Shenron1226

No content yet

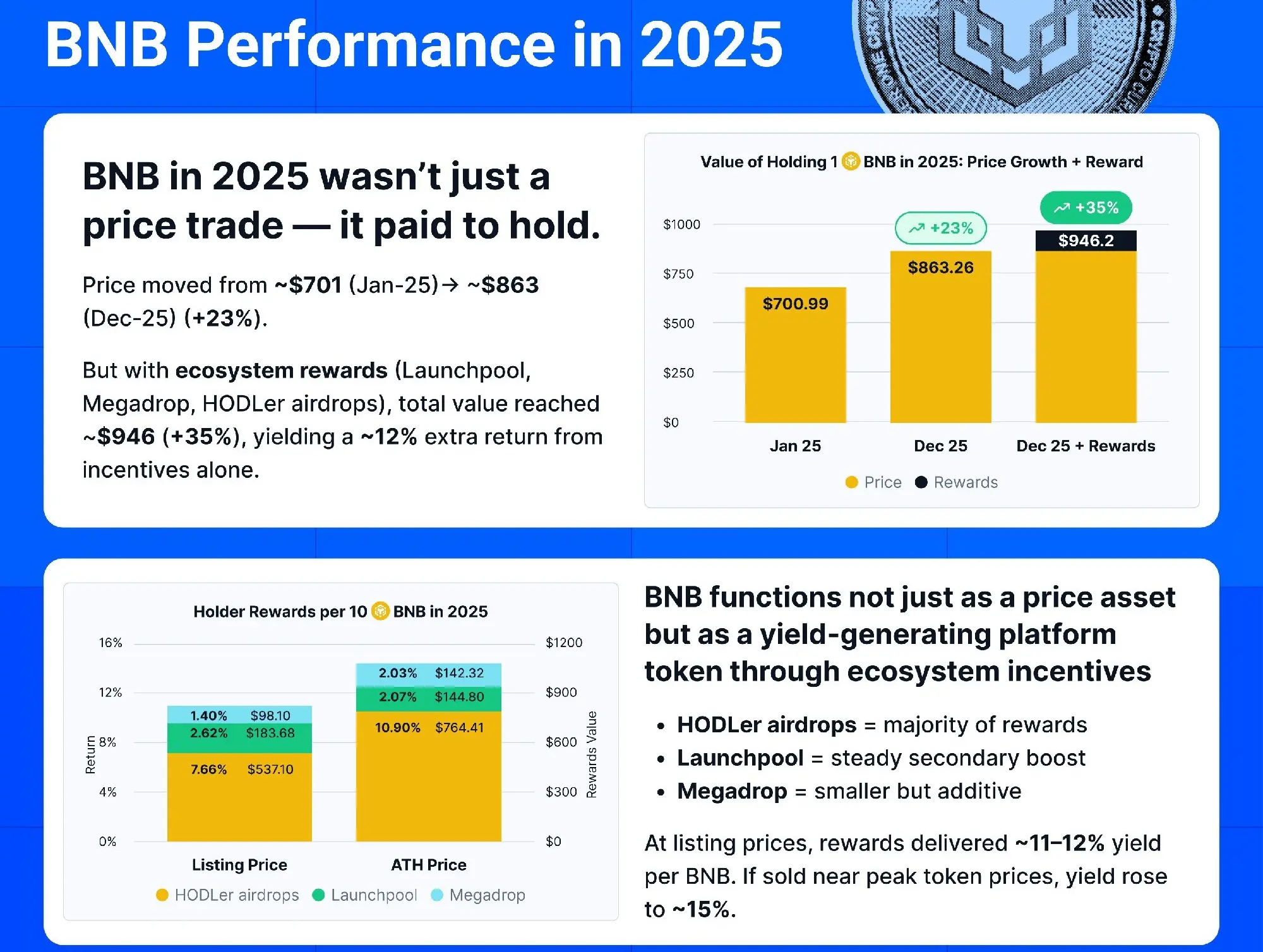

When the market moves sideways, utility matters.

Take BNB as an example, we analyzed the total return from holding just 1 BNB throughout 2025. Incentives alone added ~12% extra return: Airdrops (HODLer), Launchpool, and Megadrop turned BNB into a yield-generating asset.

Utility + incentives > price action alone.

Check out our analysis below on why utility tokens can outperform even in flat markets 👇

Take BNB as an example, we analyzed the total return from holding just 1 BNB throughout 2025. Incentives alone added ~12% extra return: Airdrops (HODLer), Launchpool, and Megadrop turned BNB into a yield-generating asset.

Utility + incentives > price action alone.

Check out our analysis below on why utility tokens can outperform even in flat markets 👇

BNB-2,58%

- Reward

- 3

- 1

- Repost

- Share

ybaser :

:

To The Moon 🌕ROBINHOOD BLOCKCHAIN HITS 4M IN 1 WEEK

Robinhood says its Arbitrum-based testnet processed 4M transactions in seven days.

Built to bring stocks and ETFs onchain, CEO Vlad Tenev says “the next chapter of finance runs onchain.”

Robinhood says its Arbitrum-based testnet processed 4M transactions in seven days.

Built to bring stocks and ETFs onchain, CEO Vlad Tenev says “the next chapter of finance runs onchain.”

ARB-11,53%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

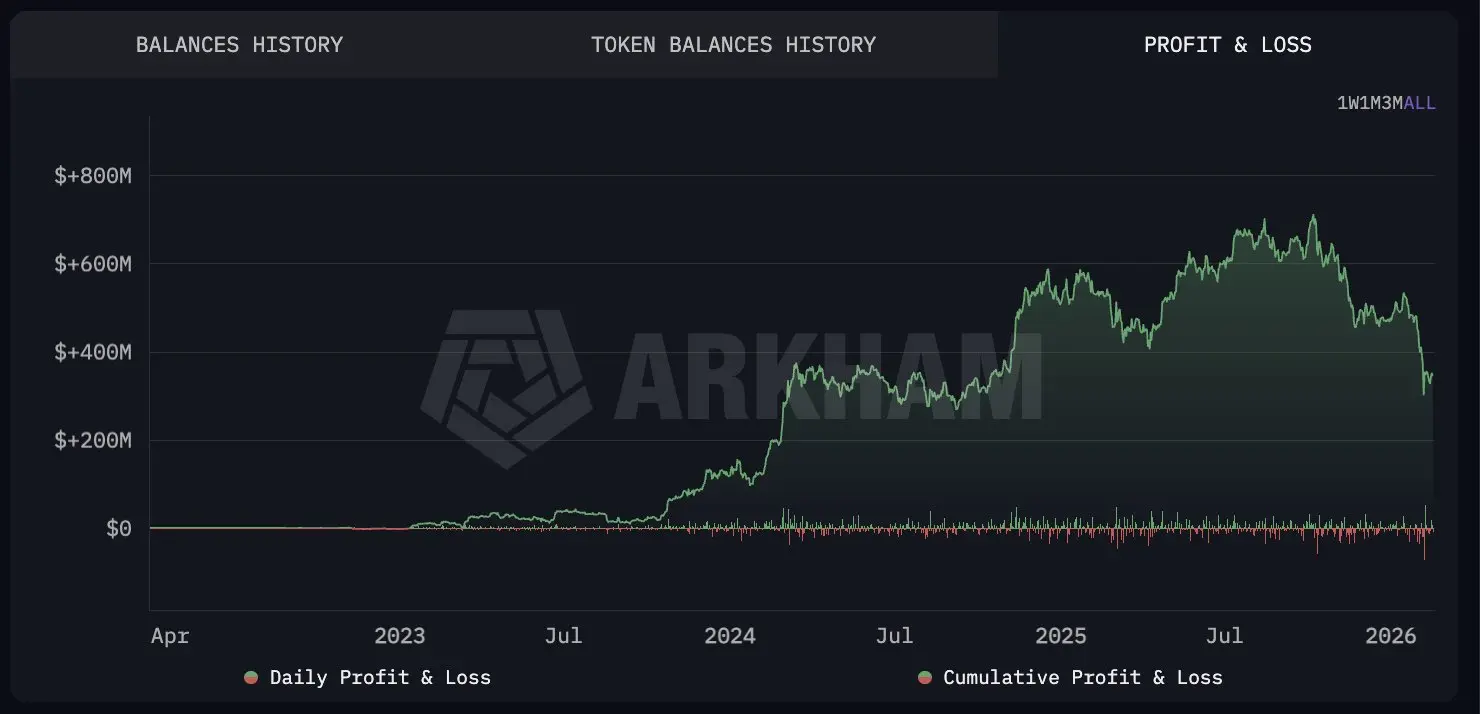

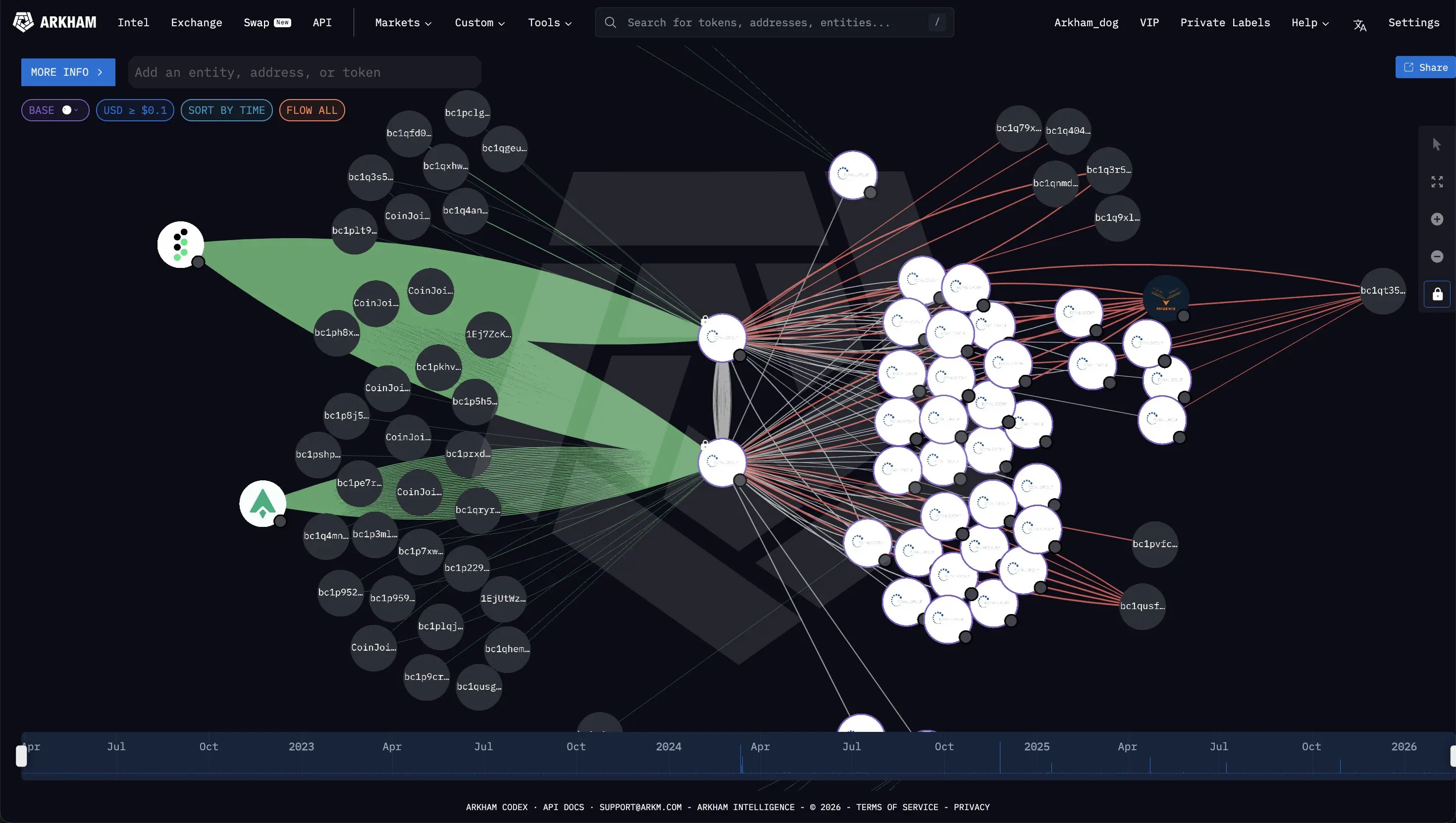

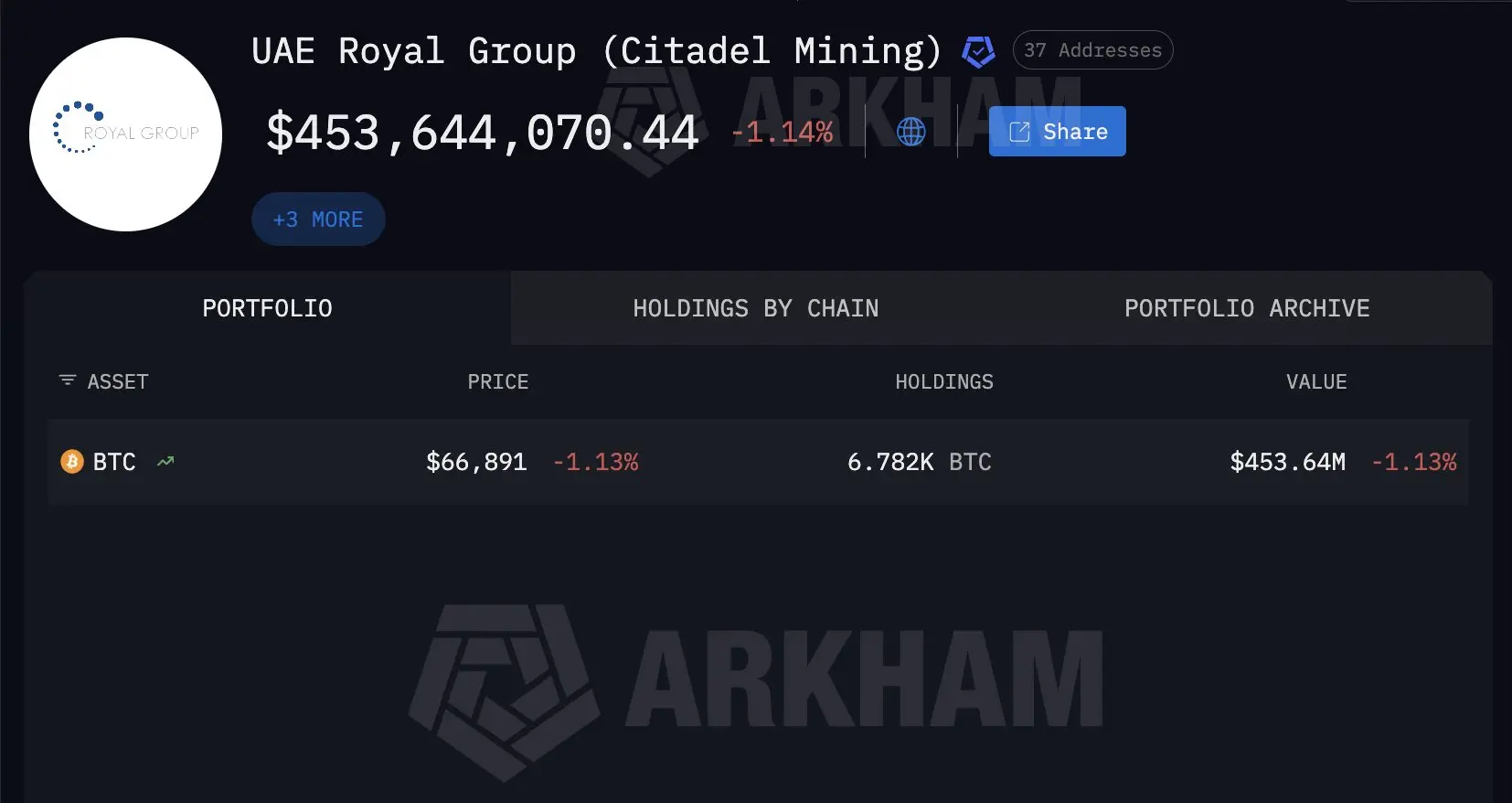

THE UAE MINED $450M BITCOIN

The UAE has so far mined $453.6M Bitcoin through their partners Citadel. It appears that they are holding the majority of the Bitcoin they produce, with their most recent outflows 4 months ago.

Excluding energy costs, the UAE is currently in profit of $344M on their Bitcoin.

The UAE has so far mined $453.6M Bitcoin through their partners Citadel. It appears that they are holding the majority of the Bitcoin they produce, with their most recent outflows 4 months ago.

Excluding energy costs, the UAE is currently in profit of $344M on their Bitcoin.

BTC-1,74%

- Reward

- 2

- Comment

- Repost

- Share

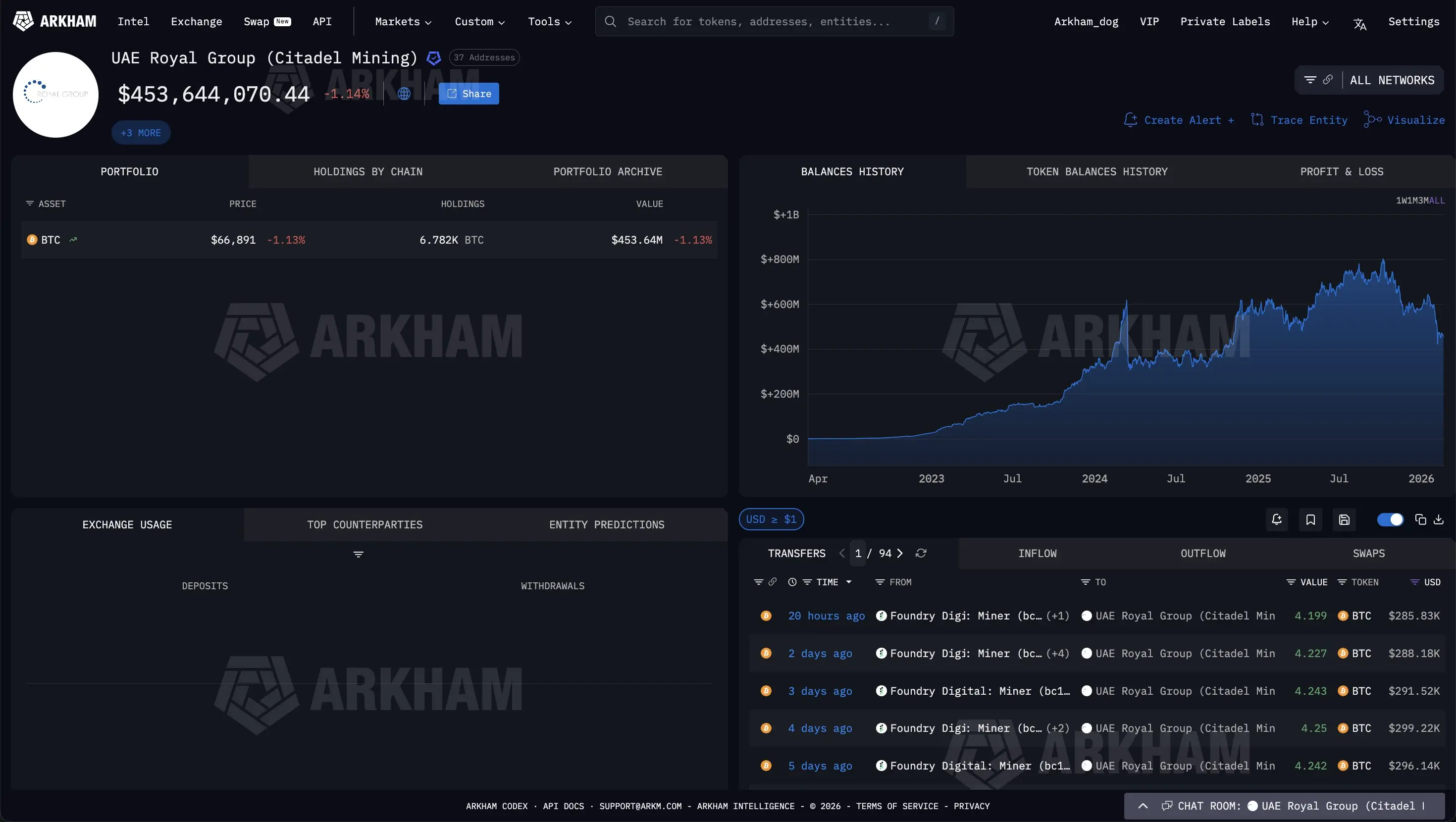

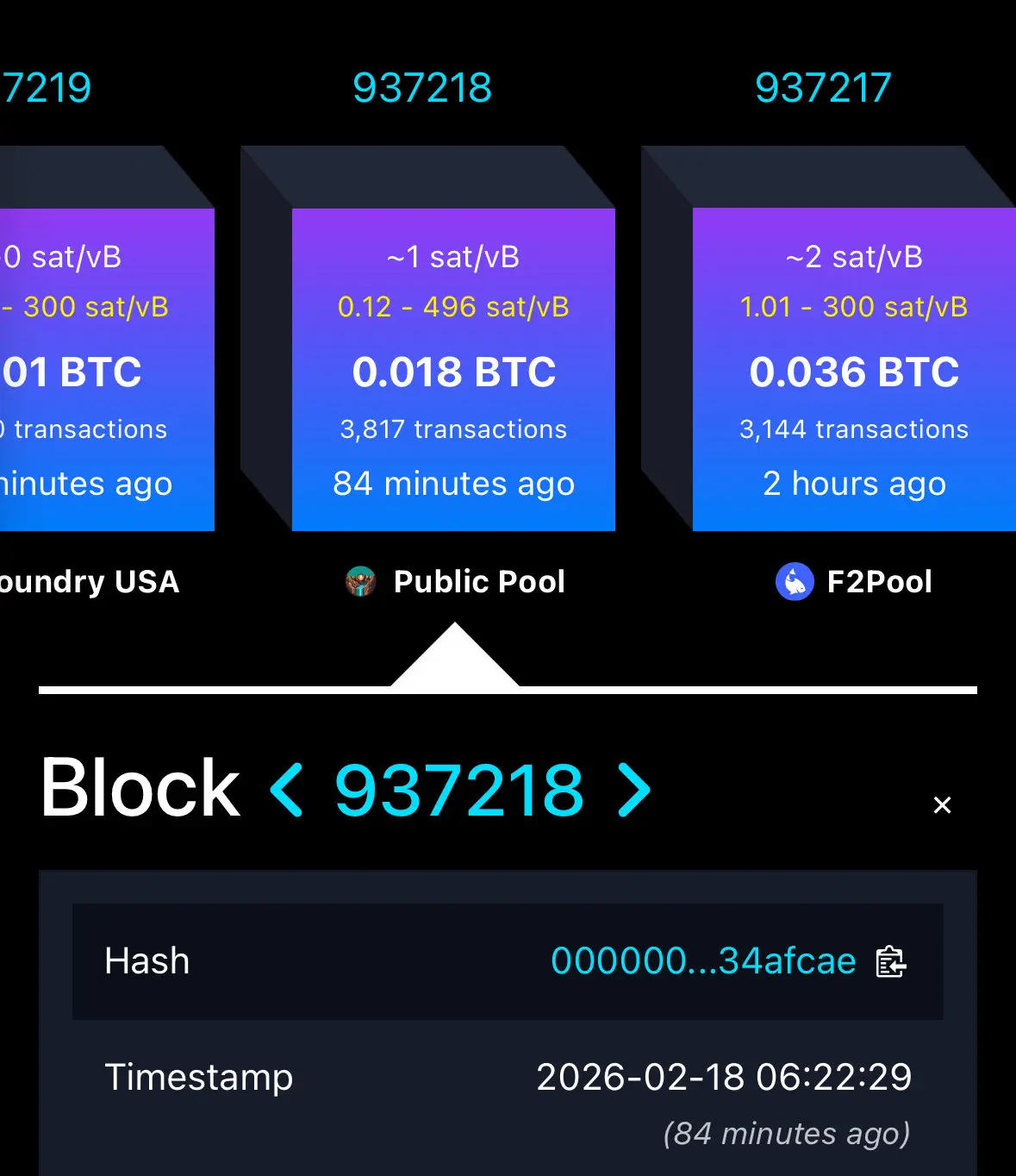

The US economy is now reliant on older Americans like never before:

Americans aged 55+ now represent 45.3% of all US consumer spending, the highest in at least 28 years.

This is nearly DOUBLE the ~28.0% seen in the early 2000s.

By comparison, those aged 54 and younger are down to just 54.7%, from ~72.0% in 2000.

The gap between the two groups has narrowed by ~35 percentage points over the last 25 years and is on track to converge for the first time in history.

This comes as 73.7% of all US wealth is held by those over 55, up from 56.2% in 2000, according to Fed data.

The US wealth divide is ac

Americans aged 55+ now represent 45.3% of all US consumer spending, the highest in at least 28 years.

This is nearly DOUBLE the ~28.0% seen in the early 2000s.

By comparison, those aged 54 and younger are down to just 54.7%, from ~72.0% in 2000.

The gap between the two groups has narrowed by ~35 percentage points over the last 25 years and is on track to converge for the first time in history.

This comes as 73.7% of all US wealth is held by those over 55, up from 56.2% in 2000, according to Fed data.

The US wealth divide is ac

- Reward

- 3

- 1

- Repost

- Share

ybaser :

:

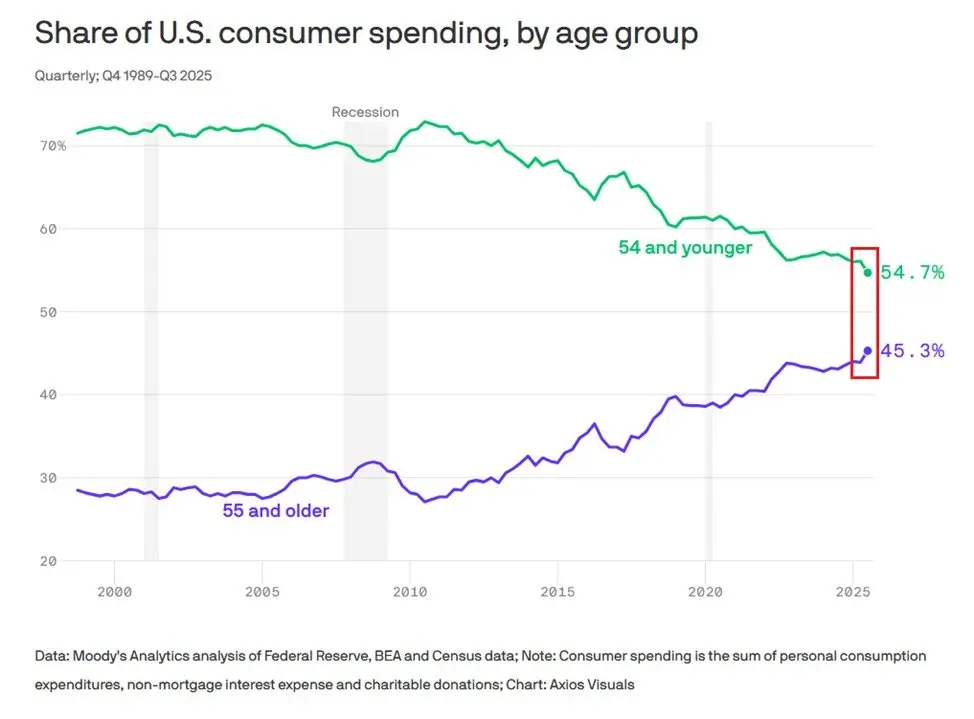

To The Moon 🌕NEW SOLO BITCOIN BLOCK FOUND ON SELF-HOSTED UMBREL NODE

A solo miner running a self-hosted Umbrel instance just mined a full Bitcoin block, earning over $212,000 in block rewards and fees.

Proof that even small, independent operators can still win big.

A solo miner running a self-hosted Umbrel instance just mined a full Bitcoin block, earning over $212,000 in block rewards and fees.

Proof that even small, independent operators can still win big.

BTC-1,74%

- Reward

- 2

- Comment

- Repost

- Share

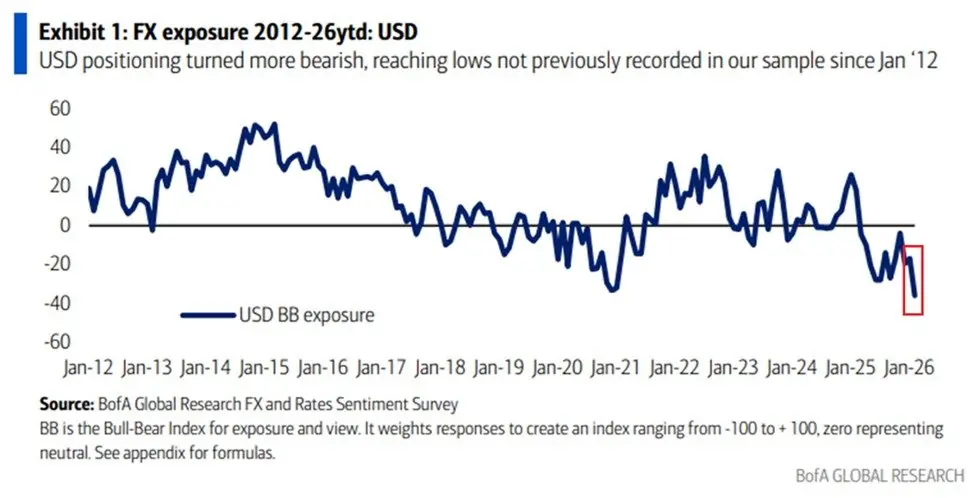

Institutional investors have rarely ever been this bearish on the US Dollar:

US Dollar net exposure by global fund managers is down to -35 points, the lowest in at least 14 years.

This is below the April 2025 bottom when President Trump surprised markets with "Liberation Day."

By comparison, at the start of 2025, net exposure was +30 points, one of the highest readings in the data set.

Furthermore, 87% of fund managers surveyed anticipate central banks worldwide to continue reducing their Dollar holdings in their foreign reserves.

The US Dollar is facing historic bearish sentiment.

US Dollar net exposure by global fund managers is down to -35 points, the lowest in at least 14 years.

This is below the April 2025 bottom when President Trump surprised markets with "Liberation Day."

By comparison, at the start of 2025, net exposure was +30 points, one of the highest readings in the data set.

Furthermore, 87% of fund managers surveyed anticipate central banks worldwide to continue reducing their Dollar holdings in their foreign reserves.

The US Dollar is facing historic bearish sentiment.

- Reward

- 2

- Comment

- Repost

- Share

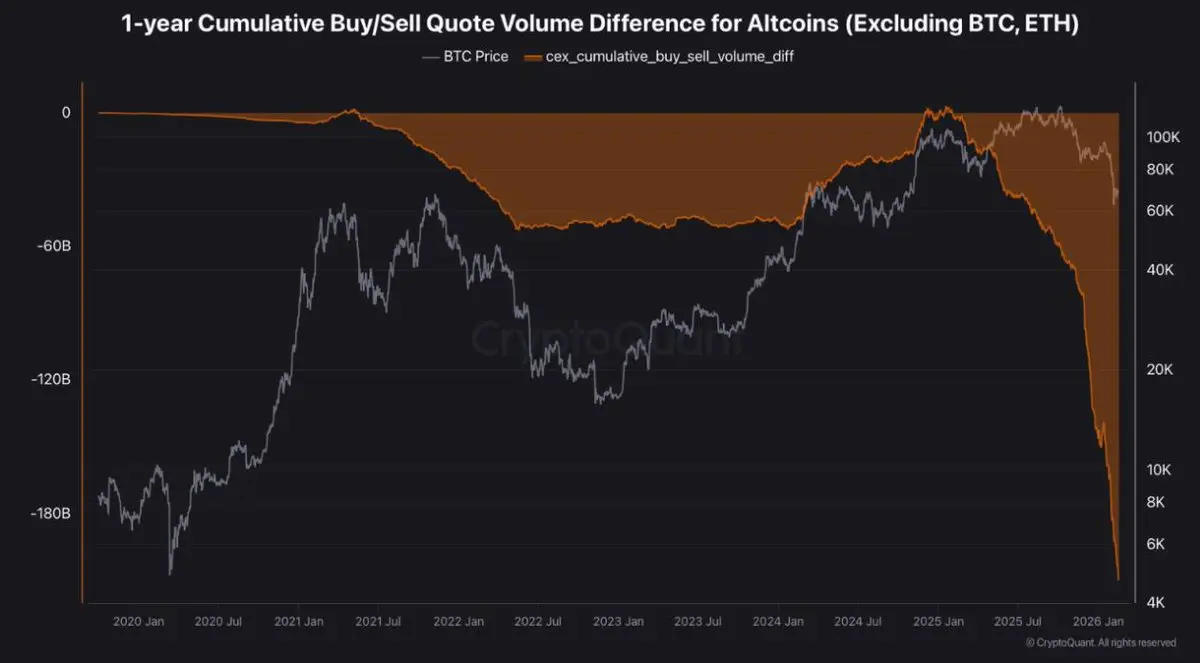

ALTCOIN SELL PRESSURE JUST HIT A 5-YEAR EXTREME

For 13 straight months, altcoins have seen continuous net selling on CEX spot markets.

Retail is largely out, smart money has rotated, and there’s still no clear sign of institutional accumulation.

This isn’t just a dip.

For 13 straight months, altcoins have seen continuous net selling on CEX spot markets.

Retail is largely out, smart money has rotated, and there’s still no clear sign of institutional accumulation.

This isn’t just a dip.

- Reward

- 1

- Comment

- Repost

- Share

SUI JUST HIT A MASSIVE INSTITUTIONAL MILESTONE

First spot SUI ETFs are LIVE today.

• Canary launches SUIS, direct spot exposure with staking

• Grayscale drops GSUI, another big step for institutional adoption

Regulated ETFs + staking exposure = a whole new level of access to SUI.

First spot SUI ETFs are LIVE today.

• Canary launches SUIS, direct spot exposure with staking

• Grayscale drops GSUI, another big step for institutional adoption

Regulated ETFs + staking exposure = a whole new level of access to SUI.

SUI-5,8%

- Reward

- like

- Comment

- Repost

- Share

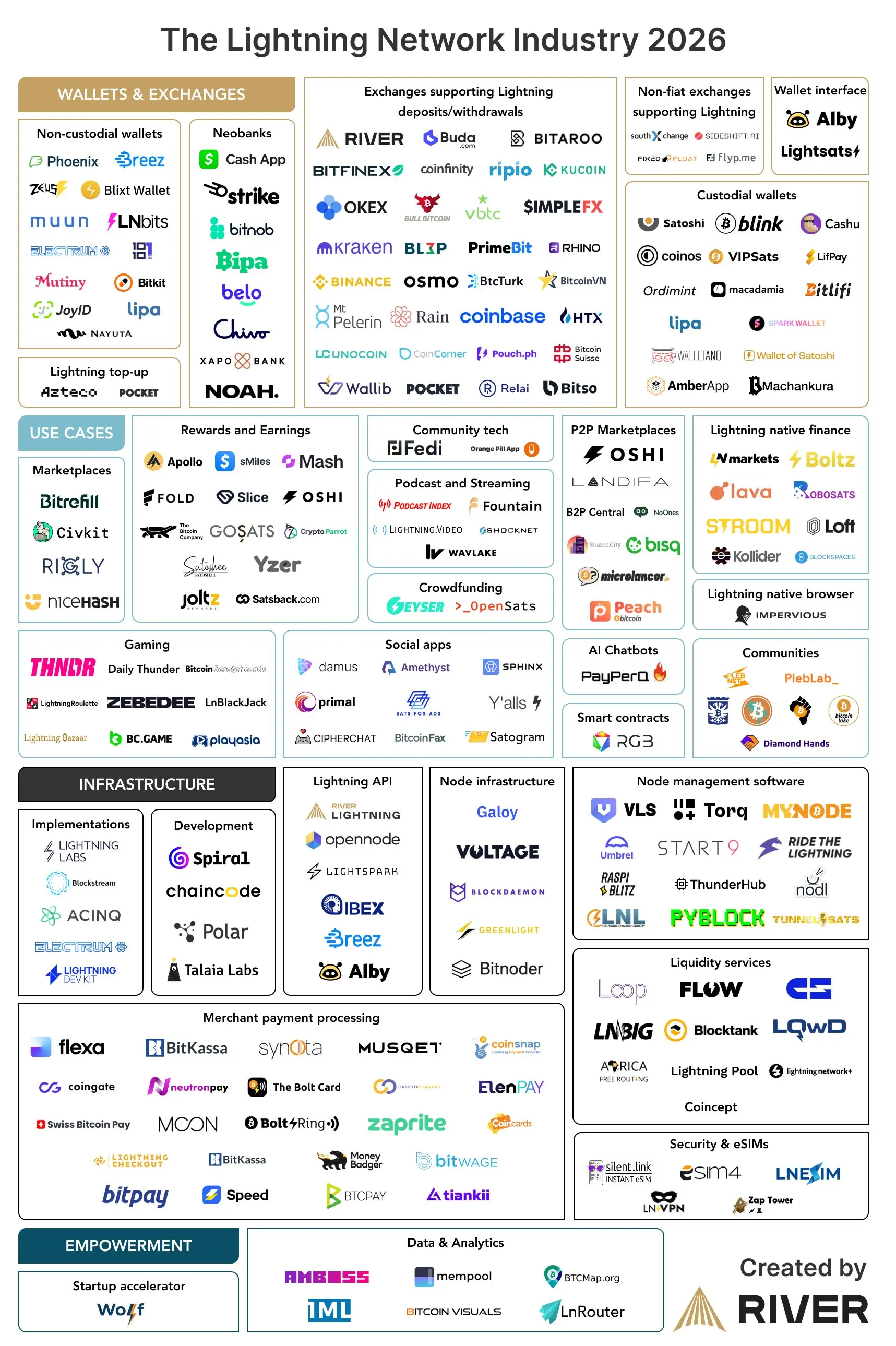

The Lightning Network ecosystem is EXPLODING 👀

Over 217 companies and projects, and still growing.

Over 217 companies and projects, and still growing.

- Reward

- like

- Comment

- Repost

- Share

BREAKING: Warren Buffett's Berkshire Hathaway announces it sold 77% of its Amazon, $AMZN, stake in Q4 2025, worth $1.7 billion.

Buffett also sold $2.7 billion of Apple last quarter.

Buffett also sold $2.7 billion of Apple last quarter.

- Reward

- like

- Comment

- Repost

- Share

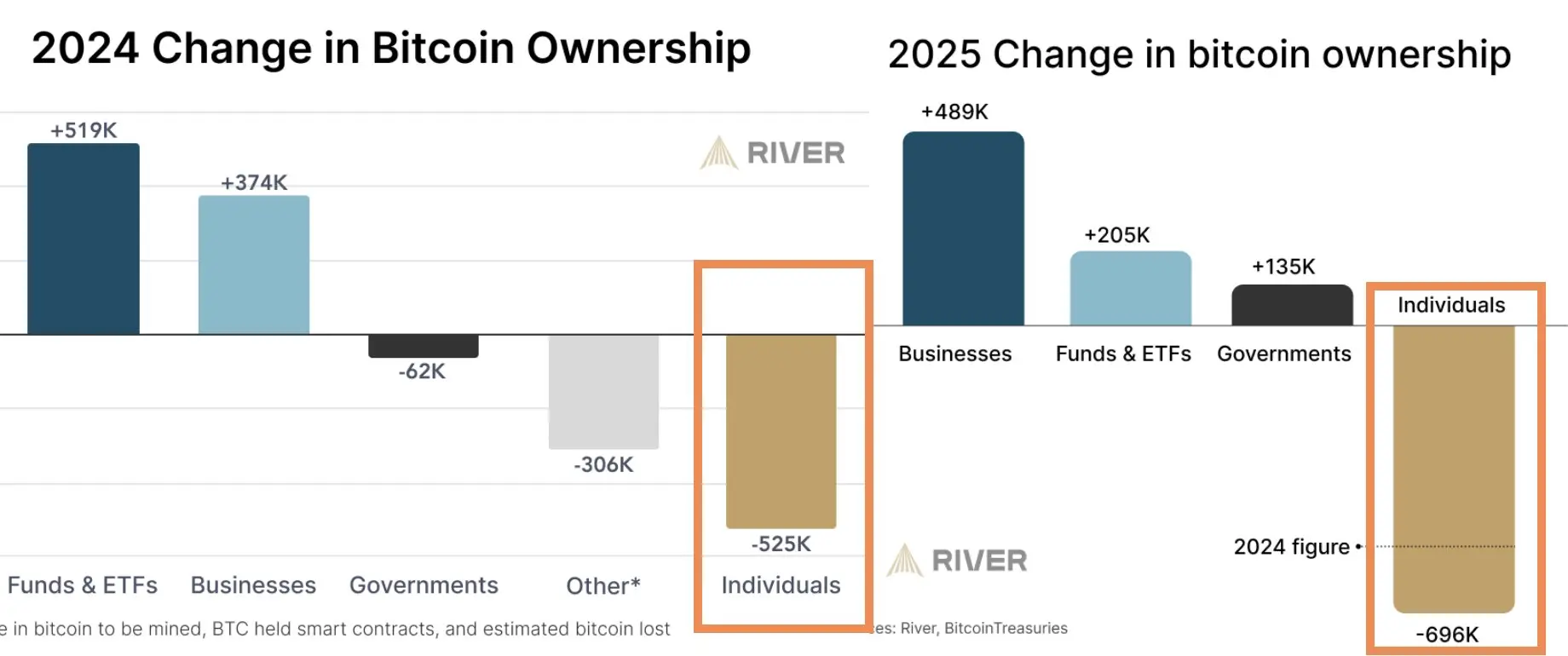

Over the past two years, individuals have sold more than 1.2 million Bitcoin.

That’s over 6% of the circulating supply, and more than is attributed to Satoshi's holdings.

Retail is distributing as ETFs and public companies are absorbing.

That’s over 6% of the circulating supply, and more than is attributed to Satoshi's holdings.

Retail is distributing as ETFs and public companies are absorbing.

BTC-1,74%

- Reward

- like

- Comment

- Repost

- Share

BITCOIN ON TRACK FOR ITS LONGEST LOSING STREAK IN 7 YEARS

The selling just isn’t stopping.

February is already down -13%.

If it closes red, Bitcoin will print 5 straight monthly losses — the LONGEST streak since 2018.

Total drawdown already sits near -40% in ~5 months.

One of the STEEPEST sustained selloffs in Bitcoin history.🔥

The selling just isn’t stopping.

February is already down -13%.

If it closes red, Bitcoin will print 5 straight monthly losses — the LONGEST streak since 2018.

Total drawdown already sits near -40% in ~5 months.

One of the STEEPEST sustained selloffs in Bitcoin history.🔥

BTC-1,74%

- Reward

- like

- Comment

- Repost

- Share

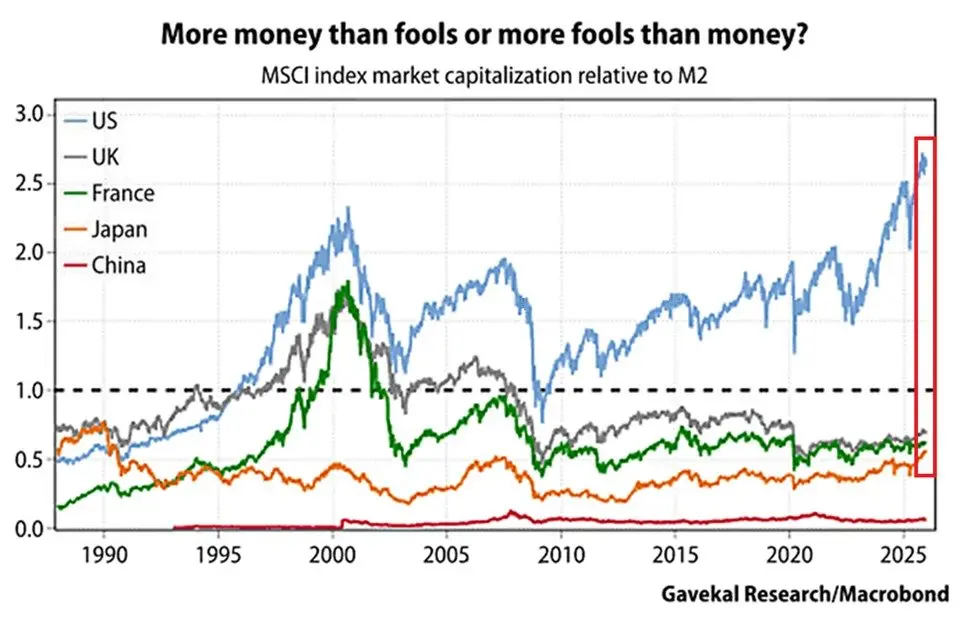

The US stock market is witnessing a historic run:

The MSCI USA Index's market cap relative to the US M2 money supply is up to a record 270%.

This ratio is up +120 percentage points since 2022.

This now surpasses the 2000 Dot-Com Bubble peak by ~40 percentage points, and the pre-2008 Financial Crisis high by ~75 percentage points.

By comparison, the UK and France MSCI indexes relative to their M2 stand at ~60%, still below pre-pandemic highs.

At the same time, Japan’s market cap to M2 is up to ~60%, the highest since the 1990s.

The market has never run this far ahead of liquidity before.

The MSCI USA Index's market cap relative to the US M2 money supply is up to a record 270%.

This ratio is up +120 percentage points since 2022.

This now surpasses the 2000 Dot-Com Bubble peak by ~40 percentage points, and the pre-2008 Financial Crisis high by ~75 percentage points.

By comparison, the UK and France MSCI indexes relative to their M2 stand at ~60%, still below pre-pandemic highs.

At the same time, Japan’s market cap to M2 is up to ~60%, the highest since the 1990s.

The market has never run this far ahead of liquidity before.

- Reward

- like

- Comment

- Repost

- Share

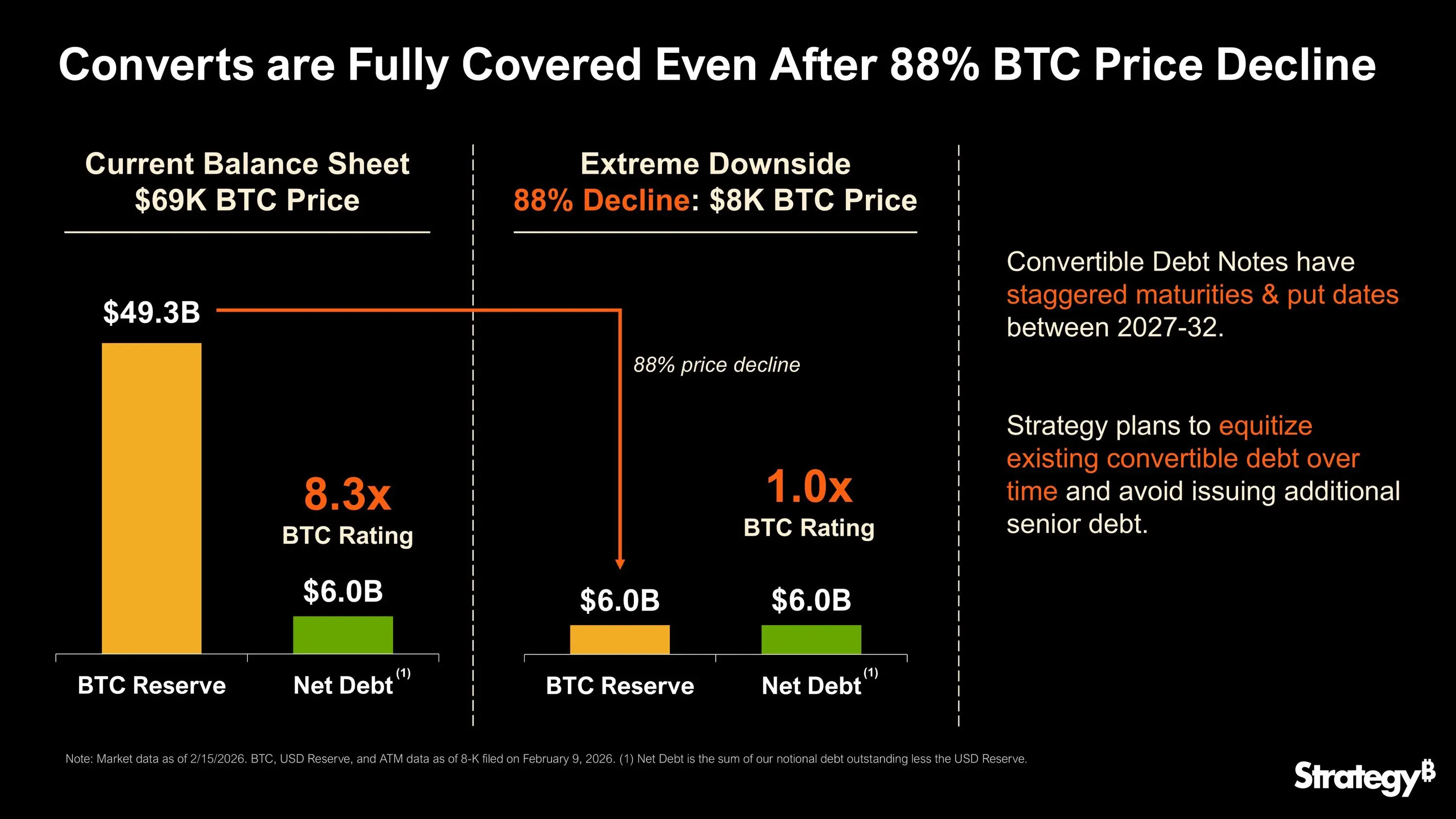

🚨 LATEST: Michael Saylor's Strategy reveals it can withstand an 88% Bitcoin price decline to $8K and “still have sufficient assets to fully cover its debt.”

BTC-1,74%

- Reward

- like

- Comment

- Repost

- Share

⚠️ INSTITUTIONS COULD “FIRE” BITCOIN DEVS OVER QUANTUM RISK

Big holders like BlackRock may lose patience if Bitcoin developers don’t address quantum computing threats, says VC Nic Carter.

He warns that if devs “do nothing,” institutions could take control and replace them.

Big holders like BlackRock may lose patience if Bitcoin developers don’t address quantum computing threats, says VC Nic Carter.

He warns that if devs “do nothing,” institutions could take control and replace them.

BTC-1,74%

- Reward

- 2

- Comment

- Repost

- Share

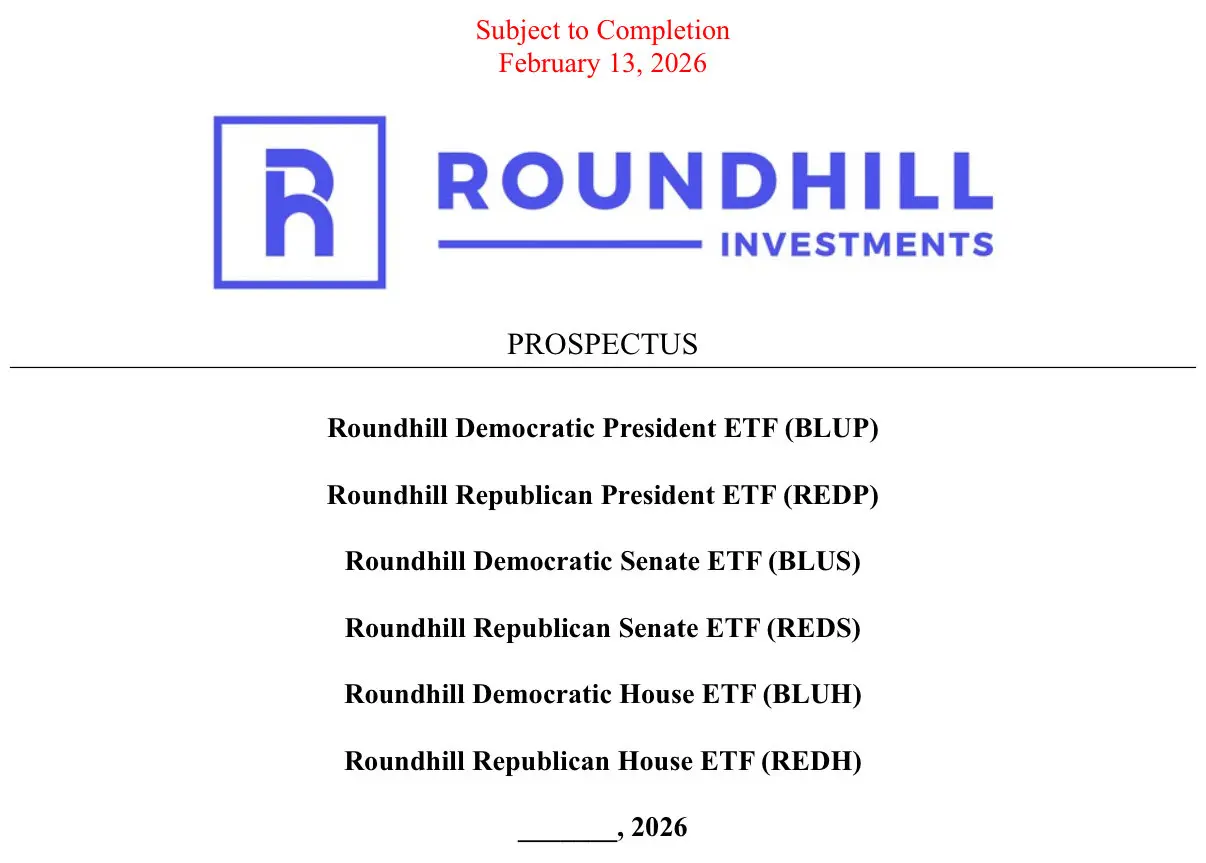

🇺🇸 ETF TO BET ON U.S. ELECTION OUTCOMES FILED

Roundhill Investments filed with the SEC to launch 6 ETFs tied to event contracts that bet on outcomes of the 2028 U.S. elections.

If approved, the funds would track results like which party controls the presidency or Congress.

Roundhill Investments filed with the SEC to launch 6 ETFs tied to event contracts that bet on outcomes of the 2028 U.S. elections.

If approved, the funds would track results like which party controls the presidency or Congress.

- Reward

- 2

- Comment

- Repost

- Share

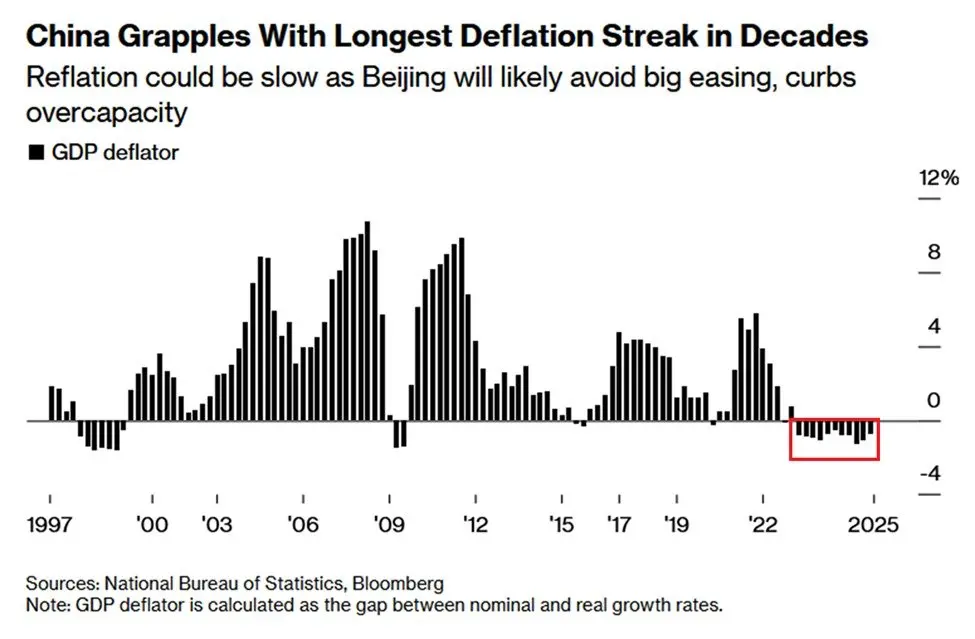

China is stuck in its longest deflationary streak in decades:

China’s GDP deflator fell -0.7% in Q4 2025, marking the 11th consecutive quarterly decline, the longest streak in at least 30 years.

China has been in deflation for 3 consecutive years now, the longest stretch since the country transitioned to a market economy in the late 1970s.

By comparison, the streak lasted just 2 quarters following the 2008 Financial Crisis.

Most recently, producer prices fell -1.4% YoY in January, marking the 40th consecutive month of factory deflation.

This comes as weak consumer demand, driven by a property

China’s GDP deflator fell -0.7% in Q4 2025, marking the 11th consecutive quarterly decline, the longest streak in at least 30 years.

China has been in deflation for 3 consecutive years now, the longest stretch since the country transitioned to a market economy in the late 1970s.

By comparison, the streak lasted just 2 quarters following the 2008 Financial Crisis.

Most recently, producer prices fell -1.4% YoY in January, marking the 40th consecutive month of factory deflation.

This comes as weak consumer demand, driven by a property

- Reward

- 2

- Comment

- Repost

- Share