JackBTC

No content yet

JackBtc

Gate CrossEx Account Now Live

Experience unified multi-exchange trading with spot, cross margin, and USDT perpetuals.

Up to 20× leverage, advanced risk control, and API-only trading for professionals.

VIP+3 Fee Benefit: Jan 19 – Feb 19, 2026

Open Now:

Experience unified multi-exchange trading with spot, cross margin, and USDT perpetuals.

Up to 20× leverage, advanced risk control, and API-only trading for professionals.

VIP+3 Fee Benefit: Jan 19 – Feb 19, 2026

Open Now:

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

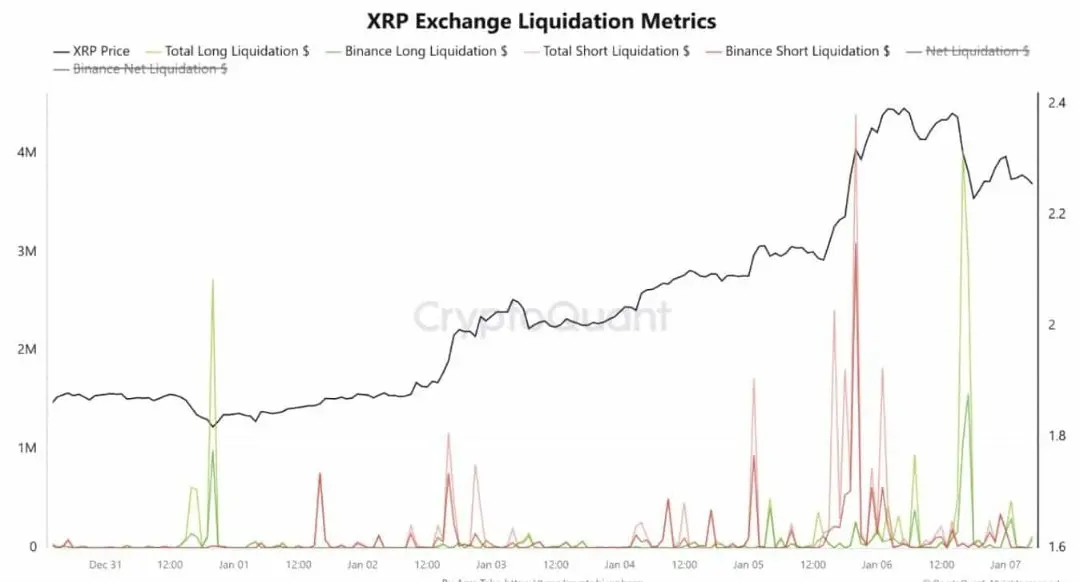

$XRP isn’t breaking out, it’s resetting.

Binance-led liquidations have wiped both longs and shorts, signaling a leverage flush, not a trend.

Crowded positioning + weak follow-through = derivatives driving price, not spot demand.

Patience here matters.

Via @coinexcreators

Binance-led liquidations have wiped both longs and shorts, signaling a leverage flush, not a trend.

Crowded positioning + weak follow-through = derivatives driving price, not spot demand.

Patience here matters.

Via @coinexcreators

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 4

- 1

- Repost

- Share

Atilss :

:

Jump in 🚀- Reward

- 2

- Comment

- Repost

- Share

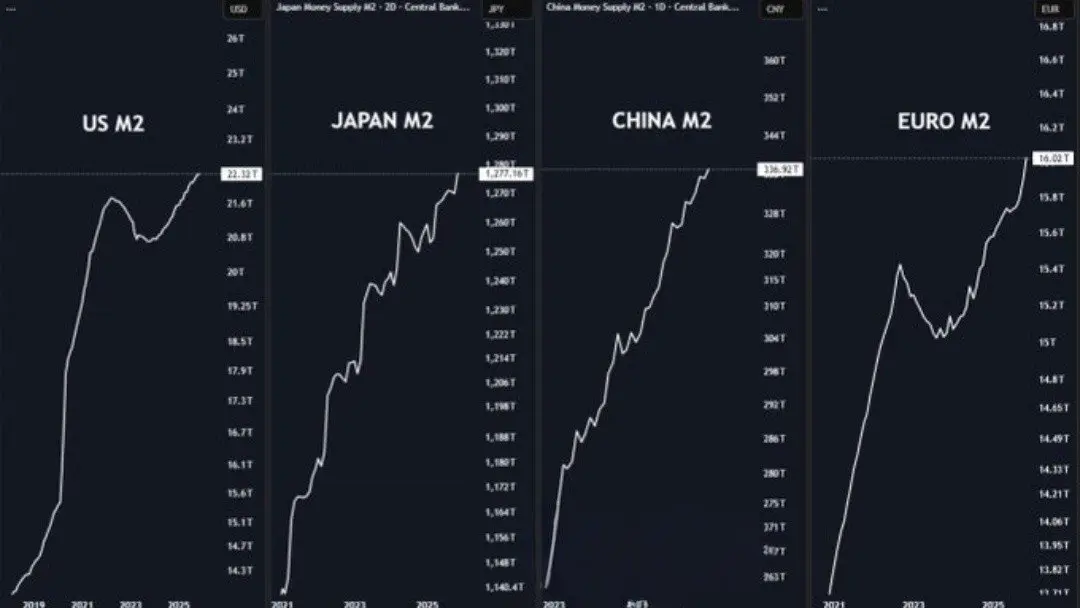

Global liquidity is at record highs.

• US M2: ATH

• Japan M2: ATH

• China M2: ATH

• Eurozone M2: ATH

Equities and precious metals are also trading at all-time highs.

In contrast, the crypto market remains well below its previous peak.

In my view, this valuation gap is hard for institutions to ignore and could drive fresh capital allocation into Bitcoin and select altcoins in Q1 2026.

• US M2: ATH

• Japan M2: ATH

• China M2: ATH

• Eurozone M2: ATH

Equities and precious metals are also trading at all-time highs.

In contrast, the crypto market remains well below its previous peak.

In my view, this valuation gap is hard for institutions to ignore and could drive fresh capital allocation into Bitcoin and select altcoins in Q1 2026.

BTC-3,72%

- Reward

- 1

- 1

- Repost

- Share

LoveToEatPigTrotterRice :

:

New Year Wealth Explosion 🤑- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More17.04K Popularity

45.51K Popularity

54.93K Popularity

16.85K Popularity

11.27K Popularity

Pin