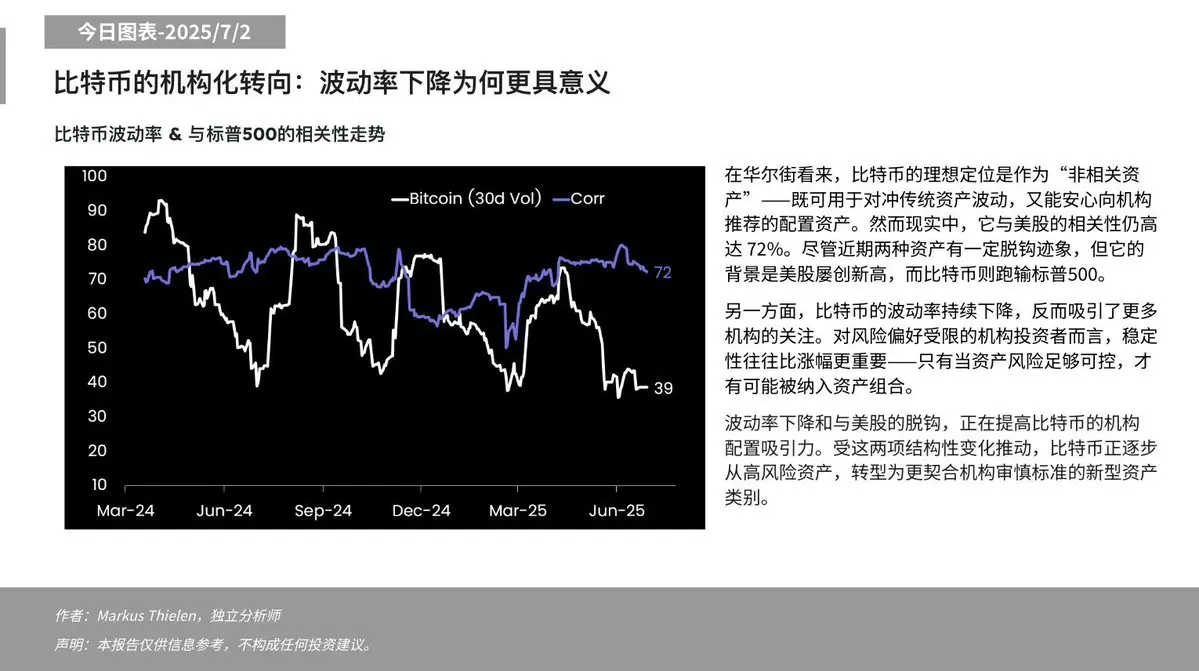

$BTC Bitcoin has indeed been quite interesting recently, with reduced volatility, making it much friendlier for institutions. Wall Street has always hoped it would become a "non-correlated asset," but its correlation remains quite high at 72%. However, it has started to loosen up recently, especially since U.S. stocks have been rising, and Bitcoin can't keep up with the S&P.

The key point is that institutions fear large risks the most. Only when volatility decreases and stability increases will they be willing to include BTC in their portfolios. With the recent decrease in volatility and the g