Adrig_iv

No content yet

Adrig_iv

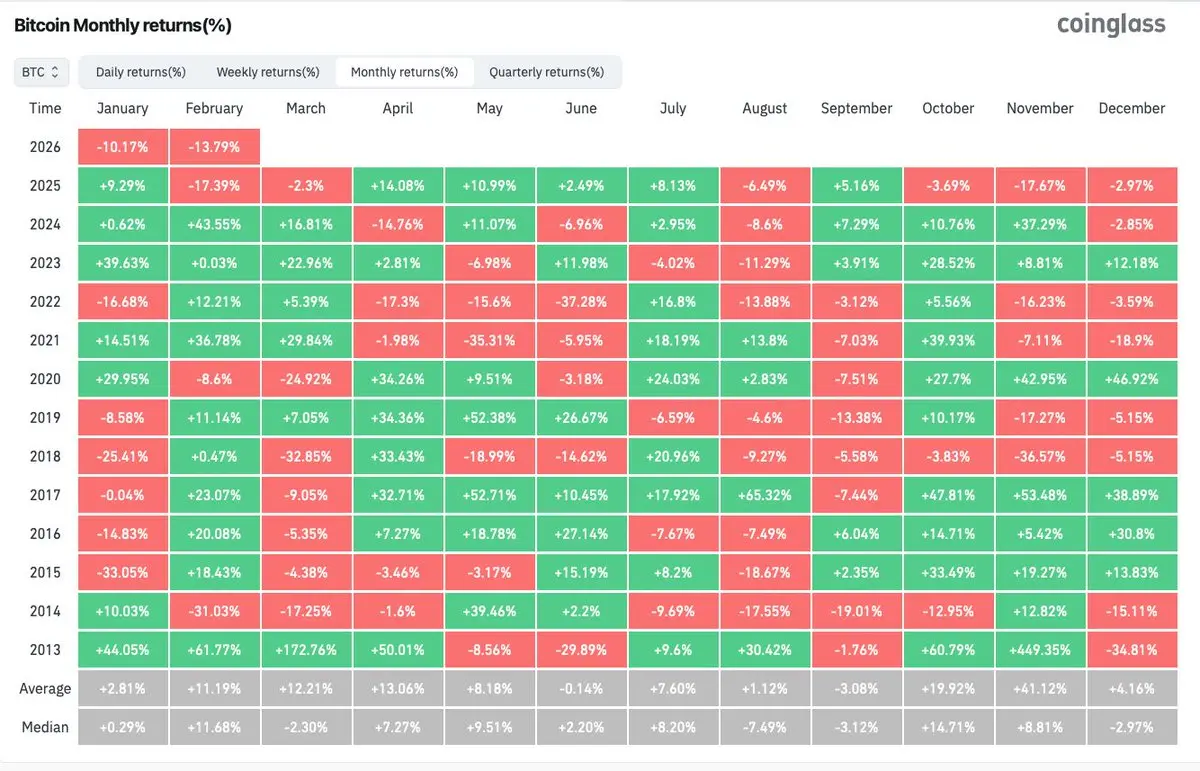

5 consecutive months in the red

first time in history that we have a red January and February

What conclusion do you draw from this?

View Originalfirst time in history that we have a red January and February

What conclusion do you draw from this?

- Reward

- 1

- Comment

- Repost

- Share

Only 3% of retail traders manage to be consistently profitable.

Most do not succeed.

And if you don't want to be part of the majority…

🧵

View OriginalMost do not succeed.

And if you don't want to be part of the majority…

🧵

- Reward

- like

- Comment

- Repost

- Share

For almost two years, trading has been my main source of income.

And along the way, I have learned something very important:

Profitability doesn't come from how good an analyst you are; it comes from self-control and the ability to stay consistent with what you said you were going to do.

View OriginalAnd along the way, I have learned something very important:

Profitability doesn't come from how good an analyst you are; it comes from self-control and the ability to stay consistent with what you said you were going to do.

- Reward

- like

- Comment

- Repost

- Share

1. Profitable trading is not exciting.

If you're looking for adrenaline, this isn't for you.

Winning traders repeat the same steps every day.

They wait, wait, wait, wait... and when their system says to fire... they fire!

View OriginalIf you're looking for adrenaline, this isn't for you.

Winning traders repeat the same steps every day.

They wait, wait, wait, wait... and when their system says to fire... they fire!

- Reward

- like

- Comment

- Repost

- Share

2. Your system is worthless if you don't respect it

You may have a perfect strategy

But if you ignore it every time there's volatility or FOMO takes over you... you're dead.

(In this thread I won't talk about the strategy to follow, if you don't have one, in point 5 I will tell you how to get backtested and profitable strategies).

In short, discipline is not a virtue. It's a must.

View OriginalYou may have a perfect strategy

But if you ignore it every time there's volatility or FOMO takes over you... you're dead.

(In this thread I won't talk about the strategy to follow, if you don't have one, in point 5 I will tell you how to get backtested and profitable strategies).

In short, discipline is not a virtue. It's a must.

- Reward

- like

- Comment

- Repost

- Share

I have spoken with the best traders in Spain.

And I have studied many more.

And to my surprise, none of them have anything magical.

What they do have are solid systems, clear rules, and a mindset tougher than your friend’s face who owes you money for a long time.

View OriginalAnd I have studied many more.

And to my surprise, none of them have anything magical.

What they do have are solid systems, clear rules, and a mindset tougher than your friend’s face who owes you money for a long time.

- Reward

- like

- Comment

- Repost

- Share

I will bring all of this down to earth, so let's go step by step on what you need to focus on starting today ⬇️

View Original- Reward

- like

- Comment

- Repost

- Share

3. Managing risk is the true skill

Forget about "doubling the account".

That will only lead to burning it out.

An account funded with a 10% drawdown is not 100k. It's 10k.

If you risk 3% on each trade, you're shooting yourself in the foot.

View OriginalForget about "doubling the account".

That will only lead to burning it out.

An account funded with a 10% drawdown is not 100k. It's 10k.

If you risk 3% on each trade, you're shooting yourself in the foot.

- Reward

- like

- Comment

- Repost

- Share

My personal rules:

➢ 1% risk per trade

➢ Maximum of two stops per day

➢ If I notice that emotions take over me, I turn off the screen

View Original➢ 1% risk per trade

➢ Maximum of two stops per day

➢ If I notice that emotions take over me, I turn off the screen

- Reward

- like

- Comment

- Repost

- Share

Imagine you are given 10 chips to play in a tournament.

Each bad trade is a chip that goes away.

When they are all gone, you're out.

It doesn't matter how good you are or how much theory you master:

Without risk management, you're self-eliminating from the market.

It's the only thing that guarantees your survival and allows your mathematical edge to have time to work in your favor.

View OriginalEach bad trade is a chip that goes away.

When they are all gone, you're out.

It doesn't matter how good you are or how much theory you master:

Without risk management, you're self-eliminating from the market.

It's the only thing that guarantees your survival and allows your mathematical edge to have time to work in your favor.

- Reward

- like

- Comment

- Repost

- Share

4. Mindset is the difference between a trader who survives and one who disappears.

It's not just about knowing when to enter, but also knowing when to stop.

Accepting that a good streak doesn't make you invincible, and a bad one doesn't define you.

The professional doesn't identify with their last trade. They identify with their process.

View OriginalIt's not just about knowing when to enter, but also knowing when to stop.

Accepting that a good streak doesn't make you invincible, and a bad one doesn't define you.

The professional doesn't identify with their last trade. They identify with their process.

- Reward

- like

- Comment

- Repost

- Share

6. Remember this:

➢ Don't trade impulsively, stick to the plan.

➢ Don't risk as if you have 7 lives. Protect your capital as if it were oxygen.

➢ You don't have to win every trade, just some of them.

➢ Surround yourself with those who are already where you want to be.

And most importantly: treat this as the business it is, we're not here to play.

View Original➢ Don't trade impulsively, stick to the plan.

➢ Don't risk as if you have 7 lives. Protect your capital as if it were oxygen.

➢ You don't have to win every trade, just some of them.

➢ Surround yourself with those who are already where you want to be.

And most importantly: treat this as the business it is, we're not here to play.

- Reward

- like

- Comment

- Repost

- Share

Greetings,

adrig.

View Originaladrig.

- Reward

- like

- Comment

- Repost

- Share