Bit_Bull

No content yet

Bit_Bull

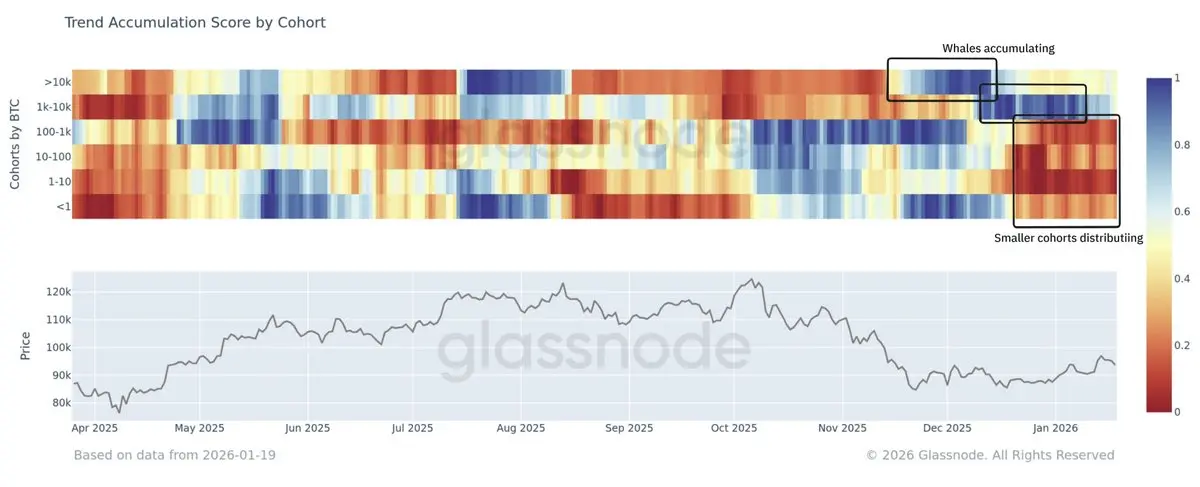

🚨BIG PLAYERS WERE BUYING WHILE SMALLER HOLDERS WERE SELLING

During the November-December bottoming phase, Bitcoin showed a clear split in behavior.

Large wallets were accumulating.

Smaller wallets were distributing.

This means strong hands were quietly building positions while weak hands were giving up.

That is usually what real bottoms look like.

When price was falling and sentiment was negative, big holders were not panicking. They were absorbing supply.

At the same time, part of this activity also came from exchange wallet reshuffling. Coins were being moved between internal wallets, which

During the November-December bottoming phase, Bitcoin showed a clear split in behavior.

Large wallets were accumulating.

Smaller wallets were distributing.

This means strong hands were quietly building positions while weak hands were giving up.

That is usually what real bottoms look like.

When price was falling and sentiment was negative, big holders were not panicking. They were absorbing supply.

At the same time, part of this activity also came from exchange wallet reshuffling. Coins were being moved between internal wallets, which

BTC-4,54%

- Reward

- like

- Comment

- Repost

- Share

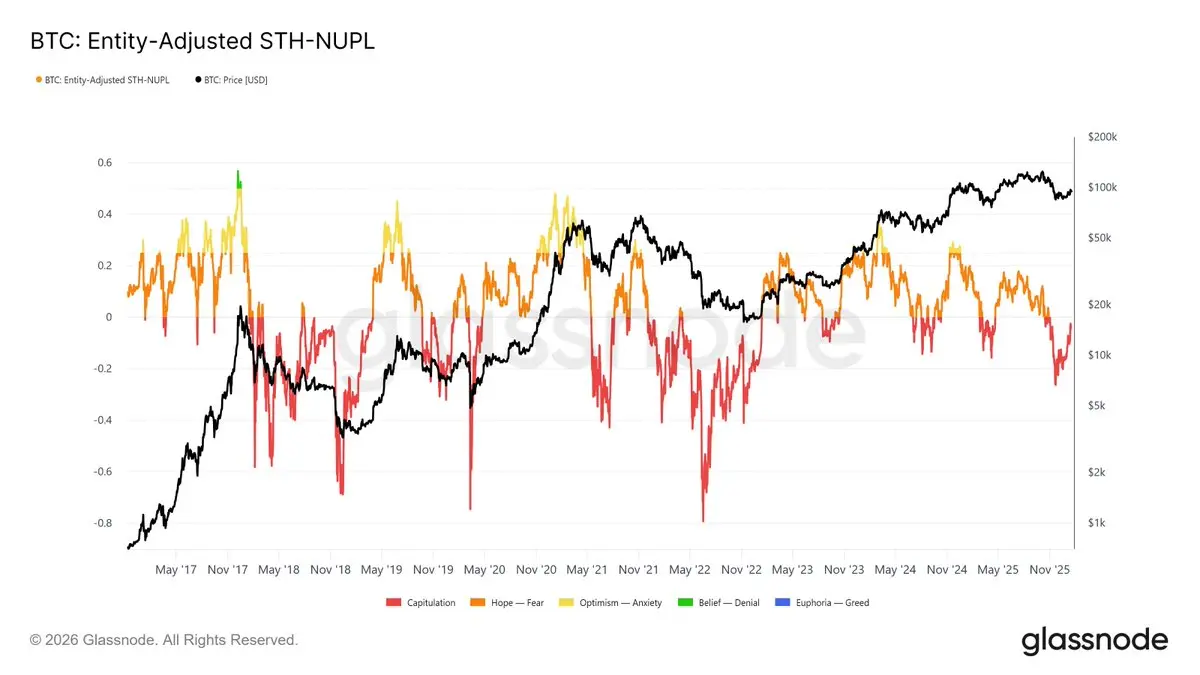

🚨 Most people who bought Bitcoin in the last 3–4 months are still in loss.

And this is exactly why the next move matters so much.

This chart shows STH-NUPL.

It tracks whether new buyers are sitting in profit or loss. Since November 2025, it has stayed below zero, meaning recent buyers are underwater and emotionally defensive.

For a retailer, this tells you something important: The market is not in euphoria.

There is no crowd chasing highs. There is no profit-taking pressure from new money. This is a recovery phase, not a top.

The key level is around $98K. That is where STH-NUPL flips back

And this is exactly why the next move matters so much.

This chart shows STH-NUPL.

It tracks whether new buyers are sitting in profit or loss. Since November 2025, it has stayed below zero, meaning recent buyers are underwater and emotionally defensive.

For a retailer, this tells you something important: The market is not in euphoria.

There is no crowd chasing highs. There is no profit-taking pressure from new money. This is a recovery phase, not a top.

The key level is around $98K. That is where STH-NUPL flips back

BTC-4,54%

- Reward

- like

- Comment

- Repost

- Share

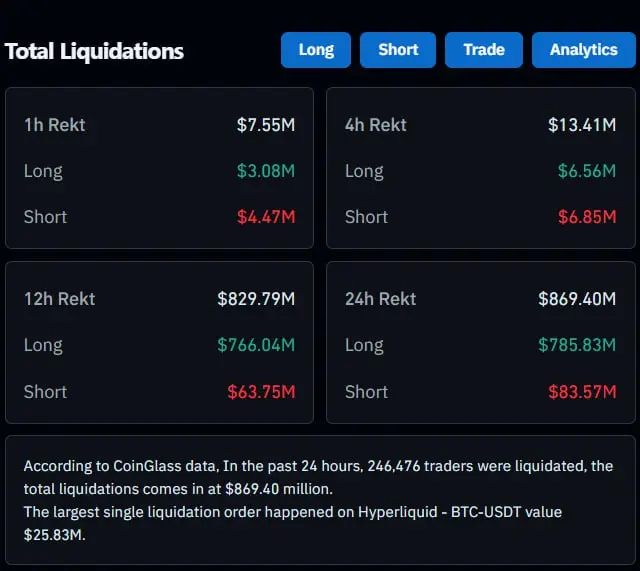

Today's dump was probably the worst since November 21st bottom.

Large-caps nuked 10%-15% in minutes while mid-caps and small-caps nuked 30%-40% in minutes.

This was a pure liquidity hunt, and most times, this mark the bottom.

I think that most damages by tariffs have happened, and BTC will trade above $100K in a few weeks.

Large-caps nuked 10%-15% in minutes while mid-caps and small-caps nuked 30%-40% in minutes.

This was a pure liquidity hunt, and most times, this mark the bottom.

I think that most damages by tariffs have happened, and BTC will trade above $100K in a few weeks.

BTC-4,54%

- Reward

- like

- Comment

- Repost

- Share

The best feeling in crypto is not profits but it's knowing your funds are safe.

@immunefi exists to create that feeling, at industry scale.

$IMU

@immunefi exists to create that feeling, at industry scale.

$IMU

- Reward

- like

- Comment

- Repost

- Share

Trump's Tariff War Is Back 🚨

Just now, Trump has imposed 10% tariffs on these countries.

• France

• Finland

• Norway

• Sweden

• Denmark

• Germany

• Netherlands

• United Kingdom

He also said that if a deal to acquire Greenland isn't reached by 1st June, tariffs will increase to 25%.

Just now, Trump has imposed 10% tariffs on these countries.

• France

• Finland

• Norway

• Sweden

• Denmark

• Germany

• Netherlands

• United Kingdom

He also said that if a deal to acquire Greenland isn't reached by 1st June, tariffs will increase to 25%.

- Reward

- like

- Comment

- Repost

- Share

Altcoin MCap giant bullish pennant formation

The breakout and rally will be epic.

The breakout and rally will be epic.

- Reward

- like

- Comment

- Repost

- Share

I’ve seen the impact firsthand.

When protocols integrate @immunefi, the posture changes. Teams ship with more confidence. Users sleep better. Security stops being reactive panic and becomes a system. That feeling of safety is rare in crypto, and it’s powerful.

When protocols integrate @immunefi, the posture changes. Teams ship with more confidence. Users sleep better. Security stops being reactive panic and becomes a system. That feeling of safety is rare in crypto, and it’s powerful.

- Reward

- like

- Comment

- Repost

- Share

I was curious to see how @ TradFi actually feels in real use.

Trading gold and forex straight from a USDT balance makes things simpler than expected.

No moving money to fiat, no extra accounts, no switching between platforms. It all stays inside one flow.

Setup was quick and didn’t need much effort.

Tried Gold (XAU) first.

Orders filled fast, liquidity looked decent, and spreads were reasonable for normal trading.

It’s still early and clearly not a finished product yet, but the idea makes sense.

Crypto and traditional markets sitting in the same place feels like where trading platforms are s

Trading gold and forex straight from a USDT balance makes things simpler than expected.

No moving money to fiat, no extra accounts, no switching between platforms. It all stays inside one flow.

Setup was quick and didn’t need much effort.

Tried Gold (XAU) first.

Orders filled fast, liquidity looked decent, and spreads were reasonable for normal trading.

It’s still early and clearly not a finished product yet, but the idea makes sense.

Crypto and traditional markets sitting in the same place feels like where trading platforms are s

FLOW-7,17%

- Reward

- like

- Comment

- Repost

- Share

USDT dominance keeps going down.

The pump isn't over yet.

The pump isn't over yet.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

We are just one breakout away from the generational wealth.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More14.03K Popularity

41.08K Popularity

53.24K Popularity

15.16K Popularity

10.3K Popularity

Pin