OmarCrypto

No content yet

OmarCrypto

There is a new coin

I added it to favorites last month with the intention to buy it

Today I noticed it and found it has been rising for two weeks +75% 😪

Sometimes, when you're pressed for time, you miss opportunities that don't come back

Especially since we've been in a downtrend for two years

If it corrects, I might buy it again

Or I might look for other options

The market is full of opportunities

View OriginalI added it to favorites last month with the intention to buy it

Today I noticed it and found it has been rising for two weeks +75% 😪

Sometimes, when you're pressed for time, you miss opportunities that don't come back

Especially since we've been in a downtrend for two years

If it corrects, I might buy it again

Or I might look for other options

The market is full of opportunities

- Reward

- like

- Comment

- Repost

- Share

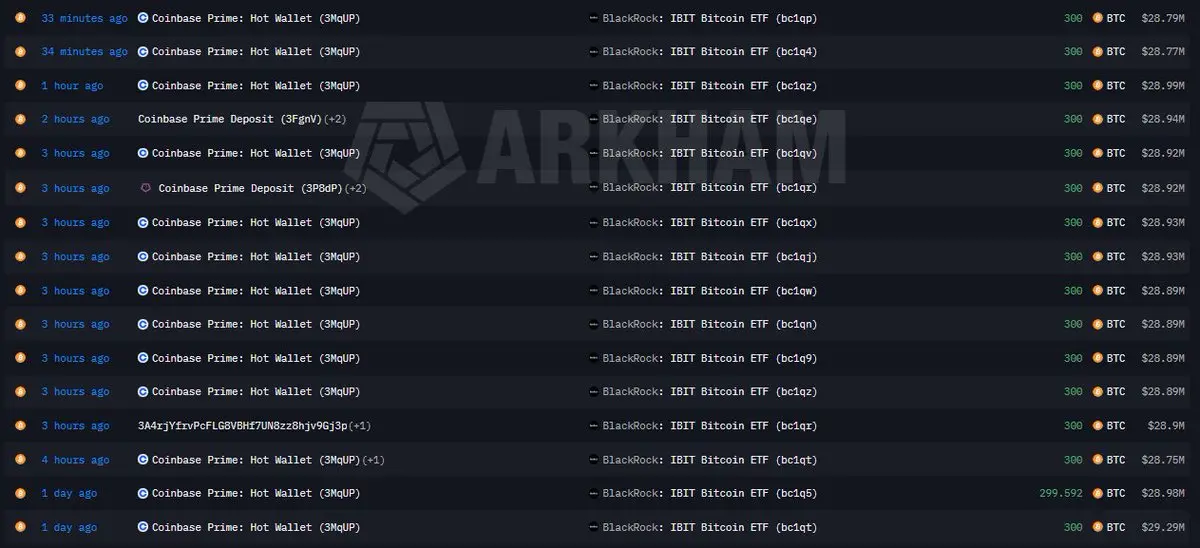

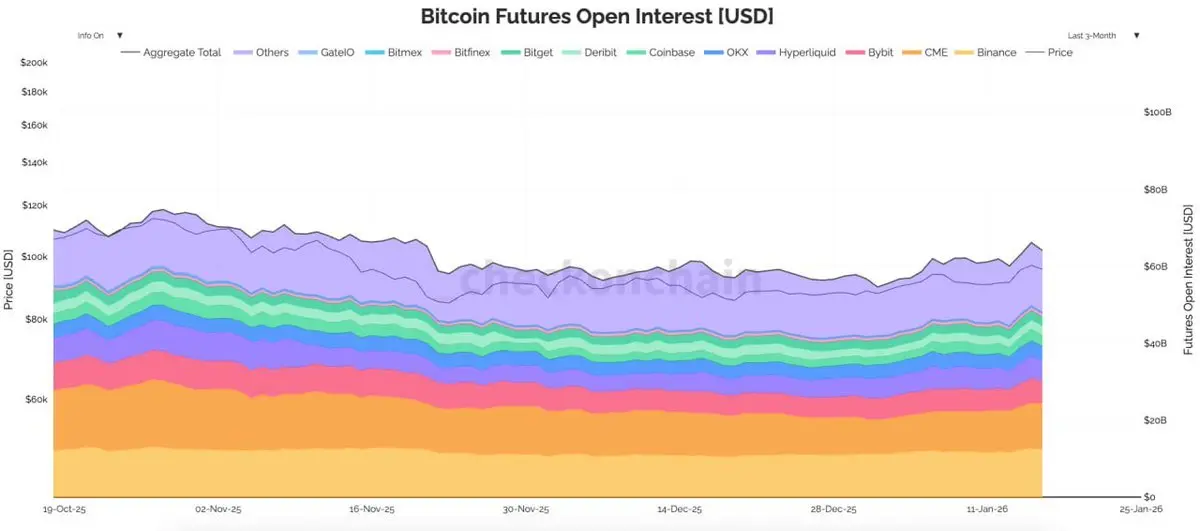

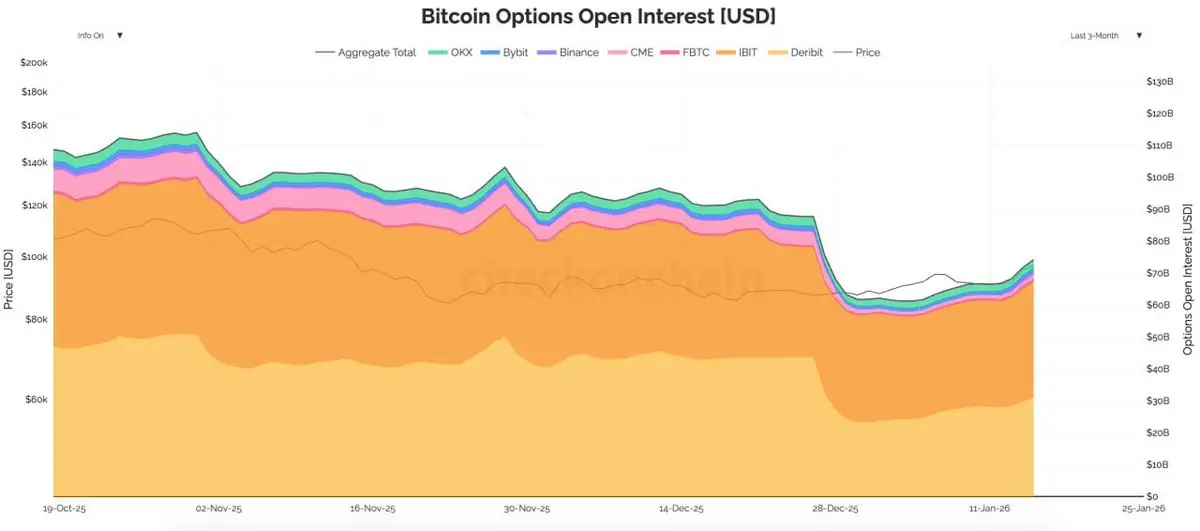

📊 A new development in the Bitcoin market #Bitcoin

For the first time, options contracts worth $74.1B surpass futures at $65.2B.

This is not just trader excitement...

This is institutional risk management and preparation for the next phase, and God knows best.

Those who understand the market work quietly "May Allah protect us from envy"…

And those who are late are still searching for a false bottom.

For the first time, options contracts worth $74.1B surpass futures at $65.2B.

This is not just trader excitement...

This is institutional risk management and preparation for the next phase, and God knows best.

Those who understand the market work quietly "May Allah protect us from envy"…

And those who are late are still searching for a false bottom.

BTC-1,98%

- Reward

- like

- Comment

- Repost

- Share

✍️ Trading opportunities and continuity or selective rise $DUSK

If you are waiting for a very sustained big rise 👇

💢The downward trend followers went all-in months ago based on the beginning of the bull run and then exited at a very big loss.💢

And the same downward trend followers have been holding back their followers since March 2024 when they were talking about the bull run because they entered late 🕐

Don’t think the downward trend owner will achieve your dreams of 50x when the market rises.

If he gives you +50%, he will tell you: Did you make a profit or not? You get upset!! Blocked.

T

If you are waiting for a very sustained big rise 👇

💢The downward trend followers went all-in months ago based on the beginning of the bull run and then exited at a very big loss.💢

And the same downward trend followers have been holding back their followers since March 2024 when they were talking about the bull run because they entered late 🕐

Don’t think the downward trend owner will achieve your dreams of 50x when the market rises.

If he gives you +50%, he will tell you: Did you make a profit or not? You get upset!! Blocked.

T

DUSK52,98%

- Reward

- like

- Comment

- Repost

- Share

I will be busy these days organizing opportunities and taking advantage of the rise 🚀

View Original- Reward

- like

- Comment

- Repost

- Share

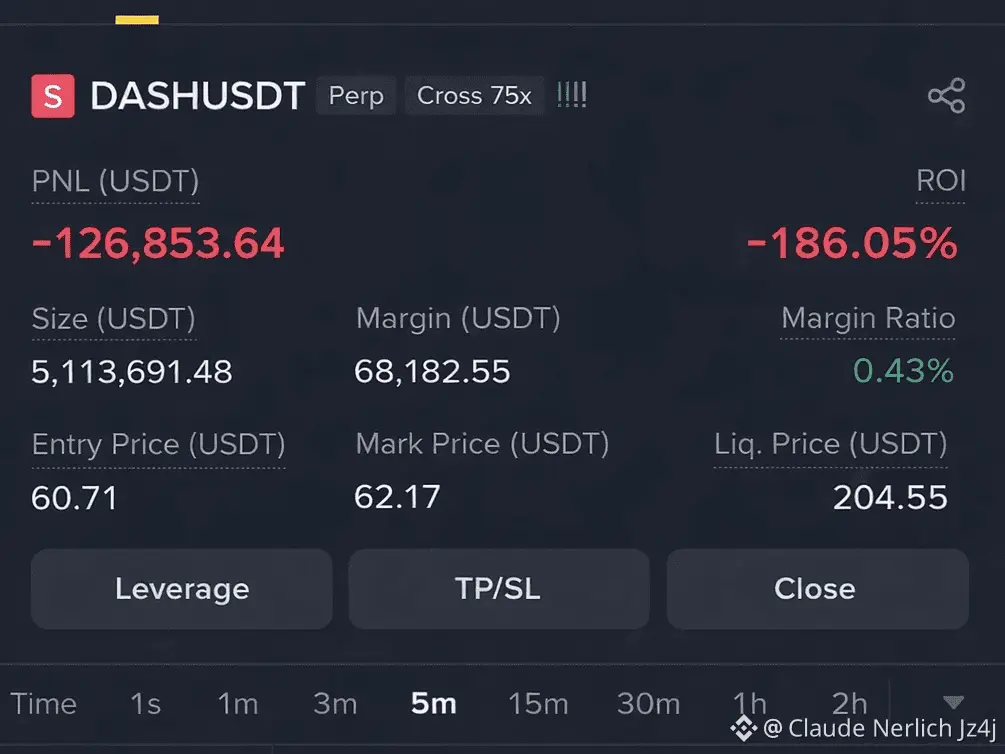

Those who exit the market at a loss in the SPOT market and think they're smart, believing they'll recover their losses in FUTURE leverage.

Sorry, my friend,

Futures are more difficult than SPOT and require mathematics 🧮

It's true they give you short and long positions, but if you're a failure in SPOT, how do you expect to succeed in Futures? You might burn through all your money.

You can win a week but lose it all in a day due to a mistake.

View OriginalSorry, my friend,

Futures are more difficult than SPOT and require mathematics 🧮

It's true they give you short and long positions, but if you're a failure in SPOT, how do you expect to succeed in Futures? You might burn through all your money.

You can win a week but lose it all in a day due to a mistake.

- Reward

- like

- Comment

- Repost

- Share

The crypto market is currently divided into three 👇

💸 A flexible group making profits through opportunity trading.

🚑 A group involved in a currency that has been drained.

🙇♂️ A group waiting for lows until the Order book reaches them in October.

View Original💸 A flexible group making profits through opportunity trading.

🚑 A group involved in a currency that has been drained.

🙇♂️ A group waiting for lows until the Order book reaches them in October.

- Reward

- 2

- 1

- Repost

- Share

Baset68 :

:

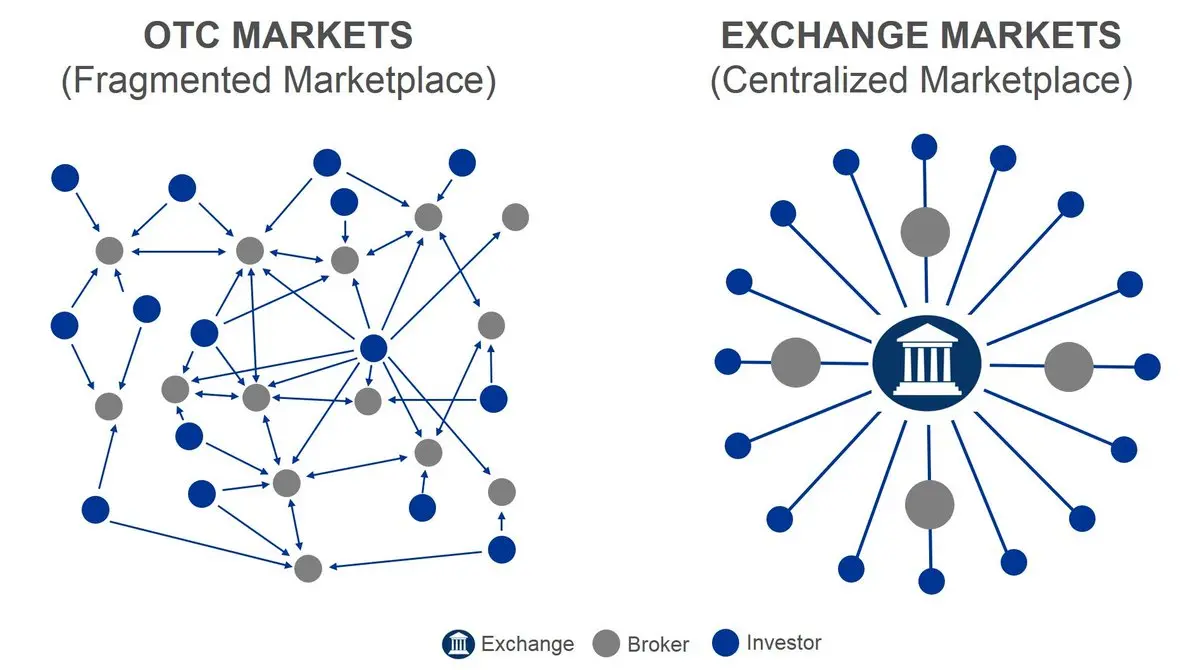

Bullish market at its peak 🐂Any institutional or ETF purchases of Bitcoin and cryptocurrencies are done via OTC.

Why OTC?

✔️ No sudden pump

✔️ No disclosure of purchase intent

The result?

The price moves after the accumulation is finished… not the execution time.

For those who only monitor on-chain…

They usually see the movement after the work is done.

View OriginalWhy OTC?

✔️ No sudden pump

✔️ No disclosure of purchase intent

The result?

The price moves after the accumulation is finished… not the execution time.

For those who only monitor on-chain…

They usually see the movement after the work is done.

- Reward

- like

- Comment

- Repost

- Share

❌ I don't buy the bottom

✅ I buy opportunities based on technical analysis

View Original✅ I buy opportunities based on technical analysis

- Reward

- like

- Comment

- Repost

- Share

For those who bought Ethereum $ETH with my entry in March - April last year

The price was $1400 and reached $4950 = a 250% increase

Currently the price is $3300, which still means a 145% profit

Not all coins have dropped, some coins are still at their peak from months ago

Coin $XRP up +500%

Coin $XLM up +200%

Coin $SOL up +700%

View OriginalThe price was $1400 and reached $4950 = a 250% increase

Currently the price is $3300, which still means a 145% profit

Not all coins have dropped, some coins are still at their peak from months ago

Coin $XRP up +500%

Coin $XLM up +200%

Coin $SOL up +700%

- Reward

- 1

- Comment

- Repost

- Share

💸 Altcoin $AXS Achieves Over 100% Double

Downtrend holders, have you ever doubled in the last year?

If you achieved 25%, you wouldn't sleep

From how much you interact with tweets

Since last December, cryptocurrencies have made profits

Since I announced the Bitcoin reversal and then altcoins

But you hold onto the decline and dream that you can buy the bottom

Downtrend holders, have you ever doubled in the last year?

If you achieved 25%, you wouldn't sleep

From how much you interact with tweets

Since last December, cryptocurrencies have made profits

Since I announced the Bitcoin reversal and then altcoins

But you hold onto the decline and dream that you can buy the bottom

AXS-9,29%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

In just 23 days, the Sounq sponsor achieved 300%

While the sleeping trader achieved 100%

And its rise from the bottom achieved 700%

They say we're heading to the permacrisis, but I see the opposite

Maybe they are measuring the market based on their crappy coins, anything is possible

Do you see the small red candle that appeared?

It will make them write tweets saying the market is red 🤌😂

View OriginalWhile the sleeping trader achieved 100%

And its rise from the bottom achieved 700%

They say we're heading to the permacrisis, but I see the opposite

Maybe they are measuring the market based on their crappy coins, anything is possible

Do you see the small red candle that appeared?

It will make them write tweets saying the market is red 🤌😂

- Reward

- 2

- 1

- Repost

- Share

AngryBird :

:

very Amazing post great content

keep update us with this great information

all the post having great content

Keep it up

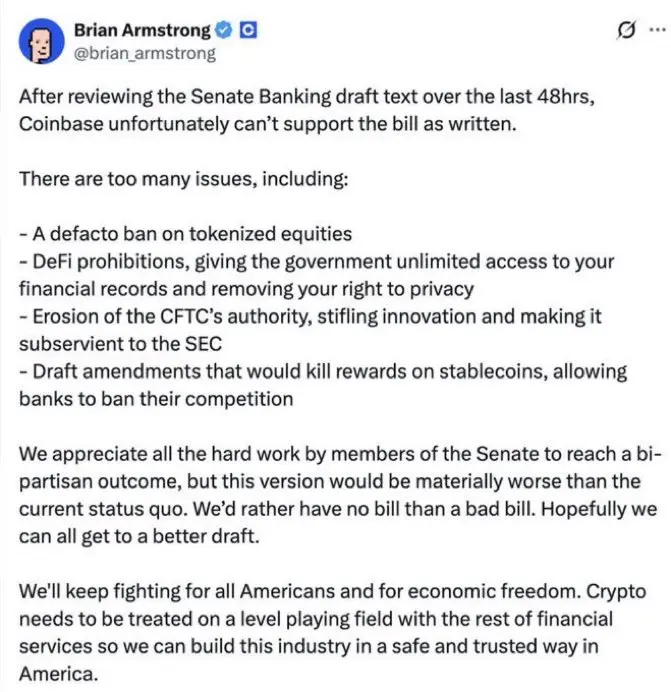

🚨 Coinbase Founder

Rejects a new American bill after reading it

Not because it's strict…

But because it opposes crypto freedom 👇

1/ A disguised ban on stock tokenization

2/ Harming DeFi and pulling privacy

3/ Empowering the SEC and stifling innovation

4/ Protecting banks at the expense of Stablecoins

📉 Fear-mongering news? Yes, it creates volatility

📈 Market trend change? No, the behavior continues

View OriginalRejects a new American bill after reading it

Not because it's strict…

But because it opposes crypto freedom 👇

1/ A disguised ban on stock tokenization

2/ Harming DeFi and pulling privacy

3/ Empowering the SEC and stifling innovation

4/ Protecting banks at the expense of Stablecoins

📉 Fear-mongering news? Yes, it creates volatility

📈 Market trend change? No, the behavior continues

- Reward

- like

- Comment

- Repost

- Share

When the clowns tell their followers

The trend is down and we're heading to a bear market

This is where the results show on the follower's trading

Who believed them and opened a short 👇

Sometimes I doubt the minds of traders

How can you talk about a bear market when you're in a bear market

Of course, I can't change everyone's mindset

But I strive to explain the market to my followers

View OriginalThe trend is down and we're heading to a bear market

This is where the results show on the follower's trading

Who believed them and opened a short 👇

Sometimes I doubt the minds of traders

How can you talk about a bear market when you're in a bear market

Of course, I can't change everyone's mindset

But I strive to explain the market to my followers

- Reward

- like

- Comment

- Repost

- Share

I have a clear mission in this market

to turn my investment portfolio

and others'

to green

before reaching the December peak.

And after that?

I'll play the market.

Because December's hurdle

is now in the past.

View Originalto turn my investment portfolio

and others'

to green

before reaching the December peak.

And after that?

I'll play the market.

Because December's hurdle

is now in the past.

- Reward

- like

- Comment

- Repost

- Share

The coin I bought

And gave you +40%?

Sell, my friend

Don't say you're waiting for the bull run.

There's nothing more beautiful than

Compound returns

It gives you multiples

While you're still at the bottom.

🎯 Short-term goals:

Speculation from +5% to +25%

More than that?

That's a medium-term investment, not speculation.

As for me?

My latest speculation has doubled and a half

Praise be to God

And yet…

Prices are still at the bottom.

And my targets are December's peak.

View OriginalAnd gave you +40%?

Sell, my friend

Don't say you're waiting for the bull run.

There's nothing more beautiful than

Compound returns

It gives you multiples

While you're still at the bottom.

🎯 Short-term goals:

Speculation from +5% to +25%

More than that?

That's a medium-term investment, not speculation.

As for me?

My latest speculation has doubled and a half

Praise be to God

And yet…

Prices are still at the bottom.

And my targets are December's peak.

- Reward

- like

- Comment

- Repost

- Share

Support is under abnormal, abnormal, abnormal pressure ♨️

View Original- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More13.45K Popularity

331.22K Popularity

41.79K Popularity

4.98K Popularity

4.31K Popularity

Pin