imJoker

No content yet

imJoker

⚡️ Friends, recently, Coinbase and Solana have been making moves one after another, which suddenly made me realize that the on-chain economy around AI Agents might really be coming.

On February 11th, Coinbase launched something called Agentic Wallets. It’s a wallet that equips AI Agents with the ability to manage their own funds.

Previously, AI could help us analyze market trends and discover arbitrage opportunities, but it could only talk—no hands to act. It was like a person with a brain but no hands. Now, that’s different. With this wallet installed, the Agent can handle identity verificati

View OriginalOn February 11th, Coinbase launched something called Agentic Wallets. It’s a wallet that equips AI Agents with the ability to manage their own funds.

Previously, AI could help us analyze market trends and discover arbitrage opportunities, but it could only talk—no hands to act. It was like a person with a brain but no hands. Now, that’s different. With this wallet installed, the Agent can handle identity verificati

- Reward

- like

- Comment

- Repost

- Share

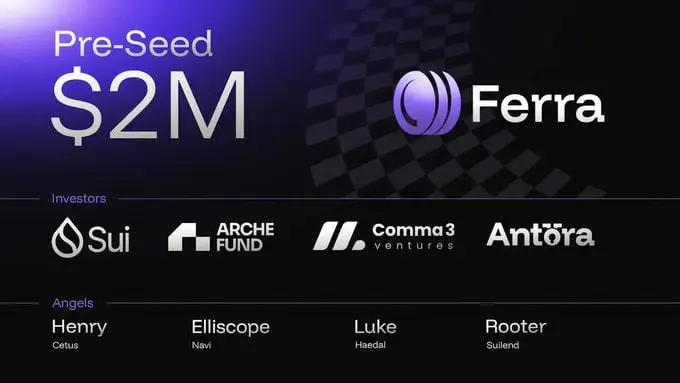

⚡️ Friends, Ferra has built a brand new dynamic liquidity layer on Sui, combining DLMM, CLMM, and DAMM mechanisms, completely breaking the limitations of traditional AMM models.

As a result, each market can have more flexible liquidity solutions instead of rigidly applying the same model. It has just completed a $2 million seed round of funding, which isn't a large amount, but the investor lineup is very strong.

Comma3 Ventures led the investment, with Sui, Arche Fund, and Antora Technology also participating. Angel investors include founders from Cetus, Navi, Haedal, and Suilend.

This investm

View OriginalAs a result, each market can have more flexible liquidity solutions instead of rigidly applying the same model. It has just completed a $2 million seed round of funding, which isn't a large amount, but the investor lineup is very strong.

Comma3 Ventures led the investment, with Sui, Arche Fund, and Antora Technology also participating. Angel investors include founders from Cetus, Navi, Haedal, and Suilend.

This investm

- Reward

- like

- Comment

- Repost

- Share

⚡️ Friends, on-chain transactions often encounter situations where the order is completed, but then various issues arise, such as settlement delays, network congestion causing transaction failures, or discrepancies between front-end and back-end data.

Most problems occur when the transaction process is split into multiple steps, making the entire process prone to errors. To address these issues, @OrderlyNetwork has introduced a brand-new transaction structure.

In simple terms, from order creation, matching, to settlement, the entire process is completed within the same transaction pipeline. Th

View OriginalMost problems occur when the transaction process is split into multiple steps, making the entire process prone to errors. To address these issues, @OrderlyNetwork has introduced a brand-new transaction structure.

In simple terms, from order creation, matching, to settlement, the entire process is completed within the same transaction pipeline. Th

- Reward

- like

- Comment

- Repost

- Share

⚡️ Friends, since launching the buyback program in November, Orderly has been using 60% of its protocol revenue to repurchase $ORDER tokens, accumulating over 3.7 million tokens so far.

This is not a short-term move but a reflection of their long-term commitment to the community and the project. Making profits is not easy, but using revenue to buy back tokens shows the project team’s confidence in the future and their consideration for users’ long-term interests.

Buybacks themselves are a strong signal, indicating they are laying a foundation and planning for the long term rather than engagin

View OriginalThis is not a short-term move but a reflection of their long-term commitment to the community and the project. Making profits is not easy, but using revenue to buy back tokens shows the project team’s confidence in the future and their consideration for users’ long-term interests.

Buybacks themselves are a strong signal, indicating they are laying a foundation and planning for the long term rather than engagin

- Reward

- like

- Comment

- Repost

- Share

⚡️ Friends, after discussing MemeCore's recent annual AMA, it feels like their 2026 roadmap is no longer just a plan but more like a clear ecosystem integration network.

It's about truly merging DeFi and SocialFi, so that trading, socializing, and creation are no longer separate activities, but grow within the same system.

Next year, you'll see MemeMax go live on the mainnet, the POL mechanism implemented, PixelSwap integrated with a more mature DEX architecture, and Kaito bringing SocialFi attributes deeper into trading scenarios.

They are not content with just spinning in the current circle;

It's about truly merging DeFi and SocialFi, so that trading, socializing, and creation are no longer separate activities, but grow within the same system.

Next year, you'll see MemeMax go live on the mainnet, the POL mechanism implemented, PixelSwap integrated with a more mature DEX architecture, and Kaito bringing SocialFi attributes deeper into trading scenarios.

They are not content with just spinning in the current circle;

M5,32%

- Reward

- like

- Comment

- Repost

- Share

⚡️ Friends, the new year always makes people instinctively look back on the past and look forward to the future. The summary of 2025 reminds me of some fundamental truths, especially about the value of persistence and effort.

Seeing @ferra_protocol's summary, my first impression is not one of bragging, but of honesty. Over the past year, Ferra, regardless of how the external environment changes, has not stopped moving forward.

From the external signals, this may not seem like some eye-catching big news, and at times, many people might feel that it has no fresh breakthroughs. However, what trul

View OriginalSeeing @ferra_protocol's summary, my first impression is not one of bragging, but of honesty. Over the past year, Ferra, regardless of how the external environment changes, has not stopped moving forward.

From the external signals, this may not seem like some eye-catching big news, and at times, many people might feel that it has no fresh breakthroughs. However, what trul

- Reward

- 1

- Comment

- Repost

- Share

⚡️ Friends, currently decentralized exchanges may seem to offer a variety of choices, but in reality, they are largely similar. Whether it’s MEME coins, mainstream assets, or obscure tokens, they are all placed into the same liquidity model.

The CPMM model is simple but inefficient; for stablecoins, it may cause slippage; for assets with low liquidity, it exacerbates volatility. The market is constrained by a one-size-fits-all mold, ignoring the unique characteristics of each asset.

Ferra Protocol’s core insight lies here: different assets should inherently exist within different liquidity env

The CPMM model is simple but inefficient; for stablecoins, it may cause slippage; for assets with low liquidity, it exacerbates volatility. The market is constrained by a one-size-fits-all mold, ignoring the unique characteristics of each asset.

Ferra Protocol’s core insight lies here: different assets should inherently exist within different liquidity env

MEME1,65%

- Reward

- 4

- 1

- 1

- Share

NingxiFour :

:

New Year Wealth Explosion 🤑Trending Topics

View More157.27K Popularity

30.35K Popularity

27.29K Popularity

72.72K Popularity

13.25K Popularity

Pin