Cipher_X

No content yet

Cipher_X

Michael Saylor just bought $2.13B worth of Bitcoin

And this is one of his largest buys ever.

And yet, price is still dropping 🚨

This tells you everything

CLEAR MANIPULATION.

And this is one of his largest buys ever.

And yet, price is still dropping 🚨

This tells you everything

CLEAR MANIPULATION.

BTC-4,61%

- Reward

- like

- Comment

- Repost

- Share

Markets are walking into danger again 🚨👇

The U.S. stock market is setting up for another tariffs-driven crash

Trade pressure is back on the table and risk sentiment is already fragile

I’m watching the U.S. market open today very closely

If stocks slip, fear spreads fast and liquidity disappears even faster

That scenario is really bad for Bitcoin

Stay Safe.

The U.S. stock market is setting up for another tariffs-driven crash

Trade pressure is back on the table and risk sentiment is already fragile

I’m watching the U.S. market open today very closely

If stocks slip, fear spreads fast and liquidity disappears even faster

That scenario is really bad for Bitcoin

Stay Safe.

BTC-4,61%

- Reward

- like

- Comment

- Repost

- Share

BIG WEEK AHEAD 🚨👇

▸ U.S. Core PCE inflation the Fed’s most important inflation gauge

▸ Bank of Japan policy decision and press conference

▸ U.S. GDP data

▸ Global Flash PMIs for manufacturing & services

▸ U.K. CPI and Retail Sales

▸ Australian employment data

▸ President Trump speaking during WEF meetings

Stay Safe.

▸ U.S. Core PCE inflation the Fed’s most important inflation gauge

▸ Bank of Japan policy decision and press conference

▸ U.S. GDP data

▸ Global Flash PMIs for manufacturing & services

▸ U.K. CPI and Retail Sales

▸ Australian employment data

▸ President Trump speaking during WEF meetings

Stay Safe.

- Reward

- 1

- Comment

- Repost

- Share

Big money is about to reshape the markets 🚨👇

$4.7T is flowing into the US over the next year

- tax refunds

- corporate cash returning

- investment incentives

This isn’t hype.

This is pure liquidity.

Cash hits stocks first, fuels risk appetite, then moves into Bitcoin.

Corporate boards will do what they always do: buybacks, dividends, M&A, capital spending.

Markets feel it before anyone notices.

Trump’s push isn’t about “fixing” the economy it’s about moving liquidity fast.

This is why assets surge while wages lag and why inflation sneaks up afterward.

Pay attention to the flows.

Timing

$4.7T is flowing into the US over the next year

- tax refunds

- corporate cash returning

- investment incentives

This isn’t hype.

This is pure liquidity.

Cash hits stocks first, fuels risk appetite, then moves into Bitcoin.

Corporate boards will do what they always do: buybacks, dividends, M&A, capital spending.

Markets feel it before anyone notices.

Trump’s push isn’t about “fixing” the economy it’s about moving liquidity fast.

This is why assets surge while wages lag and why inflation sneaks up afterward.

Pay attention to the flows.

Timing

BTC-4,61%

- Reward

- like

- Comment

- Repost

- Share

Silver market cap added $3.9 trillion in just 12 months 👇

That single move is now nearly 2× Bitcoin’s entire current market cap

Let that sink in

Silver is a slow, traditional asset with limited global accessibility

Bitcoin is digital, borderless, liquid 24/7, and increasingly adopted by institutions.

If Bitcoin simply catches up to silver’s market cap $BTC would be trading around $270,000+

This isn’t a moonshot narrative.

It’s pure relative valuation.

Hard asset vs harder asset.

One already proved capital can flow at scale.

The other is still early.

That single move is now nearly 2× Bitcoin’s entire current market cap

Let that sink in

Silver is a slow, traditional asset with limited global accessibility

Bitcoin is digital, borderless, liquid 24/7, and increasingly adopted by institutions.

If Bitcoin simply catches up to silver’s market cap $BTC would be trading around $270,000+

This isn’t a moonshot narrative.

It’s pure relative valuation.

Hard asset vs harder asset.

One already proved capital can flow at scale.

The other is still early.

BTC-4,61%

- Reward

- like

- Comment

- Repost

- Share

Crypto fails because of hacks!

Before trillions come onchain, one thing has to be solved first: security.

Immunefi is already doing that work at scale. They’ve helped protect:

→ 650+ protocols

→ ~$180B in value

→ stopped ~$25B in hack damage

IMU is all about backing the system that makes crypto feel safe enough to grow.

If security becomes mandatory, platforms like Immunefi become unavoidable.

@immunefi

Before trillions come onchain, one thing has to be solved first: security.

Immunefi is already doing that work at scale. They’ve helped protect:

→ 650+ protocols

→ ~$180B in value

→ stopped ~$25B in hack damage

IMU is all about backing the system that makes crypto feel safe enough to grow.

If security becomes mandatory, platforms like Immunefi become unavoidable.

@immunefi

- Reward

- like

- Comment

- Repost

- Share

HUGE 🚨

US Senate releases draft of the crypto market structure Clarity Act

The bill focuses on defining regulatory authority across US crypto markets.

It’s an early draft but marks progress toward clearer rules.

US Senate releases draft of the crypto market structure Clarity Act

The bill focuses on defining regulatory authority across US crypto markets.

It’s an early draft but marks progress toward clearer rules.

- Reward

- like

- Comment

- Repost

- Share

BIG WEEK AHEAD 🚨

Heavy macro lineup incoming:

- US CPI & Core CPI

- PPI + Retail Sales

- Unemployment Claims

- UK GDP

These numbers will drive rates, USD, gold, and crypto

Expect volatility.

Heavy macro lineup incoming:

- US CPI & Core CPI

- PPI + Retail Sales

- Unemployment Claims

- UK GDP

These numbers will drive rates, USD, gold, and crypto

Expect volatility.

- Reward

- like

- Comment

- Repost

- Share

Bitcoin didn’t just bounce - structure shifted 👇

First week of 2026 erased weeks of sell pressure, forcing shorts to exit aggressively.

That kind of move doesn’t come from retail chasing candles

What matters now is acceptance above the mid-$90k zone imo

A clean close there flips momentum and opens the path toward $100k and higher.

First week of 2026 erased weeks of sell pressure, forcing shorts to exit aggressively.

That kind of move doesn’t come from retail chasing candles

What matters now is acceptance above the mid-$90k zone imo

A clean close there flips momentum and opens the path toward $100k and higher.

BTC-4,61%

- Reward

- like

- Comment

- Repost

- Share

Dusk is building what most blockchains avoid 👇

REGULATION WITHOUT KILLING PRIVACY

Dusk is a Layer 1 designed specifically for regulated financial infrastructure not meme speculation not shortcuts.

What stands out:

▸ Privacy and auditability are built into the base layer

▸ Modular architecture made for institutional-grade finance

▸ Native support for compliant DeFi and tokenized real-world assets

▸ Designed to work with regulators, not around them

This is the kind of blockchain TradFi can actually plug into imo

It’s quietly laying the rails for compliant on-chain finance

@DuskFounda

REGULATION WITHOUT KILLING PRIVACY

Dusk is a Layer 1 designed specifically for regulated financial infrastructure not meme speculation not shortcuts.

What stands out:

▸ Privacy and auditability are built into the base layer

▸ Modular architecture made for institutional-grade finance

▸ Native support for compliant DeFi and tokenized real-world assets

▸ Designed to work with regulators, not around them

This is the kind of blockchain TradFi can actually plug into imo

It’s quietly laying the rails for compliant on-chain finance

@DuskFounda

DUSK9,01%

- Reward

- like

- Comment

- Repost

- Share

Spot Bitcoin ETFs start 2026 strong 🚨

Spot Bitcoin ETFs pulled in over $1.2B in just the first two trading days of 2026.

If this pace continues it annualizes to roughly $150B in inflows.

This is not retail hype this is steady institutional demand showing up early in the year.

Spot Bitcoin ETFs pulled in over $1.2B in just the first two trading days of 2026.

If this pace continues it annualizes to roughly $150B in inflows.

This is not retail hype this is steady institutional demand showing up early in the year.

BTC-4,61%

- Reward

- like

- Comment

- Repost

- Share

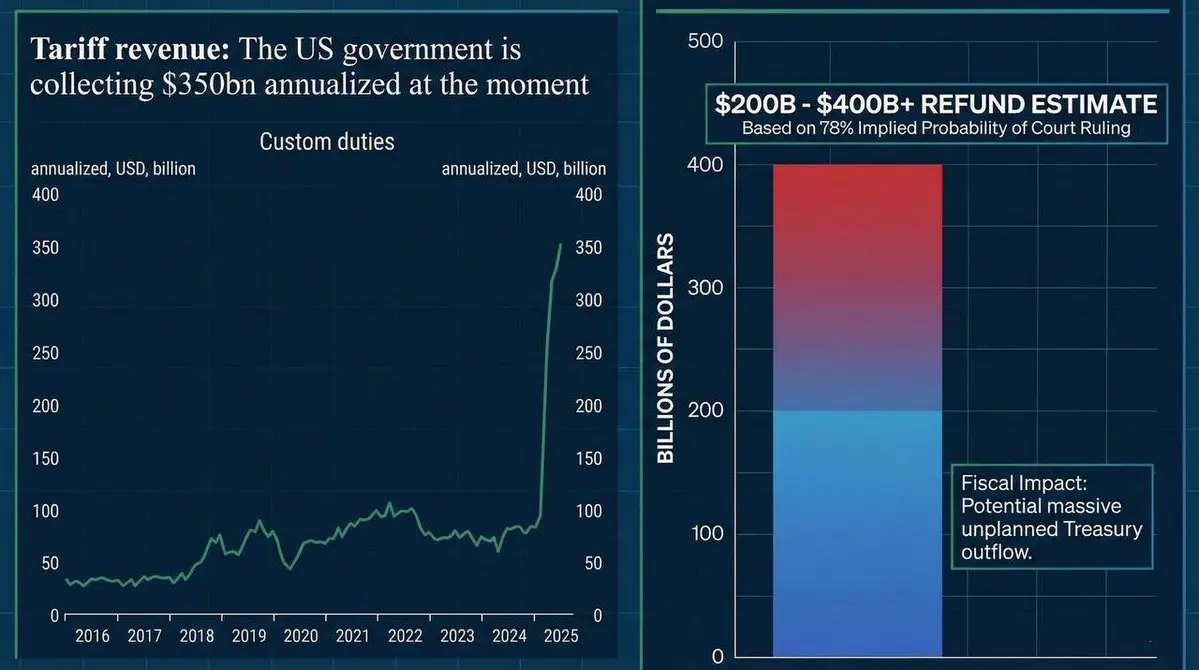

A Court Case Markets Should Pay Attention To 👇

Tariffs imposed under emergency powers during Donald Trump’s term are being challenged

If ruled illegal → refunds are required, not optional

Estimated cost: $200B–$400B

This wouldn’t be bullish.

It would be disruptive.

Tariffs imposed under emergency powers during Donald Trump’s term are being challenged

If ruled illegal → refunds are required, not optional

Estimated cost: $200B–$400B

This wouldn’t be bullish.

It would be disruptive.

- Reward

- like

- Comment

- Repost

- Share

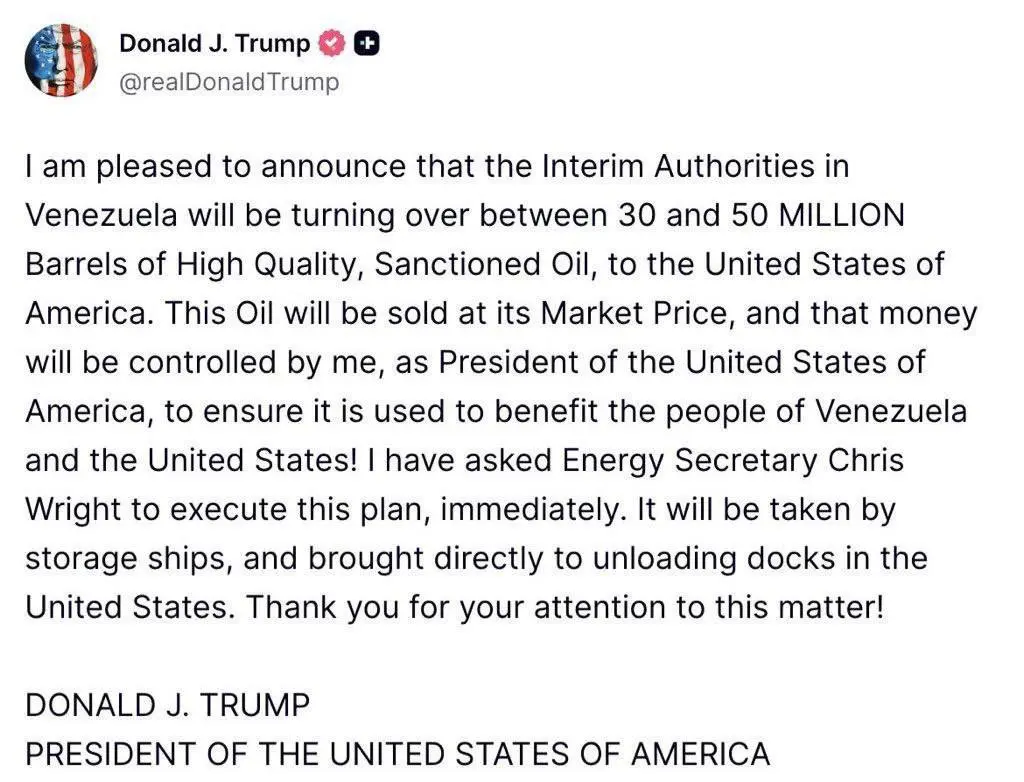

Donald Trump says Venezuela will hand over 30–50 million barrels of high-quality sanctioned oil to the U.S 🚨

Why this matters:

– Adds near-term supply to global oil markets

– Could ease U.S. energy pressures

– Signals a major geopolitical shift around sanctions and energy flows

Energy markets will be watching closely how and when this supply hits.

Why this matters:

– Adds near-term supply to global oil markets

– Could ease U.S. energy pressures

– Signals a major geopolitical shift around sanctions and energy flows

Energy markets will be watching closely how and when this supply hits.

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING

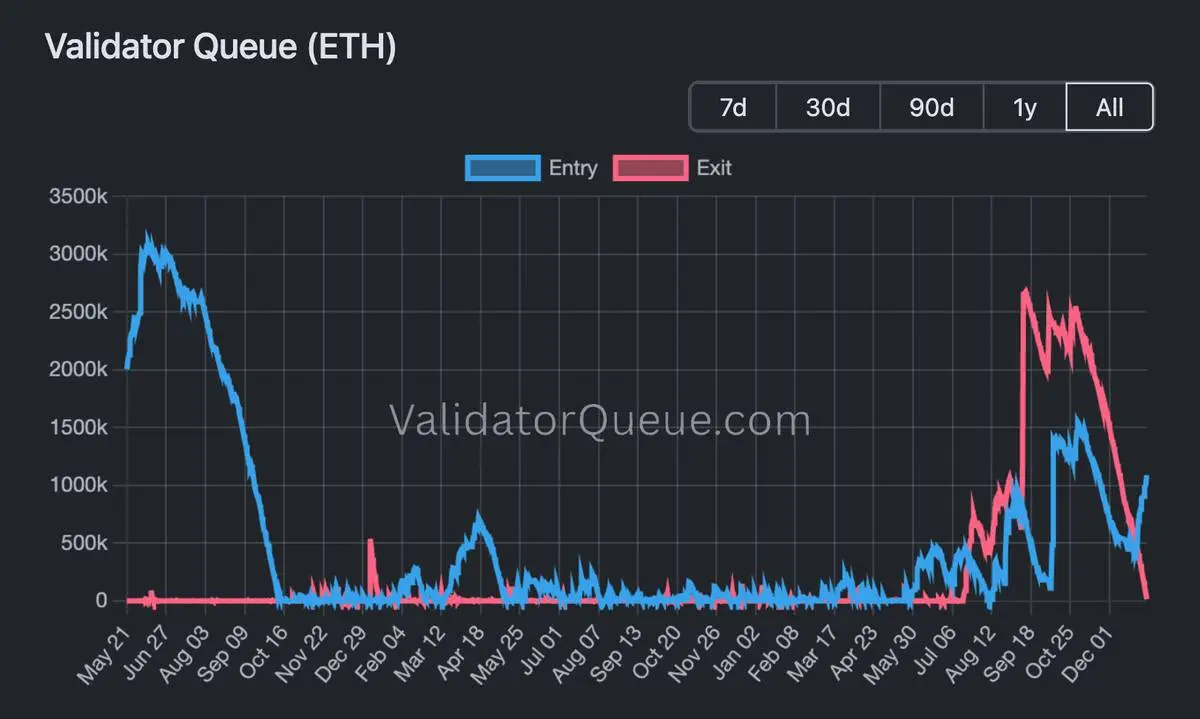

$ETH selling pressure is clearly fading.

Outflows are slowing, forced selling is drying up, and entry flows are starting to stabilize

A classic sign that distribution is losing momentum.

This doesn’t mean instant upside, but it does suggest sellers are running out of fuel.

When supply weakens while price holds structure, it usually sets the stage for a stronger directional move.

Market is quietly transitioning from defense to accumulation.

$ETH selling pressure is clearly fading.

Outflows are slowing, forced selling is drying up, and entry flows are starting to stabilize

A classic sign that distribution is losing momentum.

This doesn’t mean instant upside, but it does suggest sellers are running out of fuel.

When supply weakens while price holds structure, it usually sets the stage for a stronger directional move.

Market is quietly transitioning from defense to accumulation.

ETH-7,3%

- Reward

- like

- Comment

- Repost

- Share

Big macro week ahead for crypto 👇

What’s lined up:

Monday: PMI Index → growth vs slowdown signal

Tuesday: FOMC → rates, tone, and liquidity expectations

Wednesday: JOLTS + balance sheet update → labor stress & liquidity

Thursday: Initial jobless claims → cracks or resilience

Friday: U.S. unemployment rate → confirms the trend

If data weakens → liquidity expectations rise.

If liquidity expectations rise → risk assets react.

What’s lined up:

Monday: PMI Index → growth vs slowdown signal

Tuesday: FOMC → rates, tone, and liquidity expectations

Wednesday: JOLTS + balance sheet update → labor stress & liquidity

Thursday: Initial jobless claims → cracks or resilience

Friday: U.S. unemployment rate → confirms the trend

If data weakens → liquidity expectations rise.

If liquidity expectations rise → risk assets react.

- Reward

- like

- Comment

- Repost

- Share

Silver is the next gold

Copper is the next silver

Gold already ran on monetary fear

Silver is now catching the same bid, but with industrial demand added on top

And copper sits one step behind both quietly absorbing demand from electrification, AI data centers, EVs, and grid expansion.

This is how commodity cycles rotate.

First the store of value.

Then the hybrid metal.

Then the industrial backbone.

Copper is the next silver

Gold already ran on monetary fear

Silver is now catching the same bid, but with industrial demand added on top

And copper sits one step behind both quietly absorbing demand from electrification, AI data centers, EVs, and grid expansion.

This is how commodity cycles rotate.

First the store of value.

Then the hybrid metal.

Then the industrial backbone.

- Reward

- like

- Comment

- Repost

- Share