Tim0x

No content yet

Tim0x

Slowly, our industry is morphing to be a much regulated industry where projects with growth and revenue generation would be much valued.

To an extent, projects ought to be valued asides through P/S and P/E metrics down to futuristic valuation in relation to current token valuation.

Seeing how much @maplefinance has stayed consistent in revenue generation, I decided to evaluate it using DCF (Discounted Cash Flow) method.

Here's the link to the article:

To an extent, projects ought to be valued asides through P/S and P/E metrics down to futuristic valuation in relation to current token valuation.

Seeing how much @maplefinance has stayed consistent in revenue generation, I decided to evaluate it using DCF (Discounted Cash Flow) method.

Here's the link to the article:

- Reward

- like

- Comment

- Repost

- Share

The emergence of AI is one thing and the utilization of AI is another.

Most people utilize AI the wrong way, and to an extent this is because they believe that the future, AGI is the current phase of AI meanwhile AGI is yet to come.

AI are basically models which are trained on internet data but AGI will be able to reinforce itself, hence, the data which which would be given to newer models can be used to create more information when prompted.

Hence, all hope isn't lost just yet and when people say there is a short window for money to be made I solely believe this is true but many need to un

Most people utilize AI the wrong way, and to an extent this is because they believe that the future, AGI is the current phase of AI meanwhile AGI is yet to come.

AI are basically models which are trained on internet data but AGI will be able to reinforce itself, hence, the data which which would be given to newer models can be used to create more information when prompted.

Hence, all hope isn't lost just yet and when people say there is a short window for money to be made I solely believe this is true but many need to un

- Reward

- like

- Comment

- Repost

- Share

An example follows:

Say I am looking for an information, and I prompt AI, but since this information isn't shared on the internet and since it requires a good level of skin in the game, AI itself cannot give me the answer to the prompt or at best, it'll give me an answer that is generic.

But say I have skin in the game, my prompting would be different. My prompt would be to work on the reason why I had prompted in the first place.

Say I am looking for an information, and I prompt AI, but since this information isn't shared on the internet and since it requires a good level of skin in the game, AI itself cannot give me the answer to the prompt or at best, it'll give me an answer that is generic.

But say I have skin in the game, my prompting would be different. My prompt would be to work on the reason why I had prompted in the first place.

- Reward

- like

- Comment

- Repost

- Share

One of my best reads for some years now.

- Reward

- like

- Comment

- Repost

- Share

Everything is sales. This goes as far as trying to beat your addiction. \nYou want to stop smoking but to stop, you have to replace it with something else. \nYour ability to convince yourself that the replacement is better off than the addiction is selling.

- Reward

- like

- Comment

- Repost

- Share

Bottom buyers: Thank you very much

View Original

- Reward

- like

- Comment

- Repost

- Share

Talmabout Vitalik saying there\'s no use of L2s?

- Reward

- like

- Comment

- Repost

- Share

Fastest way to damage your brain cells is by turning on your LinkedIn notifications.

- Reward

- like

- Comment

- Repost

- Share

Niggas be talking to me as though they were Colonel Michael Rice.

- Reward

- like

- Comment

- Repost

- Share

Personal news: i got life sentence

Moving into @Jaileddotfun soon

I’ve got about 3 codes to share left, who wants in?

Moving into @Jaileddotfun soon

I’ve got about 3 codes to share left, who wants in?

- Reward

- like

- Comment

- Repost

- Share

What do I think about Equity Perps?

Primarily, capital rotation and wealth transfer happens because of the introduction new asset class and this, we watched happen from traditional finance down to internet capital markets (blockchain rails).

While crypto industry itself is driven by narratives, most narratives have better longevity than others.

Equity perps poses as a new asset class and financial vehicle for capital rotation and wealth transfer and will have better longevity compared to other narratives such as prediction markets and memecoins.

Read here to find out why:

Primarily, capital rotation and wealth transfer happens because of the introduction new asset class and this, we watched happen from traditional finance down to internet capital markets (blockchain rails).

While crypto industry itself is driven by narratives, most narratives have better longevity than others.

Equity perps poses as a new asset class and financial vehicle for capital rotation and wealth transfer and will have better longevity compared to other narratives such as prediction markets and memecoins.

Read here to find out why:

- Reward

- like

- Comment

- Repost

- Share

The word “Sunset” is the new “revolutionizing” but for crypto marketers.

- Reward

- like

- Comment

- Repost

- Share

“Sunset” is the new “revolutionizing” for crypto marketers.

- Reward

- like

- Comment

- Repost

- Share

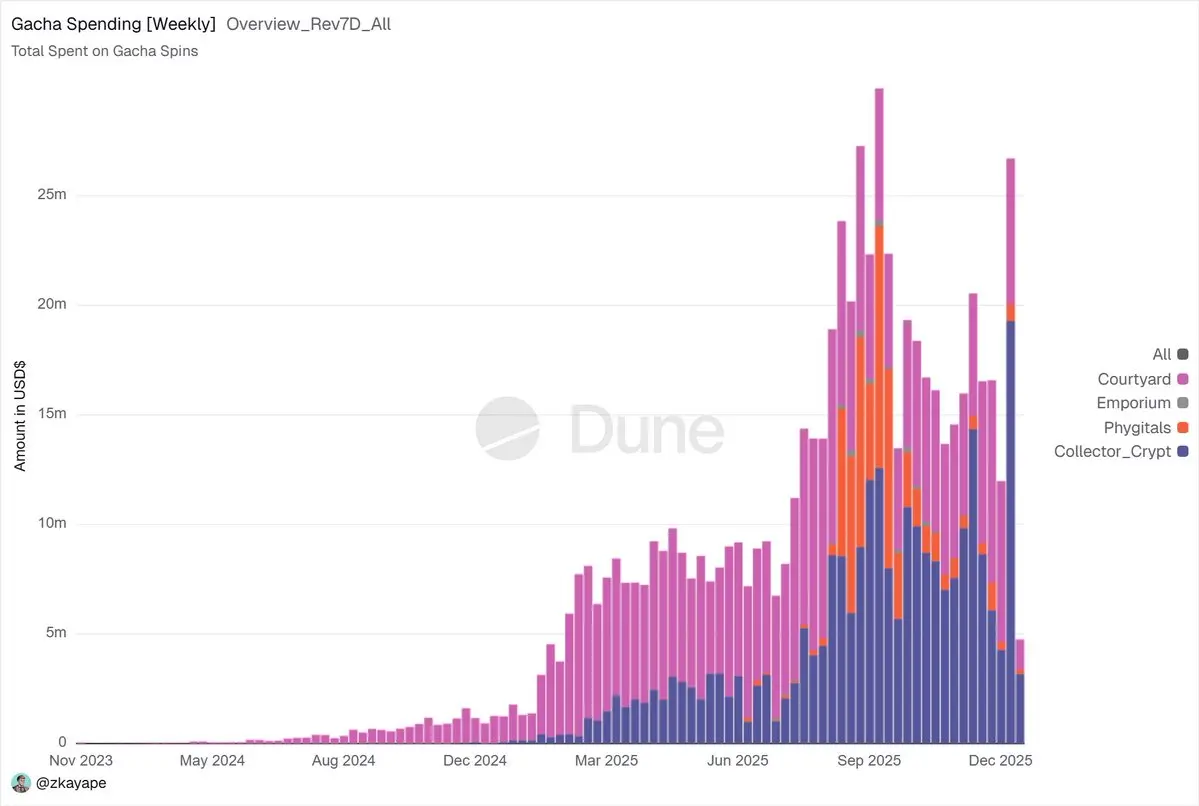

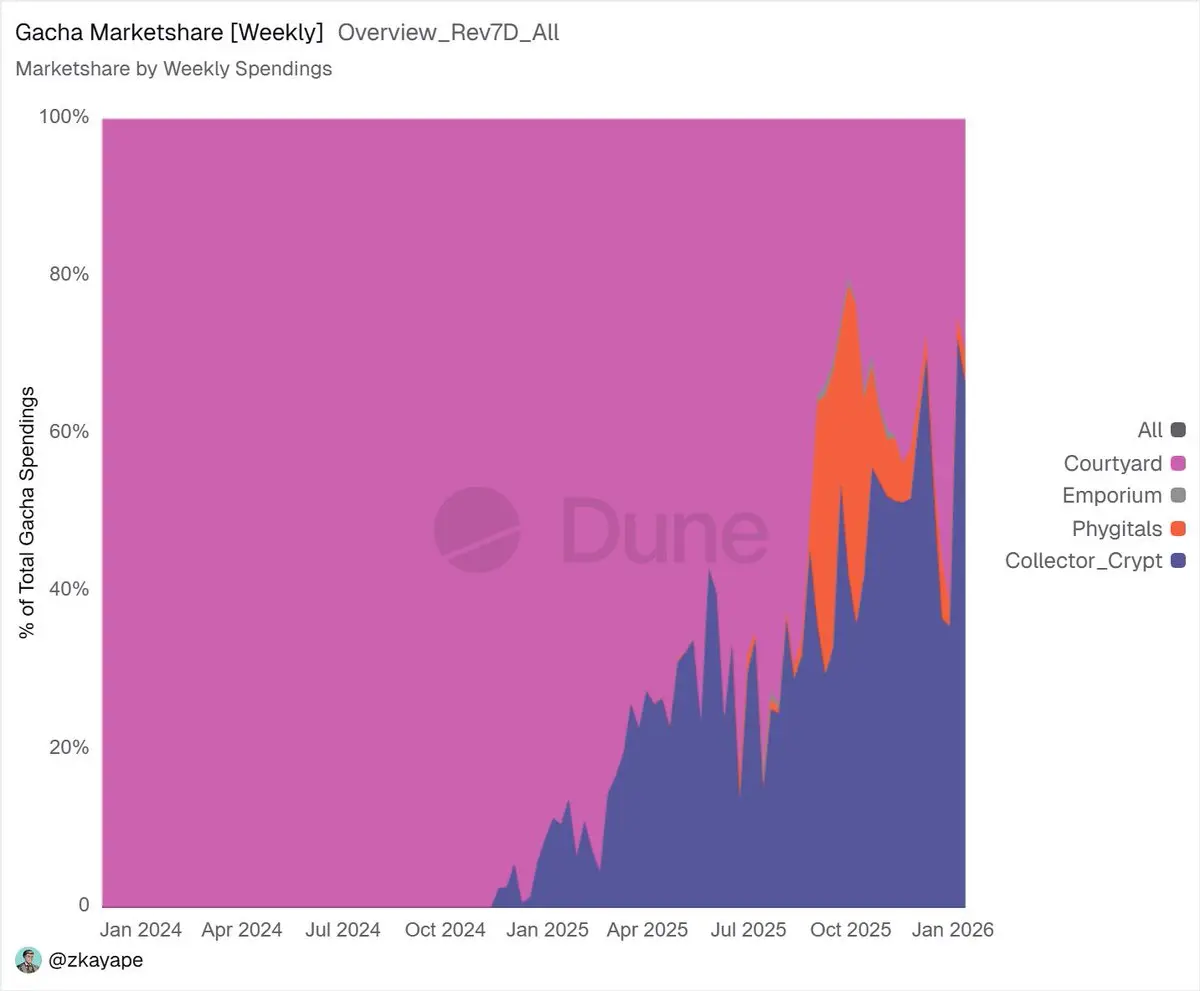

TCGs as a sector has been ganering attention recently due to the LEGO X Pokemon partnership. From this chart, Collector Crypt is outperforming every other tokenised TCG platform despite a platform like @phygitals without a token just yet of which I expected to not be the case.

While TCGs are now becoming a thing, it'll be great to keep an eye on @PlayKamiApp.

While TCGs are now becoming a thing, it'll be great to keep an eye on @PlayKamiApp.

- Reward

- like

- Comment

- Repost

- Share

Everyone plays AOW3 right?

- Reward

- like

- Comment

- Repost

- Share

In the past 1 year, M&As takes up 12.8% of fundraising deals and in the past 2 years, M&As only represent 8.8% of the pie signaling the rise in the interest of companies

M&As in TradFi is quite different compared to crypto where most products have tokens leading to rugging and this begs the question of:

- Why the sudden rise in M&As?

- Why are tokens excluded from most M&As?

Read here to get your questions answered and your thoughts confirmed:

M&As in TradFi is quite different compared to crypto where most products have tokens leading to rugging and this begs the question of:

- Why the sudden rise in M&As?

- Why are tokens excluded from most M&As?

Read here to get your questions answered and your thoughts confirmed:

- Reward

- like

- Comment

- Repost

- Share

Crazy how fast we moved from bullposting privacy as the next meta to talking about the art of vibecoding.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More51.2K Popularity

73.89K Popularity

18.66K Popularity

44.51K Popularity

254.32K Popularity

Pin