Post content & earn content mining yield

placeholder

YourCryptoDJ

All we had to do was buy and hold the Dollar Menu in 2003

- Reward

- like

- Comment

- Repost

- Share

- Technical Outlook on Altcoins: Ethereum and XRP Look for Short-Term Rebound:

Ethereum's price remains within a range of $2900 to $3000, despite the overall trend leaning downward. The Relative Strength Index (RSI) at 39 on the daily chart is hindering its recovery, indicating that sellers continue to dominate the trend. Any move toward the midline could signal a shift in momentum from bearish to bullish.

The MACD indicator on the daily chart remains below the signal line, which may prompt investors to reduce their exposure and protect their capital. The red histogram bars below zero continue

View OriginalEthereum's price remains within a range of $2900 to $3000, despite the overall trend leaning downward. The Relative Strength Index (RSI) at 39 on the daily chart is hindering its recovery, indicating that sellers continue to dominate the trend. Any move toward the midline could signal a shift in momentum from bearish to bullish.

The MACD indicator on the daily chart remains below the signal line, which may prompt investors to reduce their exposure and protect their capital. The red histogram bars below zero continue

- Reward

- 1

- 1

- Repost

- Share

Before00zero :

:

Altcoins, including Ethereum (ETH) and Ripple (XRP), are testing key support levels, confirming the fragility of the current market structure. Ethereum's price remains above the $2900 support level but below the pivotal support level of $3000. Meanwhile, XRP has maintained stability above the $1.90 level, indicating short-term stability as bulls attempt to regain the $2.00 level.

The less you say, the more you earn. Click on the avatar to view subscriptions and get firsthand information resources.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- 3

- Repost

- Share

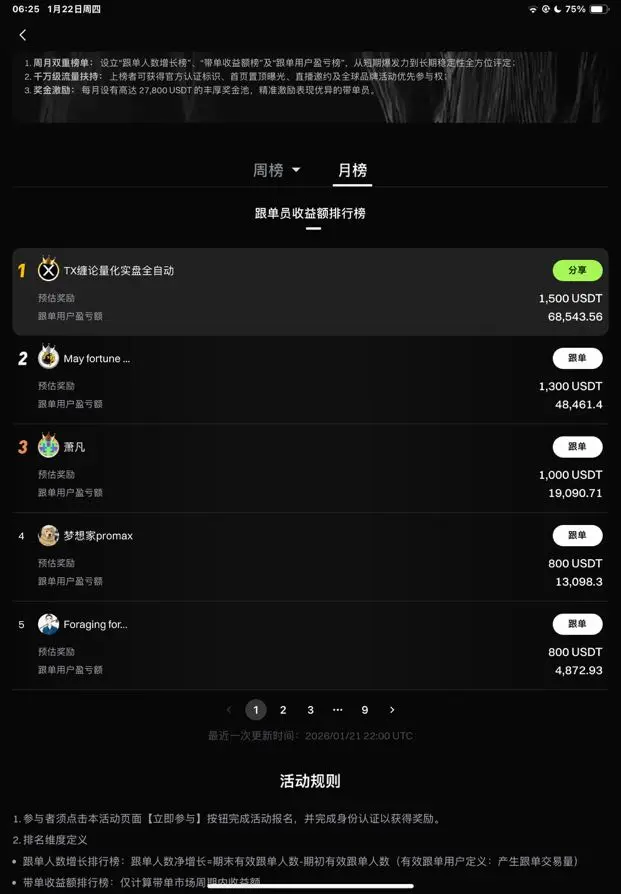

TxRobotAutomatically :

:

Big brother is awesomeView More

singa

singaraja

Created By@mndt21

Subscription Progress

0.00%

MC:

$0

Create My Token

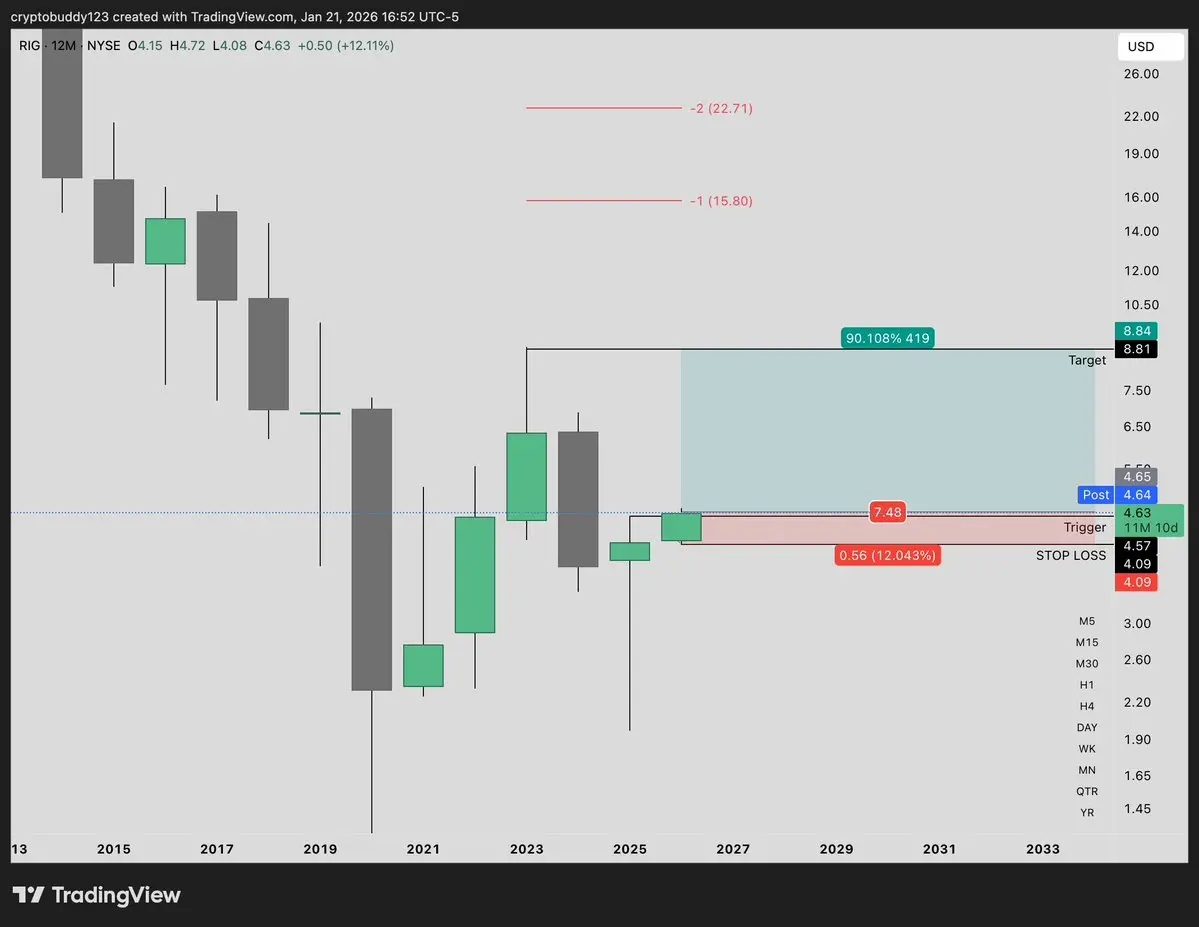

$RIG \n\n1M close above $4.57 to trigger the move up\nSL $4.09\nTP $6.91, $8.81

- Reward

- like

- Comment

- Repost

- Share

institutional bullish signals? BlackRock + Delaware Life investing in Bitcoin

- Reward

- like

- Comment

- Repost

- Share

$RIVER Airdrop buddies, if you're alive, give a like, and see how many are still around.

View Original

- Reward

- like

- Comment

- Repost

- Share

🗣 President Trump Executive Director Patrick Witt says there will be a #crypto market structure bill, it’s a question of when, not if. #crypto

- Reward

- like

- Comment

- Repost

- Share

The US cuts interest rates, but the effect is like raising rates...

Yields rise. When the US is strong, gold, silver, uranium, copper, and aluminum are likely to fall...

Now the empire is not doing well, commodities are skyrocketing.

Japanese government bonds will definitely be the first to blow up 💣

View OriginalYields rise. When the US is strong, gold, silver, uranium, copper, and aluminum are likely to fall...

Now the empire is not doing well, commodities are skyrocketing.

Japanese government bonds will definitely be the first to blow up 💣

- Reward

- like

- Comment

- Repost

- Share

#Trading Bot#我正在 Gate Use I am coming/USDT Spot Martingale Bot, total return since creation +151.11%

Prices are starting to rise, that's great, let's go up a little more

If it rises a little more, I will close the position

Keep going😊Keep going, keep going, keep going, keep going, keep going, keep going, keep going, keep going

No mistake in choosing

From the beginning, I felt it was powerful

Prices are starting to rise, that's great, let's go up a little more

If it rises a little more, I will close the position

Keep going😊Keep going, keep going, keep going, keep going, keep going, keep going, keep going, keep going

No mistake in choosing

From the beginning, I felt it was powerful

我踏马来了90.7%

- Reward

- like

- Comment

- Repost

- Share

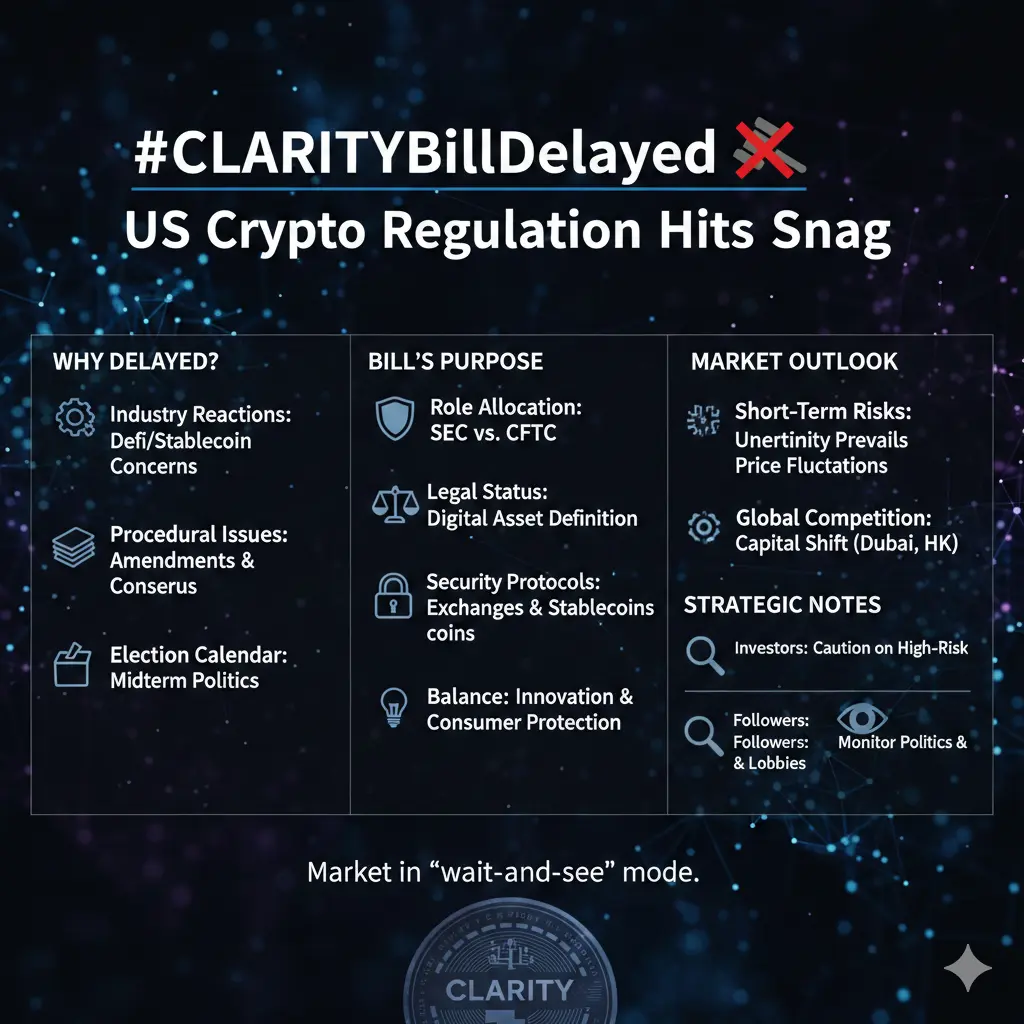

#CLARITYBillDelayed US Crypto Regulation Faces a Pause, What It Means for 2026

The cryptocurrency market had been eagerly anticipating the CLARITY Act, a proposed law designed to create a federal standard for digital assets in the United States. However, recent developments in the Senate have introduced significant uncertainty. The vote on the bill, originally expected to clarify the legal landscape for crypto, has been postponed indefinitely, leaving investors and industry participants in a wait-and-see mode.

🛑 Why Was the CLARITY Act Suspended?

Several key factors contributed to this unexpe

The cryptocurrency market had been eagerly anticipating the CLARITY Act, a proposed law designed to create a federal standard for digital assets in the United States. However, recent developments in the Senate have introduced significant uncertainty. The vote on the bill, originally expected to clarify the legal landscape for crypto, has been postponed indefinitely, leaving investors and industry participants in a wait-and-see mode.

🛑 Why Was the CLARITY Act Suspended?

Several key factors contributed to this unexpe

- Reward

- 3

- 5

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

Hold on, you'll definitely get rich. Hold on, you'll definitely get rich. Hold on, you'll definitely get rich. Hold on, you'll definitely get rich. Hold on, you'll definitely get rich. Hold on, you'll definitely get rich. Hold on, you'll definitely get rich.

View Original

- Reward

- 1

- 1

- Repost

- Share

TheManFromQiWorries :

:

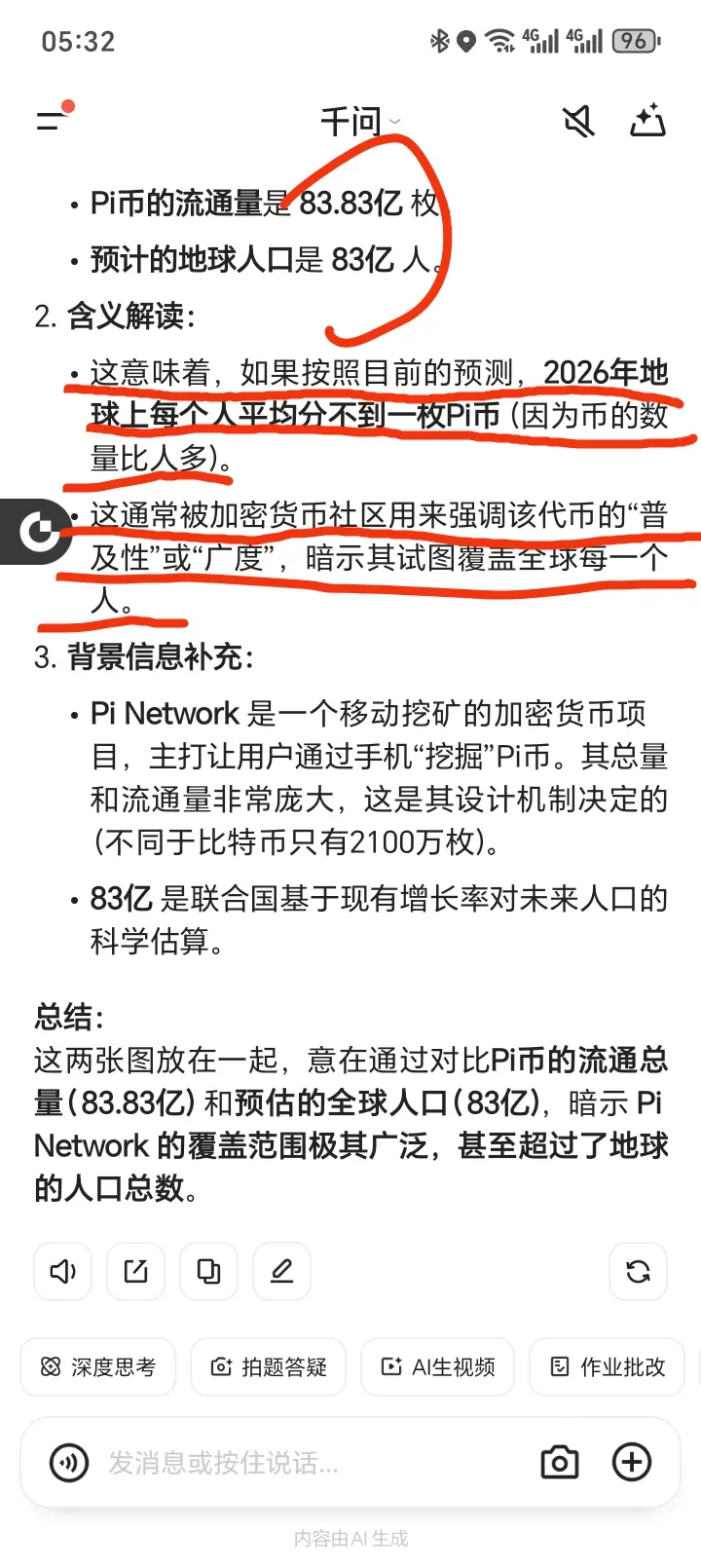

"Major Split in the Pi Community! Youlong predicts Pi Coin will drop below $0.1, supporters say 'It's about time to wake up,' opponents accuse 'deliberately talking down.' Who do you think is right or wrong?"MAYQ

马上有钱

Created By@SmartWin

Subscription Progress

0.00%

MC:

$0

Create My Token

$SPY - Gaps all over the place. Swiss cheese market conditions.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 2

- 8

- Repost

- Share

BuyOneGetOne :

:

You really have a knack for fantasizing; you can connect anything to pi?View More

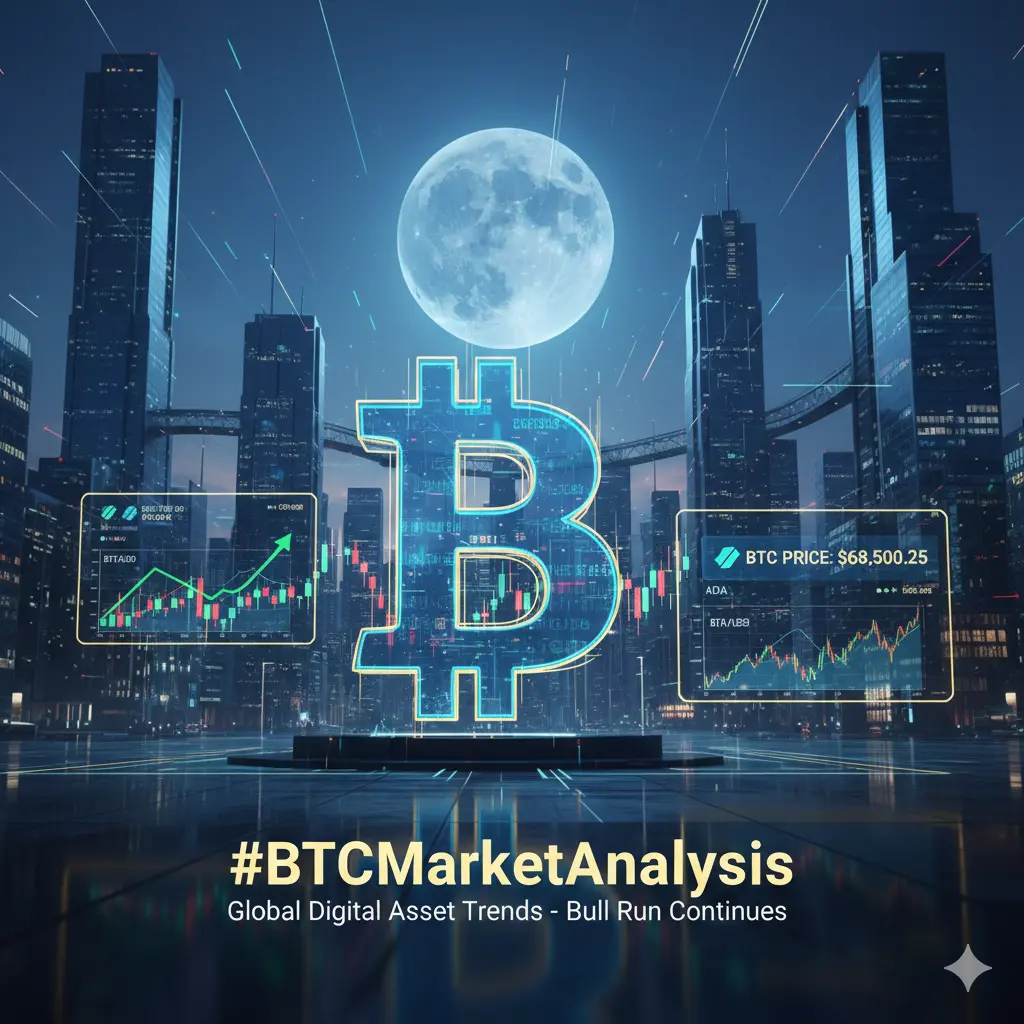

#BTCMarketAnalysis Bitcoin in 2026: Trends, Risks, and Opportunities

As 2026 unfolds, Bitcoin (BTC) continues to dominate the cryptocurrency landscape, balancing between maturing adoption and persistent volatility. The market has entered a new phase where institutional participation, macroeconomic factors, and regulatory signals collectively shape price action more than ever before.

📈 Price Trends and Market Structure

BTC has shown periods of strong resilience in early 2026, maintaining support around key levels established in late 2025. Analysts note that Bitcoin’s higher lows and consolidat

As 2026 unfolds, Bitcoin (BTC) continues to dominate the cryptocurrency landscape, balancing between maturing adoption and persistent volatility. The market has entered a new phase where institutional participation, macroeconomic factors, and regulatory signals collectively shape price action more than ever before.

📈 Price Trends and Market Structure

BTC has shown periods of strong resilience in early 2026, maintaining support around key levels established in late 2025. Analysts note that Bitcoin’s higher lows and consolidat

BTC2.03%

- Reward

- 4

- 5

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#TariffTensionsHitCryptoMarket ‼️‼️‼️‼️🚀🚀🚀🚀

Buy any cryptocurrency pegged to Bitcoin (BTC) now because Bitcoin's next move will be volatile.

Why?

Because what happened recently after the sudden surge is what's called a Fair Value Gap (FVG). This caused the price to drop and correct, and I bought several cryptocurrencies, especially altcoins, which are closely tied to Bitcoin's price movements.

I bought a large quantity of Plasma (XPL) because it's currently at its lowest point and will rise, God willing. 📈

I wish everyone success and substantial profits.

$BTC $XRP $SOL

Buy any cryptocurrency pegged to Bitcoin (BTC) now because Bitcoin's next move will be volatile.

Why?

Because what happened recently after the sudden surge is what's called a Fair Value Gap (FVG). This caused the price to drop and correct, and I bought several cryptocurrencies, especially altcoins, which are closely tied to Bitcoin's price movements.

I bought a large quantity of Plasma (XPL) because it's currently at its lowest point and will rise, God willing. 📈

I wish everyone success and substantial profits.

$BTC $XRP $SOL

- Reward

- 1

- 1

- Repost

- Share

BlockchainDisaster :

:

2026 GOGOGO 👊🚨JUST IN: President Trump says he’s “working hard to ensure America remains the crypto capital of the world.”🇺🇸

- Reward

- like

- Comment

- Repost

- Share

Here\'s a chart showing Bitcoin vs Silver vs Gold zoomed out. It\'s not even up to for debate what\'s been the better investment over the past 2, 4, 6, 8, 10+ years. Those lines on the bottom? Those are Silver and Gold trying to catch up to Bitcoin.

BTC2.03%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More39.05K Popularity

21.27K Popularity

8.77K Popularity

58.53K Popularity

343.71K Popularity

Hot Gate Fun

View More- MC:$3.42KHolders:10.00%

- MC:$3.42KHolders:10.00%

- MC:$3.42KHolders:10.00%

- MC:$3.42KHolders:10.00%

- MC:$3.43KHolders:10.00%

News

View MoreThe Federal Reserve has a 95% probability of maintaining interest rates in January, with only a 5% chance of a rate cut.

1 h

Data: 1,705 BTC transferred from anonymous addresses, worth approximately $136 million

1 h

US stocks close with the three major indices up over 1%, Trump’s post boosts the market

2 h

Trump: Hopes Hasset remains in office; the Federal Reserve Chair candidates have been narrowed down to two or three.

2 h

Data: In the past 24 hours, the total liquidation across the network was $1.005 billion, with long positions liquidated at $670 million and short positions at $335 million.

3 h

Pin

Strike Gold by Sharing Your TradFi Orders and Pictures!

Post on Gate Square and split $10,000 in rewards!

The TradFi Gold Lucky Bag is now live—1g of real gold every 10 minutes. Trade nonstop, win nonstop!

👉 https://www.gate.com/announcements/article/49357

🎁 50 lucky winners × $200 Position Vouchers ($10 × 20 leverage)

How to Join:

1️⃣ Post your order on Square with #GateTradFi1gGoldGiveaway, including:

A trade or draw screenshot

A brief experience sharing

2️⃣ Or create a related image (AI creation allowed) with a short promo line, such as:

Get gold on Gate App — 1g every 10 minutes!

⏰ Jan 2Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889