#HongKongPlansNewVAGuidelines

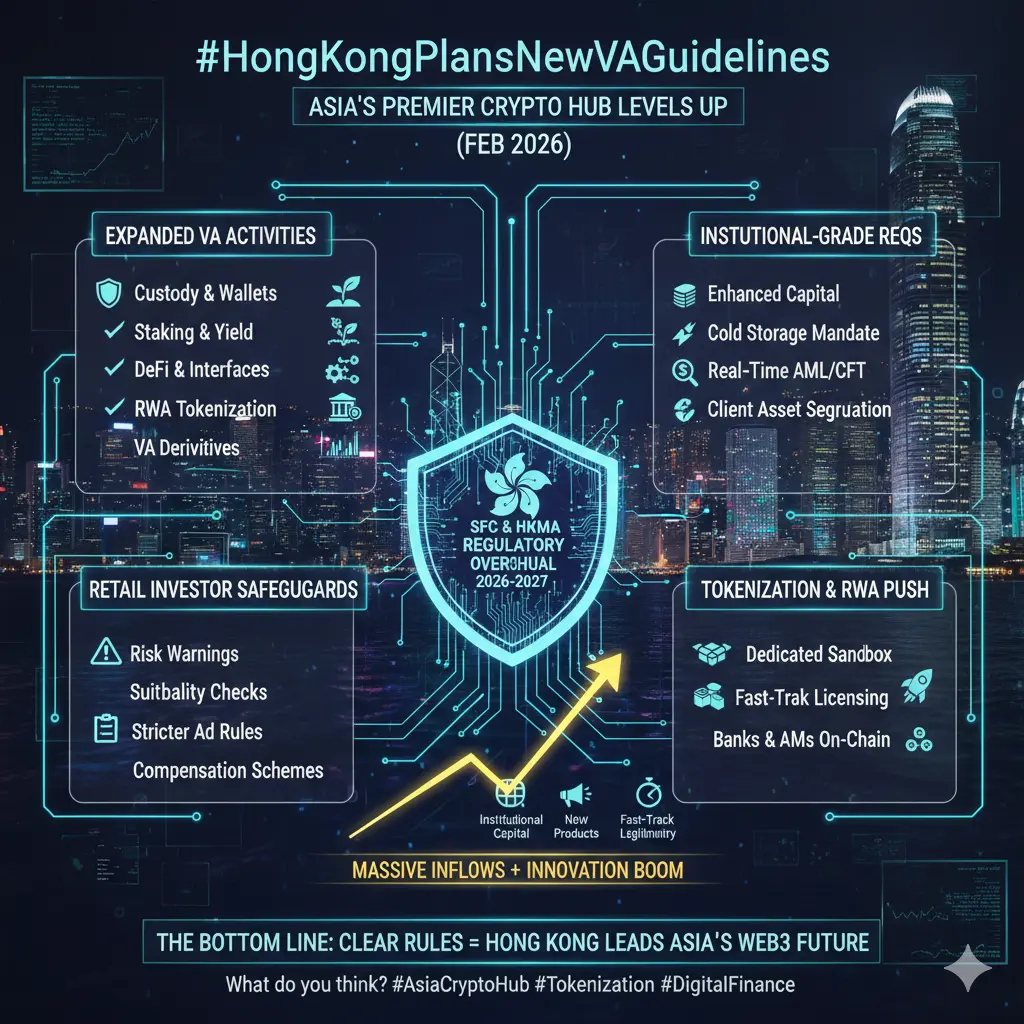

Hong Kong is gearing up to introduce comprehensive new guidelines and regulatory enhancements for Virtual Assets (VA) — encompassing cryptocurrencies, exchanges, stablecoins, digital asset platforms, dealing services, custody, advisory, and management — as part of its ongoing push to become a leading global hub for responsible digital finance in 2026.

This signals tighter oversight, clearer compliance standards, expanded product diversity, and a more structured framework while balancing innovation with robust investor protection.

It builds on Hong Kong's ASPIRe Roadmap (launched in 2025) and recent updates, moving beyond spot trading platforms to cover the full VA ecosystem.

Key Recent Developments (Early 2026 Focus)

February 11, 2026 SFC Guidance — Issued new circulars to boost market vibrancy:

Licensed VA brokers (providing dealing services) can now offer margin financing for VA trading to eligible clients (strong credit profiles, sufficient collateral, and strict safeguards like haircuts).

High-level framework for licensed Virtual Asset Trading Platforms (VATPs) to develop and offer VA-related leveraged products, including perpetual contracts, exclusively to professional investors.

Aims to enhance liquidity, product diversity, and institutional participation under controlled risks.

Ongoing Legislative Push for Broader Licensing (Target: 2026 Bill):

Consultation conclusions (December 2025) on regulating VA dealing and VA custodian services — finalizing mandatory licensing under the Anti-Money Laundering Ordinance (AMLO).

Further public consultation (closed January 23, 2026) on extending licensing to VA advisory (e.g., recommendations on buying/selling VAs) and VA management (portfolio management involving VAs).

Expected bill introduction to Legislative Council in 2026 to close gaps, align with existing regimes (e.g., securities laws), and cover non-securities VAs comprehensively.

Expedited processes for existing regulated intermediaries/banks already offering similar services.

What These New VA Guidelines Mean in Practice

Tighter Oversight & Compliance:

Mandatory licensing for more VA activities (dealing, custody, advice, management) → reduces unregulated risks, enforces AML/KYC, custody standards (e.g., high cold storage), and fit-and-proper requirements.

Clearer taxonomy and rules for VA classification, reducing ambiguity that previously deterred institutions.

Clearer Standards for Key Areas:

Exchanges & Platforms (VATPs): Expanded offerings (e.g., leveraged products for pros), global liquidity access, relaxed track-record rules for professional-only assets.

Stablecoins & Tokens: Better integration into regulated ecosystems, with ongoing refinements for issuance and use.

Custody & Dealing: Robust safeguards for client assets, financing options, and settlement risk minimization.

Advisory & Management: Dedicated licenses for advisors/managers handling VA portfolios, consistent with traditional regulated activities.

Investor Protection & Market Integrity:

Focus on safeguards like collateral requirements, investor suitability, fraud prevention, and professional investor restrictions for high-risk products.

Aims to minimize illicit use while fostering trust and attracting global capital.

Why Now? Core Drivers

Building on 2025 Momentum — Refinements to intermediary rules, custody standards, product expansions, and stablecoin pilots.

Global Competitiveness — Positioning Hong Kong as Asia's premier regulated crypto hub (vs. stricter regimes elsewhere), drawing institutions amid digital finance trends.

Balancing Innovation & Safety — Expand access (margin, perps, more products) while addressing risks from past market volatility and enforcement gaps.

Institutional Inflows — Clear rules unlock banks, funds, and brokers to offer VA services, tokenized assets, and on-chain integration.

Potential Impacts

Upside Benefits

Deeper liquidity and product diversity (e.g., leveraged trading for pros).

Stronger institutional confidence and capital inflows.

Enhanced Hong Kong's role in global digital finance.

Reduced reliance on offshore/unregulated platforms.

Risks & Challenges

Short-term compliance costs and adjustments for operators.

Potential overreach if rules become too restrictive.

Adoption hurdles if global partners hesitate on certain VA integrations.

Ongoing refinements needed for emerging areas like DeFi.

Bottom Line

Hong Kong's planned new VA guidelines aren't just more red tape — they're a strategic evolution toward a mature, regulated VA ecosystem. Recent SFC moves (Feb 2026 margin/perps guidance) and the anticipated 2026 licensing bill signal Hong Kong's commitment to clarity, innovation, and leadership in digital assets.

This could accelerate mainstream adoption, boost market resilience, and solidify Hong Kong as a bridge between TradFi and crypto — turning regulatory pressure into sustainable growth.

Hong Kong is gearing up to introduce comprehensive new guidelines and regulatory enhancements for Virtual Assets (VA) — encompassing cryptocurrencies, exchanges, stablecoins, digital asset platforms, dealing services, custody, advisory, and management — as part of its ongoing push to become a leading global hub for responsible digital finance in 2026.

This signals tighter oversight, clearer compliance standards, expanded product diversity, and a more structured framework while balancing innovation with robust investor protection.

It builds on Hong Kong's ASPIRe Roadmap (launched in 2025) and recent updates, moving beyond spot trading platforms to cover the full VA ecosystem.

Key Recent Developments (Early 2026 Focus)

February 11, 2026 SFC Guidance — Issued new circulars to boost market vibrancy:

Licensed VA brokers (providing dealing services) can now offer margin financing for VA trading to eligible clients (strong credit profiles, sufficient collateral, and strict safeguards like haircuts).

High-level framework for licensed Virtual Asset Trading Platforms (VATPs) to develop and offer VA-related leveraged products, including perpetual contracts, exclusively to professional investors.

Aims to enhance liquidity, product diversity, and institutional participation under controlled risks.

Ongoing Legislative Push for Broader Licensing (Target: 2026 Bill):

Consultation conclusions (December 2025) on regulating VA dealing and VA custodian services — finalizing mandatory licensing under the Anti-Money Laundering Ordinance (AMLO).

Further public consultation (closed January 23, 2026) on extending licensing to VA advisory (e.g., recommendations on buying/selling VAs) and VA management (portfolio management involving VAs).

Expected bill introduction to Legislative Council in 2026 to close gaps, align with existing regimes (e.g., securities laws), and cover non-securities VAs comprehensively.

Expedited processes for existing regulated intermediaries/banks already offering similar services.

What These New VA Guidelines Mean in Practice

Tighter Oversight & Compliance:

Mandatory licensing for more VA activities (dealing, custody, advice, management) → reduces unregulated risks, enforces AML/KYC, custody standards (e.g., high cold storage), and fit-and-proper requirements.

Clearer taxonomy and rules for VA classification, reducing ambiguity that previously deterred institutions.

Clearer Standards for Key Areas:

Exchanges & Platforms (VATPs): Expanded offerings (e.g., leveraged products for pros), global liquidity access, relaxed track-record rules for professional-only assets.

Stablecoins & Tokens: Better integration into regulated ecosystems, with ongoing refinements for issuance and use.

Custody & Dealing: Robust safeguards for client assets, financing options, and settlement risk minimization.

Advisory & Management: Dedicated licenses for advisors/managers handling VA portfolios, consistent with traditional regulated activities.

Investor Protection & Market Integrity:

Focus on safeguards like collateral requirements, investor suitability, fraud prevention, and professional investor restrictions for high-risk products.

Aims to minimize illicit use while fostering trust and attracting global capital.

Why Now? Core Drivers

Building on 2025 Momentum — Refinements to intermediary rules, custody standards, product expansions, and stablecoin pilots.

Global Competitiveness — Positioning Hong Kong as Asia's premier regulated crypto hub (vs. stricter regimes elsewhere), drawing institutions amid digital finance trends.

Balancing Innovation & Safety — Expand access (margin, perps, more products) while addressing risks from past market volatility and enforcement gaps.

Institutional Inflows — Clear rules unlock banks, funds, and brokers to offer VA services, tokenized assets, and on-chain integration.

Potential Impacts

Upside Benefits

Deeper liquidity and product diversity (e.g., leveraged trading for pros).

Stronger institutional confidence and capital inflows.

Enhanced Hong Kong's role in global digital finance.

Reduced reliance on offshore/unregulated platforms.

Risks & Challenges

Short-term compliance costs and adjustments for operators.

Potential overreach if rules become too restrictive.

Adoption hurdles if global partners hesitate on certain VA integrations.

Ongoing refinements needed for emerging areas like DeFi.

Bottom Line

Hong Kong's planned new VA guidelines aren't just more red tape — they're a strategic evolution toward a mature, regulated VA ecosystem. Recent SFC moves (Feb 2026 margin/perps guidance) and the anticipated 2026 licensing bill signal Hong Kong's commitment to clarity, innovation, and leadership in digital assets.

This could accelerate mainstream adoption, boost market resilience, and solidify Hong Kong as a bridge between TradFi and crypto — turning regulatory pressure into sustainable growth.