NolanVincent

No content yet

NolanVincent

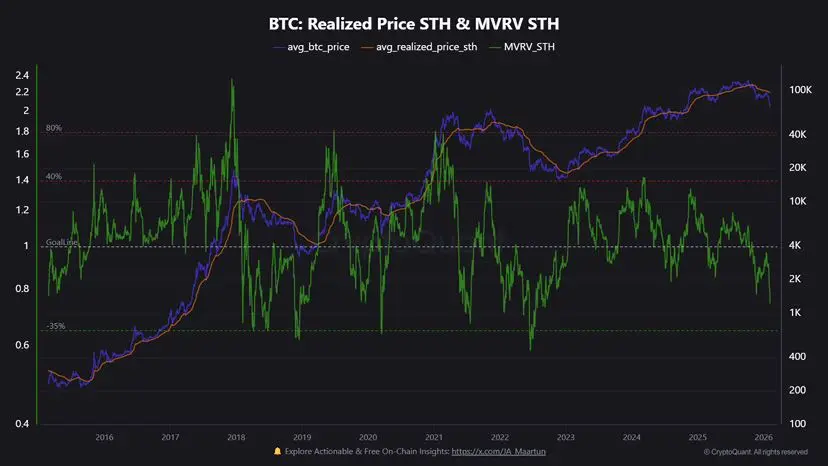

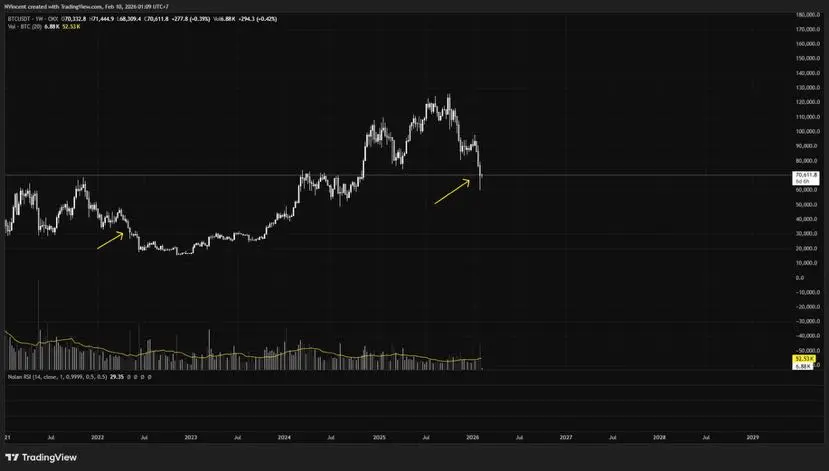

I’ve already shared this BTC analysis inside my premium group and with my copy-trade followers. Now I’m making it public so everyone can review it and evaluate it together.

So BTC only managed to hold above the potential demand zone of 75–80k for four days before continuing exactly in line with the Markdown phase. In times like this, what should we do? Today, this is Nolan’s perspective on BTC at the current stage. For those who don’t want to read the full analysis, here are 5 key takeaways:

1. BTC is in Phase E – Markdown, mid-to-late stage, but not finished yet.

2. The 70k area is not a Wy

So BTC only managed to hold above the potential demand zone of 75–80k for four days before continuing exactly in line with the Markdown phase. In times like this, what should we do? Today, this is Nolan’s perspective on BTC at the current stage. For those who don’t want to read the full analysis, here are 5 key takeaways:

1. BTC is in Phase E – Markdown, mid-to-late stage, but not finished yet.

2. The 70k area is not a Wy

BTC-1,2%

- Reward

- 2

- Comment

- Repost

- Share

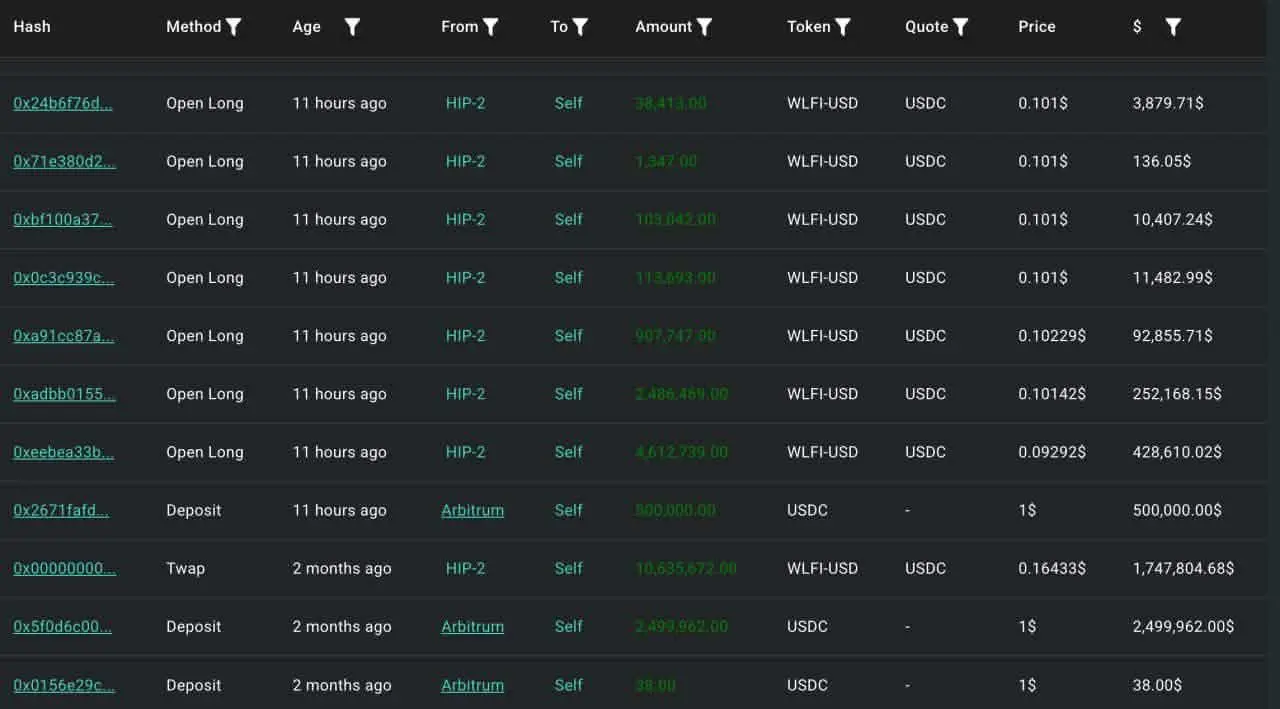

Whale 0x9b3b deposited another $500K USDC into Hyperliquid today to keep going long on $WLFI.

He now holds a long of 42.47M $WLFI($4.26M) and is currently down over $1M.

He now holds a long of 42.47M $WLFI($4.26M) and is currently down over $1M.

WLFI-4,88%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

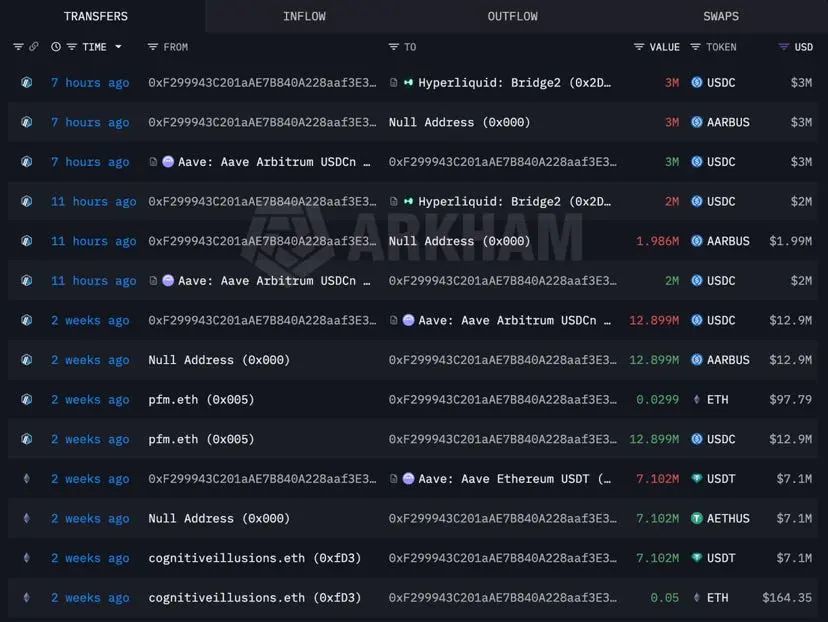

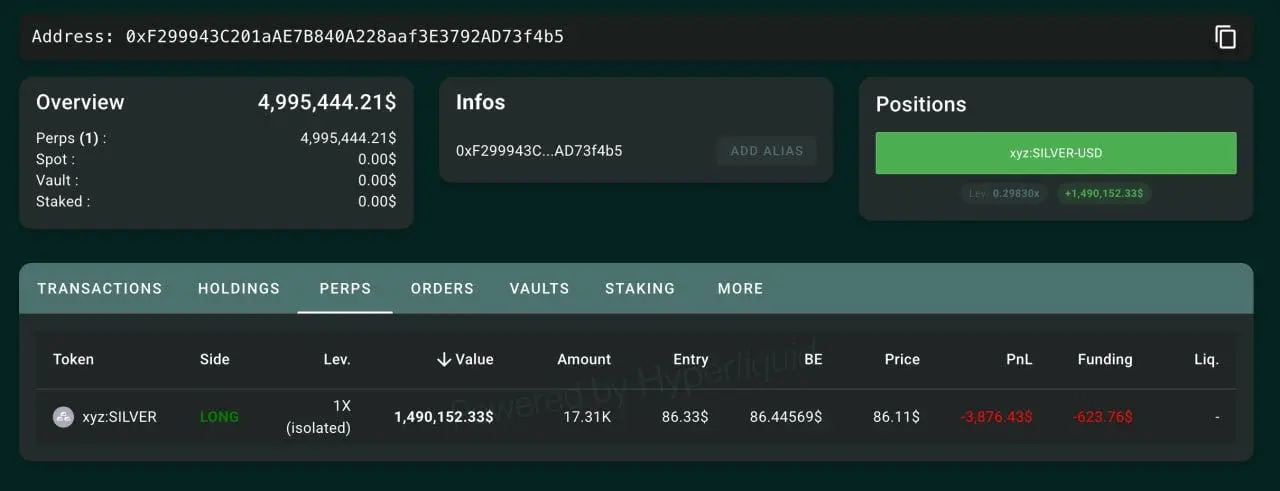

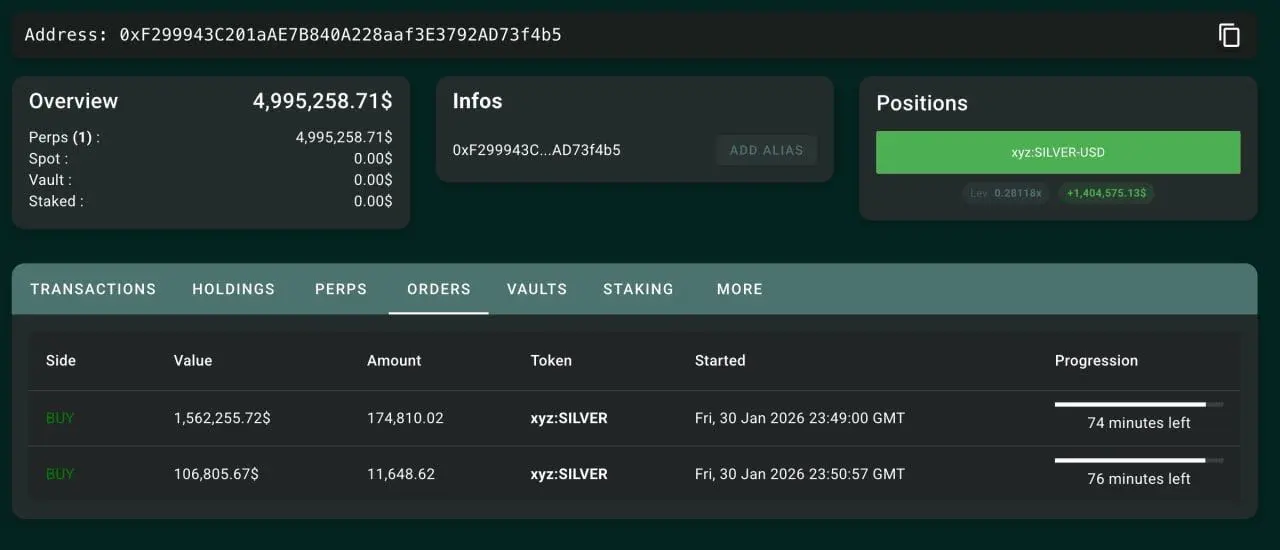

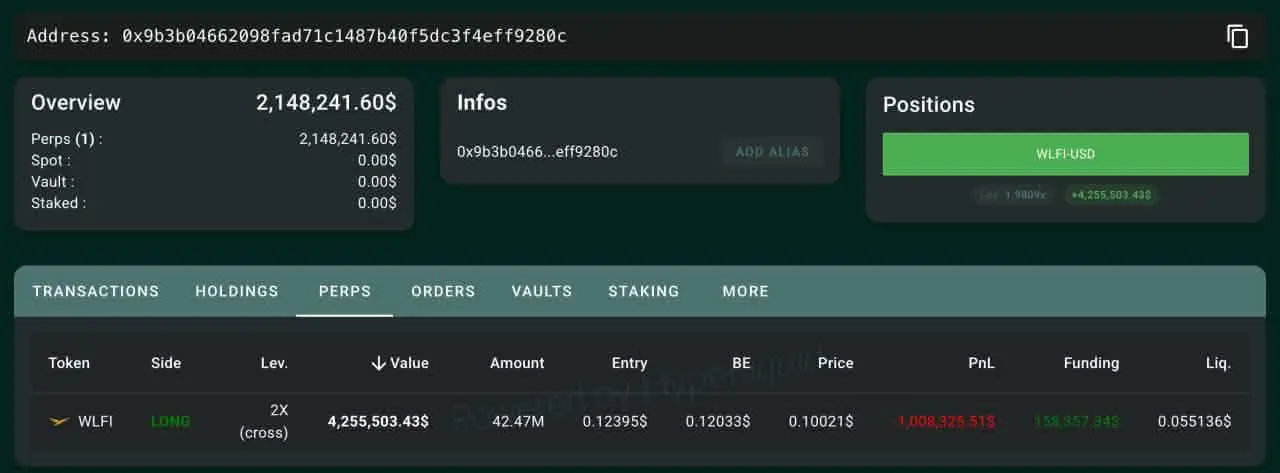

This OTC whale continues to buy the dip!

He bought another 33,000 $ETH($76.6M) and 250 $CBBTC($18.95M) today.

He bought another 33,000 $ETH($76.6M) and 250 $CBBTC($18.95M) today.

ETH-1,7%

- Reward

- like

- 1

- Repost

- Share

TheSongOfTheBees :

:

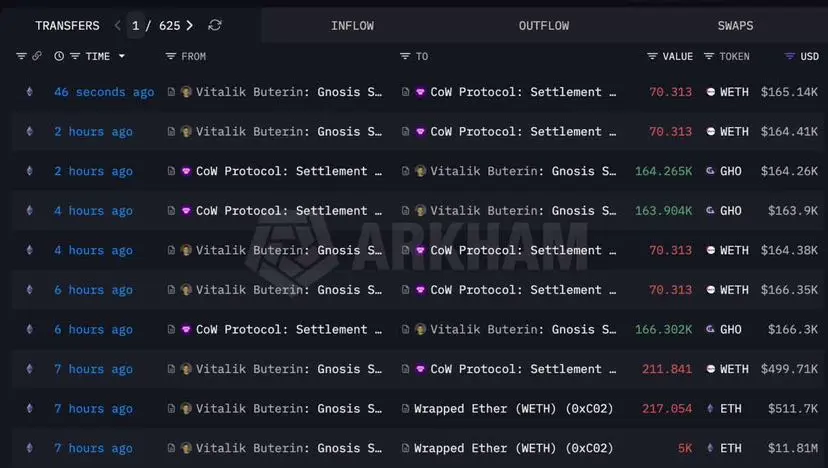

Wall Street elites are very optimistic about the future of the Ethereum network. They want to buy the dip and will inevitably suppress and liquidate large contract positions before entering the market at a lower price. 😄🥤vitalik.eth(@VitalikButerin) continues to sell $ETH, having sold 493 $ETH($1.16M) in the past 8 hours.

ETH-1,7%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

TheSongOfTheBees :

:

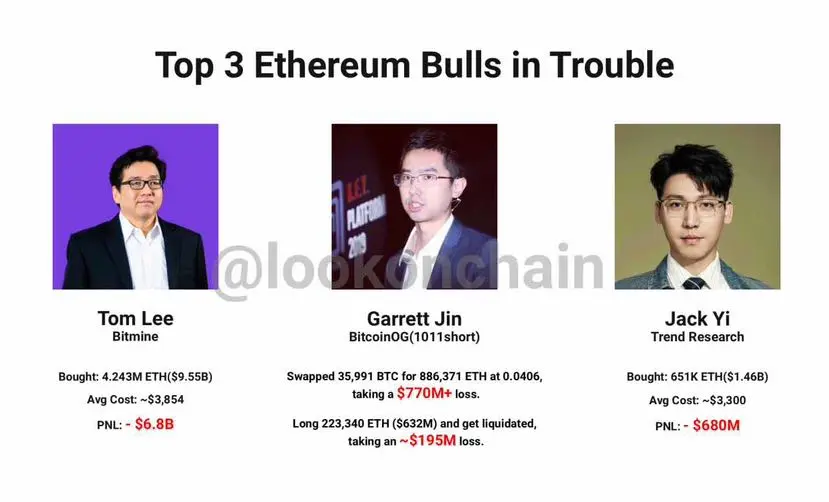

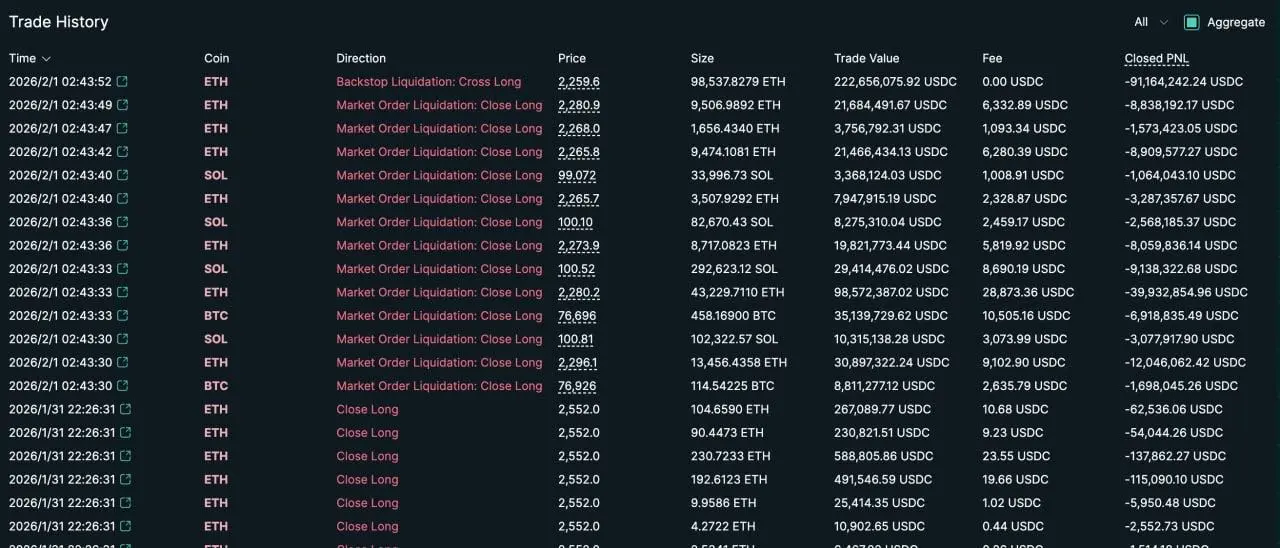

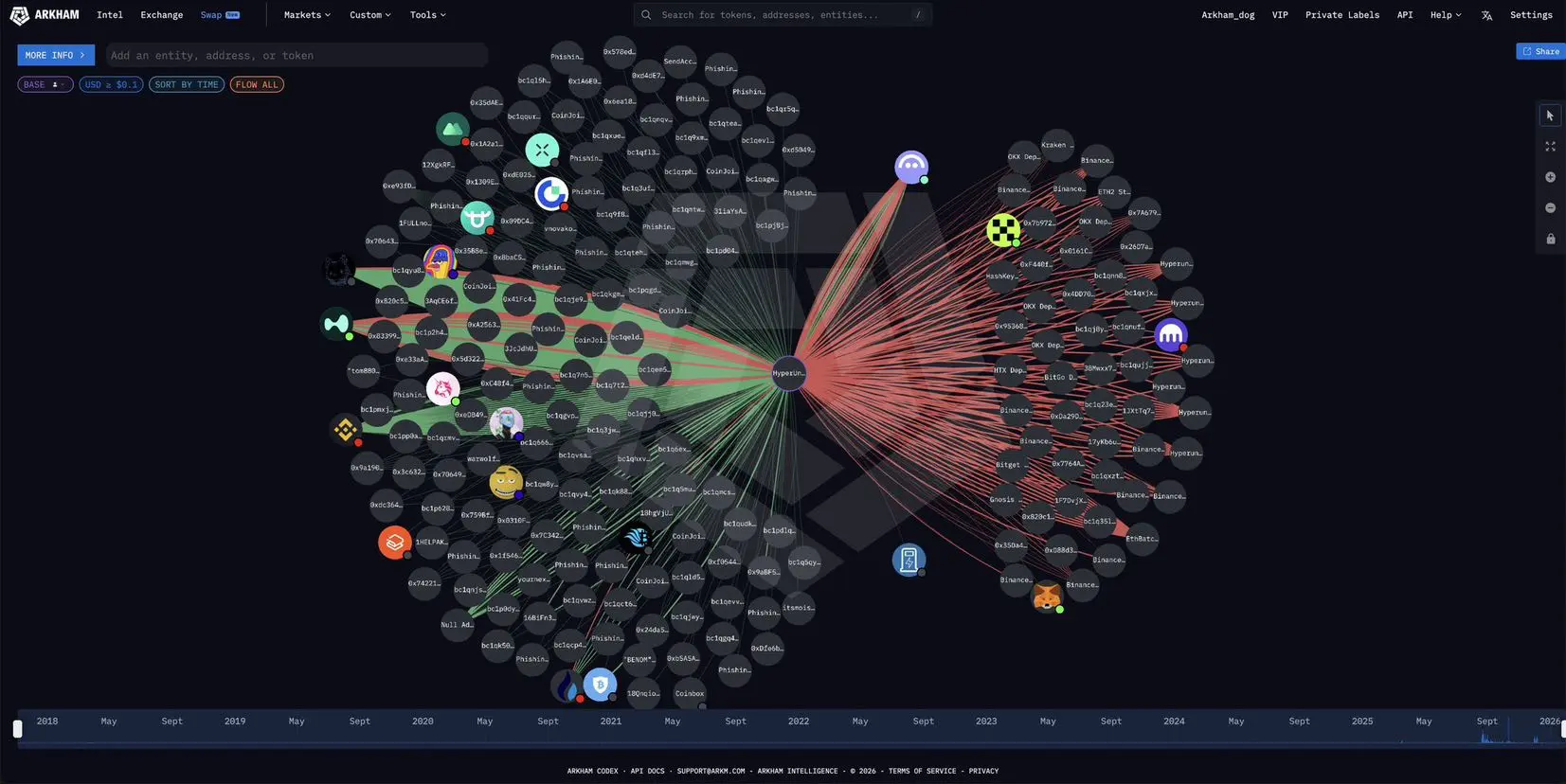

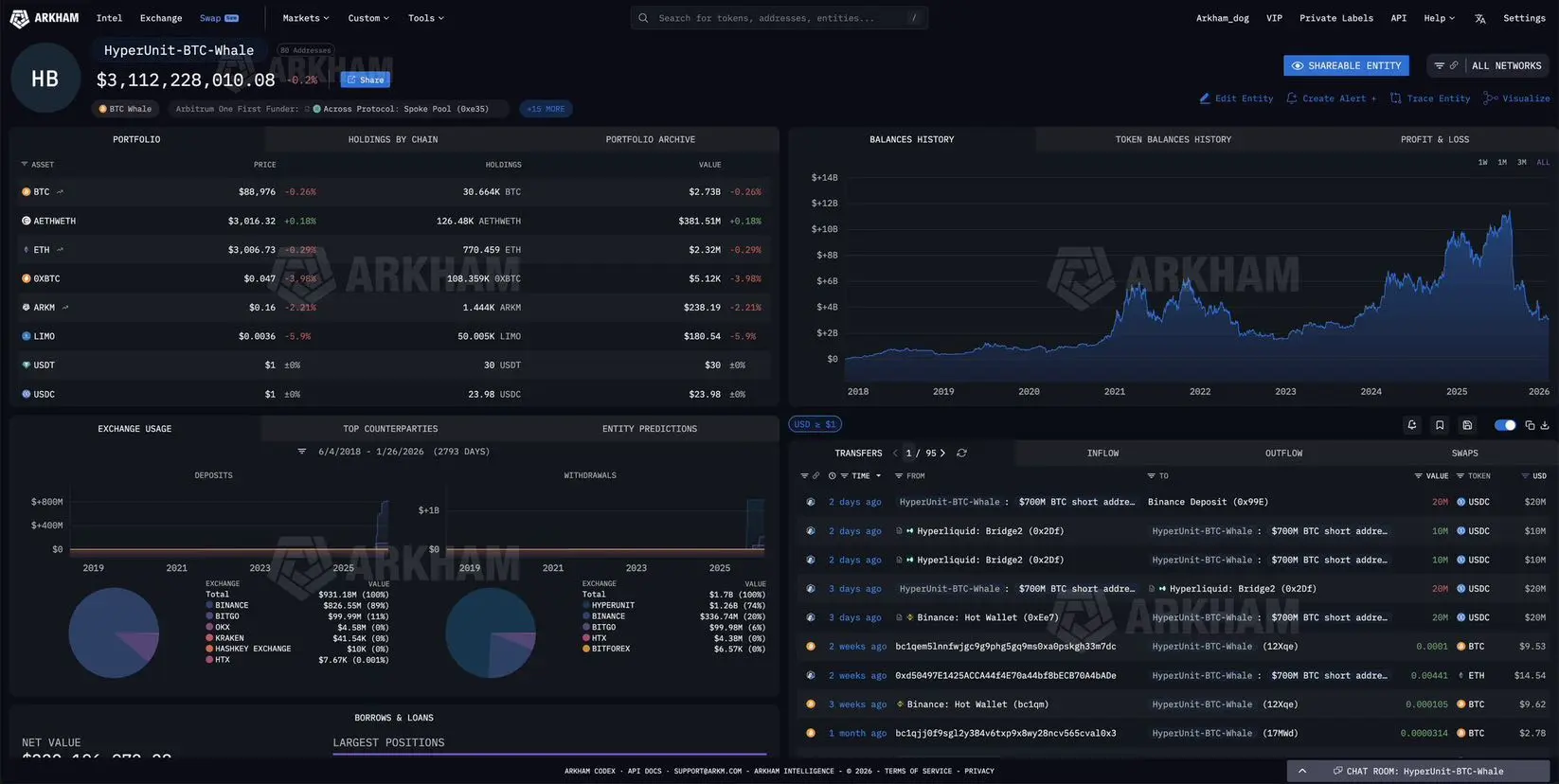

Wall Street elites are very optimistic about the future of the Ethereum network. They want to buy the dip and will inevitably suppress and liquidate large contract positions before entering the market at a lower price. 😄🥤The market has finally liquidated this #BitcoinOG(1011short), with total liquidations reaching $522M.

He went from a profit of $142M+ to a loss of $128.87M.

The account has been fully wiped — balance at zero.

He went from a profit of $142M+ to a loss of $128.87M.

The account has been fully wiped — balance at zero.

- Reward

- like

- Comment

- Repost

- Share

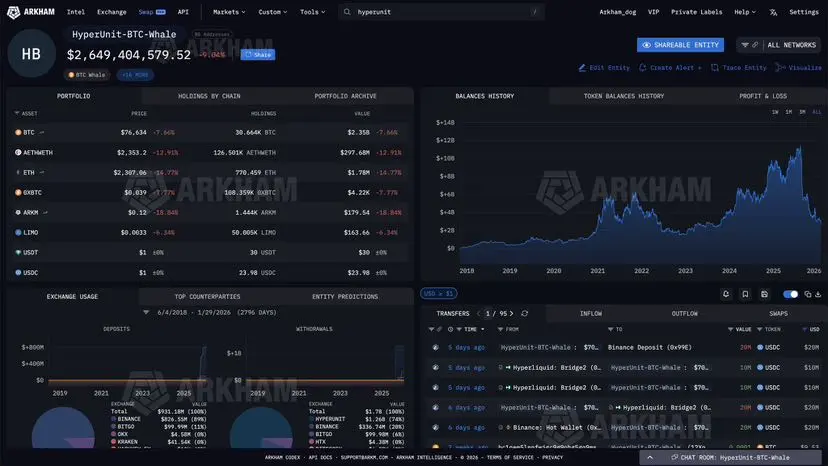

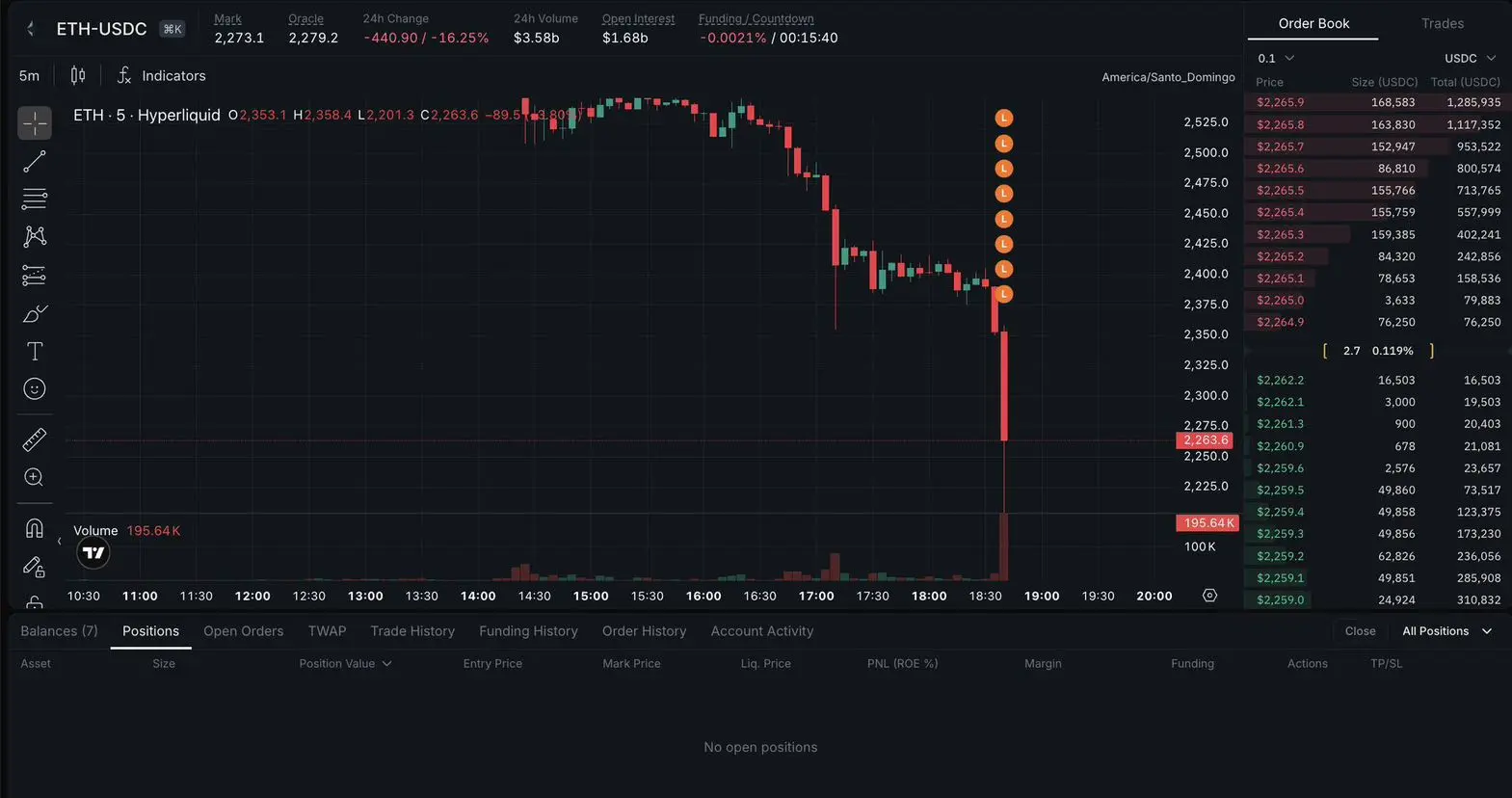

HYPERLIQUIDATED: HYPERUNIT WHALE [GARRETT JIN]

The Hyperunit whale, Garrett Jin, has just sold HIS ENTIRE ETH POSITION, realizing a COMPLETE loss of $250 MILLION.

He has $53 left in his Hyperliquid account.

The Hyperunit whale, Garrett Jin, has just sold HIS ENTIRE ETH POSITION, realizing a COMPLETE loss of $250 MILLION.

He has $53 left in his Hyperliquid account.

ETH-1,7%

- Reward

- like

- 2

- Repost

- Share

PhoenixPavilion :

:

This data is monitored there.View More

- Reward

- like

- Comment

- Repost

- Share

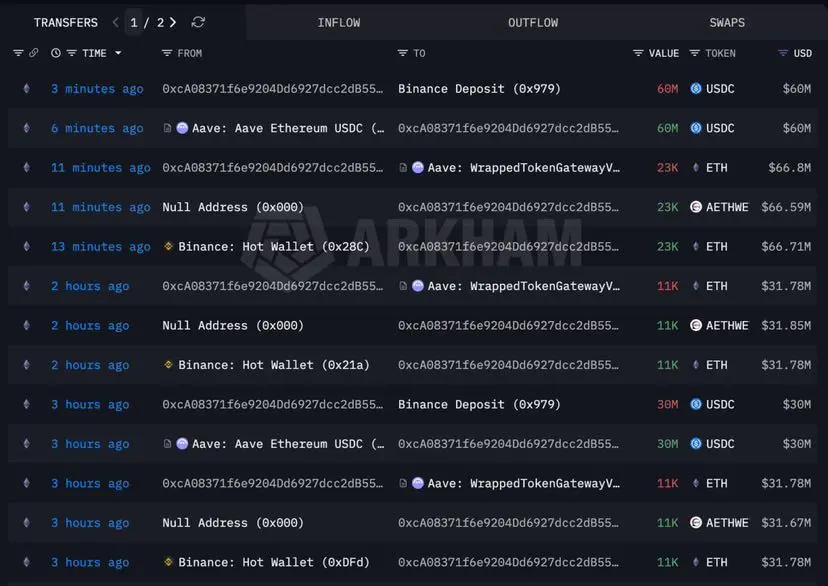

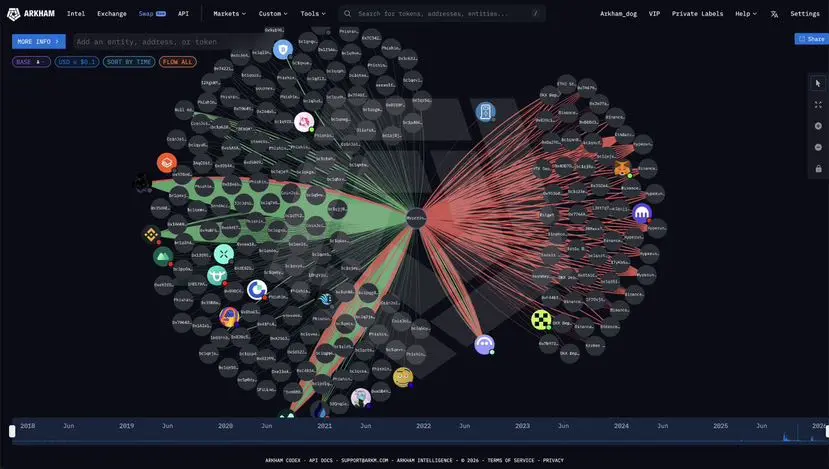

HE IS LONG $750M: THE HYPERUNIT WHALE IS BUYING BACK ETH

After offloading almost $100M in ETH from his ETH position, the Hyperunit whale linked to Garrett Jin is buying back ETH - and has purchased $60.54M of ETH already.

The Hyperunit Whale was long 223.34K ETH last week, and at the lows had offloaded over 30K ETH, losing around $9M of PnL. Now, he’s back - and he’s still long over $750M of ETH, SOL and BTC.

After offloading almost $100M in ETH from his ETH position, the Hyperunit whale linked to Garrett Jin is buying back ETH - and has purchased $60.54M of ETH already.

The Hyperunit Whale was long 223.34K ETH last week, and at the lows had offloaded over 30K ETH, losing around $9M of PnL. Now, he’s back - and he’s still long over $750M of ETH, SOL and BTC.

- Reward

- like

- Comment

- Repost

- Share

Big win for follower, take the profit and happy new year

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

A large ETH whale deposited 135K ETH to Gemini in the last 24 hours.

These wallets originally withdrew 450K ETH from Bitfinex back in 2017 at an average price of $64.

They sold some along the way but held most of it

$29M cost basis, $431M in total proceeds, $402M profit.A large ETH whale deposited 135K ETH to Gemini in the last 24 hours.

These wallets originally withdrew 450K ETH from Bitfinex back in 2017 at an average price of $64.

They sold some along the way but held most of it

These wallets originally withdrew 450K ETH from Bitfinex back in 2017 at an average price of $64.

They sold some along the way but held most of it

$29M cost basis, $431M in total proceeds, $402M profit.A large ETH whale deposited 135K ETH to Gemini in the last 24 hours.

These wallets originally withdrew 450K ETH from Bitfinex back in 2017 at an average price of $64.

They sold some along the way but held most of it

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More344.56K Popularity

113.29K Popularity

426.43K Popularity

9.65K Popularity

125.35K Popularity

Pin