than that. They’re a reflection of how cryptocurrency platforms are innovating not just technologically but culturally, creating community experiences that blend financial opportunity with social interaction.

From my perspective, the s

Seeing GateSquare launch a $50,000 Red Packet Giveaway recently made me stop and think about how promotional campaigns are shaping the crypto space today. On the surface, giveaways can feel like a simple marketing tactic an incentive to attract users or drive engagement. But personally, I view initiatives like this as much more than that. They’re a reflection of how cryptocurrency platforms are innovating not just technologically but culturally, creating community experiences that blend financial opportunity with social interaction.

From my perspective, the s

- Reward

- 14

- 21

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#BuyTheDipOrWaitNow?

Lately, I’ve been asking myself over and over: Is now the time to buy the dip, or should I wait? It’s a question that feels deceptively simple but is actually one of the toughest decisions an investor or trader faces. Watching markets swing sharply, sometimes without clear reason, makes me realize that buying the dip isn’t just a financial decision it’s a reflection of psychology, timing, and personal conviction.

From my perspective, the first thing I try to do is step back and really analyze why the dip is happening. In my opinion, not all dips are created equal. Some a

Lately, I’ve been asking myself over and over: Is now the time to buy the dip, or should I wait? It’s a question that feels deceptively simple but is actually one of the toughest decisions an investor or trader faces. Watching markets swing sharply, sometimes without clear reason, makes me realize that buying the dip isn’t just a financial decision it’s a reflection of psychology, timing, and personal conviction.

From my perspective, the first thing I try to do is step back and really analyze why the dip is happening. In my opinion, not all dips are created equal. Some a

- Reward

- 14

- 18

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

#GoldTops$5,190

Watching gold climb past $5,190 recently made me pause and reflect on what this move really means, beyond the headline numbers. It’s tempting to think of gold purely in terms of price as a static asset that moves with inflation or investor sentiment — but in my eyes, a milestone like this tells a far richer story about market psychology, macro uncertainty, and the enduring role of gold in global finance.

What strikes me first is the timing of the rally. In periods of economic uncertainty, geopolitical tension, or market volatility, gold often serves as a safe haven, a tangibl

Watching gold climb past $5,190 recently made me pause and reflect on what this move really means, beyond the headline numbers. It’s tempting to think of gold purely in terms of price as a static asset that moves with inflation or investor sentiment — but in my eyes, a milestone like this tells a far richer story about market psychology, macro uncertainty, and the enduring role of gold in global finance.

What strikes me first is the timing of the rally. In periods of economic uncertainty, geopolitical tension, or market volatility, gold often serves as a safe haven, a tangibl

- Reward

- 12

- 9

- Repost

- Share

xxx40xxx :

:

To The Moon 🌕View More

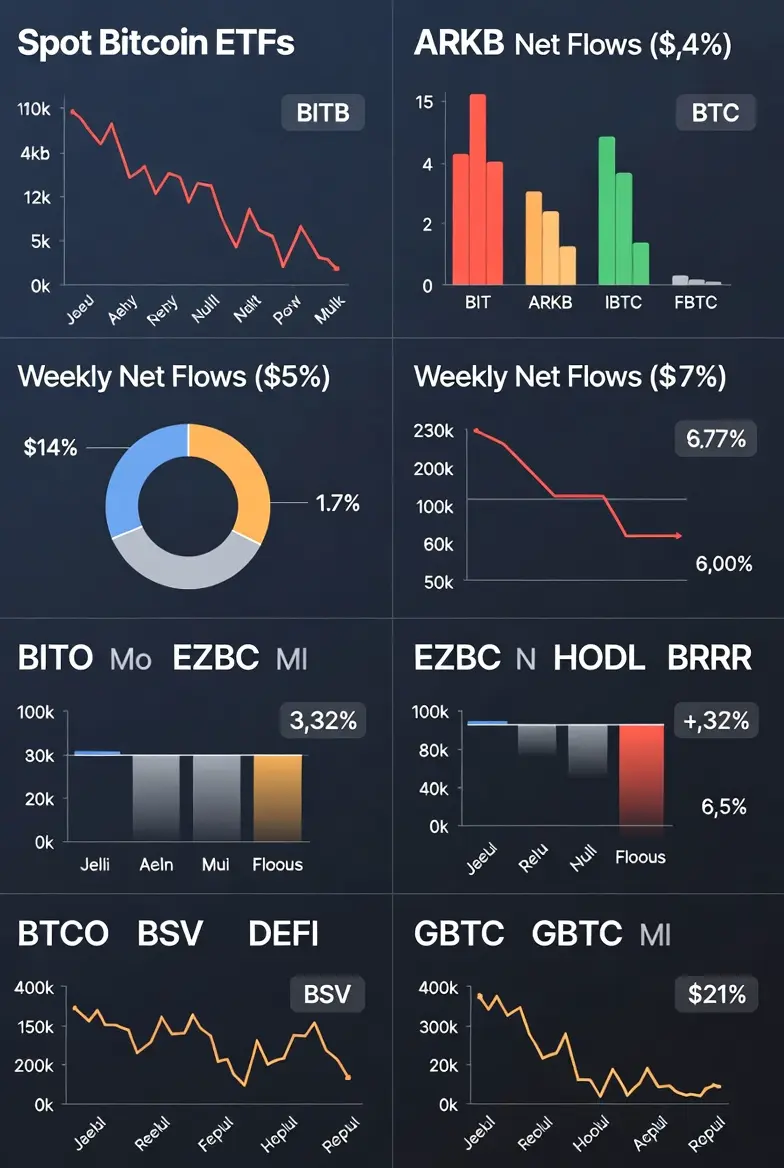

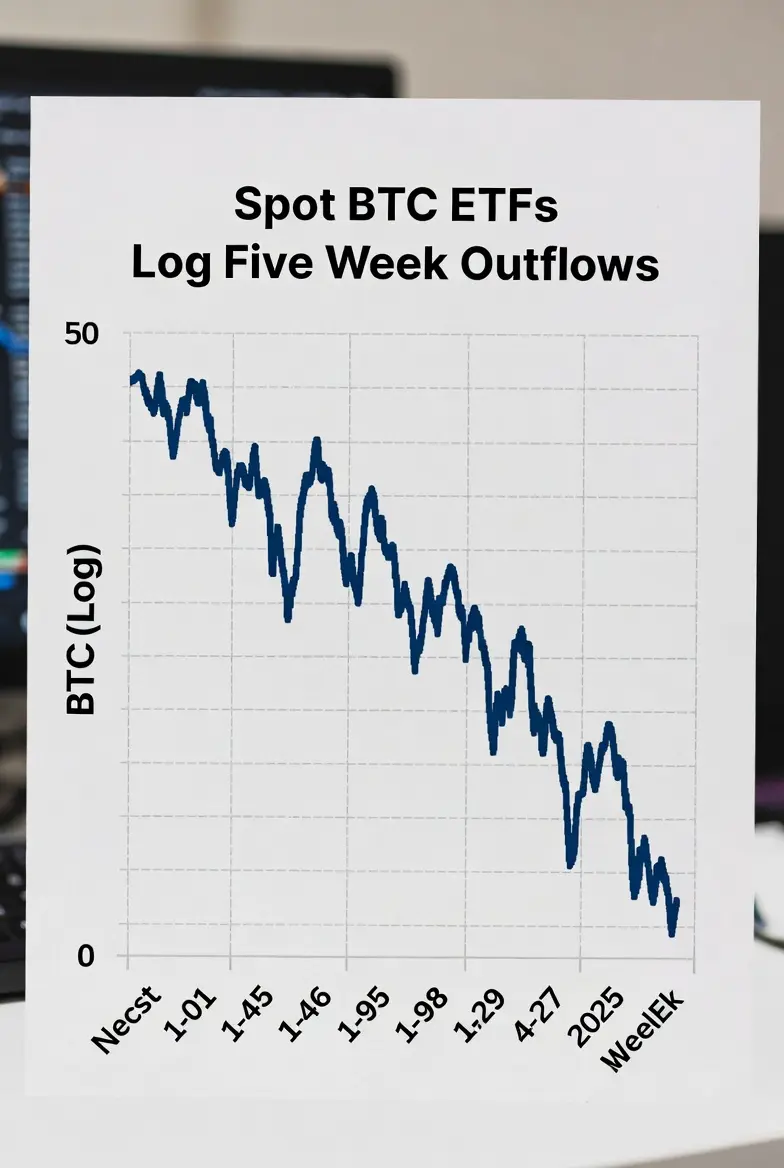

#SpotBTCETFsLogFiveWeekOutflows

Seeing spot Bitcoin ETFs register outflows for a fifth consecutive week has been one of the most telling developments in the cryptocurrency space recently. At first glance, it might seem like a statistic just a series of weeks where money left these funds. But when you zoom out and look at it with context, it feels like a significant shift in institutional sentiment toward Bitcoin, especially in how traditional investors approach crypto exposure through regulated products.

Over the past five weeks, a notable amount of capital has pulled out of these ETFs. That

Seeing spot Bitcoin ETFs register outflows for a fifth consecutive week has been one of the most telling developments in the cryptocurrency space recently. At first glance, it might seem like a statistic just a series of weeks where money left these funds. But when you zoom out and look at it with context, it feels like a significant shift in institutional sentiment toward Bitcoin, especially in how traditional investors approach crypto exposure through regulated products.

Over the past five weeks, a notable amount of capital has pulled out of these ETFs. That

BTC7,37%

- Reward

- 12

- 11

- Repost

- Share

repanzal :

:

To The Moon 🌕View More

#TrumpGroupMullsGazaStablecoin

Seeing reports that the Trump Group is considering launching a Gaza-backed stablecoin really caught my attention. Honestly, it feels like a convergence of so many different trends at once geopolitical tension, digital finance innovation, and the ever-expanding reach of cryptocurrencies. My initial thought is that this isn’t just a simple financial move; it’s a signal about how the boundaries of blockchain finance are being tested in politically sensitive and high-risk areas.

What I find particularly striking is the context. Stablecoins are usually pegged to fia

Seeing reports that the Trump Group is considering launching a Gaza-backed stablecoin really caught my attention. Honestly, it feels like a convergence of so many different trends at once geopolitical tension, digital finance innovation, and the ever-expanding reach of cryptocurrencies. My initial thought is that this isn’t just a simple financial move; it’s a signal about how the boundaries of blockchain finance are being tested in politically sensitive and high-risk areas.

What I find particularly striking is the context. Stablecoins are usually pegged to fia

- Reward

- 10

- 13

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#AIFearsSendIBMDown11%

Honestly, seeing IBM drop 11% in a single session really got me thinking about how fast markets react to AI news these days. It’s not just about numbers on a screen it feels like the market is telling a story about fear, expectation, and pressure on even the most established companies. IBM has been a technology giant for decades, pioneering everything from enterprise computing to AI research with Watson. And yet, this huge drop shows that history and experience alone aren’t enough anymore; perception and narrative matter just as much.

What strikes me is that this decli

Honestly, seeing IBM drop 11% in a single session really got me thinking about how fast markets react to AI news these days. It’s not just about numbers on a screen it feels like the market is telling a story about fear, expectation, and pressure on even the most established companies. IBM has been a technology giant for decades, pioneering everything from enterprise computing to AI research with Watson. And yet, this huge drop shows that history and experience alone aren’t enough anymore; perception and narrative matter just as much.

What strikes me is that this decli

- Reward

- 13

- 12

- 1

- Share

repanzal :

:

To The Moon 🌕View More

#EthereumFoundationAdvancesDeFipunk

Ethereum Foundation Advances DeFiPunk Analysis and Perspective

The recent initiatives by the Ethereum Foundation around DeFiPunk mark a significant step forward for decentralized finance and NFT-driven innovation. This development is not just another technical upgrade or protocol deployment it reflects how the Ethereum ecosystem continues to expand the boundaries of finance, digital ownership, and community governance. DeFiPunk sits at the intersection of NFTs, DeFi protocols, and social finance, and Ethereum Foundation’s backing signals that these experi

Ethereum Foundation Advances DeFiPunk Analysis and Perspective

The recent initiatives by the Ethereum Foundation around DeFiPunk mark a significant step forward for decentralized finance and NFT-driven innovation. This development is not just another technical upgrade or protocol deployment it reflects how the Ethereum ecosystem continues to expand the boundaries of finance, digital ownership, and community governance. DeFiPunk sits at the intersection of NFTs, DeFi protocols, and social finance, and Ethereum Foundation’s backing signals that these experi

- Reward

- 11

- 11

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#BitdeerLiquidates943.1BTCReserves

In my view, Bitdeer’s decision to liquidate 943.1 BTC from its reserves, effectively bringing its corporate bitcoin holdings to zero, is far more than a routine financial maneuver. To me, it signals a seismic shift in how leading cryptocurrency miners are positioning themselves in a rapidly evolving market. For years, miners treated bitcoin not just as a product of operations but as a strategic asset, a hedge against inflation, and a store of value. By completely liquidating its reserves, Bitdeer is signaling that liquidity, flexibility, and strategic reinve

In my view, Bitdeer’s decision to liquidate 943.1 BTC from its reserves, effectively bringing its corporate bitcoin holdings to zero, is far more than a routine financial maneuver. To me, it signals a seismic shift in how leading cryptocurrency miners are positioning themselves in a rapidly evolving market. For years, miners treated bitcoin not just as a product of operations but as a strategic asset, a hedge against inflation, and a store of value. By completely liquidating its reserves, Bitdeer is signaling that liquidity, flexibility, and strategic reinve

- Reward

- 10

- 8

- Repost

- Share

repanzal :

:

To The Moon 🌕View More

#ThreeMajorUSIndexesDecline

In my view, the recent decline across the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite is not just another red day on the charts — it is a reflection of shifting economic psychology. Markets are often described as numbers, percentages, and points, but beneath those figures lies something far more powerful: collective belief. When all three major benchmarks move downward together, I believe it reveals a deeper recalibration of expectations about growth, risk, and the stability of the broader economic system.

From my perspective, the Dow’s decl

In my view, the recent decline across the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite is not just another red day on the charts — it is a reflection of shifting economic psychology. Markets are often described as numbers, percentages, and points, but beneath those figures lies something far more powerful: collective belief. When all three major benchmarks move downward together, I believe it reveals a deeper recalibration of expectations about growth, risk, and the stability of the broader economic system.

From my perspective, the Dow’s decl

- Reward

- 12

- 10

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#MyViewOnWeb4.0’sOutlook

In my view, Web 4.0 is more than just the next step in internet evolution it is a fundamental transformation in how humans will interact with information, technology, and each other. I believe that Web 4.0 represents a shift from a predominantly digital world to an intelligent, interconnected, and human-centric cyber-ecosystem that blends data, experience, and automation in ways we are just beginning to imagine. While previous iterations of the web focused on connectivity (Web 1.0) and interactivity/social engagement (Web 2.0), and then personalization and collaborat

In my view, Web 4.0 is more than just the next step in internet evolution it is a fundamental transformation in how humans will interact with information, technology, and each other. I believe that Web 4.0 represents a shift from a predominantly digital world to an intelligent, interconnected, and human-centric cyber-ecosystem that blends data, experience, and automation in ways we are just beginning to imagine. While previous iterations of the web focused on connectivity (Web 1.0) and interactivity/social engagement (Web 2.0), and then personalization and collaborat

- Reward

- 11

- 12

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More