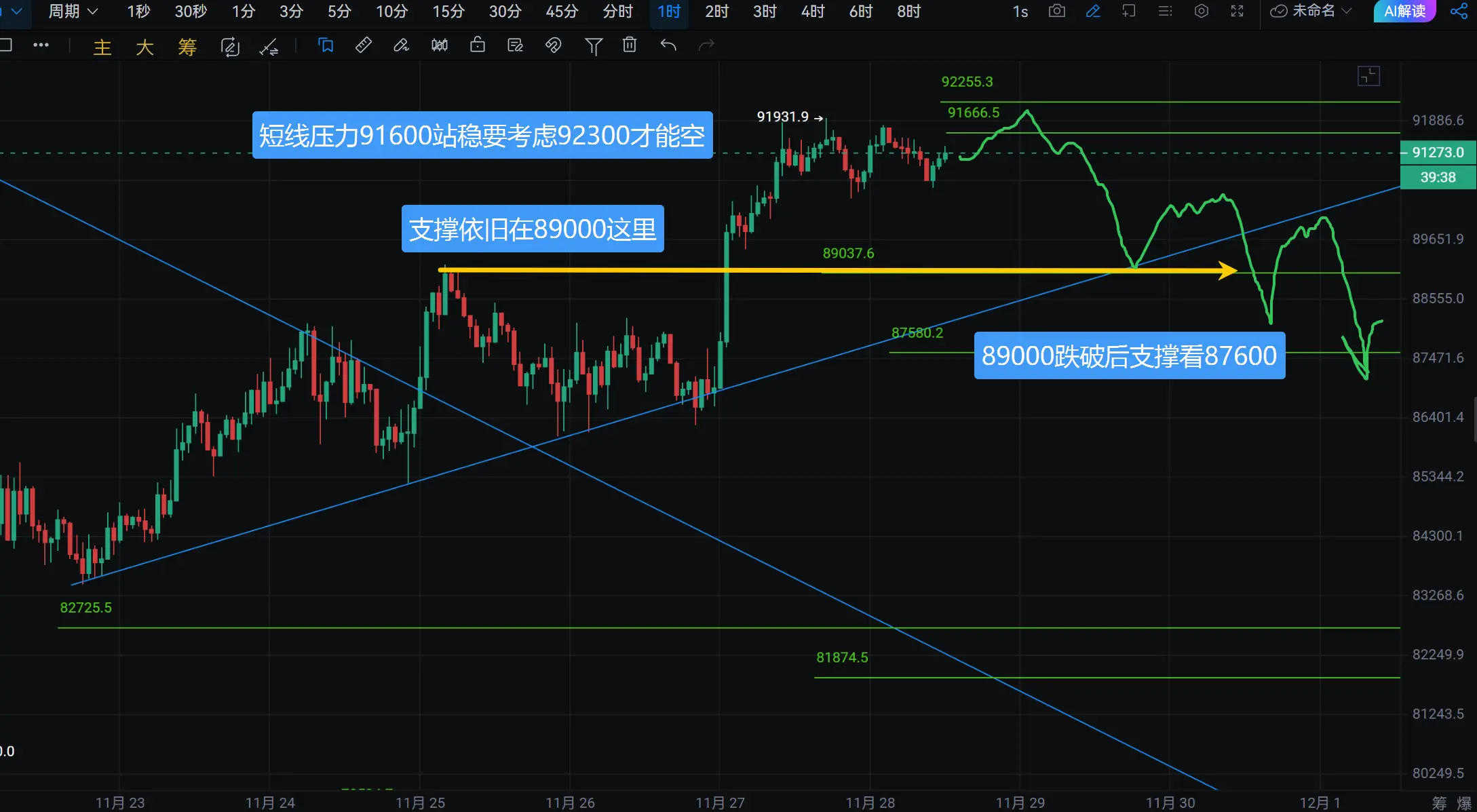

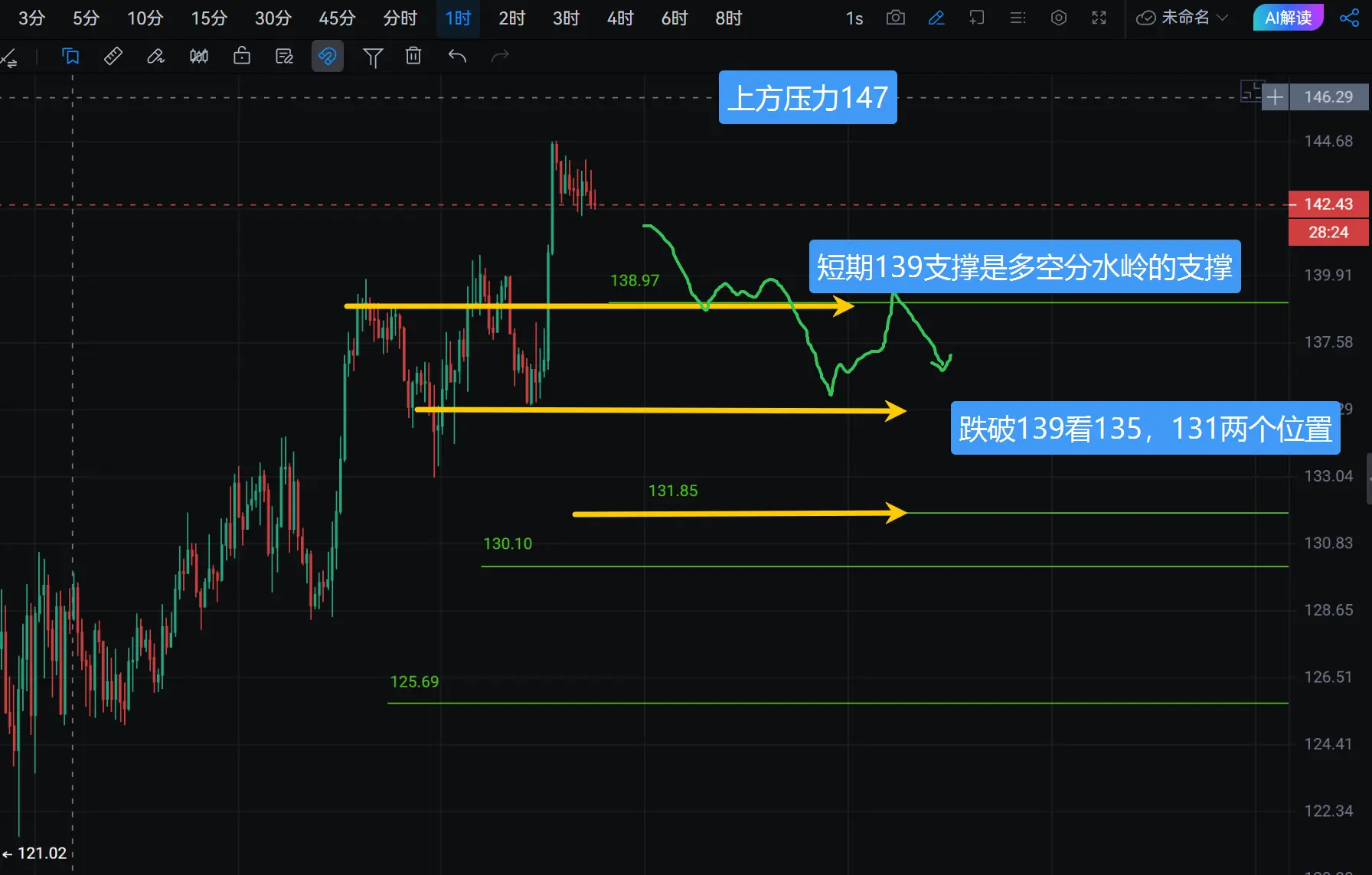

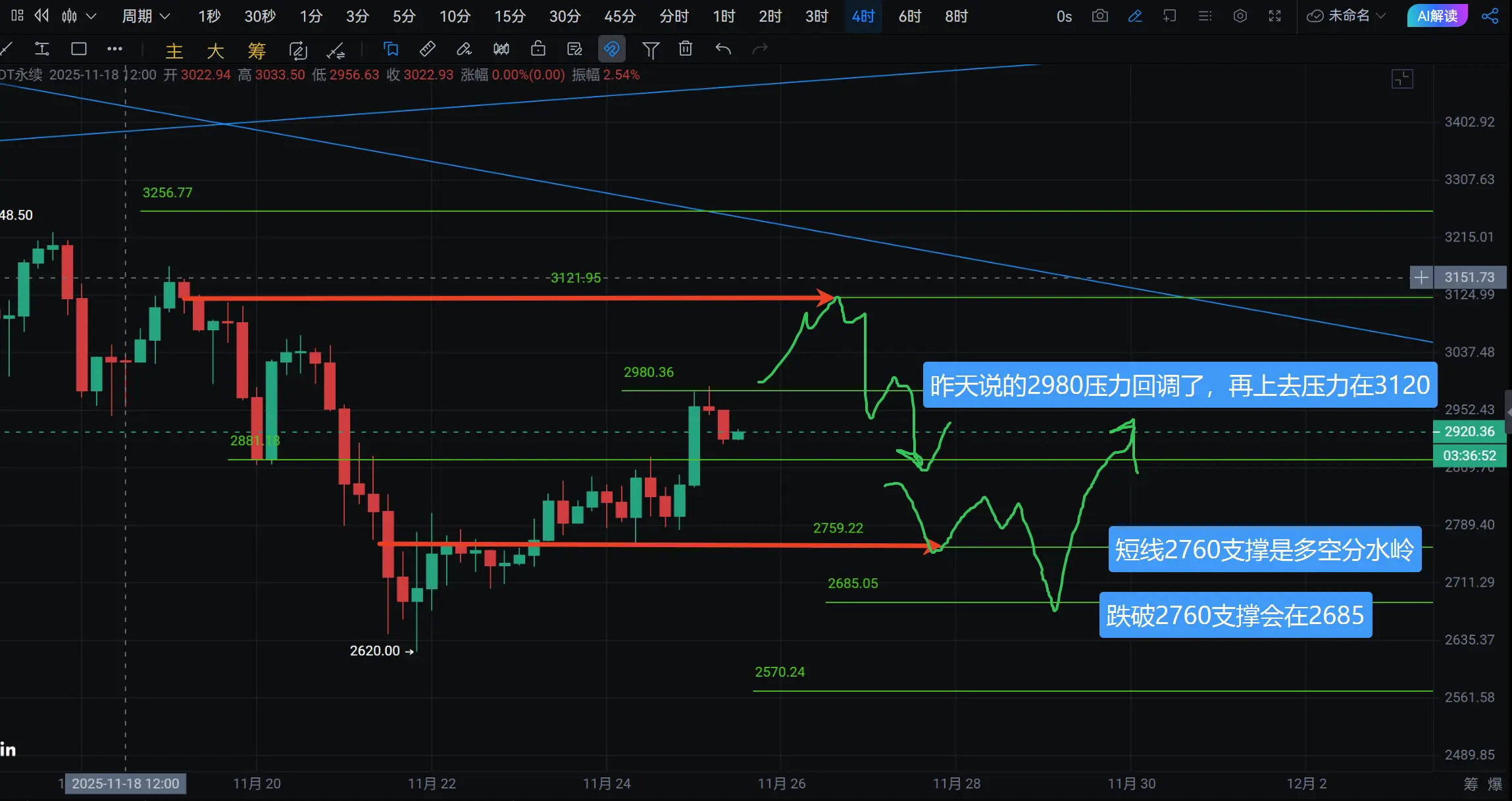

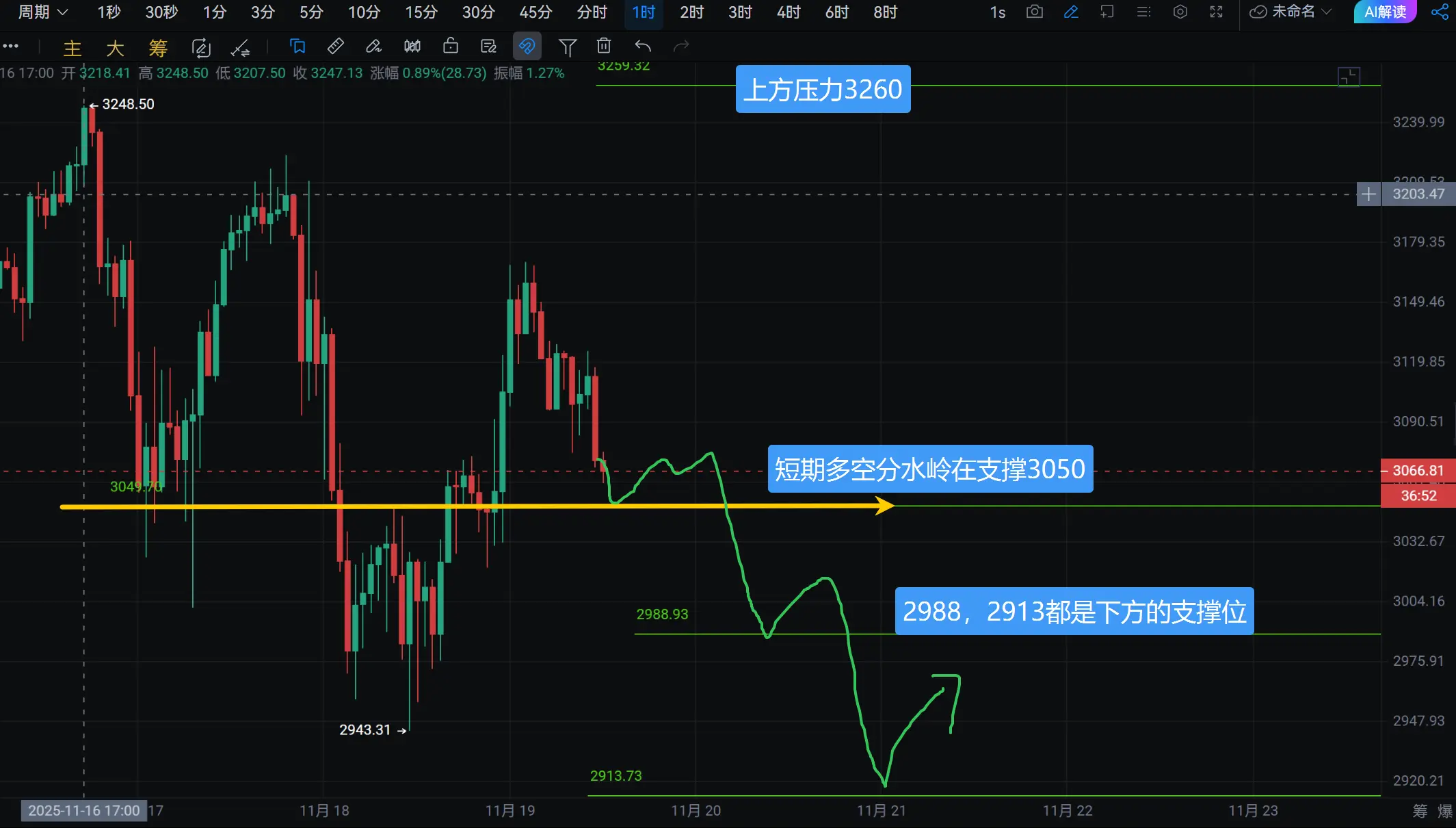

Here it comes, late-night benefits, laying out the plot for this Tuesday's exploration. $SOL Spot recommendation to buy in batches at 130-128-125, with this setup, your spot won't be trapped for long. Take profit can be looked at long-term at 146-152. For contracts, the extreme support is at 125, enter the position at 123, and set the stop loss at a closing below 121 on the hourly level. This is where you can find a suitable stop loss position; if the market moves unkindly, it might long wick candle down to 118 and quickly rebound. So prepare for several scenarios! Meeting adjourned!

SOL-4.17%