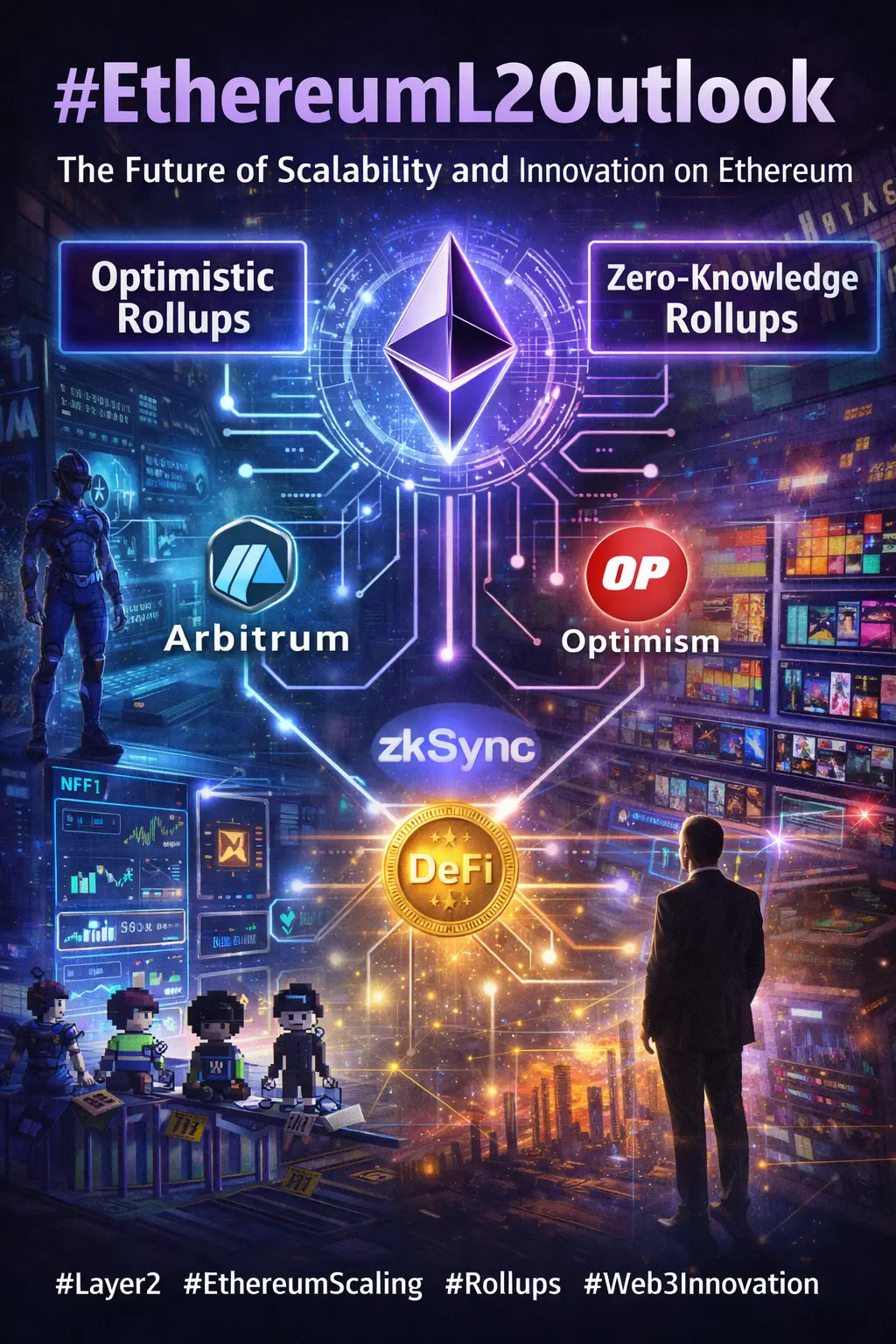

#EthereumL2Outlook

🚀 Scaling Race Heats Up as L2 Ecosystem Enters a New Phase

Ethereum Layer-2 networks are moving from pure scaling solutions into full economic ecosystems. Activity across major L2s continues to reshape how liquidity, users, and developers interact with Ethereum. Instead of competing with Ethereum, these networks are increasingly acting as growth engines that extend its reach.

From a structural perspective, the L2 landscape is entering a consolidation phase. Leading rollups are focusing less on raw transaction speed and more on ecosystem stickiness — developer tooling, cross-chain liquidity, and user experience. Networks that successfully attract sustainable on-chain activity, not just short-term incentives, are separating themselves from the rest.

One key trend is modular scaling. Data availability upgrades and improved rollup infrastructure are reducing costs and increasing throughput, which directly supports DeFi, gaming, and high-frequency applications. As fees stabilize, L2s are becoming practical environments for real consumer use rather than experimental platforms.

At the same time, competition between optimistic and zero-knowledge rollups is intensifying. ZK technology is advancing rapidly, promising faster finality and stronger security guarantees, while optimistic rollups maintain an first-mover advantage in liquidity and ecosystem maturity. The long-term winner may not be a single chain, but an interconnected network of specialized L2s optimized for different use cases.

From Dragon Fly Official’s view, the real opportunity is not just price speculation but infrastructure positioning. The strongest L2 projects are those building durable ecosystems — deep liquidity, active developers, and real transaction demand. Short-term volatility will continue, but the broader trajectory points toward Ethereum evolving into a multi-layer settlement network supported by a diverse L2 economy.

For traders and investors, watching capital rotation inside the L2 sector is critical. Ecosystems showing consistent user growth and cross-chain integration are more likely to sustain long-term value than those driven purely by hype.

Ethereum’s scaling story is no longer theoretical. It is actively reshaping how blockchain networks grow — and the next cycle of innovation will likely be led from the Layer-2 frontier.

What’s your outlook on Ethereum’s L2 race as adoption accelerates?

🚀 Scaling Race Heats Up as L2 Ecosystem Enters a New Phase

Ethereum Layer-2 networks are moving from pure scaling solutions into full economic ecosystems. Activity across major L2s continues to reshape how liquidity, users, and developers interact with Ethereum. Instead of competing with Ethereum, these networks are increasingly acting as growth engines that extend its reach.

From a structural perspective, the L2 landscape is entering a consolidation phase. Leading rollups are focusing less on raw transaction speed and more on ecosystem stickiness — developer tooling, cross-chain liquidity, and user experience. Networks that successfully attract sustainable on-chain activity, not just short-term incentives, are separating themselves from the rest.

One key trend is modular scaling. Data availability upgrades and improved rollup infrastructure are reducing costs and increasing throughput, which directly supports DeFi, gaming, and high-frequency applications. As fees stabilize, L2s are becoming practical environments for real consumer use rather than experimental platforms.

At the same time, competition between optimistic and zero-knowledge rollups is intensifying. ZK technology is advancing rapidly, promising faster finality and stronger security guarantees, while optimistic rollups maintain an first-mover advantage in liquidity and ecosystem maturity. The long-term winner may not be a single chain, but an interconnected network of specialized L2s optimized for different use cases.

From Dragon Fly Official’s view, the real opportunity is not just price speculation but infrastructure positioning. The strongest L2 projects are those building durable ecosystems — deep liquidity, active developers, and real transaction demand. Short-term volatility will continue, but the broader trajectory points toward Ethereum evolving into a multi-layer settlement network supported by a diverse L2 economy.

For traders and investors, watching capital rotation inside the L2 sector is critical. Ecosystems showing consistent user growth and cross-chain integration are more likely to sustain long-term value than those driven purely by hype.

Ethereum’s scaling story is no longer theoretical. It is actively reshaping how blockchain networks grow — and the next cycle of innovation will likely be led from the Layer-2 frontier.

What’s your outlook on Ethereum’s L2 race as adoption accelerates?