ShafynKhan

No content yet

ShafynKhan

Should I change my PFP?

- Reward

- 1

- Comment

- Repost

- Share

A brutal reality check to all CT followers out there.

I have seen people here with 1000 followers and having more money and being more profitable than those with 100k following;

More followers don't mean they are profitable in trading; they might be earning from affiliates, which is completely fine, as they worked to get those followers, but making claims that you are profitable in trading, too is absurd.

I have seen people here with 1000 followers and having more money and being more profitable than those with 100k following;

More followers don't mean they are profitable in trading; they might be earning from affiliates, which is completely fine, as they worked to get those followers, but making claims that you are profitable in trading, too is absurd.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

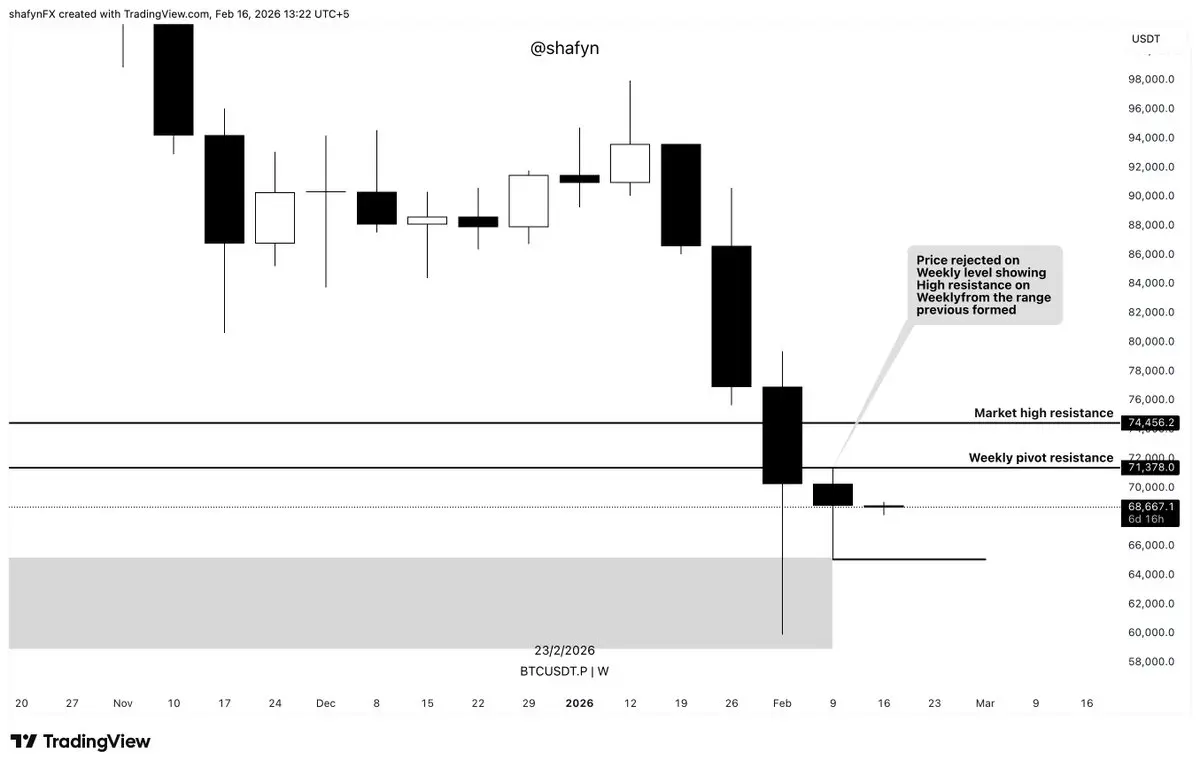

$BTC

Liquidity at 71.3-74k zone, clearly depicting where the next move will be,

The previous weekly range was 7% roughly, where the price will roam for some time to manipulate lower around 61.5-62k and then take the higher liquidity.

A major pivotal resistance level at the weekly is formed, which can be tested soon

Liquidity at 71.3-74k zone, clearly depicting where the next move will be,

The previous weekly range was 7% roughly, where the price will roam for some time to manipulate lower around 61.5-62k and then take the higher liquidity.

A major pivotal resistance level at the weekly is formed, which can be tested soon

BTC-1,78%

- Reward

- 1

- Comment

- Repost

- Share

GM

New week and new opportunities,

Opened X to see some people getting liquidated on $BTC.

What a time to be alive....

New week and new opportunities,

Opened X to see some people getting liquidated on $BTC.

What a time to be alive....

BTC-1,78%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

No trade execution before 15th February

GN

GN

- Reward

- like

- Comment

- Repost

- Share

Euphoria & Fear over X feed,

Clearly entering the phase where market will bottom

GN

Clearly entering the phase where market will bottom

GN

- Reward

- like

- Comment

- Repost

- Share

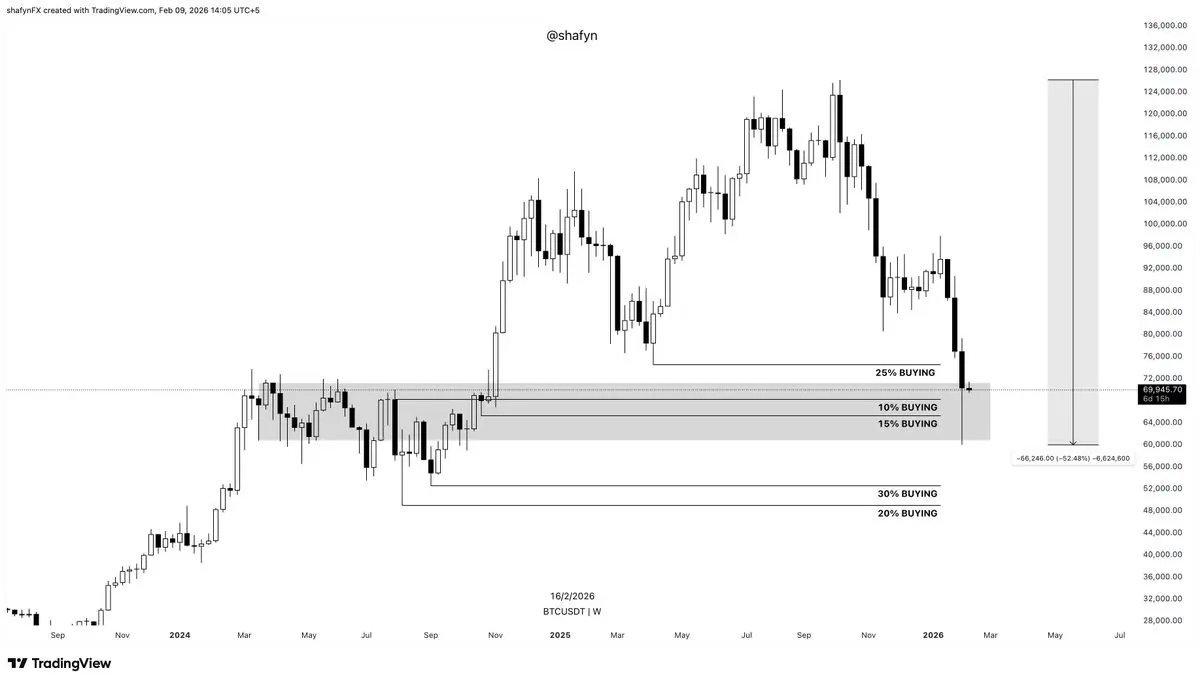

$BTC

Daily BTC Update

Right now, everything comes down to the daily close around 72k and 15th February.

If we can close above 72k, with stronger orderflow, it shows buyers are stepping back in, and the market can turn bullish again.

We could see a short-term top around Feb 15 if we don't get close above 72k and a slow rotation back into the 62k demand zone.

72k is the line. Orderflow decides.

Daily BTC Update

Right now, everything comes down to the daily close around 72k and 15th February.

If we can close above 72k, with stronger orderflow, it shows buyers are stepping back in, and the market can turn bullish again.

We could see a short-term top around Feb 15 if we don't get close above 72k and a slow rotation back into the 62k demand zone.

72k is the line. Orderflow decides.

BTC-1,78%

- Reward

- like

- Comment

- Repost

- Share

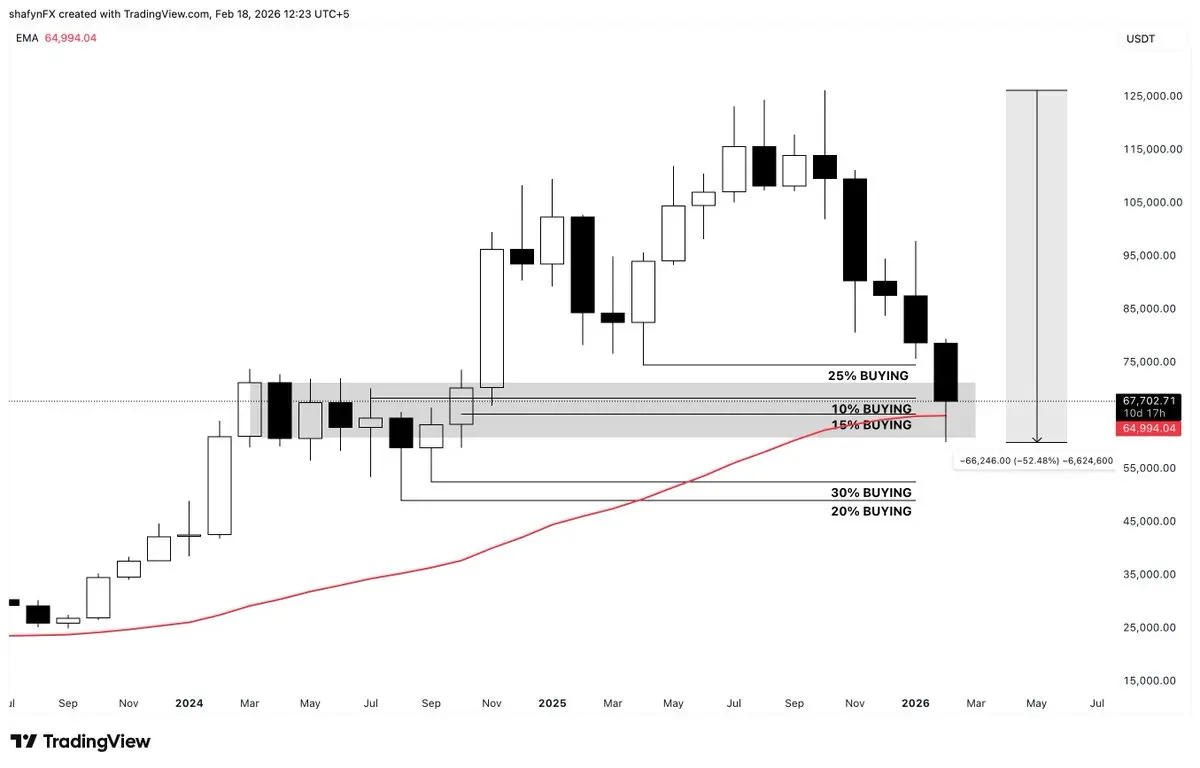

$BTC

Moves in cycles, and those cycles repeat because WHALES never change.

We’re already about 53% down from the ATH. Historically, this is where long-term accumulation starts, not where it finishes.

Every big drop feels like the end when you’re inside it. And every time, the biggest players are quietly buying while everyone else is waiting for “confirmation.”

I’m not trying to time the exact bottom. I’m buying spot BTC slowly, in parts.

So far, 50% of my position is filled, with an average of around $66k.

Moves in cycles, and those cycles repeat because WHALES never change.

We’re already about 53% down from the ATH. Historically, this is where long-term accumulation starts, not where it finishes.

Every big drop feels like the end when you’re inside it. And every time, the biggest players are quietly buying while everyone else is waiting for “confirmation.”

I’m not trying to time the exact bottom. I’m buying spot BTC slowly, in parts.

So far, 50% of my position is filled, with an average of around $66k.

BTC-1,78%

- Reward

- 1

- 1

- Repost

- Share

IFTAKER :

:

Happy New Year! 🤑$BTCGM"Small bounce, now liquidate them"

- Reward

- 1

- 3

- Repost

- Share

MrKing :

:

Buy To Earn 💎View More

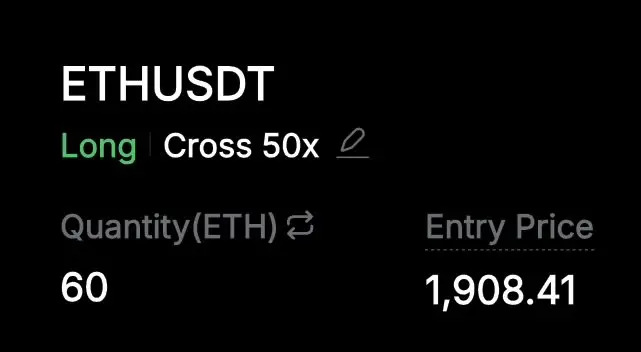

$ETHGenerational entry 🧪Longed

- Reward

- like

- Comment

- Repost

- Share

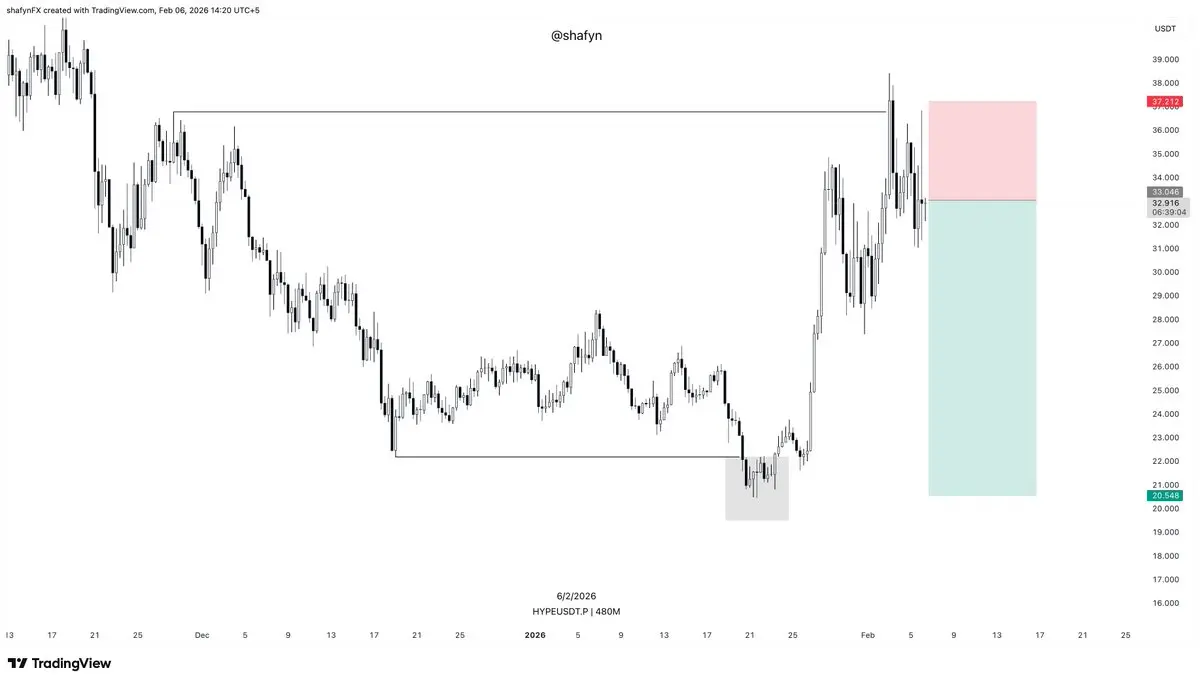

$HYPEShorted

- Reward

- like

- Comment

- Repost

- Share